Audit Panel Presentation

advertisement

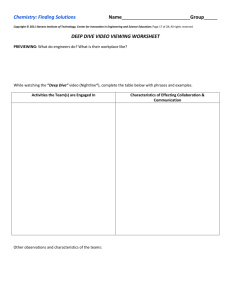

IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY AUDIT PANEL NOVEMBER 4, 2015 IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY AGENDA ITEMS 1. ROLE OF FINANCE COMMITTEE MEMBERS 2. FINANCE COMMITTEE PART IN INTERNAL CONTROLS 3. IMPORTANCE OF MANAGEMENT LETTER AND INTERNAL CONTROLS 4. FUND REVIEW SPREADSHEET – VERIFY GRANTS AND ADMIN FEES 5. 1023 EZ GRANTEES 6. 990 DONOR REPORTING OVER $250 7. OUTSIDE CONSULTANT FOR ACCOUNTING WORK VS. CFO 8. OVERVIEW OF FUNCTIONAL COSTS PROCESS 9. OVERVIEW OF PROPOSED FASB CHANGES 10.Q & A IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY ROLE OF FINANCE COMMITTEE MEMBERS BIG PURPOSE: The accounting, financial, and investment “experts” of the board IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY ROLE OF FINANCE COMMITTEE MEMBERS BIG PURPOSE: Drives selection committee 1. Skills 2. Experience 3. Objectivity 4. Active role IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY ROLE OF FINANCE COMMITTEE MEMBERS Key Responsibilities: 1. Ensure good accounting records 2. Review, evaluate and assess financial reporting 3. Oversee investment strategy and performance IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY ROLE OF FINANCE COMMITTEE MEMBERS Additional Responsibilities: 1. Financial and Investment Policies 2. Assess/approve contractual relationships 3. Risk assessment process/oversight 4. Oversight of operating budget 5. Analysis of areas having financial impact IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY FINANCE COMMITTEE PART IN INTERNAL CONTROLS When is this appropriate to consider? IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY FINANCE COMMITTEE PART IN INTERNAL CONTROLS When to involve the Finance Committee: 1. Significant payments/payouts (approval) 2. Employee credit card/expense reporting 3. Independent financial report access 4. Journal entries reported 5. Bank reconciliations and check registers IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY MANAGEMENT LETTER Required audit communications • Our responsibility as it relates to internal control • Qualitative aspects of accounting practices New accounting policies Use of estimates • Difficulties encountered • Audit adjustments or potential adjustments • Disagreements with management IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY MANAGEMENT LETTER Required audit communications (continued) • • • • Management representations Consultations with other accountants Other audit findings or issues Other information in the financial statements Internal control matters • Significant deficiencies • Material weaknesses • Control deficiencies and other recommendations IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY INTERNAL CONTROLS General controls • Documentation of policies and procedures Segregation of duties • Ensuring important functions are independent from one another • Limitation based on size • Compensating controls Board involvement • Timely review of appropriate financial reporting • Education on operational and financial matters IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY SPECIFIC CONTROLS TO CONSIDER 1. 2. 3. 4. 5. 6. 7. Dual signatures Pre- or post-approval of checks Bank statement review and timely reconciliations Use of budgets Special event issues Financial reporting controls Policies – conflict of interest, whistleblower, document retention, disaster recovery, credit cards, etc. 8. Regular board meetings with written minutes 9. Fidelity bonding insurance IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY FUND ANALYSIS TOOL Analyze activity on a fund level to ensure: • Contributions and grants credited to correct fund • Proper amount of administrative fees charged • Fund receiving proper investment return Summary of activity by fund • Progression from opening fund balance to ending • Contributions, grants, investment return, administrative fees, other FIMS: Columnar Financial Statement Pearl: Must specifically request IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY FUND ANALYSIS TOOL Fund Beg Bal Contr. Inv Ret Grants Admin Fee Other End Bal % of Inv Ret % of Grants Admin Fee % A 100,000 2,500 7,000 5,000 1,000 -0- 103,500 6.9% 4.9% 1.0% B 50,000 -0- 3,500 2,500 500 -0- 50,500 7.0% 5.0% 1.0% C 125,000 80,000 14,000 6,500 1,200 500 205,800 5.4% 3.9% 0.7% D -0- 75,000 3,800 -0- 450 -0- 79,300 9.6% 0.0% 1.1% E 25,000 -0- 1,800 1,250 375 -0- 25,175 7.2% 5.0% 1.5% F 80,000 15,000 2,500 25,000 1,350 -0- 71,150 3.3% 33% 1.8% IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY IRS FORM 1023-EZ • Introduced July 1, 2014 to help small charities Three pages instead of the standard 26 pages Must be filed online Shorter approval process timeline • Gross receipts < $50,000 for first three years • Total assets valued < $250,000 • Cannot be an LLC or private foundation IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY IRS FORM 1023-EZ • Specific purpose exclusions apply • Application fee did not change - $400 • Online application is printable with filing signature Pay.gov receipt for application fee • Determination letter & Exempt Org. Select Check Tool IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY IRS FORM 1023-EZ SHOULD WE GRANT TO AN ORGANIZATION WHO RECEIVED THEIR 501 (C)(3) USING THE 1023-EZ? WHAT DOCUMENTATION SHOULD BE REQUIRED FROM THE GRANTEE? IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY DONEE SUBSTANTIATION- SECTION 170(F)(8) Proposed Regulations • Implement the exception to the “contemporaneous written acknowledgement” requirement • Would apply to charitable contributions of $250 or more Donee organization would file information returns Returns due by February 28 (voluntary to start) Privacy and Identity Theft Concerns • Would require collection of donor Social Security numbers • Legal requirements to retain and protect from identity theft • Public comments through December 16th IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY FUNCTIONAL COST PROCESS - FORM 990 • • • • • • • Avoid using static percentages Operating expenses = 8% of distributions Programs should be 60% - 80% of total Operating and fundraising =< 25% of revenue 37% of nonprofits report zero fundraising expense 13% of nonprofits report zero operating expense Cost Sustainability Tool coming… IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY CFO VS OUTSIDE CONSULTANT The pros of hiring a consultant • • • Full-time position and salary not required No significant training Broad base of experiences to pull from The cons of hiring a consultant • • • Not available for other tasks/duties May not have their undivided attention Availability outside scheduled hours IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY FASB NFP FINANCIAL STATEMENT EXPOSURE DRAFT • • • • • Issued April 22, 2015 Comment period ended August 20, 2015 Public Roundtables held in Sept/Oct Board deliberations Effective date for adoption not yet determined IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY STATEMENT OF FINANCIAL POSITION Currently 3 classes of net assets Unrestricted Temporarily Restricted Permanently Restricted Proposed 2 classes of net assets Without Donor Restrictions With Donor Restrictions IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY STATEMENT OF ACTIVITIES • Present the change in each of the 2 classes of net assets • Additional subtotals for “without donor restrictions” column Operating excess, before transfers Operating excess, after transfers • Subtotals are to reflect inflows and outflows directed to carrying out a NFP’s purpose for existence and available for current-period operating activities • Non-operating follows – includes items such as interest expense, investment return, actuarial changes, etc. IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY TRANSFERS • Governing board designations, appropriations, and similar actions that place (or remove) self-imposed limits on the use of resources that make them unavailable (or available) for current-period operating activities Ex: Grant from a board-designated endowment fund Ex: Designation of assets for use in a future period – operating reserve • Gifts for acquisition or construction Revenue increasing net assets with donor restrictions Release of donor restriction within operations and report a transfer out of current operations IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY STATEMENT OF CASH FLOWS • Currently – many use indirect method • Proposed – use direct method • Certain cash flows will also be classified differently than current guidance Ex: Purchases and sales of long-lived assets will be classified as operating activity rather than as investing IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY OPERATING EXPENSES • Currently – required to be shown only on functional basis (except for certain types of NFPs) • Proposed – shall be presented by both natural expense classification and functional expense classification in one location Can be either on the face of the statement of activities, as a separate statements or the notes to the financial statements IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY ENHANCED DISCLOSURES • Transfers – purpose, amounts, types • Composition of net assets with donor restrictions • Management of liquidity; financial assets available to meet net-term demands for cash • Underwater endowment funds – stays in “with donor restriction” classification IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY COMMENTS RECEIVED • • • • • • • • Desire to maintain as much consistency as possible between NFP and For-Profit reporting Concern regarding cost to implement changes Net Assets - support for combining two classes Assessing Liquidity – too subjective, too vague, business entities not required to provide Measures of Operations – need clarification of what should or should not be included Transfers – makes Statement of Activities too complex Functional Expenses – mostly support to report on both function and nature Statement of Cash Flows – mixed feedback; will continue to be underutilized regardless of method IPA/GIFT FINANCE AND INVESTMENT DEEP DIVE DAY AUDITOR PANEL Shannon Borden, CPA, Director Blue & Co., LLC sborden@blueandco.com Patrick W. Burkey, CPA Estep Burkey Simmons, LLC pwburkey@ebscpa.com Rich Haddad, President and CEO K21 Health Foundation rhaddad@k21foundation.org