Chapter 14

advertisement

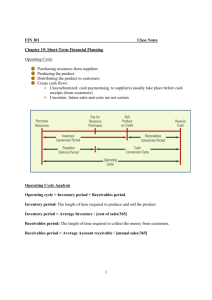

The Management of Working Capital Chapter 16 (Ch. 15 in 4th edition) Basics Working Capital Basics The assets/liabilities that are required to operate a business on a day-to-day basis Cash Accounts Receivable Inventory Accounts Payable Accruals These assets/liabilities are short-term in nature and turn over regularly 2 Working Capital, Funding Requirements, and the Current Accounts Gross Working Capital (GWC) represents the investment in assets Working Capital Requires Funds Maintaining a working capital balance requires a permanent commitment of funds Example: Your firm will always have a minimum level of Inventory, Accounts Receivable, and Cash—this requires funding 3 Working Capital, Funding Requirements, and the Current Accounts Spontaneous Financing Your firm will also always have a minimum level of Accounts Payable—in effect, money you have borrowed Accounts Payable (and Accruals) are generated spontaneously Offset the funding required to support assets Net working capital is Gross Working Capital – Current Liabilities (or spontaneous financing) Reflects the net amount of funds needed to support routine operations 4 Objective of Working Capital Management To run the firm efficiently with as little money as possible tied up in Working Capital Involves trade-offs between easier operation and the cost of carrying short-term assets Benefit of low working capital Less capital invested for the level of business (higher rate of return) Cost of low working capital Lost sales risk 5 Objective of Working Capital Management Inventory High Levels Low Levels Benefit: Happy customers Few production delays (always have needed parts on hand) Cost: Expensive High storage costs Risk of obsolescence Cost: Shortages Dissatisfied customers Benefit: Low storage costs Less risk of obsolescence Cash High Levels Benefit: Reduces risk Cost: Increases financing costs Low Levels Benefit: Reduces financing costs Cost: Increases risk 6 Objective of Working Capital Management Accounts Receivable High Levels (favorable credit terms) Benefit: Happy customers High sales Cost: Expensive High collection costs Increases financing costs Low Levels (unfavorable terms) Cost: Dissatisfied customers Lower Sales Benefit: Less expensive Payables and Accruals High Levels Benefit: Reduces need for external finance--using a spontaneous financing source Cost: Unhappy suppliers Low Levels Benefit: Happy suppliers/employees Cost: Not using a spontaneous financing source 7 Operations—Cash Conversion Cycle A firm begins with cash which then “becomes” inventory Which then becomes a product which is sold Eventually this will turn into cash again The firm’s operating cycle is the time from the acquisition of inventory until cash is collected from product sales 8 Figure 15.2: Time Line Representation of the Cash Conversion Cycle 9 Wal Mart CCC WAL MART STORES INC sales per day COGS per day RECEIVABLES INVENTORIES ACCOUNTS PAYABLE 718558 552075 1,254,000 26,612,000 19,332,000 10 Wally World CCC – 2007 data ICP 48.2 DSO +1.7 AP deferrals CCC -35 14.2 11 Permanent and Temporary Working Capital Temporary working capital supports seasonal peaks in business Working capital is permanent to the extent that it supports a constant of minimum level of sales 12 Figure 15.3: Working Capital Needs of Different Firms 13 Financing Net Working Capital Since working capital is of a short-term nature, it is often financed with short-term sources This is known as the maturity-matching principle Permanent working capital can be financed either long or short term Temporary working capital needs should be supported with short-term funds 14 Short-Term vs. Long-Term Financing Long-term financing Safe but expensive Safe because you don’t have re-issue risk Expensive because long-term rates are generally higher than short-term rates Short-term financing Cheap but risky Cheap because short-term rates are generally lower than long-term rates Risky because you are continually entering marketplace to borrow—borrower will face changing conditions 15 Alternative Policies The mix of short- or long-term working capital financing is a matter of policy Use of longer term funds reflects conservatism 16 Figure 15.4—Working Capital Financing Policies 17 Working Capital Policy Firm must set policy on following issues: How much working capital is used The extent to which working capital is supported by short- vs. long-term financing The nature/source of any short-term financing used How each component of working capital is managed 18 Sources of Short-term Financing Spontaneous financing Accounts payable and accruals Unsecured bank loans Commercial paper Secured loans 19 Spontaneous Financing Accruals Money you owe employees (for example) for work they have performed but not yet been paid Tend to be very short-term Accounts payable (AKA trade credit) Money you owe suppliers for goods you bought on credit Credit Terms: Terms of trade specify when you are to repay the debt Example of terms of trade: 2/10, net/30 You must pay the entire amount by 30 days If you pay within 10 days, you will receive a 2% discount 20 Spontaneous Financing The prompt payment discount Example Passing up prompt payment discounts is generally a very expensive source of financing If the terms of trade are 2/10, net 30, and you elect to not pay by the 10th day, you are essentially paying 2% interest for 20 days’ use of money. There are 18.25 20-day periods in one year (365 days 20). We can convert the 2% foregone discount into an annual rate by multiplying 2% by 18.25 to obtain 36.5%. Thus, most prompt payment discounts are very attractive. 21 Spontaneous Financing Abuses of Trade Credit Terms Trade credit, while originally a service to a firm’s customers, has become so commonplace it is now expected Companies offer it because they have to Stretching payables is a common abuse of trade credit Paying payables beyond the due date Slow paying companies receive poor credit ratings in credit reports issued by credit agencies 22 Unsecured Bank Loan Represent the primary source of short-term loans for most companies Promissory note (AKA Notes Payable) Note signed promising to repay the amount borrowed plus interest Bank usually credits the amount to borrower’s checking account 23 Unsecured Bank Loans Line of credit Informal, non-binding agreement between bank and firm that specifies the maximum amount firm can borrow over a specific time frame (usually a year) Borrower pays interest only on the amount borrowed Revolving credit agreement Similar to a line of credit except bank guarantees the availability of funds up to a maximum amount (effectively a binding agreement) Borrower pays a commitment fee on the unborrowed funds (whether they are used or not) 24 Unsecured Bank Loans Example Q: The Arcturus Company has a $10 million revolving credit agreement with its bank at prime plus 2.5% based on a calendar year. Prior to the month of June, it had taken down $4 million that was outstanding for the entire month. On June 15, it took down another $2 million (assume the funds were available on June 16). Prime is 9.5% and the bank’s commitment fee is 0.25% annually. What bank charges will Arcturus incur for the month of June? A: Arcturus will have to pay both interest on the money borrowed and a commitment fee on the unused balance of the revolving agreement. Monthly interest rate: (Prime + 2.5%) 12 = 1% Monthly commitment fee: 0.25% 12 = 0.0208% $4 million was outstanding for the entire month of June and $2 million was outstanding for 15 days of June, so the total dollar interest charges are: 15 ($4,000,000 x 0.01) .01 x $2,000,000 x $50,000 30 The commitment fee must be paid on an average of $5,000,000 that was unused during June, or: • $5,000,000 .000208 = $1,040 • Total interest payment = $51,040 25 Unsecured Bank Loans Compensating balances A minimum amount by which the borrower’s bank account cannot drop below (therefore it is unavailable for use) Increases the effective interest rate on a loan Typically between 10% and 20% of amounts loaned 26 Example Unsecured Bank Loans Q: A firm borrows $100,000 subject to a 20% compensating balance. The firm will only receive $80,000 in usable funds and the remaining $20,000 must remain in the firm’s account. If the stated rate on the loan is 12%, what is the effective rate? A: The firm must pay the 12% on the entire $100,000 borrowed. Thus, the firm will pay $12,000 in interest for a year on $80,000 of usable funds. This translates to an effective annual rate of 15%, or $12,000 $80,000. 27 Unsecured Bank Loans Clean-Up Requirements Theoretically a firm can constantly roll-over its short-term debt Borrow on a new note to pay off an old note Risky for both the firm and the bank Some banks require that borrowers clean up short-term loans once a year Remain out of short-term debt for a certain time period 28 Commercial Paper Notes issued by large, financially-strong firms and sold to investors Basically a short-term corporate bond Unsecured (usually) Buyers are usually other institutions (insurance companies, mutual funds, banks, pension funds) Maturity is less than 270 days Considered a very safe investment, therefore pays a relatively low interest rate Rather than paying a coupon rate, interest is discounted Commercial paper market is rigid and formal—no flexibility in repayment terms 29 Short-Term Credit Secured by Current Assets Debt is secured by the current asset being financed More popular in some industries than in others Common in seasonal businesses 30 Short-Term Credit Secured by Current Assets Receivables Financing: Accounts receivable represent money that is to be collected in the near future Banks recognize that this money will be collected soon are are willing to lend money based on this soon-to-becollected money Pledging AR: firm promises to use the money paid from the collected AR to pay off bank loan (but AR still belong to firm which still collects the accounts) If firm doesn’t repay, lender has recourse to borrower Factoring AR: firm sells AR to lender (at a severe discount) and the lending firm (factor) takes control of the accounts AR are now paid directly to lender 31 Short-Term Credit Secured by Current Assets Pledging Accounts Receivable Firm promises to use the money paid from the collected accounts to pay off bank loan Accounts Receivable still belong to firm which still collects the accounts If firm doesn’t repay, lender has recourse to borrower Lender can provide General line of credit tied to all receivables Lender likely to advance at most 75% of the balance of accounts Specific line of credit tied to individual accounts receivable Evaluates based on creditworthiness of account Lender likely to advance as much as 90% of the balance of accepted accounts Expensive form of financing 32 Short-Term Credit Secured by Current Assets Factoring Accounts Receivable Firm sells Accounts Receivable to lender (at a severe discount) and the lending firm (factor) takes control of the accounts Accounts Receivable are now paid directly to lender Factor usually reviews accounts and only accepts accounts it deems creditworthy Factors offer a wide range of services Perform credit checks on potential customers Advance cash on accounts it accepts or remit cash after collection Collect cash from customers Assume the bad-debt risk when customers don’t pay 34 Short-Term Credit Secured by Current Assets Inventory Financing Use a firm’s inventory as collateral for a short-term loan Popular but subject to a number of problems Lenders aren’t usually equipped to sell inventory Specialized inventories and perishable goods are difficult to market Types of methods used Blanket liens—lender has a lien (claim) against all inventories of the borrower but borrower remains in physical control of inventory Chattel mortgage agreement—collateralized inventory is identified by serial number and can’t be sold without lender’s permission (but borrower remains in physical control of inventory) Warehousing—collateralized inventory is removed from borrower’s premises and placed in a warehouse (borrower’s access controlled by third party) When inventory is sold a paper trail is generated and copy sent to lender (signaling lender to expect money from borrower soon) 35 Cash Management Why have cash on hand? Transactions demand: need money to pay bills (employees, suppliers, utility/phone, etc.) Precautionary demand: to handle emergencies (unforeseen expenses) Speculative demand: to take advantage of unexpected opportunities (purchase of raw materials that are on sale) Compensating balances 36 Objective of Cash Management Cash doesn’t earn a return Want to maintain liquidity without losing too much in return Can place a portion of cash balance into marketable securities (AKA: near cash or cash equivalents) Liquid investments that can be held instead of cash and earn a modest return Examples include Treasury bills, commercial paper 37 Check Disbursement and Collection Procedures When you pay a bill, the process generally works like this: You write a check and place it in the mail to payee (2-3 days of mail float) Payee receives check and performs internal processing (1 day of processing float) Payee deposits check in its own bank (1 day of processing float) Payee’s bank sends check into Federal Reserve’s interbank clearing system which processes the check (2 days of transit float) As a payer, you want to extend this time period As a payee, you want to reduce this time period 38 Accelerating Cash Receipts Lock-box systems A post office box(es) located near customers in order to shorten mail and processing float Payee rents post office box(es) in strategic locations and hires a bank to check the box and deposit payments received into account After deposits are made, copies are send to payee’s office and internal processing completed Concentration Banking A single concentration bank manages balances in multiple remote accounts, sweeping excess cash into a central location for investment in marketable securities Funds can be moved electronically or via a depository transfer check 40 Managing Accounts Receivable Generally firms like as little money as possible tied up in receivables Reduces costs (firm has to borrow to support the receivable level) Minimizes bad debt exposure But, having good relationships with customers is important Increases Sales Firm needs to strike a balance on these issues 45 Managing Accounts Receivable Objective: Maximize profitability (not Sales) Questions that need to be answered: Credit Policy—what type of customer will you lend to? How financially viable must that customer be? Terms of sale (Trade)—What terms will the firm offer to credit customers? Collections Policy—How will the firm collect from those customers who don’t pay? 46 Credit Policy Must examine the creditworthiness of potential credit customers Credit report Customer’s financial statements Bank references Customer’s reputation among other vendors Having a tight credit policy means you’ll probably have lower Sales Having a loose credit policy means you’ll probably have high bad debts Conflicts often arise between the sales and credit departments Sales department’s job is to generate sales and if salespeople are paid on commission it can get personal 47 Terms of Sale Credit sales are made according to specified terms of sales Example: 2/10, net 30 means the customer receives a 2% discount if payment is made within 10 days, otherwise the entire amount is due by 30 days Prompt payment discount is usually an effective tool for managing receivables Customers pay quickly to save money Generally follow industry standard 48 Collections Policy Collections department’s function is to follow up on overdue receivables (called dunning) Mail a polite letter Follow up with additional dunning letters Phone calls Collection agency Lawsuit A firm’s collection policy is the manner and aggressiveness with which a firm pursues payment from delinquent customers Being overly aggressive can damage customer relations 49 Receivables Monitoring 1. Days Sales Outstanding (DSO) The average length of time required to collect accounts receivable Also called the average collection period 50 Receivables Monitoring 2. Aging Schedule Report showing how long accounts receivable have been outstanding The report divides receivables into specified periods, which provides information about the proportion of receivables that are current and proportion that are past due for given lengths of time 51 Aging Schedule Age of Account (in days) 0-30 31-60 61-90 Over 90 Net Amount Outstanding $ 72,000 90,000 10,800 7,200 $ 180,000 Fraction of Total Receivables Average Days 40% 50% 6% 4% 100% 18 55 77 97 DSO = 0.40 (18 days) + 0.50 (55 days) + 0.06 (77 days) + 0.04 (97 days) = 43.2 days 52 Inventory Management Mismanagement of inventory has the potential to ruin a company Inventory is not the direct responsibility of the finance department Usually managed by a functional area such as manufacturing or operations However, finance department has an oversight responsibility for inventory management Monitor level of lost of obsolete inventory Supervise periodic physical inventories Benefits and Costs of Carrying Adequate Inventory Benefits Reduces stockouts and backorders Makes operations run more smoothly, improves customer relations and increases sales Costs Interest on funds used to acquire inventory Storage and security Insurance Taxes Shrinkage Spoilage Breakage Obsolescence Inventory Control and Management Inventory management refers to the overall way a firm controls inventory and its cost Define an acceptable level of operating efficiency with regard to inventory Try to achieve that level with the minimum inventory cost Economic Order Quantity (EOQ) Model EOQ model recognizes trade-offs between carrying costs and ordering costs Carrying costs increase with the amount of inventory held Ordering costs increase with the number of orders placed EOQ minimizes the sum of ordering and carrying costs Economic Order Quantity (EOQ) Model The EOQ model is: 2 Fixed Cost per Order Annual Demand EOQ = Annual Carrying Cost per Unit 1 2 Economic Order Quantity (EOQ) Model—Example Example Q: The Galbraith Corp. buys a part that costs $5. The carrying cost of inventory is approximately 20% of the part’s dollar value per year. It costs $45 to place, process and receive an order. The firm uses 1,000 of the $5 parts per year. What ordering quantity minimizes inventory costs and how many orders will be placed each year if that order quantity is used? What inventory costs are incurred for the part with this ordering quantity? A: Since the unit carrying cost is 20% of the part’s price, the annual carrying cost per unit in dollars is $1, or 20% x $5. Substituting the known information into the EOQ equation, we have: 1 2 $45 1,000 2 EOQ = = 300 units $1 The annual number of reorders is 1,000 300, or 3.33. Carrying costs are $150 a year, or (300 2) x $5 x 20%; and ordering costs are $45 x 3.333, or $150. The total inventory cost of the part is $300. Safety Stocks, Reorder Points and Lead Times Safety stock provides a buffer against unexpectedly rapid use or delayed delivery An additional supply of inventory that is carried at all times to be used when normal working stocks run out Rarely advisable to carry so much safety stock that stockouts never happen Carrying costs would be excessive Ordering lead time is the advance notice needed so that an order placed will arrive at the needed time Usually estimated by the item’s supplier Figure 15.9: Pattern of Inventory on Hand Tracking Inventories—The ABC System Some inventory items warrant a great deal of attention Are very expensive Are critical to the firm’s processes or to those of customers Some inventory items do not warrant a great deal of attention Commonplace, easy to obtain An ABC system segregates items by value and places tighter control on higher cost (value) pieces Just In Time (JIT) Inventory Systems Suppliers deliver goods to manufacturers just in time (JIT) Theoretically eliminates the need for factory inventory A late delivery can stop a factory’s entire production line JIT works best with large manufacturers who are powerful with respect to the supplier Supplier is willing to do almost anything to keep the manufacturer’s business 63