High Court Interpretation

advertisement

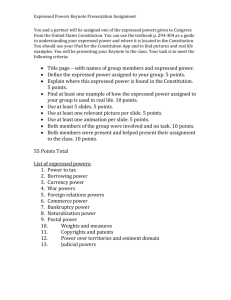

High Court Interpretation Effect on the Federal Balance of Power What is the High Court? The High Court is established under s 71-80 of the Constitution It was established as a Constitutional Court – to be the final arbiter in matters of the Constitution Federal Balance of Power In any federation there is a division of power between two levels of government. The ratio of powers between these levels is termed the Federal Balance The Federal Balance is not static – it changes with changes in the Constitution Alterations of the Federal Balance Any mechanism for changing the Constitution may impact the Federal Balance. Therefore… Referenda Referral of powers Unchallenged legislation Conventions and Commissions High Court Interpretation may all affect the Federal Balance Alterations to the Federal Balance As we know, most methods of constitutional change in Australia are very limited in their impact on the Constitution – except one. The interpretations of the Constitution by the High Court of Australia Therefore, the High Court has had more impact on the Federal Balance than any other mechanism How Does the High Court Interpret the Constitution? Judicial interpretation is an art and a science When asked to clarify the meaning of a statute (or a Constitution) judges apply various styles of judicial interpretation The style used depends the judges’ discretion Judicial Interpretation in Phase 1 Intentionalism: A style of interpretation in which the judges seek the original intention of the Constitution. In Australia’s case the Constitution was intended to set up a cooperative federation in which the states retained most of their powers – even thought the way the Constitution is written doesn’t seem to reflect this Intentionalism In order to achieve the intention of the Constitution the judges were forced to find “implications” in the Constitution that are not expressly mentioned In this they used US Supreme Court persuasive precedent in Collector v Day (US) in D’Emden v Pedder 1903 to create implied immunities (the states immune from Commonwealth power) In Peterwald’s Case 1904 the Court found implied prohibitions (against the Commonwealth expanding its power in areas of state power) Intentionalism These cases created the doctrine of implied immunity of instrumentalities (instrumentalities are government functions such as railways, power, roads etc) And the doctrine of reserve powers The most famous case from the Intentionalist Phase is Railway Servants 1906. Intentionalism - Doctrines Explained doctrine of implied immunity of instrumentalities Because it is federalist, the Constitution contains implications that state powers should be preserved. Thus - the states are immune from commonwealth interference and the commonwealth is prohibited from interfering with states. doctrine of reserve powers When interpreting concurrent powers, do so in a narrow sense that preserves the power of the states and limits the power of the commonwealth to legislate in areas of shared powers. Railway Servants 1906 – implied immunities of instrumentalities A dispute between the WA Government and the Commonwealth about the right of the Commonwealth to legislate working conditions for workers employed by the WA government The Court, applying the doctrine of implied immunities of instrumentalities, found that Commonwealth industrial laws passed under s 51 (xxxv) could not apply to State Government railway employees (a state instrumentality) Peterswald’s Case – doctrine of reserve powers Section 90 makes excise an exclusive commonwealth tax. Griffiths CJ held that a NSW tax imposed on brewers was not an excise by defining “excise” very narrowly – reserving the taxing power for the states This made it less likely that a state tax could be defined as an excise and therefore invalid. Judicial Interpretation in Phase 2 Literalism/ legalism: A style of interpretation in which the court regards the actual wording to be most important. A “black letter of the law” style Read this way, the Constitution grants a great deal of power to the Commonwealth at the expense of the states. In particular s 51 concurrent powers and s 109, which gives priority to Commonwealth law. The financial powers of the Commonwealth are great Literalism / Legalism By 1920 none of the Justices of the Court were involved in the drafting of the Constitution. They felt that they could not know its intention and so sought a SAFER method. They began to treat the Constitution as if it were an ordinary statute Engineers Case 1920 This case opened the second phase of High Court constitutional interpretation and remains the most significant landmark case in the Court’s history The Amalgamated Society of Engineers (a union) was involved in a dispute with a sawmilling factory owned by the WA Gov’t. Engineers Case 1920 The Commonwealth sought to legislate for the union because it felt it had the power to legislate for state based businesses when a dispute crossed state borders (the Society of Engineers was a national union) The High Court agreed – giving a much broader interpretation to Commonwealth industrial powers This decision reversed the precedents of the Railway Servants Case – the doctrine of implied immunities of instrumentalities Other implications of legalism A legalistic interpretation of s 51 concurrent powers leads to broad interpretations of shared powers. The commonwealth “covers the field” of concurrent powers. The doctrine of reserved powers was overturned. A literalist interpretation of the grants power under s 96 – allowing the Commonwealth to attach any condition to monies granted to the states A serious diminishing of the concept of residual powers – which, being unspecified, cannot be interpreted literally Uniform Tax Case 1942 During WW2 the Commonwealth passed four acts, under s 51(ii) (the tax power), which had the effect of taking control of income tax for the duration of the war They did not outlaw state income tax but the Commonwealth decided that if a state collected income tax its s 96 Commonwealth grant money would be reduced by that amount. Further, the citizens of the state would be paying both state and federal income tax and would likely vote the state government out. This made it impossible for the states to collect the tax Uniform Tax Case 1942 The States challenged the four acts in the High Court. The Court found that three of the acts could continue in peacetime – ie forevermore This case marks the point at which the VFI began to tip very much towards the Commonwealth Judicial Interpretation in Phase 3 The Court continued the legalist / literalist method of interpretation during this phase. This phase is not marked by a change of judicial style but by the effect of the Court’s decisions on the federal balance. This effect was neutral Phase 3 – In Favour of the States State Banking Case 1947 – Stuck down Commonwealth legislation that forced the states to bank with the Commonwealth Bank on the grounds that it discriminated against the states Bank Nationalisation Case 1948 – Struck down the ALP Government’s attempt to nationalise all banks on the grounds that it prevented freedom of interstate trade (this was highly controversial as nationalisation was ALP policy) Communist Party Case 1951 – Struck down the Menzies’ Government attempt to ban the Communist Party (also highly controversial) Phase 3 – In Favour of the Commonwealth Concrete Pipes Case 1971 – Accepted the right of the Commonwealth to legislate on the inter-state activities of corporations under the Corporations Power in s 51(xx) and led to the Trade Practices Act 1974 – a powerful piece of legislation Uniform Tax Case 1957 – upheld the 1942 decision Judicial Interpretation in Phase 4 Activism / Realism: A style of interpretation in which the Court tries to consider the law in the presence of a wider social context Activism is intended to make the High Court's decisions more transparent and honest by rejecting purely legalistic interpretations and considering the views of the community at large It is controversial because some see it as the Court acting in a legislative way instead of a purely judicial way and therefore a breach of the separation of powers. Judges are unelected and not directly accountable to the people The External Affairs Power In recent times, as Australia has signed more treaties and agreements with overseas governments and organisations the External Affairs Power in s 51 (xxix) has become more important This power allows the Commonwealth to sign a treaty, ratify it by passing it through the Commonwealth Parliament and thus making it law in Australia. S 109 then allows this law to override state law Thus s 51 (xxix) and s 109 together allow the Commonwealth to become involved in areas of state responsibility External Affairs Cases Koowarta 1982 – overruled a QLD Gov’t decision to prevent aborigines from purchasing a lease on land because it contravened the Racial Discrimination Act 1975 This Act was passed to give effect to an international agreement to eliminate all forms of racial discrimination (UN Convention on Human Rights) External Affairs Cases Tasmanian Dams 1983 – used the Koowarta precedent to prevent the Tasmanian Gov’t from damming the Gordonbelow-Franklin River. The Commonwealth signed the International Convention for the Protection of the World’s Cultural & Natural Heritage Then passed the World Heritage Properties Conservation Act 1983. It then listed the Gordon-below-Franklin River as a World Heritage Area under the Act – making it unlawful for Tasmania to dam the river Other Phase 4 Landmarks Mabo 1992 – Eddie Mabo, a Torres Strait Islander, challenged the QLD Government’s rights over his home island claiming that a form of “native title” existed at the time of European settlement and had never been extinguished. The Court agreed, overturning a centuries old legal doctrine - terra nullius. Native Title may exist all across unsettled parts of Australia Phase 4 Landmarks cont’d Mabo cont’d: Land management is a residual power but the Constitution gives the Commonwealth exclusive power over Aboriginal Affairs – thus Native Title reduces state powers over land – this is the most controversial case in recent times, creating doubts about private land ownership in Australia. This was clarified by the Native Title Act 1993 Hammond Case 1997 – Franchise fees classed as excise Phase 4 Landmarks cont’d Cole v Whitfield 1988 – State laws which discriminate against interstate trade in a protectionist manner are unconstitutional. A Tasmanian company was not allowed to import smaller SA crayfish because the Tasmanian Gov’t had restricted the size of crayfish that could be sold to protect Tasmanian crayfish stocks (this is not protectionist in the economic sense). This reduced the protection of free trade between the states Phase 4 Landmarks cont’d There are many other landmark cases from Phase 4 that extend individual citizens rights but these do not affect the federal balance.. Examples… Dietrich 1992 – legal representation Australian Capital Television Case 1992 – freedom of speech Theophanous 1994 – freedom of speech How to Answer the Essay The essay asks you to ASSESS the impact of the High Court on the Federal Balance What is the Federal Balance? This needs to be addressed. Some outline of federalism, division of powers and the changing balance of these powers is necessary You MUST conclude that the Court’s impact has been very significant – given the extension of Commonwealth power since 1920 Styles of judicial interpretation are fundamental to understanding the way the Court has altered the Federal Balance. There needs to be some discussion of the styles How to Answer the Essay The case details are examples that you use to argue that the Court’s role has been significant A brief discussion of the High Court’s role in Constitutional change – given the ineffectiveness of the other mechanisms, might be useful Accurate quotation of case details, relevant sections of the Constitution where appropriate, and knowledge of key issues such the method of allocating powers, the VFI, Commonwealth grants powers, external affairs powers etc etc is needed