Pacific Island Telecommunications: A Stocktaking - UN

advertisement

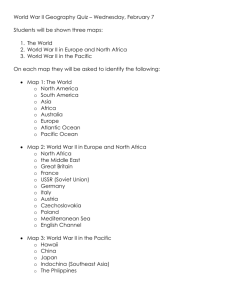

0: Contents: 0. Overview 1. Stocktaking – the situation is better than one may think 2. Technical situation – several options are available 3. Economic situation – everyone should be able to have access, even if shared. 4. Institutional situation – role models exist. The Pacific has good opportunities – if it moves soon. 5. Appendices – online only David Hastings Information, Communication and Space Technology Division United Nations ESCAP, Bangkok hastings@un.org 1: Stocktaking background 2: Pacific Islands Socioeconomics – “Bargain knowledge workers” Population GDP_PC_PPP HDI.Eq.Inc Income Ratio Life Expectancy Literacy HDI 2007 Papua New Guinea 6473910 2501 2300 1.1 65 65 0.530 New Zealand 4268000 26660 26500 1.0 79 99 0.943 Hawaii 1283388 53123 33000 1.6 80 99 0.97 Timor Leste 1115000 400 2200 0.2 66 59 0.514 Fiji 839324 6090 9050 0.7 70 94 0.762 Solomon Islands 517455 2049 3500 0.6 73 77 0.602 French Polynesia 263267 17500 10700 1.6 76 98 0.78 New Caledonia 246614 15000 11350 1.3 74 91 0.79 Vanuatu 233026 3493 5100 0.7 63 74 0.674 Samoa 179645 6823 10600 0.6 71 99 0.785 Guam 178980 15000 22000 0.7 79 99 0.90 Tonga 102724 8694 12800 0.7 70 99 0.81 Micronesia 110443 3900 3900 1.0 70 89 0.61 Kiribati 97231 2397 3900 0.6 62 100 0.61 Northern Mariana Is. 62969 12500 15500 0.8 76 97 0.84 Marshall Islands 53236 2300 4100 0.6 71 94 0.62 American Samoa 66107 5800 12800 0.5 76 97 0.81 Cook Islands 15537 5000 7500 0.7 72 95 0.72 Palau 20279 5800 9500 0.6 70 92 0.76 Wallis and Futuna 15472 3800 7000 0.5 69 95 0.71 Nauru 10163 5000 7000 = 0.7 63 95 0.71 Tuvalu 9729 1100 5500 0.2 68 98 0.67 Niue 1549 3600 10700 0.3 70 95 0.78 Norfolk Island 2114 27000 26500 1.0 78 99 0.93 Economy / 3: Typically Expressed Challenges Now: good answers for most • Small populations (is 10+ million people small – compared with success stories like Singapore, Hong Kong, the Eastern Caribbean, Mauritius?). • Widely dispersed/isolated (like Atlantic Ocean African cities, Mauritius, the Eastern Caribbean?). • About half of ~600 populated islands have telecoms - much of those have 2-way radio. (Solar-powered satellite phone can be cheaper (~40 cents/minute) than current systems for long-distance calling or emergency communication in some economies.) • Saddled with legacy “monopolistic” concessions This is a policy which can be maintained or changed. (The eastern Caribbean found that monopolies violate constitutional provisions for freedom of expression, including to receive and disseminate freely). • Not attractive to investors (But many are knowledge societies with 90+% literacy and more than competitive wages, or are excellent markets for distance education – Pacific islands are solutions awaiting good partners). Maybe US$80 million/year could be available for investors, if more competitive prices/services were available. • Cable and satellite are expensive (Telikom PNG just re-deployed 1st-generation cable for US$11 million. Adding Tonga, Samoa or Vanuatu to existing cabling might cost $4 million each. A new broadband satellite, with local participation, could serve Pacific island states as well as bigger markets. Is it time to pursue such goals?) 4: Options 5: An alternative to high-priced 2G cable? Re-deployed (good quality) 1G cable ~$2-5 million per leg? “SPIN++” or for US$35-50M, rather than for US$100+M? 6: How much for a Pacific satellite? Can it attract markets in Asia, ANZ, Americas? EDUSAT was built and launched for $65 million. Could 2 EDUSATs serve you? P a c i f i c i s l a n d Anik F2 spot beams 7: Thuraya ECO SIM: USA$.20/.39 calls – coverage area 8: DC-powered terminals, PCs, phones (universal service – even off the power grid) 9: Economic 10: Is there enough money to pay for improvements? • Prof. James McMaster estimated US$66M/year saved by current-model telecoms. 13 Pacific economies. • For all economies in this study, we guess US$80M/yr => >US$1.2 Billion over 15 years of cable, satellite. • • Satellite =>$100-400M? Cable => $50-500M? 15 yr savings => $1200M? => “the money is there” (?) 11: A challenge: Falling telecoms prices: Will they bankrupt providers? (Traffic growth usually outpaces price declines – bringing profits) Source: Telegeography 12: Institutional 13: Good experiences? (satellite) • OPT & Telecom Cook Islands – shared satcom bandwidth. Such models can save $$$ elsewhere in the Pacific. • Before going for a new satellite, should Pacific consortia try negotiating with Sat-GE-23, AsiaSat, and others (to form a supplier/user consortium) to serve the Pacific safely for less $ • O3B Networks – sounds good – but details of up-front, marginal (bandwidth, Earth station operations costs), and possible regulatory challenges are needed. Good experiences? (cable) Affordable re-deployment of 1st-generation cable? PNG? Samoa (an update today?) 14: Good experiences? (regulatory, etc.) • ECTEL’s Caribbean federation helped small island states build competitive modern telecoms systems. • Dominica determined that restriction of telecoms competition infringed on constitutional freedom of expression. Laws & contracts establishing monopolies were declared unconstitutional, thus void. • Competitive mobile phone services/pricing in the Caribbean & elsewhere are dramatically increasing accessibility, even to low-income people. 15: Possible Next Steps? • Short-term?: (a) Forming state-provider user consortia to aggregate user volumes, to obtain more cost-effective group(ed) rates satellite operators for cheaper bandwidth? (PITA is working on this.) (b) be ready to negotiate (cohesively?) with possible cable promoters? • Medium-term?: (a) pursue wholesale-able & retail-able affordable infrastructure? (b) pursue services? (c) pursue partnerships toward providing more cutting edge services/pricing? (d) opportunistically pursue cable landings as opportunities may arise? • Longer-term?: (a) pursue a satellite, and additional marketable services? (b) pursue additional retailers, who could become your customers for wholesaling services? 16: Summary 1. 2. 3. 4. Typically expressed challenges – Now: good answers for most. Is there enough money to pay for improvements? Yes. Do governments have to pay for or subsidize infrastructure or customers? No. Good experiences to adapt? – how to leverage for the Pacific? a. Monopolies – (1) Found to be unconstitutional impingement of freedom of expression in the Caribbean. Laws, contracts were declared void. (2) Competitors DO want to come into small economies, where opportunity exists. (3) A single provider CAN act competitively – but supportive practices, and accountability, need to be in place. a. Are people offering you a cable for $50-150 million? How about $3-15 million as happened for PNG? Are they offering landings for $3 million? (How about being a part owner if you must capitalize the system, as was done for WASC in Africa)? 6. a. Short-term satellite – groups arranging for better collective deals? It happened in .pf and .ci. a. Longer-term: Can the Pacific get a satellite, also generating revenue from Pacific rim Western Pacific – 40-cent/minute international satcom phone calls? (Thuraya ECO system.) economies? Something like this was offered to the Pacific, but “not responded to”. It could be offered again. Satellites are often costed at $300+ million. But they have been built/launched for < $100 million. Pacific decisionmakers could use a colleague network to make good decisions, and to design, build, operate and support good modern telecoms. 7. How to benefit from cooperation?: The Pacific has many regional cooperative institutions, among governments & service providers. At Noumea in March (2008), a strategy for moving forward, using the Pacific Plan Digital Strategy, was sketched. Is this what you also think? Are more resources useful? I wish I were with you for the rest of the day, as you discuss this and other issues on moving forward. 17: For the Pacific – is it time to better leverage regional cooperation toward affordable “universal service?” For several other non-ideally connected economies. Maybe there is a little of the Pacific (‘s problems) in you, and a little of you (‘re problems) in the Pacific? Is there an opportunity to strengthen your own situation through greater cooperation? David Hastings (author-speaker): hastingsd@un.org (to 31 December) roi@earthling.net (after 31 December) WU Guoxiang (ESCAP, Bangkok): wugu@un.org Thank You!