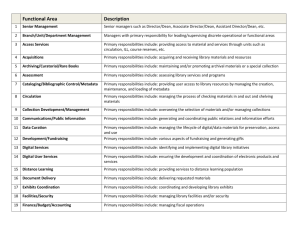

MTR-Compliance_Officer_Regime

advertisement

Compliance Regime Kenneth Baker Deputy Managing Director Financial Services Commission 1 What is a Compliance Regime? • Appointment of an individual to oversee the compliance function • Development & application of • • compliance policies and procedures Review of compliance policies & procedures to test effectiveness On-going training for employees Financial Services Commission 2 Current Regime – Compliance Officer • Regulated Person designates one • • • of his staff as Compliance Officer Compliance Officer shall be a senior officer Compliance Officer shall act as a liaison between Regulated Person and Commission Compliance Officer shall prepare and submit to the Commission written reports Financial Services Commission 3 New Regime - Individual with Responsibility for Compliance Oversight • Licensee shall designate one of his • • • staff as the individual responsible for compliance oversight Individual shall be a senior officer Individual shall act as a liaison between the Licensee and the Commission Individual shall prepare and submit to the Commission written reports Financial Services Commission 4 New Regime Compliance Function Proposed new Section 34 of the Financial Services Commission (Amendment) Act, 2006: • Every Licensee shall ensure the compliance function is performed; and • Every Licensee shall appoint an individual approved by the Commission to oversee the compliance function. Financial Services Commission 5 New S.34(1) FSCA Licensee to establish and maintain systems and controls to ensure compliance with: • Financial Services Commission Act and all financial services legislation; • Regulatory Codes; and • Directives issued by Commission. Financial Services Commission 6 New S.34(2) FSCA Licensee shall establish and maintain a compliance procedures manual complying with the requirements specified in Regulatory Code Financial Services Commission 7 New S.34(3) FSCA Individual responsible for overseeing compliance function shall have an obligation for: • Reporting to the Commission; • Reporting to the directors; and • Acting as a liaison between the Licensee and the Commission. Financial Services Commission 8 New S.34(4) FSCA Individual responsible for overseeing the compliance function must satisfy the Commission’s “fit and proper” criteria: • Honesty, integrity and reputation; • Competence and capability; and • Financial soundness. Financial Services Commission 9 New S.34(5) FSCA Individual responsible for overseeing the compliance function shall have responsibility for: • Establishing and maintaining a programme for training staff; and • Overseeing the implementation of the compliance procedures manual. Financial Services Commission 10 New S.34(7) FSCA The Commission may issue a Regulatory Code specifying: • Maintenance of compliance procedures manuals; • Persons who may be appointed to oversee compliance function; and • Reporting requirements to the Commission and directors. Financial Services Commission 11 New S.34(8) FSCA Person appointed to serve as Compliance Officer under the AML Code of Practice may be appointed to oversee the Licensee’s compliance function Financial Services Commission 12 Who will Oversee the Compliance Function? • • • • • • • • • Banks Company Managers Insurance Companies Insurance Intermediaries Private & Professional Funds Recognised Managers Managers and /or Administrators Public Funds Trust Companies Financial Services Commission 13 Compliance Oversight Banks • General bank licensee – BVI resident individual • Restricted bank licensee – BVI resident individual Financial Services Commission 14 Compliance Oversight Fiduciary Services • Company Managers – BVI resident • • individual General Trust Licensee with physical presence – BVI resident individual General and Restricted Trust Licensee without physical presence – individual who may be an employee of Registered Agent Financial Services Commission 15 Compliance Oversight Insurance • Captive insurer – Insurance • Manager, otherwise an approved, BVI resident individual Credit Life re-insurer – Insurance Manager, if one exists, or an approved, BVI resident individual Financial Services Commission 16 Compliance Oversight Insurance • Locally incorporated Domestic • insurer – an approved BVI resident individual Overseas incorporated Domestic insurer – an individual who fulfils that function to the satisfaction of the insurer’s home regulator Financial Services Commission 17 Compliance Oversight Insurance All of the following must appoint an approved BVI resident individual: • Agents; • Brokers; and • Insurance Managers. Financial Services Commission 18 Compliance Oversight Investment Business • Private & Professional Funds – • one of a fund’s functionaries (for example, fund manager or fund administrator) Public Funds – one of a fund’s functionaries (for example, fund manager or fund administrator) Financial Services Commission 19 Compliance Oversight Investment Business • Recognised Managers – • responsible licence-holder Managers &/or Administrators – an approved BVI resident individual unless the manager or administrator is non-resident, in which case the compliance function may be performed by a non-resident individual Financial Services Commission 20 Compliance Oversight Notification Where an individual is not required to be approved, notification of the individual with responsibility for oversight of the compliance function must be submitted to the Commission Financial Services Commission 21 AML Code of Practice The AML Code of Practice is to be amended in line with proposed new Section 34 FSCA Financial Services Commission 22 Implementation • Financial Services Commission • • • • (Amendment) Act, 2006 Distribute answers to FAQ Distribute Guidance Notes Distribute Application Forms Advise implementation date of regime Financial Services Commission 23 Contact details • compliance@bvifsc.vg • enquiries@bvifsc.vg Financial Services Commission 24