Vietnam country's factors to attract FDI

advertisement

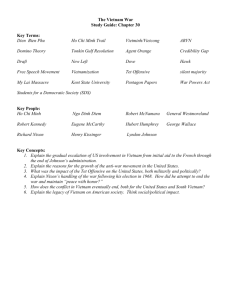

WORKSHOP (IYSW) 3 AUGUST 2011 KYOTO UNIVERSITY, JAPAN CHARACTERISTICS OF FDI CONTRIBUTION TO VIETNAM ECONOMY AND GOVERNMENT’S POLICY TO ATTRACT INWARD FDI SELECTIVELY. Presenter: Mai Hai Sam Vietnam National University Content 1. Outlook of inward FDI in Vietnam 1.1. FDI by investors 1.2. FDI by geographic structure 1.3. FDI in ownership 2. Contribution of FDI to Vietnam economy 2.1. Grossed fixed capital 2.2. GDP growth 2.3. Business structure 2.4. International trade capacity 3. Vietnam country’s factors to attract FDI 3.1. Political Stability 3.2. Rule of Law 3.3. Competitive investment cost 3.4 Corruption freedom 4. Recommendation on government policies to attract FDI 5. Conclusion 1.Outlook of inward FDI in Vietnam From 1995-2004, foreign investors were attracted by the potentiality of a transitional economy Vietnam officially joined ASEAN (1995) Agreement of Cooperation and Development between Vietnam and EU (1995), A bilateral trade agreement (BTA) between Vietnam and the United States (2001). However, from 1997 to 1999, a sharp fall in FDI inflows to Vietnam, mainly as a result of the Asian financial crisis (1997) and the unattractiveness of Vietnam’s investment environment relative to other regional countries, especially China Figure 1 . Vietnam FDI in selected years ( Unit: Millions of USD) Source: UNCTAD, World Investment Report 2011 Outlook of inward FDI in Vietnam From 2005-2007, Vietnam has witnessed the strong comeback of FDI The Law of Foreign investment in 1996 was also revised, taking out some favors to foreign investors since it generated unequal competitive environment between domestic and foreign investors. This upsurge in performance indicates a great interest from foreign investors, especially since Vietnam became the 150th member of the World Trade Organization (WTO) in 2007. The year 2008 was a particularly good year for Vietnam to attract FDI. Vietnam FDI in selected years ( Unit: Millions of USD) Source: UNCTAD, World Investment Report 2011 Dip in 2009 and 2010 due to global crisis (2007) and other internal and external reasons However, it satisfied Vietnam authorities’ plan while Vietnam Ministry of Planning & Investment (MPI) set the FDI target of year 2009 to attract almost a half of actual in year 2008 1.1.FDI characteristics by investors Foreign investors in Vietnam (1999-2010) Share of reg. cap. From 1990-2009 Share of reg. cap. From 1990-2010 Reg. FDI of 2007-2010 compared to 1990-2006 (%) SEA 40,18 39,8 193,9 ASEAN 23,22 26,3 213,5 Tax haven*1 15,48 12,8 124,52 Europe 8,97 6,4 31,6 USA, Canada, Australia 11,57 9,8 330,36 Others 0,58 4,9 Territory Source: Created from data of GSO Vietnam SEA includes: Japan, Korea, HongKong, Taiwan and mainland China. *1. Tax havens are states or countries or territories where certain taxes are levied at a low rate or not at all while offering due process, good governance and a low corruption rate. In this research, taz havens are defined according to OECD including British Virgin Islands, Cayman Islands, Bermuda, Channel Islands, Cook Islands, Island of Man, Barbados, Belize, Bahamas , Samoa, Panama, Mauritius, Sain Kitts Nevis, British West Indies, Cyprus… European investors reacted weakest during recent 3 years after Vietnam’s full participation in ASEAN (1995) While USA, Canadian, Australian investors’ capital injected into Vietnam during 2007-2010 took 3 times more than total registered capital in last 15 years It’s noted that capital coming from tax haven territories has been originated from multinational corporations (MNEs) who set up their fund subsidiaries in these tax haven. 1.1.FDI by investors (cont.) Taiwan is the biggest foreign investor (11,8%) with US$ 22,7 billion of registered capital, followed by Korea, Singapore, Japan. These top five economies have invested with total committed capital of US$ 87,6 billion (45,6 % of the total FDI capital). Top 20 foreign investors in Vietnam from 1990-2010 US’s investment capital doubled their direct registed capital (MPI/ FIA and USAID/STAR , CIEM and FIA, 2007) Source: Vietnam partner data, 2011 1.2. FDI by geographic structure Foreign investments concentrated geographically in key economic areas in the South ( 65% of total investment projects and 57,7% of registered FDI capital) and North due to wellimproved infrastructure, good sea ports, international airports, acceptable costs for employees, office and accommodation FDI in Vietnam provinces up to 2002 City/province Baria-VungTau Project (%) Capital (%) 2.36 4.73 BinhDuong 16.44 7.05 DongNai 10.54 13.73 HoChiMinh city 34.11 26.56 LamDong 1.60 2.20 QuangNgai 0.15 3.44 ThanhHoa 0.21 1.15 HaiDuong 1.12 1.30 HaiPhong 3.20 3.38 HaNoi 12.30 20.42 Others 17.98 16.05 100 100 Total Source: Vietnam Investment Review, No 563/July 29-August 4, 2002. 1.3. FDI in ownership The increasing FDI contribution seemed to motivate the increasing domestic investment as well with the stable share in about 22% average in foreign investment and higher rate from 24% to 36,4% among private sectors in 1996-2000 and 2006-2009 respectively 1.3. FDI in ownership (cont) Share of foreign invested enterprise (Unit: %) Year 2000 2003 2005 2007 2008 Small size 60,85 62,66 64,27 65,94 66,52 Medium size 13,25 11,36 9,85 9,99 9,99 Large size 25,9 26,69 25,89 25,02 23,5 FIEs/Total Es 3,61% 3,67% 3,27% 3,18% 2,74% 2009 Parent TNCs China 3.429 Taiwan 606 Vietnam 4 2,65% Total invested TNCs 286.232 3.034 326 Source: UNTCAD, 2008 Foreign investors increasingly prefer the wholly owned form for their investment after learning the various difficulties occurring by operating a JV with Vietnamese counterparts These enterprises came to Vietnam not directly from their parent corporations, but from their affiliates or branches from the third countries into Vietnam. 2. Contribution of FDI to Vietnam economy 2.1. Grossed fixed capital FDI has been an important supplementary source of funds for gross fixed capital and improved the balance of payment for the past years. The event of Vietnam becoming member of WTO in 2007 made implemented FDI accounting highly again for over 30 percent • sfsf Source: Created by author from data of CIEC, World Development indicators, World Bank (2009) and UNCTAD, World Investment Report 2011 What’s your best guess? 2.2.Contribution of FDI to GDP growth Evidently, Vietnam economic growth during these recent 5 years has been based on foreign investment more than in the past. Vietnam was one of very few countries to reach plus growth in the context of global crisis leading to economic regression in many countries, only following China in region (IMF 2011 Article IV report) FDI stock situation in Vietnam (Unit: Millions of USD and %) Year Inward FDI stocks Vietnam Share of gross domestic product Vietnam Inward FDI stocks SEA Share of gross domestic product SEA 1995 7.150 34,5 2000 20.596 2008 49.854 55 2009 57.454 61,7 2010 65.628 66,1 152.403 22,4 266.291 661.143 44,1 746.258 50,7 938.401 51,5 Source: UNCTAD, World Investment Report 2011 What’s your best guess? 2.3. Contribution to business structure The sectors which attract higher inflows were light and heavy industry and services (30% each in 2007) However, FDI in agriculture, forestry and fishing is under-proportionate compared to the importance and huge potential of these industries in Vietnam. • sfsf Source: Annual Statistical Books 2006-2009. Industry: crude oil, light industry, heavy industry, foodstuff, construction Agriculture: agri and forestry, aquatic Service: transport and telecoms, hotel and tourism, finance and banking, culture, health and educ, new cities, offices and apartment Source: Vietnam partner What’s your best guess? 2.4. Contribution to International trade capacity With foreign investors increasingly attracted to export-oriented industries, FDI has played an important role in export growth, especially after the crisis in 1997 Beside motivating export from domestic companies, FDI certainly has impacts on domestic firms’ effectiveness in export, making the market become more competitive. Contribution of FDI to Export (bil USD) Source: Vietnam Ministry of Trade Year 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Total Export 5,45 7,26 9,19 9,36 11,54 14,48 15,03 16,71 20,15 26,5 Export by FIEs 1,47 2,16 3,21 3,22 4,68 6,81 6,8 7,87 10,16 14,49 Contribution to export(%) 27% 30% 35% 34% 41% 47% 45% 47% 50% 55% 2.4. Contribution to International trade capacity FDI accelerate export more quickly than import, leading to unbalance in trade balance as well. Vietnam Balance of Payment, 2007-12 In billions of USD 2007 2008 2009 2010 2011 Projecte d -10,3 -12,8 -8,3 -7,1 -7,6 Export, F.O.B 48,6 62,7 57,1 72,2 89,4 Import, F.O.B 58,9 75,5 65,4 79,3 97 Investment income -2,2 -4,4 -3 -4,6 -4,7 Receipts 1,1 1,4 0,8 0,5 0,6 Payments 3,3 5,8 3,8 5,1 5,3 Current account balance Trade balance Source: IMF 2011 Articale iV report, p24 3. Vietnam country’s factors to attract FDI Empirical researches using an institutional theoretical approach have emphasized the study of institutional quality, political risk, bilateral investment treaties, foreign investment and trade regulations, and capital markets liberalization to explain flow of FDI (Busse et al., 1996; Habib & Zurawicki, 2002). The flow of FDI into Vietnam is related to these simultaneous satisfied institutional quality conditions: (1) The Political Stability (2) Rule of Law (3) Competitive investment cost (4) Corruption Freedom Still, there are other variables such as bilateral investment treaties, foreign investment and trade regulation, and capital markets liberalization to attract FDI, which should be further evaluated in future research. Vietnam country’s factors to attract FDI 3.1. Political Stability A big concern of developing countries to express themselves as a stable government and as a security state to ensure investment (Agarwal & Feils, 2007; Brada et al., 2003; Trevino & Mixon, 2004; Zitta & Power, 2003); Political and social stability is strength of Vietnam. There are in Vietnam less problems related religions, languages or ethnic disputes, and the safety of foreign direct investments is guaranteed Vietnam country’s factors to attract FDI 3.2. Rule of Law Comparison of Vietnam’s foreign ownership commitment among regional and global countries Segment New M&A investment Vietnam Region Globe 50 75,7 92 100 75 50 82,9 86,8 64,9 95,9 96,6 88 71,4 75,8 87,6 65 100 69,4 0 100 75,5 76,1 80,9 63,7 36,1 91,6 84,1 91 91,2 78,5 68 98,1 96 Fuel Coal Oil and gas Agriculture- forestry Light industry Telecommunication Electricity Electricity transfer Banking Insuarance Transportation Media (Journal & Television) Construction, Tourism and service Pharmacy and clean water management 100 0 100 100 49-51 100 0 100 100 49-100 0 100 51-100 100 0 100 100 49-51 100 0 30 100 49-100 0 100 51-100 Source: Investing Across Borders 2010, World Bank and Vietnam Foreign Investment Law Vietnam government has endeavored to undertake market reforms for more attractive to FDI open better investment climate and get closer to regional commitment. The amended Law of Foreign Investment was to improve its investment climate, and thus to compete with other regional economies Vietnam country’s factors to attract FDI 3.3 Competitive investment cost Comparison of investment-related cost among ASIA (10/2011- Unit: USD) Source: Japan External Trade Organization (JETRO), 2011, p66-71 According to a survey conducted by the Asian Business Council, Vietnam ranked third for investment attraction among Asian nations in the 2007-2009 period, after China and India (VIR, 2007) Due to lower costs for labor, land rent, telecommunications, power and water supplies, Việt Nam is in better position than regional countries (JETRO, 2010). Vietnam country’s factors to attract FDI 3.3. Competitive investment cost Comparison of investment-related cost among ASIA (10/2011- Unit: USD) Investment-related cost Non-manufacturing staff's salary/actual annual Danang HCMC Hanoi Jakarta ManilaBangkok Beijing Shanghai Kuala L 3.205 5.638 5.954 5.333 5.737 9.806 11.270 12.154 14.460 Engineer's salary/actual annual 2.724 4.574 5.194 6.082 6.841 9.778 6.694 10.494 14.827 Worker's salary/actual annual Office rent/month/sp.m Electricity rate for general use/kWh Housing rent for resident agent/month Regular gasoline price/liter Mobile phone basic charge/month Corporate income tax rate (%) 1.816 17 1.891 38 1.733 45 3.247 20 3.897 18 5.125 22 6.107 114 5.609 40 5.615 24 0,07 0,07 0,07 0,09 0,23 0,08 0,07 0,09 0,11 1.025 0,84 2.550 0,84 3.013 0,84 2.950 0,5 1.532 1,11 1.935 1,31 4.629 1,09 2.277 1,08 2,5 25 2,5 25 2,5 25 5 25 41 30 33 30 7,6 25 7,6 25 HK 28.94 9 31.75 0 21.87 8 94 Seoul Sing 30.73 9 30.835 30.60 9 37.266 24.60 1 22.206 52 67 0,14 0,07 0,20 1.554 2.414 1.795 0,62 1,98 1,79 4.969 1,51 86,9 25 28 16,5 11 16 80,8 17 Source: Japan External Trade Organization (JETRO), 2011, p66-71 Country ranking by inward FDI performance index and inward FDI potential index, 2007-2009 Economy Vietnam Inward FDI performance Inward FDI Potential Index 2008 2009 2010 2008 2009 20 22 22 77 73 2010 Source: UNCTAD, World Investment Report 2011 Note: Ranking is that of the latest year available. Covering 141 economies. The potential index is based on 12 economic and policy variables. Vietnam country’s factors to attract FDI 3.4 Corruption Freedom In Vietnam, law enforcement is not consistent and uniform in the country, the law interpretation and enforcement depend too much on local agencies or lower ranking state officials (JETRO, 2010). Corruption is a disturbing barrier existing in the institution to increase business cost. If the rule of Law is not strong enough, it would let corruption surrounding institutional administration. Therefore, bureaucracy and low transparency are the big weaknesses of the business environment in Vietnam. 4. Recommendation on government policies to attract FDI What are government’s effective ways to attract FDI? How to keep foreign investors make more long-term investment rather than short-term? Legal system Transparency, accountability and predictability Up-grading infrastructure Enhanced labor force by training / retraining Improved foreign investment regulations What’s your “to” Statement? 4. Recommendation on government policies to attract FDI (cont.) First priority is to adjust the legal system according to the international. Legal regulations in Vietnam in foreign investors’ assessment are generally fast changing, less predictable and less consistent, especially in tax, foreign exchange, labor regulation, land and jurisdiction. Business information has to be provided; Transparency, accountability and predictability of the public administration must be improved rapidly commitments. Post-licensing procedures especially on land clearing, foreign exchange, tax and customs must be simplified tangibly. Secondly, up-grading of infrastructure, especially in power and clean water supply, Internet connection is one of the top priorities. Vietnam maintain a competitive investment cost advantage but the quality of some public goods and services is low. Higher charges and fees for public goods and services like international dial, Internet, seaport fees and others than in regional level. Low stability, fluctuating tension, sudden black outs in power supply create significant additional costs for users and prevent investors to move high-tech investment into Vietnam. In future policy to attract inward FDI flow, Vietnam should allocate national funds to up-grade its roads, ports and various areas of infrastructure as well as improve foreign investment regulations in these sectors. 4. Recommendation on government policies to attract FDI (cont.) Thirdly, training and re-training Vietnamese labor force Young, fast learning relatively well-educated labor forces, competitive labor cost are advantages for Vietnam in region Geographic location, natural resources (oil, gas) are other factors foreign investors will take in consideration to choose a place for investment. Therefore, the quality of Vietnam's labor forces must be enhanced in different ways like vocational training, foreign languages, health and industrial discipline to keep up these competitive advantages. Fourth, enhance capability of government organization, agent to evaluate inward FDI and select new efficient foreign investment FDI has represented an extremely important source of growth for the Vietnamese economy. However, its impacts on employment and technology transfer have been limited than its potentiality. Even the imposed local content requirements have not yielded the desired results. The authorities need to clearly communicate their views of the inward FDI effectiveness in economic situation and provide economic agents with timely and comprehensive data, withdraw licenses in ineffective FDI projects to provide opportunity for more potential and capable investors, controlling the project’s land transaction. Projects which may cause pollution to environment, whose investment-scope is small but use much land and spend a lot of energy will be considered to be controlled. 5. Conclusion FDI contributes capitals help accelerate the government’s development goal and has been recognized as a major indicator to promote economic growth. Inward FDI flows contribute in the form of capital (to enrich their foreign exchange reserves) Accelerate export capacity and contribute to change the economic sector . FDI sector accounts for an increasing share in GDP. Vietnam’s restored macroeconomic stability and efforts to reduce corruption are significant factors for potential foreign investors, while incentive policies in the government’s investment law do not register as attractive enough for foreign investors rather than more transparent legal system, improved infrastructure, enhanced labor force and local agent capability 5. Conclusion (cont.) Vietnam still remains an attractive destination for investment due to favorable economic growth prospects and the implementation of pragmatic economic policies. FDI outlook for 2011-2012 is projected to grow to USD 7.7 billion and USD 8.5 billion, respectively due to returning interest and confidence by investors who are investing and doing business in the country (IMF, 2011). THANK YOU FOR YOUR ATTENTION ! 26