Strategic Management and Project Selection

advertisement

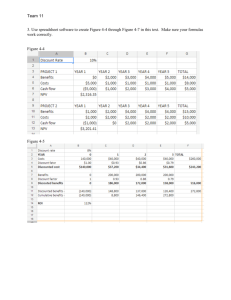

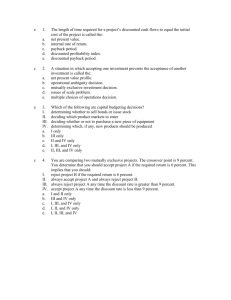

Chapter 2 Strategic Management and Project Selection Copyright 2009 John Wiley & Sons, Inc. Problems With Multiple Projects 1. 2. 3. Delays in one project delays others Inefficient use of resources Bottlenecks in resource availability Project Results 30 Percent late Over half 190 percent over budget Over half 220 percent late Challenges Making sure projects closely tied to goals and strategy How to handle growing number of projects How to make projects successful Project Management Maturity Project management maturity refers to mastery of skills required to manage project competently Number of ways to measure Most organizations do not do well Project Selection and Criteria of Choice Project selection… – – – Evaluating Choosing Implementing Same process as other business decisions Types of Companies Companies considering projects fall into two broad categories: 1. 2. Companies whose core business is completing projects Companies whose core business is something else They can also be broken down as: 1. 2. Companies looking at projects to do for others Companies looking at projects to do for themselves Project Companies Must select which projects they will bid on Generally based on… – – – Their expertise Resource they have availability Their chance of winning bid Preparing a bid is expensive They do not want to waste that effort on bids where they are unlikely to be successful Non-Project Companies Must decide which potential projects they will pursue Available capital is the major constraint Profitability is often the major criteria Must evaluate approaches when there is more than one project that can accomplish a goal Models Models are used to select projects All models simplify reality That is, they only look at the key variables involved in a decision The more variables included in a model, the more complex it becomes Simpler models usually work better Types of Models Stochastic Model – A model that includes the probabilities of events occurring within the model. In other words, the same inputs might yield different outputs at different runs. Also known as a probabilistic model. Deterministic Model – A model that does not include probabilities. Given the same inputs, the outputs will always be the same. Criteria For Project Selection Models Companies only want to undertake successful projects Projects that fail waste resources and hurt profitability and competitiveness Projects that succeed improve profitability and competitiveness It is not possible to know ahead of time if a project will succeed or fail In fact, there is a continuum of possible results from total success through absolute failure Criteria Companies need a way of weeding out the bad projects while keeping the good ones No model can predict with absolute certainty No model could predict – – (Continued) The Exxon Valdez wreck The explosion of the Challenger What we want is a model with a “good batting average” Model Criteria Realism Capability Flexibility Easy to use Inexpensive Easy to implement Realism Needs to include all objectives of the firm Needs to include the firms expertise as well as its limitations Needs to report results in a fashion that allows different projects to be compared, e.g. how do we compare a project to lower production cost and one to raise market share Capability Model needs to be sophisticated enough to deal with all projects – – – Varying resource requirements Varying time periods Varying probabilities of success Needs to be able to select the optimum projects among all contenders Flexibility Needs to be able to work with all projects Needs to be updated as the firm and its environment evolves Easy to Use Needs to be quick to gather the data and easy to use Easy to be able to “fit” the project in the model Inexpensive Do not want the model to eat up all the savings that result from using the model Expenses include the cost of writing and maintaining the model Also includes the expense of gathering the data needed by the model Easy to Implement This is less of an issue with modern spreadsheets However, a model to be used to evaluate all the firm’s projects should be centrally maintained The Nature of Project Selection Models Models turn inputs into outputs Managers decide on the values for the inputs and evaluate the outputs The inputs never fully describe the situation The outputs never fully describe the expected results Models are tools Managers are the decision makers Different Factors Affecting Outcome Many factors affect the outcome of a project – Some are one-time factors – Others are reoccurring The cost of an item Maintenance Not all factors are equally important Critical factors on one project may be trivial on another project Types of Project Selection Models Nonnumeric models Numeric models Nonnumeric Models Models that do not return a numeric value for a project that can be compared with other projects These are really not “models” but rather justifications for projects Just because they are not true models does not make them all “bad” Types of Nonnumeric Models Sacred Cow – Operating Necessity – A project, often suggested by top management, that has taken on a life of its own. It continues, not due to any justification, but “just because.” A project that is required in order to protect lives or property or to keep the company in operation. Competitive Necessity – A project that is required in order to maintain the company’s position in the marketplace. Types of Nonnumeric Models Product Line Extension – Continued Often, projects to expand a product line are evaluated on how well the new product meshes with the existing product line rather than on overall benefits. Comparative Benefit – Projects are subjectively rank ordered based on their perceived benefit to the company. Numeric Models Models that return a numeric value for a project that can be easily compared with other projects Two major categories: 1. 2. Profit/profitability Scoring Profit/Profitability Models Models that look at costs and revenues – – – – Payback period Discounted cash flow (NPV) Internal rate of return (IRR) Profitability index NPV and IRR are the more common Payback Period The length of time until the original investment has been recouped by the project A shorter payback period is better Payback Period Example Project Cost Payback Period Annual Cash Flow $100,000 Payback Period 4 $25,000 Payback Period Drawbacks 1. 2. 3. Does not consider time value of money More difficult to use when cash flows change over time Less meaningful over longer periods of time (due to time value of money) Discounted Cash Flow The value of a stream of cash inflows and outflows in today’s dollars Also know as discounted cash flow or just discounting Widely used to evaluate projects Includes the time value of money Includes all inflows and outflows, not just the ones through payback point Discounted Cash Flow Continued Requires a percentage to use to reduce future cash flows – This is known as the discount rate The discount rate may also be know as a hurdle rate or cutoff rate There will usually be one overall discount rate for the company NPV Formula Ft NPV (project) A0 t 1 t 1 k n NPV Formula Terms A0 Initial cash investment Ft The cash flow in time period t (negative for outflows) k The discount rate T The number of years of life A higher NPV is better The higher the discount rate, the lower the NPV NPV Example 8 $25,000 NPV (project) $100,000 t t 1 1 0.15 0.03 $1,939 Internal Rate of Return [IRR] The discount rate (k) that causes the NPV to be equal to zero The higher the IRR, the better – While it is technically possible for a series to have multiple IRR’s, this is not a practical issue Finding the IRR requires a financial calculator or computer In Excel “=IRR(Series,Guess)” Profitability Index a.k.a. Benefit cost ratio NPV divided by initial cash investment Ratios greater than 1.0 are good Advantages of Profitability Models Easy to use and understand Based on accounting data and forecasts Familiar and well understood Give a go/no-go indication Can be modified to include risk Disadvantages of Profitability Models Ignore non-monetary factors Some ignore time value of money Discounting models (NPV, IRR) are biased to the short-term Payback models ignore cash flow after payback Scoring Models Unweighted factor model Weighted factor model Unweighted Factor Model Each factor is weighted the same Less important factors are weighted the same as important ones Easy to compute Just total or average the scores Unweighted Factor Model Example Figure 2-2 Weighted Factor Model Each factor is weighted relative to its importance – Weighting allows important factors to stand out A good way to include non-numeric data in the analysis Factors need to sum to one All weights must be set up so higher values mean more desirable Small differences in totals are not meaningful Weighted Factor Model Example Figure B Analysis Under Uncertainty—The Management of Risk Everything to do with projects is risky Some projects, like R&D, are more risky than others, like construction Risks include… – – – The timing of the project and its associated cash flow Risk regarding the outcome of the project Risk about the side effects Risk and Uncertainty What the decision maker does What nature does Uncertainty 1. 2. 3. Pro forma financial statements Risk analysis Simulation (requires detailed probability information) Comments on the Information Base for Selection 1. 2. 3. Accounting data Measurements Uncertain information Accounting Data 1. 2. 3. Cost and revenue are linear Cost-revenue data derived using standard cost standardized revenue assumptions Costs may include overhead Measurements 1. 2. 3. 4. Subjective versus objective Quantitative versus qualitative Reliable versus unreliable Valid versus invalid Uncertain Information Must estimate inputs for risk analysis These inputs cannot be known exactly Inputs must be adjusted over time Project Portfolio Process (PPP) Links projects directly to the goals and strategy of the organization Means for monitoring and controlling projects PPP Steps 1. 2. 3. 4. 5. 6. 7. 8. Establish a project council Identify project categories and criteria Collect project data Assess resource availability Reduce the project and criteria set Prioritize the projects within categories Select projects to be funded and held in reserve Implement the process Step 1: Establish a Project Council Senior management The project managers of major projects The head of the Project Management Office Particularly relevant general managers Those who can identify key opportunities and risks facing the organization Anyone who can derail the PPP later on Step 2: Identify Project Categories and Criteria 1. 2. 3. 4. Derivate projects Platform projects Breakthrough projects R&D projects Step 3: Collect Project Data Assemble the data Document assumptions Screen out weaker projects The fewer projects that need to be compared and analyzed, the easier the work Step 4: Assess Resource Availability Assess both internal and external resources Assess labor conservatively Timing is particularly important Step 5: Reduce the Project and Criteria Set Organization’s goals Have competence Market for offering How risky Potential partner Right resources Good fit Use strengths Synergistic Dominated by another Has slipped in desirability Step 6: Prioritize the Projects Within Categories Apply the scores and criterion weights Consider in terms of benefits first, resource costs second Summarize the returns from the projects Step 7: Select the Projects to be Funded and Held in Reserve Determine the mix of projects across the categories Leave some resources free for new opportunities Allocate the categorized projects in rank order Step 8: Implement the Process Communicate results Repeat regularly Improve process Project Proposals The project proposal is essentially a project bid Putting together a project proposal requires a detailed analysis of the project Project proposals can take weeks or months to complete A more detailed analysis may result in not bidding on the project Project Proposal Contents Cover letter Executive summary The technical approach The implementation plan The plan for logistic support and administration Past experience