3.01 Notes

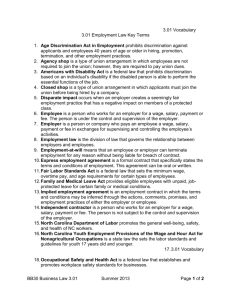

advertisement

Employment Law Objective 3.01 Understand employment law Employment Law Basics • Employment law – Division of law that governs the relationship between employers and employees – Employment law stems from various forms of law including tort, criminal, contract, and labor law Employment Law Basics • Employer – Person or company who pays a person for a wage, salary, payment or fee in exchange for supervising and controlling the employee’s activities Employment Law Basics • Employee – Person who works for an employer for a wage, salary, payment or fee, guided by an express or implied agreement – The employee is under the control and supervision of the employer Employment Law Basics • Independent contractor – Person who works for an employer for a wage, salary, payment or fee, guided by an express or implied agreement – Person is not subject to the control or supervision of an employer Employment Law Basics • Express employment agreement – A formal contract, either oral or written, that specifically states the terms and conditions of employment Employment Law Basics • Implied employment agreement – An employment contract in which the terms and conditions may be inferred through the actions, comments, promises, and employment practices of either the employer or employee. NC Department of Labor • Promotes the general well-being, safety, and health of NC workers by: – Enforcing occupational and health standards – Setting the minimum wage and maximum number of work hours per week – Providing apprentice programs for the skilled trades – Conducting inspections for mines, boilers, elevators, amusement rides, and quarries Fair Labor Standards Act • Also referred to as the Wage and Hour Act • Federal law that sets the minimum wage, overtime pay, and age requirements for certain types of employees • This act does not apply to the minimum wage or overtime pay of professional workers, executives, administrative, and outside sales employees Fair Labor Standards Act • North Carolina Youth Employment Provisions of the Wage and Hour Act for Nonagricultural Occupations – Law that establishes labor standards and labor guidelines for youth 17 years old and younger – In general, children of any age are permitted to work for business owned by parents Occupational Safety & Health Act • Federal act that establishes and promotes workplace safety standards for businesses • Employers should undertake specific precautions to ensure that the workplace is free of hazards that would lead to harm, permanent injury or death • Violators may be fined up to $7,000 per day Americans with Disability Act • Federal act that prohibits discrimination based on a person’s disability if the person with the disability is able to perform the essential functions of the job requirements Age Discrimination Act in Employment • This act prohibits discrimination against applicants and employees 40 years of age or older throughout the employment process • This act only apply to businesses employing 20 or more employees Family and Medical Leave Act • This act provides eligible employees with unpaid, job-protected leave for certain family or medical conditions, such as: – The birth or adoption of a child – The employee is diagnosed with a serious health condition – The employee needs to care for a close relative with a serious health condition Title VII of the Civil Rights Act of 1964 • This act prohibits employment agencies, employers, and unions from discrimination against applicants and employees on the basis of race, color, religion, national origin or sex • Discrimination is prohibited throughout the employment process including hiring, compensation, promotion, training, and termination The Civil Rights Act of 1991 • The purpose of this act was to strengthen civil rights law, in particular disparate impact • Disparate impact – Occurs when an employer creates a seemingly fair employment practice that has a negative impact on members of a protected class • Under this act, employers must prove that their practices are based on job qualifications Employment-at-Will • An employer or employee can terminate employment “at-will” for any reason or no reason without being liable for breach of contract • Certain types of employees are not subject to employment-at-will laws including employees with contracts and unionized employees. Union • An organization of employees formed to ensure favorable work conditions, wages, work hours, benefits and grievance procedures Types of Shops • Closed shop – Employees must join the union before being hired • Union shop – Non-union employees can by hired, but must join union within a certain amount of time Types of Shops • Agency shop – Employees are not required to join the union, yet they still must pay union dues • Open shop – Employees are not required to join the union or pay union dues Right to Work Law • State law that prohibits employers from requiring employees to join a union or pay union dues as a condition of employment • Airline and railway employees are not protected by this law • What are the right to work states? Right to Work States Unemployment Compensation • Insurance program that provides temporary income for qualified individuals who are unemployed through no fault of their own • Eligibility requirements for collecting unemployment compensation varies by state • The North Carolina Division of Employment Security handles unemployment claims Unemployment Benefit Requirements • In North Carolina, any individual wanting to collect or continue to collect unemployment compensation must: – Register for work through the Employment Security Commission – File a claim for each week that benefits are needed – Actively seek employment during any week unemployment benefits are received Denial of Unemployment Benefits • In North Carolina, an individual may be denied unemployment compensation if he/she: – Quits a job – Gets fired from a job – Refuses a referral job – Turns down a job offer – Refuses to Approved Commission Training – Fails to complete Approved Commission Training Social Security Act • Enacted in 1935 to provide financial assistance to eligible workers and their dependents in the form of retirement, disability, and death benefits • The act established the social insurance program commonly called Social Security – Federal insurance program funded by the tax contributions of employees and employers Social Security Disability Benefit • Replaces income when a severe long lasting disability or terminal illness prevents eligible person from doing “any substantial work” • Claim is filed through the through Social Security Administration – Six month required elimination (waiting) period – Periodic review of status to continue benefits Social Security Retirement Benefit • Eligible persons can receive a percentage of social security by age 62, but the individual can receive full benefits at either age 65 or 67 • A person can receive social security retirement benefits if the spouse dies • Medicare is also considered a social security benefit Social Security Death Benefit • Lump sum payment given to the surviving spouse upon the death of a person who worked long enough to qualify for Social Security benefits • The average death benefit is $255 Worker’s Compensation • A government-regulated program that provides medical benefits and income to employees who are injured or who develop a disability or disease as a result of their job • Indemnifies (pays) employee for their loss of income • Insurance is paid for by employer