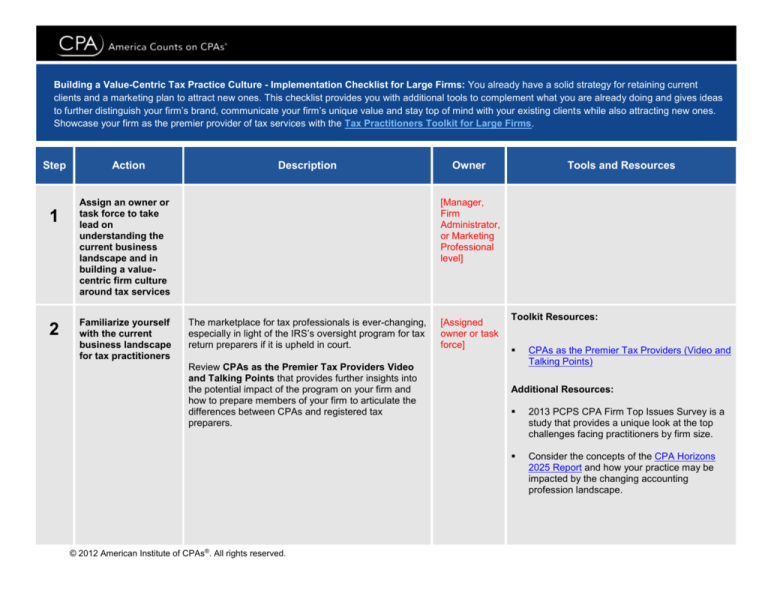

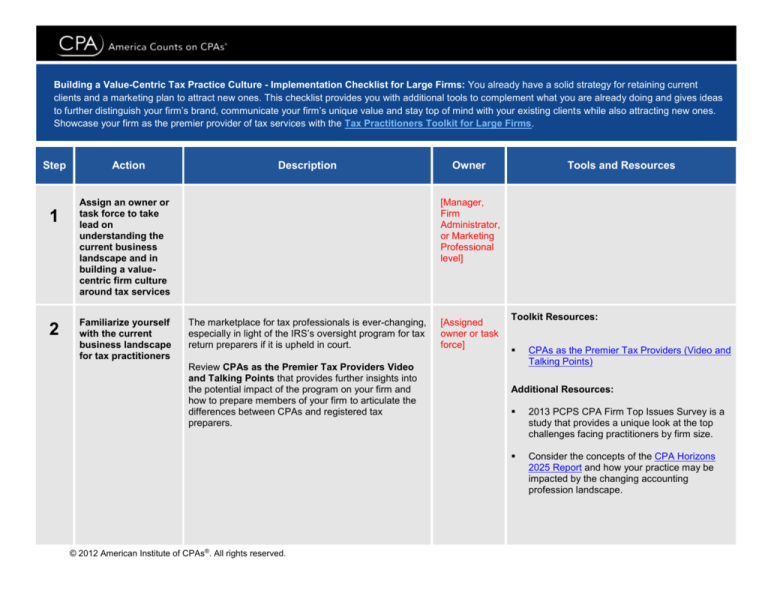

Building a Value-Centric Tax Practice Culture - Implementation Checklist for Large Firms: You already have a solid strategy for retaining current

clients and a marketing plan to attract new ones. This checklist provides you with additional tools to complement what you are already doing and gives ideas

to further distinguish your firm’s brand, communicate your firm’s unique value and stay top of mind with your existing clients while also attracting new ones.

Showcase your firm as the premier provider of tax services with the Tax Practitioners Toolkit for Large Firms.

Step

1

2

Action

Description

Assign an owner or

task force to take

lead on

understanding the

current business

landscape and in

building a valuecentric firm culture

around tax services

Familiarize yourself

with the current

business landscape

for tax practitioners

Owner

Tools and Resources

[Manager,

Firm

Administrator,

or Marketing

Professional

level]

The marketplace for tax professionals is ever-changing,

especially in light of the IRS’s oversight program for tax

return preparers if it is upheld in court.

Review CPAs as the Premier Tax Providers Video

and Talking Points that provides further insights into

the potential impact of the program on your firm and

how to prepare members of your firm to articulate the

differences between CPAs and registered tax

preparers.

© 2012 American Institute of CPAs®. All rights reserved.

[Assigned

owner or task

force]

Toolkit Resources:

CPAs as the Premier Tax Providers (Video and

Talking Points)

Additional Resources:

2013 PCPS CPA Firm Top Issues Survey is a

study that provides a unique look at the top

challenges facing practitioners by firm size.

Consider the concepts of the CPA Horizons

2025 Report and how your practice may be

impacted by the changing accounting

profession landscape.

Step

Action

Description

Owner

3

Facilitate a meeting

with your

professional team to

get them up to speed

on the current

business

environment;

specifically the

Preparer

Registration

Program and what it

means for the firm

and working with

clients.

Educate your team on the IRS registered tax preparer

program starting with the CPA vs. Unlicensed Tax

Preparers PowerPoint that provides a visual

presentation of the differences in qualifications and can

be tailored for use in the team meeting.

[Assigned

owner or task

force]

Consider

incorporating these

resources in your

new hire orientation

so that new staff

members have the

same understanding

and information.

Additionally, the CPAs as the Premier Tax

Professional Talking Points will assist you and your

professional team that further emphasize how the CPA

credential supports members of your firm as premier

tax providers.

Questions and concerns may arise from clients and

prospects due to the confusion in the marketplace

resulting from the IRS registered tax program. Refer

the professional team to the Overcoming Objections

about Hiring a CPA Talking Points to ensure they are

prepared with confident responses when articulating

the difference between a CPA and unlicensed tax

preparer.

Tools and Resources

Toolkit Resources:

“CPAs vs. Unlicensed Tax Preparers”

PowerPoint

Overcoming Objections to Hiring a CPA

Talking Points

CPAs as the Premier Tax Professional Talking

Points

Additional Resources:

© 2012 American Institute of CPAs®. All rights reserved.

Tax Section Resource Page dedicated to the

new IRS Preparer Registration Program

Step

Action

Description

Owner

4

Build an actionable

strategy to articulate

the firm’s value to

clients and

prospects –

differentiating the

firm and making

meaningful client

connections.

Begin the process of discovering what makes your firm

valuable and different from other CPA firms and

develop a plan to memorialize and communicate your

value. The end result should be a firm-wide strategy to

knowledgably and confidently present the firm’s value

to clients in a unique way and infuse that value into

each and every client contact.

[Assigned

owner or task

force]

Start generating ideas by watching the webinar CPA:

The Value of Articulating Your Value that provides

practical tips and insights from other CPA practitioners

on communicating value.

Hear directly from clients by facilitating a Client

Satisfaction Survey – use this to gauge how the firm

is doing and identify areas for improvement so you

retain the clients you have worked so hard to get in the

first place.

Members of your staff are likely giving technical

presentations to clients and potential clients.

Incorporate additional slides into the presentation that

build the firm’s brand and also the CPA credential – the

CPAs vs. Unlicensed Tax Preparers PowerPoint can

be tailored and included for this purpose.

PCPS member firms – walk through practical strategies

in the You Are the Value Workshop to help everyone

in the firm articulate why they are uniquely qualified to

help clients address their problems and achieve their

goals. This exercise will help those in the firm truly

understand what your firm does best and the firm’s

overarching business beliefs and client successes, as

well as define the process on how the firm works with

clients – setting the overall expectations when meeting

with clients. You and your professional team can show

up at the initial client meeting and represent the firm in

a way that resonates with the client.

© 2012 American Institute of CPAs®. All rights reserved.

Tools and Resources

Toolkit Resources:

“CPA: The Value of Articulating Your Value”

Webinar

Client Satisfaction Survey

“CPAs vs. Unlicensed Tax Preparers”

PowerPoint

Additional Resources:

PCPS You Are the Value Workshop (Developed

from Leo Pusateri’s book You Are the Value:

Define Your Worth, Differentiate Your CPA Firm,

Own your Market written specifically for CPAs)

Step

Action

Description

Owner

5

Identify resources

and strategies to

help you stay top of

mind with your tax

clients, reach out to

them throughout the

year and enhance

your client

development and

retention efforts.

These resources are available for your use during tax

season and year-round. Regularly communicate with

clients on a variety of tax-related subjects using

different media and channels to maintain and deepen

those relationships. Tips on using these resources and

how to get started can be found in the Making Your

Voice Heard, Tax Season and Beyond Guide.

[Assigned

owner or task

force]

Stay front and center with your clients with the CPA

Value and Tax Blubs highlighting important tax topics

reminding clients to contact the firm and showcasing

the firm’s expertise and value. Tailor them with your

firm’s name and use them in client newsletters, emails

or on your website. Also, weave these key messages

into your branded client-facing materials to reinforce

your firm's value and the unique qualifications of your

CPAs.

Either incorporate the key messages into your existing

branded marketing collateral, or add your firm’s logo

and contact information to these professionally

designed brochures such as Preparing for Life’s Most

Important Moments. Templated PowerPoint

presentations are also available for you to tailor for

client facing lunch-and-learn meetings. Also, remind

your clients of the value of working with a CPA with the

‘Preparing for Life’s Important Moments’

customizable brochure.

Furthermore, connect with clients via the firm’s social

media outlets. Choose from a selection of themed,

technical and general Social Media posts for LinkedIn,

Facebook or Twitter and stay connected with all your

important audiences.

© 2012 American Institute of CPAs®. All rights reserved.

Tools and Resources

Toolkit Resources:

“Making Your Voice Heard, Tax Season and

Beyond” Guide

CPA Value and Tax Blurbs for your website or

client newsletter

Key Messages

“Preparing for Life’s Important Moments”

Brochure

Social Media posts

Total Tax Insights Calculator (backgrounder,

one-pager, logo and description)

Additional Resources:

Tax Section E-alerts (for news of tax laws

changes and advocacy initiatives that may be

worth mentioning to clients and prospects)

Step

Action

Description

Owner

Tools and Resources

The Total Tax Insights™ calculator materials are

another excellent way of deepening client relationships

and fostering further discussions about financial

planning. Read the backgrounder to learn more about

it. Introduce the calculator during a client meeting using

the one-pager, Taxes and the Big Picture, or include

it as a mailing.

Include the Total Tax Insights calculator logo along with

the description in your next client newsletter or place

them on your website so your clients can click through

and learn about all the various taxes they pay and their

estimated amounts. They will see this as a value add,

and reinforcement of your firm’s commitment to serving

the public interest.

6

Amp up your client

acquisition efforts.

Here are some tools to complement your current

marketing strategies, which can be tailored for your

specific audiences and areas of expertise. Tips on

using these resources and how to get started can be

found in the Making Your Voice Heard, Tax Season

and Beyond Guide.

Weave these key messages into your marketing

materials to promote your firm's value and the unique

qualifications of your CPAs.

Customize a professionally designed PowerPoint:

Preparing for Life’s Most Important Moments when

presenting to groups at industry and chamber

meetings, or other networking events. Another

opportunity is educating the public on the variety of

taxes they pay and introducing them to the Total Tax

Insights calculator.

© 2012 American Institute of CPAs®. All rights reserved.

[Assigned

owner or task

force]

Toolkit Resources:

“Making Your Voice Heard, Tax Season and

Beyond” Guide

Key Messages

Preparing for Life’s Most Important Moments

(PPT)

Step

6

Action

Description

The PowerPoint presentation, A Clear View of Your

Taxes Can Give You Insights into Your Financial

Picture, will help you do this and showcase the public

service work of CPAs. Also, remind prospects of the

value of working with a CPA with the Preparing for

Life’s Important Moments customizable brochure.

Attract new clients with the Social Media posts for

LinkedIn, Facebook or Twitter. Additionally, expand

your client acquisition efforts with these sample

Google AdWords.

Owner

Tools and Resources

A Clear View of Your Taxes Can Give You

Insights into Your Financial Picture

“Preparing for Life’s Important Moments”

Brochure

Social Media Posts

Google AdWords

Printed Advertisements

You have options for placing printed advertisements

focused on the individual tax client and small business

owner.

Media Advisory Template

Finally, the Media Advisory Template may provide

further support in being a resource for reporters and

includes possible tax topics that you can tailor for your

areas of expertise.

Additional Resources:

© 2012 American Institute of CPAs®. All rights reserved.

CPA Marketing Toolkit Resources