RFP Panel presentation

advertisement

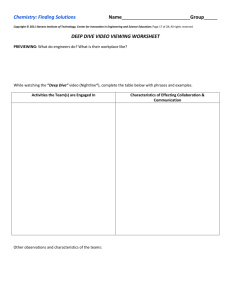

IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY INVESTMENT RFP PANEL NOVEMBER 4, 2015 IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY SERVICE PROVIDERS, CUSTODIANS, COMPENSATION Types of Providers Brokerage Firms Banks Registered Investment Advisors Mutual Fund Companies Types of Service Models Non-Discretion Limited Discretion Full Discretion Is OCIO an additional choice? IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY SERVICE PROVIDERS, CUSTODIANS, COMPENSATION Types of Products Cash, Bonds, Stocks Mutual Funds, ETFs, Index Funds, Sub-Advised Funds Hedge Funds, Private Equity, Other Illiquid Investments Custody of Funds Local/Regional National Third Party IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY SERVICE PROVIDERS, CUSTODIANS, COMPENSATION Fees and Compensation Advice Product Transactions Custody Direct vs. Indirect Research, Recommendations and Resources Get to know SEC FORMs ADV Part I and Part II Understand when conflicts of interest are present http://www.adviserinfo.sec.gov/IAPD/Content/Search/iapd_Se arch.aspx brokercheck.finra.org IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY The foundation makes payouts for grants and administrative fees from the earnings of the endowment funds each year. In order for the endowed assets to grow, the net total return must be enough for the annual payout needs plus inflation and real growth over time. 4.0% 4.0% 4.5% 4.5% 5.0% 5.0% Payout % for grantmaking 1.0% 1.5% 1.0% 1.5% 1.0% 1.5% Administrative fees 5.0% 5.5% 5.5% 6.0% 6.0% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% Inflation factor 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% Real growth factor 7.5% 8.0% 8.0% 8.5% 8.5% 6.5% 9.0% Total PAYOUT % Ave. NET TOTAL RETURN desired IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY Actual Investment Performance and Desired Return 25.00% 17.60% 20.00% 15.00% 16.80% 12.70% 11.10% 7.70% 10.00% 5.00% 21.00% 20.20% 1.40% 9.70% 9.00% 7.00% 6.70% 13.50% 6.55% 0.77% 1.60% 4.60% 0.00% -5.00% -4.30% -10.00% -9.30% -15.00% -20.00% Red Line = Desired return of 8.5% (2.0% admin fee + 4.0% target distribution rate -25.00% -23.70% -30.00% • • • • Investment/spending policies use a trailing quarter average Example 12 or 16 quarters Levels out market fluctuations Annual grant distributions are more consistent from year to year IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY RFP PANEL William Jarvis Facilitator Executive Director Commonfund Institute william.jarvis@commonfund.org Bill Barnes Will Thorpe President Community Foundation of Madison and Jefferson County bill@cfmjc.org Director of Business Development-Investment Stewardship The Mason Companies wthorpe@masoncompanies.com Cheryl Cooper Barb Young Vice President, Charitable Services Fifth Third Bank cheryl.cooper@53.com President Porter County Community Foundation byoung@portercountyfoundation.org