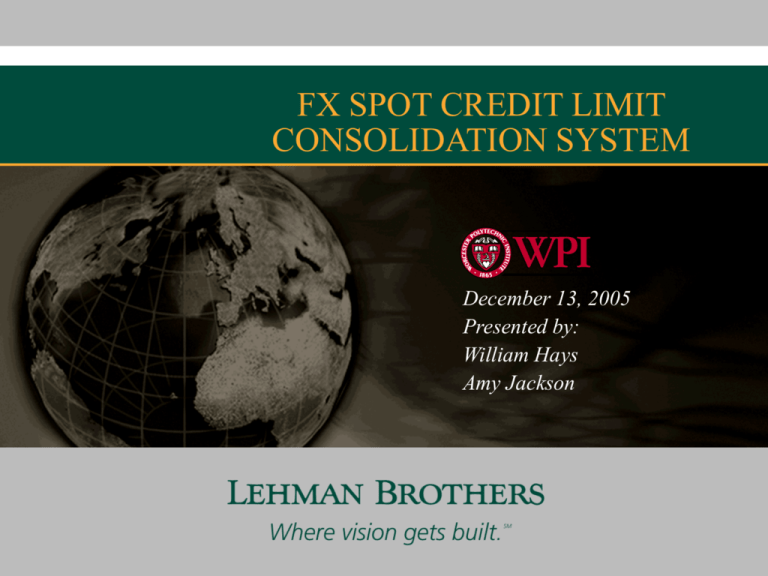

New_York_Presentation - Worcester Polytechnic Institute

advertisement

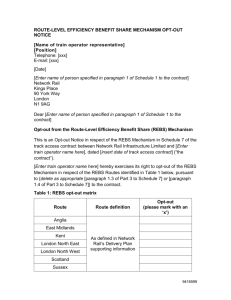

Confidential FX SPOT CREDIT LIMIT CONSOLIDATION SYSTEM December 13, 2005 Presented by: William Hays Amy Jackson PRESENTATION OUTLINE Background Overview Goals Methodology Results Overview of new process Demonstration of new system Conclusions Recommendations 1 Project Background FX trading Spot credit limits Broker services systems Reuters Electronic Broker System (EBS) Credit Work Station (CWS) 2 PROJECT OVERVIEW Spot and Forward matches received Matches prioritized Check if credit limit exists Current FX credit data received Requests sent to analysts Estimated Total Manual Time: 2:40 Legend Symbol Count 2 5 1 Credit limits assigned Investigations logged Description Data Manual operation Manual input Limits entered on trading floor 3 PROJECT GOALS 1. View of the total FX limit allocation for each client. 2. Log of the clients. 3. Clean-up of sub-entities. 4. System’s interface integrated into CRM website. 5. Internal Technology team member to maintain and update system. 6. Knowledge of FX trading and credit limits. 4 METHODOLOGY UNDERSTAND CURRENT PROCESS DESIGN NEW PROCESS IMPLEMENT NEW SYSTEM FINALIZE DOCUMENTATION TEST NEW SYSTEM 5 MOVE NEW SYSTEM TO PRODUCTION RESULTS: Understand the Current Process System * * Use-Case User User meeting notes Research on systems involved Research on credit limits and FX trading Documentation of current process 6 RESULTS: Design the New Process REBS_legal_entities Functional requirements REBS_legal_entities_log Use-case and Sequence diagrams Proof of Concept REBS_client_history Database structure REBS_subentities Interface prototype REBS_reports REBS_source_update_history 7 RESULTS: Implement REBS FX Database structure Views/Stored procedures Application layer 8 RESULTS: Move REBS FX To Production TESTING STAGING IN Q & A PRODUCTION 9 OVERVIEW OF NEW PROCESS: Steps Current FX credit limit data received Data sent to technology Database updated Matches checked with REBS FX Spot and Forward matches received Unlinked/new groups investigated Problematic counterparties updated Requests sent to analysts Credit limits assigned Credit limits entered on trading floor Investigations logged in REBS FX Legend Symbol Count Description 5 Manual operation 2 Stored data 2 Data received 1 Manual input Estimated Total Manual Time: 1:55 10 OVERVIEW OF NEW PROCESS: Demo. 11 CONCLUSIONS Requirements met: 2:52 User 2:24 Technical 1:55 Informational 1:26 2:40 Previous Process New Process 1:55 0:57 0:28 0:00 1st Qtr 12 RECOMMENDATIONS Post Project Long Term Automated feeds Readily available CRM implementation standards REBS FX extension Global use of REBS FX WPI project continuation 13 ACKNOWLEDGMENTS Lehman Brothers: Ayoob, Mahvish Burton, Scott Chang, Scott Eisen, Daniel Fox, Andrew Girard, Jocelyn McConnon, Thomas Moeller, Christian Murphy, Brendan Tan, Ford Wilkins, Simon Wong, Leesan Worcester Polytechnic Institute: Abraham, Jon P. Ciaraldi, Michael Gerstenfeld, Arthur 14 QUESTIONS 15 16 Database Structure Database Structure for new system credit..REBS_client_history credit..REBS_legal_entities PK PK entityID dealing_code group_name line_limit source change_date FK1 historyID description actiondate actioncode entityID user_code credit..REBS_source_update_history PK updateID credit..REBS_entities_subentities PK,FK1 PK,FK2 filename source file_asof load_date entityID subentityID credit..REBS_reports credit..REBS_legal_entities_log FK1 credit..REBS_subentities PK subentityID dealing_code description 17 entityID dealing_code legal_name line_limit source client_code change_date delete_date PK reportID query_string description reportname author filter_fields sort_fields check_column highlight_regex last_run create_date Demonstration (1) First screen shows possible reports. The default is the unlinked entities (that have been imported from Retuers/EBS systems) 18 Demonstration (2) Second screen shows a list of possible reports (from the reports table) When a report is selected, it is queried for viewing. 19 Demonstration (3) Third screen shows the “existing limits” report corresponding to limits related to all CWS counterparties 20 Demonstration (4) When a user clicks on a CWS client code in the reports window, the details for that counterparty are shown. Shown are the associated Reuters/EBS accounts. 21 Demonstration (5) Below the associated accounts are the subentities (or branches) related to the counterparty. 22 Demonstration (6) Below the sub-entities is a log of the history for that client. History entries are changes to the database as well as userentered history items. 23 Demonstration (7) Wherever an entity ID is shown, the entity detail page can be opened. Shown on this page is linking/unlink ing to CWS counterparty functionality. 24 Demonstration (8) The user searches CWS for the counterparty name and then updates the link to the counterparty once one is found. 25 Demonstration (9) Further down on the entity detail page you will find similar subentity and history information as found on the client detail page. 26 Demonstration (10) This is an example of an unlinked entity. This will occur for new clients and clients that do not exist in CWS. 27 Demonstration (11) This is an example of a changed limit when importing from Reuters/EBS systems. 28