NO MINIMUM FICO SCORE REQUIRED

advertisement

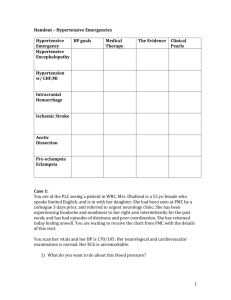

FMC Product Overview Presentation Desktop Underwriter is a registered trademark of Fannie Mae. Loan Prospector is a registered trademark of Freddie Mac. This presentation is a summary and is not complete. This information is for mortgage professionals only and should not be distributed to or used by consumers or other third-parties. Information is accurate as of the date shown below and is subject to change without notice. 6/4/2015 Agenda Government Programs: FHA Programs – includes Jumbo, Streamline, 203(k), EEM VA Programs – includes VA IRRRL USDA Program Down Payment Assistance Programs: Access (CA) / FirstDown (AZ, CO, ID, NM, NV, OR, TX, UT) SAPPHIRE (CA) CalHFA Program – Retail/Builder Only (CA) Conventional Program and Other Programs HARP DU Refi Plus Program 97% LTV Program - NEW HomeStyle Renovations Program - NEW Other Programs EB Programs - RT Jumbo Program - TC HELOC Program – FK Program FMC Niches and Value Added Advantages FMC Product Offering, Niches and Overlays GOVERNMENT PROGRAMS FHA Programs: FHA Conforming & High Balance Jumbo loans FHA Streamline Refinance FHA 203(k) Streamline Program FHA EEM Program VA Programs: VA Conforming & High Balance Jumbo loans VA IRRRL USDA Program FMC Product Offering, Niches and Overlays FHA FMC Product Offering, Niches and Overlays FHA Program Highlights Program Highlights (Conforming & High Balance Jumbo Loans)… Reduced Annual Mortgage Insurance Premium by .50% Purchases to 96.5% LTV with as low as zero fico scores (07 Program Only – 620 for FG Program) Down Payments as low as 3.5% (borrowers own funds, gift, approved DAP, grant) Rate & Term Refinances to 97.75% LTV Cash out to 85% LTV Gift funds can be used for Down Payment or Closing Costs Non-occupant co-borrower/co-signer permitted Manual UW with expanded qualifying ratios up to 50%; or follow acceptable DU approval No Reserves for 1-2 units with a DU approval 1 mo PITI required on 1 unit and 3 mos. PITI required on 3-4 Unit properties for Manually Underwritten loans ONLY) Manufactured Homes allowed up to 96.50% LTV/CLTV, and up to 5 acres max FMC Product Offering, Niches and Overlays FHA Streamline Highlights 1. NO FICO SCORE REQUIRED – No Credit Qualify Streamlines Only (Program 07) 2. NO CREDIT REPORT REQUIRED – No Credit Qualify Streamlines Only 3. 12-MONTH MORTGAGE RATING required on Subject Property Only 4. NO APPRAISAL – NO AVM 5. Reduced UFMIP/AMIP for FHA loans endorsed 5/31/2009 or prior - .01% / .55% 6. Reduced AMIP for all other FHA loans by .50% 7. WITH a new appraisal up to 97.75% LTV • 90% for fico scores between 500-579 8. Non Owner Occupied and 2nd Home properties allowed 9. Manual UW Preferred for No Credit Qualify Streamlines Only • DU approvals allowed on Full Credit Qualify Streamlines 10. See separate training for more information FMC Product Offering, Niches and Overlays FHA Streamline 203(k) Highlights 1. Streamline 203(k) loan allows a borrower to finance up to $35,000 into their purchase/refinance to make improvements, repairs and/or renovate their property 2. Available for purchases or rate/term refinances 3. Eligible properties can be REO’s (including HUD REO’s), foreclosed properties, short sold properties 4. Minimum 580 credit score required (620 for Jumbo 203(k) loans) 5. Initial disbursements paid approximately 10 business days after closing 6. Use Program 07 Only…. (NOT AVAILABLE under the FG Program) 7. Available in CA, NV, AZ, OR, WA (Other states on an as needed basis with prior approval) 8. Certification required to originate this product 9. See separate training for complete program details FMC Product Offering, Niches and Overlays FHA EEM Program 1. The FHA EEM Program allows a borrower to finance 100% of the expense of a cost effective “energy package, that is, the property improvements, to make the house energy efficient. 2. Because the home is energy efficient, the occupant(s) will save on utility costs, and therefore, be able to devote more income to the monthly mortgage payment 3. Loan limits may be exceeded 4. No additional re-qualifying – borrower doesn’t have to qualify for the additional money 5. No additional down payment required 6. Does not affect the DTI (Debt to Income Ratios) 7. No appraisal of improvements is required 8. No additional contract requirements 9. GHS does ALL the paperwork 10. See separate training for complete program details FMC Product Offering, Niches and Overlays VA FMC Product Offering, Niches and Overlays VA Program Highlights Program Highlights… NO DOWN PAYMENT 100% up to $417,000 including VAFF (Higher for high cost areas) NO MINIMUM FICO SCORE REQUIRED (07 Program Only – 620 for FG Program) NO MONTHLY MORTGAGE INSURANCE PREMIUMS NO RESERVE REQUIREMENTS Conforming 1 unit only (Own no other real estate) 100% gift funds allowed Ability to finance the funding fee (plus reduced funding fee depending on down payment, and the exemptions for veterans receiving compensation) Manually UW loan ratios to allowed up to 46% with residual requirement and comp factors FMC Product Offering, Niches and Overlays VA IRRRL Highlights 1. NO FICO SCORE REQUIRED (Program 07 – 620 for FG Program) 2. NO CREDIT REPORT REQUIRED (Program 07) 3. 12-MONTH MORTGAGE RATING required on Subject Property Only 4. No Mortgage lates in last 12 months 5. NO Appraisal NO AVM required 6. Primary Residence, 2nd Home, Investment Properties allowed • Two (2) Current Utility bills to confirm occupancy FMC Product Offering, Niches and Overlays USDA FMC Product Offering, Niches and Overlays USDA Program Highlights Program Highlights… Purchase of a home in a Rural Area Owner-occupied non-farm SFR and PUDs No acreage limitation 100% LTV of the appraised value up to $417,000 max loan amount 30-yr Fixed Rate mortgages Borrower must have very-low, or low-to-moderate income Must meet program income limits Guarantee Fee can be financed into the loan allowing up to 102% financing First Time Homebuyer FMC Product Offering, Niches and Overlays USDA Program Highlights Program Highlights… GUS approval required Manual UW must be approved by USDA directly Minimum 640 representative credit score from ALL borrowers required (620 for 07 Program Only) Low or No Down Payment and Closing Costs required No cash reserves required No minimum homebuyer contribution required Residual Income required See separate training for full program details FMC Product Offering, Niches and Overlays DOWN PAYMENT ASSISTANCE PROGRAMS Access (CA) FirstDown (AZ, CO, ID, NM, NV, OR, TX, UT) Sapphire (CA) CalHFA (CA) Retail/Builder Available now CalHFA “Wholesale” coming July 1, 2015… FMC Product Offering, Niches and Overlays ACCESS & FIRSTDOWN FMC Product Offering, Niches and Overlays Access / FirstDown Highlights FMC Product Offering, Niches and Overlays Access / FirstDown Eligibility Topic Description Eligible Borrowers Geographic Restrictions • • Eligible Programs FHA 30 Year Fixed Rate Mortgage Eligible Properties Occupancy Owner Occupied Primary Residences only Purpose Purchase Only Income Limit 115% of HUD Area Median Income (AMI) First Time Homebuyer NO First-Time Home Buyer requirement Sales Price Limit NO Sales Price Limits Follows standard FHA borrower eligibility requirements MAY OWN OTHER PROPERTIES – must meet FHA requirements NO Non-Occupant co-borrowers or co-signers Access: California FirstDown: Arizona, Colorado, Idaho, New Mexico, Nevada, Oregon, Texas, Utah Single Family Residences PUD’s FHA Approved Condos 2 Units – 640 minimum fico required Manufactured Homes – 660 credit score required FMC Product Offering, Niches and Overlays Access / FirstDown 1st Mortgage Topic Description Term 30-Year Fixed Max LTV 96.50% Max CLTV 99.50% Access / FirstDown 1st & 2nd (Follow FHA guidelines) Maximum Loan Amount Conforming: Up to $417,000 Jumbo: > $417,000 to $625,500 based on county where property is located Down Payment Assistance Access / FirstDown 2nd: • CAN be used to fulfill the borrower’s equity contribution required on FHA 1st Mortgage Minimum Fico Score NONE - Follow 4155 (580 or Zero to maximum financing) Max DTI <620 Fico: 43%; 620-659 Fico: 45%; 660+: 48.90% regardless of UW method • Manually Underwritten loans Only: Ratios stretched over 43% must meet the new FHA manual UW debt ratio guidelines. See ML 2014-02 Reserves NONE w/DU Approval (1 month PITI required on manually underwritten loans) UW Guidelines Follow standard FHA guidelines unless stated in Term Sheet or Training FMC Product Offering, Niches and Overlays Access / FirstDown 2nd Mortgage Topic Description Term 15-yrs Fixed-Rate Fully Amortizing Maximum Loan Amount Sized up to 3% of the lower of the Sales Price or Appraised Value Interest Rate 8.25% Max CLTV 99.50% Access / FirstDown 1st & 2nd (Follow FHA guidelines) Use of Funds Proceeds may be used for: DOWN PAYMENT CLOSING COSTS Price Adjustments Up Front or Single Premium MI No cash back to the borrower from the 2nd loan proceeds • Any overage over POCs must be used to reduce principal balance • Any overage over $500 results in redraw of loan documents FMC Product Offering, Niches and Overlays SAPPHIRE FMC Product Offering, Niches and Overlays SAPPHIRE Highlights What the Sapphire Program Offers… 1st Mortgage Loans: o FHA and VA available products o Available throughout the State of California o Interest Rate available at the Reservation Portal at https://nhfresportal.nhfloan.org o The published rate is subject to change at any time Grant: o May not exceed 3% or 5% of total 1st lien loan amount (including upfront MIP or VAFF) o Proceeds can be used for: Down Payment Closing Costs Prepaid Items Earnest money MIP o Not a 2nd lien; does not need to be calculated into the DTI/CLTV o There must be no cash back to the borrower from the Grant Fund proceeds FMC Product Offering, Niches and Overlays SAPPHIRE Eligibility Borrower Eligibility: Be a US Citizen, permanent resident alien, or qualified alien Occupy the residence as their primary residence Non-occupant co-borrowers/co-signers – NOT allowed Borrower income cannot exceed NHF Income limits for the county in which the property is located 115% Area Median Income (AMI) Minimum Credit Score of 620 Meet all required agency Guidelines (FHA/VA) FHA must meet HUD 4155 guidelines plus FMC overlays VA must meet VA Handbook plus FMC overlays Property Eligibility: Eligible Properties 1-2 Units, PUDs, FHA Approved Condos Ineligible Properties 3-4 Units, Manufactured Homes, 2nd Homes, NOO, Co-Ops, Recreation FMC Product Offering, Niches and Overlays CalHFA 1. 2. 3. 4. 5. 6. CalPLUS Conventional with ZIP CalPLUS Conventional with ZIP EXTRA CalPLUS FHA with ZIP CalHFA Conventional CalHFA FHA CHDAP FMC Product Offering, Niches and Overlays CalPLUS Conventional W/ZIP (Zero Interest Program) CalHFA Conventional first mortgage with DAP built in Up to 97% LTV (Condo’s capped at 95% LTV) Up to 105% CLTV First Time Homebuyer or Non-First Time Homebuyer MCM Guidelines. In DU… Select HFA Preferred in the Community Lender Product Field CalHFA Subordinate loans must be entered as Community 2nds Reduced MI with Genworth (see next slide) Single Premium and Monthly Options Up to $417,000 Maximum loan amount on first mortgage ADMC .25% NO LLPA NO Minimum Borrower Contribution required Can be combined with Fannie Mae Community 2nds or CHDAP FMC Product Offering, Niches and Overlays ZIP (Zero Interest Program) w/CalPLUS Conventional 3% of the first mortgage loan amount Total loan amount including Upfront MI if applicable 0.00% (Zero) Interest Rate Payments are deferred over life of loan, until… Refinanced Transferred Sold Matches term of CalPLUS 1st Mortgage Use for Down Payment Assistance ONLY First Time Homebuyer or Non-First Time Homebuyer Can be combined with Fannie Mae Community 2nds or CHDAP Conventional Loans with 95.01 - 97% LTV Overlays: 680 min FICO No condos allowed Underwritten by Investor FMC Product Offering, Niches and Overlays ZIP (Zero Interest Program) EXTRA w/CalPLUS Conventional FIRST TIME HOMEBUYERS ONLY 3% of the total 1st mortgage amount (ZIP) $6,500 3% ZIP can be used for Down Payment Assistance ONLY $6,500 can be used for Down Payment, Closing Costs, or Single Premium MIP 0.00% (Zero) Interest Rate Deferred Payments All other guidelines follows the regular ZIP FMC Product Offering, Niches and Overlays CalPLUS FHA W/ZIP (Zero Interest Program) CalHFA FHA insured first mortgage with DAP built in Up to 96.50% LTV - Lesser of $417,000 (excluding UFMIP) or FHA loan limit Up to 105% Max CLTV High balance loans allowed – See CalHFA rate sheet for additional fee 640 Minimum Fico Score First Time Homebuyer or Non-First Time Homebuyer Borrower contribution no longer required Zero score borrower(s) allowed Allowed ONLY if one of the occupant borrower’s has a fico score that meets the minimum program required score Manual Underwriting allowed Manufactured Homes allowed with 660+ Fico Score Can be combined with any FHA approved 2nds, CHDAP FMC Product Offering, Niches and Overlays ZIP (Zero Interest Program) w/CalPLUS FHA 3.5% of the first mortgage loan amount Total loan amount including Upfront MI 0.00% (Zero) Interest Rate Payments are deferred over life of loan, until… Refinanced Transferred Sold Matches term of CalPLUS 1st Mortgage Use for Down Payment Assistance ONLY First Time Homebuyer or Non-First Time Homebuyer Manufactured Homes Allowed with 660+ Fico Score Can be combined with FHA Approved Seconds, CHDAP FMC Product Offering, Niches and Overlays CalHFA Conventional & FHA CalHFA Conventional and CalHFA FHA Same as corresponding CalPLUS product With lower interest rate published daily Use when your borrower doesn’t need ZIP Can be combined with CHDAP FMC Product Offering, Niches and Overlays CHDAP (California Homebuyers Down-Payment Assistance Program) 3% loan amount – Lower of Sales Price or Appraised Value 3.25% simple interest Payments are deferred over life of loan, until refinanced, sold, transferred First-Time Homebuyers Only Up to 105% Max CLTV (103% Standalone; Non-CalHFA 1st) Max 45.00% DTI (43% Standalone; Non-CalHFA 1st) Manual UW allowed if combined with an FHA first mortgage (Can be CalHFA or non-CalHFA first) Manufactured Homes Allowed with a 660+ Fico Score Can be in any Lien Position Can be combined with any CalHFA or Non-CalHFA 1st mortgage, Fannie Mae Community 2nd or FHA Approved 2nd FMC Product Offering, Niches and Overlays Upcoming CalHFA Programs 1. CalEEM + Grant Program 2. ECTP – Extra Credit Teachers Program 3. CalHFA MCC Program FMC Product Offering, Niches and Overlays CONVENTIONAL Highlights of the Conventional Products FMC Approved MI Companies: *** Genworth: www.mortgageinsurance.genworth.com *** MGIC: www.mgic.com *** United Guaranty: www.ugcorp.com Lender Paid MI Option FMC Product Offering, Niches and Overlays Conventional Program Highlights Topic Description Highlights 5-20% minimum down payment required based on MI availability Minimum 620 fico score required Gift funds allowed Ratios up to 45% (DU with flex up to 50%) See MI matrix for max DTI Manufactured Homes available up to max - 90% LTV/CLTV - 2 acres max • Check MI for eligibility Jumbo loan amounts available up to $625,500 DU approval required Manual Underwriting NOT ALLOWED! FMC Product Offering, Niches and Overlays Conventional Program Highlights Topic Description Minimum Fico Score 620 - Follow DU approval. Higher Fico Requirements on 5+ more financed properties See Announcement 09-02 Mortgage Insurance MI available up to 95% for most states Check MI company guidelines for details See next page for highlights Approved MI Companies FMC Approved MI Companies – see next slide for highlights Genworth MGIC United Guaranty Niche: Borrowers with 5-10 financed properties Allowed up to 75% LTV - Purchase/R&T Refinances Minimum 720 fico score Must meet minimum reserve requirement FMC Product Offering, Niches and Overlays OTHER PROGRAMS HARP DU RefiPlus 97% LTV Program HomeStyle Renovations Program EB Jumbo - RT Jumbo - TC HELOC FMC Product Offering, Niches and Overlays FMC Product Offering, Niches and Overlays Program Highlights Highlights of the DU Refi Plus Program: Borrower(s) must have an existing Fannie Mae loan, acquired before 6/1/2009, with an acceptable payment history Borrowers must benefit from the refinance with no more than $250 cash back NO MAXIMUM LTV for FRM with terms up to 30 years NO MINIMUM FICO SCORES – Doesn’t follow standard Fico requirements NO MI - MI flexibilities, with no additional coverage required 1-4 Primary Residences, 1-4 Non-Owner Investments, 1-unit 2nd Homes DU Approval required (Manual UW not allowed) Price Adjustment caps - LLPA’s effectively eliminated for HARP loans with terms of 20 yrs or less; cap for other HARP loans is .75%; 2% for NOO.. FMC Product Offering, Niches and Overlays FMC Product Offering, Niches and Overlays Program Overview Non-MCM Program – Regular 97% LTV Standard Program Purchase transactions if at least one borrower is a FirstTime Homebuyer Standard Limited Cash-Out Refinance Option for existing Fannie Mae loans No Income Limits, No Counseling required FMC Product Offering, Niches and Overlays Eligibility Guidelines PURCHASE Eligible Borrowers Must be a First Time Home Buyers • At least 1 borrower must be a FTHB • FTHB is defined as someone who has not owned any residential property in the last 3 years Income Limits No Income Limit required Minimum MI Coverage 18% + MI Loan-Level Price Adjustment or 35% Home-buyer Education Not required and Counseling Minimum Borrower Contribution Standard contribution requirements apply Pricing Standard risk-based LLPAs • Based on credit score and LTV range FMC Product Offering, Niches and Overlays Eligibility Guidelines REFINANCE (Limited Cash-Out) Existing Loan Loan must be owned (or securitized) by Fannie Mae • Documentation may come from the current servicer, Fannie Mae’s loan lookup tool, or any other eligible source Minimum MI Coverage 18% + MI Loan-Level Price Adjustment or 35% All other guidelines Follow standard limited cash-out refinance guidelines Pricing Standard risk-based LLPAs • Based on credit score and LTV range FMC Product Offering, Niches and Overlays FMC Product Offering, Niches and Overlays Program Overview HomeStyle Renovation is a single-close loan that enables borrowers to purchase a home that may need repairs, or refinance the mortgage on their existing home, and include the necessary funds for the renovation into the loan balance The loan amount is based on the “as-completed” value of the home, rather than the present value The Fannie Mae HomeStyle Renovations Program allows lenders to combine a traditional first mortgage with the funds necessary for renovating, repairing, or improving a home in a single-close loan Available via Retail / Builder Only! • State Restrictions: AZ, CA, NM, NV, TX, UT Wholesale via the Special Products Division Only! FMC Product Offering, Niches and Overlays ELIGIBILITY GUIDELINES Eligible Borrowers Individual home buyers or homeowners Eligible Properties / Primary Residence: Occupancy Type • 1-4 Unit SFRs, PUDs, Fannie approved Condos 2nd Homes: • 1 Unit Investor Properties: • 1 Unit • Manufactured Homes - INELIGIBLE Repair Amount Up to 50% of the As-Completed Value • Up to 10% for Borrower Do-It-Yourself work FMC Product Offering, Niches and Overlays ELIGIBLE REPAIRS FMC Product Offering, Niches and Overlays FMC Product Offering, Niches and Overlays Program Guidelines Topic Description Program Types Conforming ARM Programs Jumbo Programs Jumbo Loan Amounts Fixed Rate Loan Minimum - $417,001 Fully Amortizing ARM Loan Minimum - $250,000 Maximum - Up to $3 Million (See EB Jumbo matrix) Loan amounts > $1,500,000 require Loan Committee Approval FMC: Over $1 Million – requires FMC Corporate approval Occupancy Type Primary Residence Only Second Homes Investment Properties Loan Purpose Purchase Transactions Technical Refinances Rate & Term Refinances Cash Out FMC Product Offering, Niches and Overlays CONFORMING Program Matrix FMC Product Offering, Niches and Overlays JUMBO Program Matrix FMC Product Offering, Niches and Overlays FMC Product Offering, Niches and Overlays CONFORMING Program Guidelines Topic Description UW Method LP (Loan Prospector) with “Accept” Recommendation ONLY!!! o Streamlined Accept and Standard Documentation acceptable Caution risk class is NOT allowed o A-Minus Offering is NOT allowed Manual Underwrite is NOT allowed Minimum Fico Score 640 Minimum FICO score DTI 50% - regardless of AUS decision Blended Ratios allowed FMC Product Offering, Niches and Overlays Conforming Program Matrix FMC Product Offering, Niches and Overlays JUMBO Program Guidelines Topic Description Program Types Fixed: Rate Mortgage: 10-Year to 30-Year Fixed ONLY ARMS: NOT AVAILABLE Loan Amounts See Matrix LTV / CLTV See Matrix Occupancy Type Primary Residence for 1-2 unit properties Only Second Home for 1 unit properties Only Investment Properties – NOT ALLOWED FMC Product Offering, Niches and Overlays Jumbo Program Matrix FMC Product Offering, Niches and Overlays FMC Product Offering, Niches and Overlays Program Overview HELOC 2nd – combined with our Conventional 1st (Agency Conventional Conforming, Conventional High Balance, or Jumbo program) 2nd available in a form of a HELOC • • Assist jumbo loans by reducing the 1st to conforming loan amounts or available jumbo 1st Eliminate MI HELOC 2nd can be up to $350,000 Recommend to take full line to 89.99%; cannot change post close Brokered loan – we close the first, investor closes 2nd concurrently Available via our FMC Retail / Builder divisions only NOT AVAILABLE IN NEVADA!!! FMC Product Offering, Niches and Overlays HELOC 2nd Matrix HELOC (30-YR Rates) (Purchase/Refinance of 1-2 Family Primary SFR, Condo, PUDs) Combined 1st & 2nd Mortgage Exposure CLTV Minimum FICO Prime + $750,000 89.99% 700 1.99% $750,000 80.00% 700 1.49% $1,275,000 85.00% 720 1.99% $1,275,000 80.00% 720 1.49% Current Prime – 3.25% FMC Product Offering, Niches and Overlays FMC Product Offering, Niches and Overlays Non-Agency JUMBO Program Overview Fixed Rate – 30 Yr Loan Amounts up to $2.5 Million LTV’s up to 80% FICO scores as low as 700 DTI’s up to 43% max Delayed financing (within 6-months of cash acquisition) Payoff of 12 month seasoned subordinate liens considered rate/term FMC Product Offering, Niches and Overlays Non-Agency JUMBO Matrix FMC Product Offering, Niches and Overlays Non-Agency EXPANDED Program Overview Eligible Borrowers • US Citizens, Permanent Resident Alien • Non-Permanent Resident Alien Foreign Nationals • Loan amounts to $1MIL up to 60% LTV, and $1.5MIL up to 55% LTV • Second Homes • B-1, B-2, H-1, I, J-1, J-2, O-2, P-1, P-2 VISAs • ITIN or SSN Credit Standards • FICO minimums as low as 640 • BK/FC/SS – None in the past 4 years Debt-to-Income Ratios • Maximum increased to 50% • > 43% DTI o o Additional Reserves Required Minimum residual income levels FMC Product Offering, Niches and Overlays Non-Agency EXPANDED Program Overview Topic Description May be used as qualifying income Asset Depletion Monthly qualifying income: Qualifying asset value divided by loan term LTV reduction Maximum LTV reduced by 10% if subject property is vacant LTV restriction LTV may be restricted depending on cash flow Impounds Required regardless of LTV Non Warrantable Condos OK FMC Product Offering, Niches and Overlays Non-Agency EXPANDED Matrix FMC Product Offering, Niches and Overlays Investor EXPRESS Program Overview 30 year fixed rate mortgage Unlimited number of financed properties (Investor will finance up to 10) Purchase or Refinances – no limit on cash out Property DTI based solely on subject property cash flow. • 65% to 90% maximum Property DTI Credit Scores as low as 620 Bankruptcy/Foreclosure: None in last 36 months Foreign nationals with ITINs allowed Non-warrantable Condos Maximum LTV reduced by 10% if subject property is vacant LTV may be restricted depending on property cash flow. Impounds required regardless of LTV FMC Product Offering, Niches and Overlays Investor EXPRESS Matrix FMC Product Offering, Niches and Overlays Non-Warrantable Condos Program Overview Loans secured by properties located in condominium projects that are not warrantable to Fannie Mae under specific, expanded project criteria are eligible. Non-Warrantable condominiums must meet the Expanded Criteria and all Standard Fannie Mae Criteria referenced below… FMC Product Offering, Niches and Overlays MISCELLANEOUS FMC Overlays Expired Loan Programs FMC Value Added advantages FMC Product Offering, Niches and Overlays FMC Overlays Dated: 11/1/2014 FMC Product Offering, Niches and Overlays FMC Overlays Overview Ineligible Products Eligible Products Appraisal Requirements 4506T Requirements Overlays for Manual underwrites Insufficient Credit Borrower requirements Overlays for FHA Manufactured Homes Overlays for VA Loans Overlays for VA Manufactured Homes Overlays for Jumbo VA loans Overlays for Disputed Accounts Overlays for Authorized Users Overlays for Age restricted communities Overlays for MCC program FMC Product Offering, Niches and Overlays FMC Value Added Advantages FICO SCORES: • We offer true ZERO FICO on FHA and VA loans • Must comply with their respective guidelines plus FMC Overlays • 500 Fico’s also allowed as long as our overlays and FHA guidelines are met CERTS: • Septic Certs – good for 6 months • Termite & Clearance – good for 90 days CONVENTIONAL LOANS: • We can loan on up to 10 financed properties through FNMA MANUFACTURED HOMES: • FHA to 96.50% LTV w/ 660+ fico (up to 99.50% with Access/FirstDown w/ 660+ fico) • VA to 100% LTV • Conventional to 95% LTV 4506-T: • 4506-T for full tax transcripts required on SELECTED BORROWERS ONLY • We only require 4506 W-2 validation in most cases • Do not get more than you need FMC Product Offering, Niches and Overlays FMC Product Support… FMC WEB SITE Rate Sheets Matrices FMC Overlays Training Schedule/Materials Guidelines Forms Marketing Tools Calculators TRAININGS First Mortgage offers FREE Weekly ONLINE Trainings See the FMC website for the June 2015 Training schedule Trainings for June 2015: 6/4 – FMC Product Overview 6/9 – CalHFA “Product” Training SUPPORT TEAM RETAIL: Contact your FMC Loan Help Team Wholesale Brokers / Correspondent Lenders: Contact your FMC Account Executive For help with: 6/11 – CalHFA “Income” Training 6/16 – CalHFA “Processing” Training 6/18 – FMC “TRID” Training FMC Product Offering, Niches and Overlays Guidelines Program questions Scenarios Pricing / Fees Loan Submissions Trainings On behalf of First Mortgage, thank you for joining today’s training and we hope the information provided will help you build your business! The main purpose of First Mortgage Corporation’s (FMC) training documents is to assist real estate and mortgage professionals in developing entry-level competence with loan programs. While FMC staff, employees, contractors and contributors take care to ensure the accuracy of the content of training documents, FMC makes no warranties as to the accuracy of the information contained within these materials. Furthermore, every user of this material uses it understanding that he or she must still conduct his or her own original legal research, analysis and drafting. In addition, every user must refer to the relevant legislation, case law, administrative guidelines, rules and other primary sources. FMC specifically disclaims any liability for any loss or damage any user may suffer as a result of information contained within this training material. While the information contained in FMC’s training material addresses guidelines and issues surrounding mortgage programs, these materials do not constitute legal advice. All non-legal professionals are urged to seek legal advice from a lawyer. FMC Product Offering, Niches and Overlays