Exchange Rates ppt

advertisement

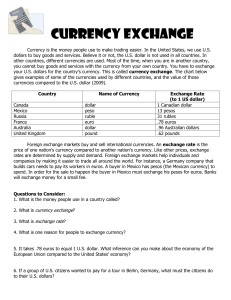

Exchange Rates Currency Markets Exchange Rates Exchange rates: is the price of one country’s currency in terms of another country’s currency. Determining exchange rates 1. Fixed exchange rate: an established price for a foreign currency that is tied to a stable currency of a developed country. 2. Floating (flexible) exchange rate: the forces of supply and demand establish the value of one country’s currency in terms of another country’s currency. How are exchange rates expressed • One countries currency is equal to ??? Units of another countries currency. Like this table: 1 USD/In USD Argentine Peso Australian Dollar Bahraini Dinar $1 8.726561 1.277665 0.376999 How are exchange rates expressed • $1USD= 8.73 Argentine Pesos • $1USD=1.28 Australian Dollar • $1USD=.377 Bahraini Dinar Which currencies are stronger than the dollar and which are weaker? 1 USD/In USD Argentine Peso Australian Dollar Bahraini Dinar $1 8.726561 1.277665 0.376999 You can tell by: • If $1USD gets you MORE THAN 1 unit of the other currency, they U.S. dollar is stronger. – I.E. $1USD= 8.73 Argentine pesos – And $1USD= 1.28 Australian Dollars • IF $1USD gets you LESS THAN 1 unit of the other currency, they U.S. dollar is weaker • $1USD= .377 Bahraini Dinar What does “Strong” and “Weak” mean? Change in the exchange rates Strong= More Valuable Weak= Less valuable How do you identify if a currency is gaining or losing it’s strength Change in the exchange rates 1. Currency appreciation: is the gain of value of a country’s currency with respect to one or more foreign currencies. A. Benefits consumers, but can hurt producers. 2. Currency Depreciation: When a nation’s currency loses value. A. Hurts consumers but benefits producers How do exchange rates change? • Supply and demand for currencies can change the value for currencies. Market for $USD Value For international trade, we will focus on the DEMAND for a currency • Exports and Imports can effect the demand for a currency • When a country’s exports are desired, they want to be paid in their own currency. – For example: If you sold your phone to a person in Mexico, would you want them to pay you in pesos? – OF COURSE NOT!! YOU WANT $USD!!! THIS TAKES PLACE ON THE FOREIGN CURRENCY EXCHANGE MARKET • THE PESOS WILL BE TURNED INTO $$$$$$ – EXAMPLE: YOU SOLD YOUR PHONE TO A PERSON IN MEXICO FOR $100. • If the exchange rate was $1 USD is equal to 10 PESOS or $1USD = 10 PESOS, how many PESOS would that $100 phone cost that person in Mexico? • CAN YOU FIGURE IT OUT? THIS IS HOW WE DO IT How? 10 PESOS/$ X 100 = 1,000 pesos. Answer: 1,000 pesos. Which CURRENCY is more valuable? –The United States dollar is more valuable. »It takes 10 pesos to equal only 1 dollar When currency values change, your $100 phone could change in terms of Pesos • LETS SEE WHAT HAPPENS IF THE MEXICAN PESO HAS GAINED VALUE – IF THERE WAS AN INCREASE IN DEMAND FOR THE PESO, THE PESO WOULD APPRECIATE IN VALUE MARKET FOR PESOS VALUE CURRENCY APPRECIATION • LETS SAY THAT THE NEW EXCHANGE RATE BECAUSE OF THIS NEW DEMAND FOR THE PESO HAS CHANGED THE EXCHANGE RATE FROM $1USD = 10 PESOS –TO: $1 = 5 PESOS – LETS SAY A PERSON IN MEXICO COULD BUY YOUR PHONE(WHICH WAS MADE IN USA) FOR $100 OR A PHONE MADE IN MEXICO FOR 1000 PESOS • NOW HOW MUCH WOULD YOUR $100 PHONE COST IN PESOS? • WHICH PHONE SHOULD THE PERSON IN MEXICO PURCHASE?????? BECAUSE OF APPRECIATION… • $1USD = 5 PESOS YOU STILL WANT TO RECEIVE $100 RIGHT? YOUR PHONE DID COST 1,000 PESOS BUT NOW…….. PHONE= 5 PESOS X 100 = 500 PESOS!!!!! SO NOW THE PERSON IN MEXICO WOULD RATHER BUY YOUR PHONE FOR 500 PESOS RATHER THAN A PHONE MADE IN MEXICO FOR 1000 PESOS. WHAT DOES THIS MEAN FOR PRODUCERS AND CONSUMERS? • BENEFIT– IN MEXICO, THE CONSUMERS BENEFIT BECAUSE THEY HAVE ACCESS TO CHEAPER PRODUCTS FROM THE U.S. RATHER BUY A 500 PESO PHONE THAN A 1000 PESO PHONE – IN THE U.S., PRODUCERS BENEFIT BECAUSE THEIR EXPORTS ARE CHEAPER FOR OTHER COUNTRIES TO BUY. YOU RECEIVE YOUR $100 EITHER WAY WHAT DOES THIS MEAN FOR PRODUCERS AND CONSUMERS? • WHO LOSES FROM THIS????? – IN MEXICO, THE PRODUCERS LOSE BECAUSE THEY HAVE TO COMPETE WITH CHEAPER AMERICAN IMPORTS AND MAY LOSE A SHARE OF THE MARKET – IN THE U.S. CONSUMERS WILL LOSE BECAUSE GOODS THEY USE TO PURCHASE FROM MEXICO WILL NOW BE MORE EXPENSIVE • WHAT???!!!?? WAIT!! WHY ARE MEXICAN PRODUCTS NOW MORE EXPENSIVE? WHY ARE MEXICAN GOODS NOW MORE EXPENSIVE IN THE U.S.? • THE EXCHANGE RATE CHANGED – $1 WAS WORTH 10 PESOS – NOW $1 IS ONLY WORTH 5 PESOS • SO LETS CHANGE THE PERSPECTIVE IF YOU WANTED TO BUY A BLANKET MADE IN MEXICO AND IT IS PRICED IN MEXICO AT 500 PESOS IF THE EXCHANGE RATE WAS $1USD=10 PESOS THE BLANKET WOULD COST $50 (500/10) BUT IF THE EXCHANGE RATE WAS $1USD=5 PESOS THE BLANKET WOULD COST $100 (500/5) So what would happen if the US DOLLAR GAINED STRENGTH? • LETS LOOK AT OUR ORGINAL EXCHANGE RATE OF $1USD = 10 PESOS AND CHANGE IT TO $1USD = 100 PESOS • YOUR $100 PHONE WOULD NOW COST 10,000 PESOS IN MEXICO ($100 x 100= 10,000) • BUT THE 500 PESO BLANKET MADE IN MEXICO WOULD NOW COST YOU $5 IN THE US. (500 PESOS/100= $5) WHO IS BENEFITS AND WHO LOSES? • IN THE U.S. – BENEFITS: CONSUMERS HAVE ACCESS TO CHEAPER GOODS – LOSES: PRODUCERS HAVE TO COMPETE WITH CHEAPER IMPORTS IN MEXICO BENEFITS: PRODUCERS CAN SELL THEIR PRODUCTS IN FOREIGN MARKETS EASIER LOSES: CONSUMERS LOSE ACCESS TO CHEAPER PRODUCTS HOW DO I DO CONVERSIONS? • TRY TO US THE $1USD =? LIKE $1=2PESOS – If converting $USD to a foreign currency, multiply the amount in $USD TIMES EXCHANGE RATE • MULTIPLY YOUR BAGS -If converting foreign currency to $USD, divide the amount of foreign currency by the EXCHANGE RATE • DIVIDE YOUR LAUNDRY TRY THESE ACTIVITY 18 EXCHANGE RATES How are Exchange rates effected by imports and exports • Trade Deficits(x-M) results in the $ losing value in foreign exchange markets • A trade Surplus (X-m) WOULD result in the dollar appreciating in value or becoming stronger.