B2B Magazine Feature Article

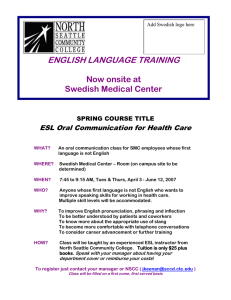

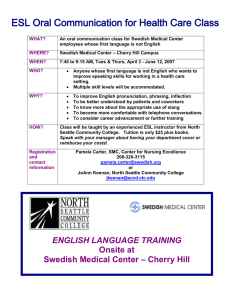

advertisement

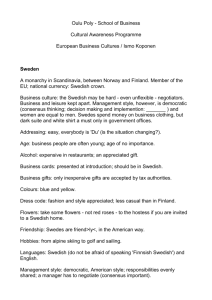

B2B Magazine Feature Article e.g. (Insurance Insider) What pricing strategy is the best for the customer? The Northern Swedish Insurance Company has recently brought there successful business to the UK. The reason for their success is down to transparent pricing, where customers can see how much they will be charged with a normal price list, enabling a quicker service for customers. Insurance can be seen as very risky for the insurer as some clients have more chance of getting a pay-out than others, e.g. A newly qualified young driver would be a lot more risky than someone with ten years driving experience. The price is increased due to this. The pricing strategy that the Northern Swedish Insurance Company has taken is that prices are clearly visible for the customer to see, by using a price list. An example of this by using car insurance would be to show how much they will have to pay for what type of car, dependant on age and experience. This is helpful so the customer can be reassured that they are getting value for money. Some customers may argue that this will be more time consuming for them, rather than just waiting a couple of days for the quote to be sent through. However a quick flick through the online price-list and they can be ready to purchase. Insurance companies are very similar to holiday and flight companies ,in the fact that pricing is usually worked out dynamically, this means that when somebody clicks online to book it will be one price but if it is clicked again, the price will go up giving it price elasticity. This is never very good for a customer- centric business that needs to gain trust. The Northern Swedish Insurance Company has shown innovation in a very complicated market, where the benefits of the product, are paramount to the customer. The Northern Swedish Company has found the gap.