ESB_Loan_Certificate.. - global american syndicate

advertisement

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Copyright EUROPEAN STANDARD BANK, 2012 (further abr. ESB)

Panama City, Republic of Panama

http://www.esbank.org

To whom it may concern

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Date of certificate issued: 04-12-2010

ASSETS-BASED LOAN

for trade by Clearing and Settlement

initially issued to ESB account number 0000 0000 0000 0000 0000

[and

further transferred to the ESB account number 0000 0000 0000 0000 0000]

based on the next assets financial characteristics and properties of

Loan and Assets:

Some Term Definitions:

An algorithm - is a specific set of instructions for carrying out a procedure or solving a

problem, usually with the requirement that the procedure terminate at some point.

Specific algorithms sometimes also go by the name method, procedure, or technique.

Asset Back Lending ("ABL") - typically provides collateralized credit facilities to

borrowers with high financial leverage and marginal cash flows.

An Asset-Based Loan - is a loan, secured by a company's assets. Real estate, accounts

receivable (A/R), inventory, and equipment are typical assets used to back the loan. The

loan may be backed by a single category of assets or some combination of assets, for

instance, a combination of A/R and equipment.

A bank run (also known as a run on the bank) - occurs in a fractional reserve banking

system when a large number of customers withdraw their deposits from a financial

institution at the same time and either demand cash or transfer those funds into

government bonds or precious metals or a safer institution because they believe that the

European Standard Bank Officer’s signature _____________________________

1

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

2

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

financial institution is, or might become, insolvent. As a bank run progresses, it generates

its own momentum, in a kind of self-fulfilling prophecy (or positive feedback loop) – as

more people withdraw their deposits, the likelihood of default increases, thus triggering

further withdrawals. This can destabilize the bank to the point where it runs out of cash

and thus faces sudden bankruptcy.

A banking panic or bank panic is a financial crisis that occurs when many banks suffer

runs at the same time, as people suddenly try to convert their threatened deposits into

cash or try to get out of their domestic banking system altogether. A systemic banking

crisis is one where all or almost all of the banking capital in a country is wiped out. The

resulting chain of bankruptcies can cause a long economic recession as domestic

businesses and consumers are starved of capital as the domestic banking system shuts

down. Much of the Great Depression's economic damage was caused directly by bank

runs.

Bookkeeping - is to be understood in the context of a business. It is simply the recording

of financial transactions. Transactions include purchases, sales, receipts and payments by

an individual or organization. Bookkeeping is usually performed by a bookkeeper. Many

individuals mistakenly consider bookkeeping and accounting to be the same thing. This

confusion is understandable because the accounting process includes the bookkeeping

function, but is just one part of the accounting process. The accountant creates reports

from the recorded financial transactions recorded by the bookkeeper and files forms with

government agencies. Any process that involves the recording of financial transactions is

a bookkeeping process. (http://en.wikipedia.org/wiki/Bookkeeping).

Clearing - The procedure by which an organization acts as an intermediary and assumes

the role of a buyer and seller for transactions in order to reconcile orders between

transacting parties. Clearing is necessary for the matching of all buy and sell orders in the

market. It provides smoother and more efficient markets, as parties can make transfers to

the clearing corporation, rather than to each individual party with whom they have

transacted. (www.investopedia.com). In banking and finance, clearing denotes all

activities from the time a commitment is made for a transaction until it is settled. Clearing

is necessary because the speed of trades is much faster than the cycle time for completing

the underlying transaction.

In its widest sense clearing involves the management of post-trading, pre-settlement

credit exposures, to ensure that trades are settled in accordance with market rules, even if

a buyer or seller should become insolvent prior to settlement.

Processes included in clearing are reporting/monitoring, risk margining, netting of trades

to single positions, tax handling, and failure handling.

(http://en.wikipedia.org/wiki/Clearing_(finance))

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

3

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Depreciation - A method of allocating the cost of a tangible asset over its useful life.

Businesses depreciate long-term assets for both tax and accounting purposes. For

accounting purposes, depreciation indicates how much of an asset’s value has been used

up. For tax purposes, businesses can deduct the cost of the tangible assets they purchase

as business expenses; however, businesses must depreciate these assets in accordance

with IRS rules about how and when the deduction may be taken based on what the asset

is and how long it will last.

EUROPEAN STANDARD BANK – Panamian non-licensed financial institution

functioning from 2004 in accordance with Panamian Law and have permission for this

activity up to 2104 year, acting independently and jointly under licensed panamian nonoffshore financial legal entity ESB Monetary SA and providing electronic currency

fasility (online electronic bookkeeping system) for lended funds intrabanking transactions

based on financial technology created by Swiss bank «Wir», (www.wir.ch) for CHW

currency. European Standard Bank is not partner and is not affiliate of Swiss Bank Wir or

any other financial institution in the World. European Standsrd Bank provide his service

exclusively for his owners, shareholders and their business partners. This service in not

available foe general public.

Financial Leverage - (sometimes referred to as gearing in the United Kingdom, or

solvency in Australia) is a general term for any technique to multiply gains and

losses.Common ways to attain leverage are borrowing money, buying fixed assets and

using derivatives.

Insolvency - is the inability of a debtor to pay their debt. Cash flow insolvency involves a

lack of liquidity to pay debts as they fall due. Balance sheet insolvency involves having

negative net assets—where liabilities exceed assets. Insolvency is not a synonym for

bankruptcy, which is a determination of insolvency made by a court of law with resulting

legal orders intended to resolve the insolvency.

Liquidity - The degree to which an asset or security can be bought or sold in the

market without affecting the asset's price. Liquidity is characterized by a high level

of trading activity. Assets that can be easily bought or sold are known as liquid

assets. By others words, liquidity is the ability to convert an asset to cash quickly.

Also known as "marketability".

Recursion – (In mathematic and programming) an algorithmic technique where a

function, in order to accomplish a task, calls itself with some part of the task. In finance

and lending Recursion can enhance loan security across all realms (including security of

Lender and Beneficiary of lended funds [Seller in deals with payment by lended funds]),

in many cases transforming it into a competitive advantage. Using Recursion in lending

allowing for our customers to benefit from reduced demands for market value of own

assets they provide as collateral for obtaining loan and provide collective knowledge and

understanding of security for each Beneficiary of lended funds in any transactions.

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

4

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

a Settlement - is a resolution between disputing parties about a legal case, reached either

before or after court action begins. A settlement, as well as dealing with the dispute

between the parties is a contract between those parties, and is one possible (and common)

result when parties sue (or contemplate so doing) each other in civil proceedings. The

plaintiff(s) and defendant(s) identified in the lawsuit can end the dispute between

themselves without a trial.

The contract is based upon the bargain that a party foregoes its ability to sue (if it has not

sued already), or to continue with the claim (if the plaintiff has sued), in return for the

certainty written into the settlement. The courts will enforce the settlement: if it is

breached, the party in default could be sued for breach of that contract. In some

jurisdictions, the party in default could also face the original action being restored.

The settlement of the lawsuit defines legal requirements of the parties, and is often put in

force by an order of the court after a joint stipulation by the parties. In other situations (as

where the claims have been satisfied by the payment of a certain sum of money) the

plaintiff and defendant can simply file a notice that the case has been dismissed.

(http://en.wikipedia.org/wiki/Settlement_(litigation)).

Clearing and Settlement historically proved solution for businesses in Financial

Crisis of 2008 – 2023++ years

The term financial crisis is applied broadly to a variety of situations in which some

financial institutions or assets suddenly lose a large part of their value. In the 19th and

early 20th centuries, many financial crises were associated with banking panics, and

many recessions coincided with these panics. Other situations that are often called

financial crises include stock market crashes and the bursting of other financial bubbles,

currency crises, and sovereign defaults. Financial crises directly result in a loss of paper

wealth; they do not directly result in changes in the real economy unless a recession or

depression follows.

Many economists have offered theories about how financial crises develop and how they

could be prevented. There is little consensus, however, and financial crises are still a

regular occurrence around the world.

Several major financial institutions either failed, were bailed-out by governments, or

merged (voluntarily or otherwise) during the crisis. While the specific circumstances

varied, in general the decline in the value of mortgage-backed securities held by these

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

5

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

companies resulted in either their insolvency, the equivalent of bank runs as investors

pulled funds from them, or inability to secure new funding in the credit markets.

Losses on mortgage-backed securities and other assets purchased with borrowed money

have dramatically reduced the capital base of financial institutions, rendering many either

insolvent or less capable of lending.

These losses impacted the ability of financial institutions to lend, slowing economic

activity.

slowing economic activity, by other word a recession in basic terms. It is when the

economy slows down. It is when people stop buying/selling/trading. The economy is the

over all general money in a way and when it "slows down" the money gets lesser and

everyone gets poorer.

Economy means the system of production and distribution and consumption so when

there is slow economic activity there is less of all of those.

A period of slow economic activity is an amount of time where there is less production,

distribution, and consumption. Generally causing a lack of money.

The Great Depression was a recession in the USA and there was a lack of money because

there was a lack of the system of production and distribution and consumption.

«Most of the world's largest economies are heading for a period of slower growth, and it

is increasingly likely that the U.S. will share that fate, according to the Organization for

Economic Cooperation and Development's composite leading indicators.» - wrote in

2011 PAUL HANNON in “The Wall Street Journal”. And most economists predict crisis

period 2008-2023++ years.

According to the Chicago Fed's National Activity Index, September 2012 economic

activity slowed from the previous month, now at -0.56. The indicator has been negative

(meaning below-trend growth) for six of the past eight months, and the all-important 3month moving average has been negative for all eight of those months and 21 of the last

27 months.

“Entering the final quarter of the [2012] year, domestic and global economic conditions

are extremely fragile. Across the globe, countries are in outright recession, and in some

instances where aggregate growth is holding above the zero line, manufacturing sectors

are contracting. The only issue left to determine is the degree of the downturn underway.

International trade is declining, so weaknesses in different parts of the world are

reinforcing domestic deteriorations in economies continents away…

New government initiatives have been announced, particularly by central banks, in an

attempt to counteract deteriorating economic conditions. These latest programs in the

U.S. and Europe are similar to previous efforts. While prices for risk assets have

improved, governments have not been able to address underlying debt imbalances. Thus,

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

6

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

nothing suggests that these latest actions do anything to change the extreme overindebtedness of major global economies. “ – wrote Van R. Hoisington Lacy H. Hunt,

Ph.D.

Despite scattered signs of improvement, the world economic situation and

prospects continue to be challenging. After a marked slowdown in 2011, global

economic growth will likely remain tepid in 2012, with most regions expanding at a pace below potential. In the face of subdued growth, the jobs crisis

continues, with global unemployment still above its pre-crisis level and unemployment in the euro area rising rapidly. The risks to the global outlook are tilted

to the downside. The euro area debt crisis remains the biggest threat to the

world economy. An escalation of the crisis would likely be associated with severe

turmoil on financial markets and a sharp rise in global risk aversion, leading to

a contraction of economic activity in developed countries, which would spill

over to developing countries and economies in transition. A further sharp rise

in global energy prices may also stifle global growth. National and international

concerted policies should be enacted on multiple fronts in order to break out

of the vicious cycle of deleveraging, rising unemployment, fiscal austerity and

financial sector fragility in developed economies. Breaking this cycle requires

policy shifts away from fiscal austerity and towards more counter-cyclical fiscal

stances oriented to job creation and green growth. These policies need to be

better coordinated across the major economies and concerted with continued

expansionary monetary policies in developed countries, and accompanied by

accelerated financial sector reforms and enhanced development assistance for

low-income countries. [1]

Although your small business may not be in the national spotlight or have a public

relations guru of its own to consult, no company is too small for a crisis. From

bankruptcy to disgruntled customers or employees seeking revenge, even a mom-and-pop

should be prepared to handle the fundamentals of crisis management.

Small and medium size businesses often don’t realize they are facing a potential crisis

until they are already in too deep, risking their credibility and support.

Small businesses or sole proprietors won’t make any changes in their business activity

until they’re on a ledge. It’s not until they realize that something really bad has happened.

Just like couples who marry without prenuptial agreements or those who chose not to

plan their estates, businesses that are unprepared often face consequences that could have

been easily prevented.

They wish for the best and hope that nothing happens. So many times, a person will walk

outside into a ‘crisis’ situation, and they look like a deer in the headlights because they

have no preparation for this.

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

7

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Here are the three fundamentals every small and medium size business should practice in

order to be prepared for a potential crisis of any measure.

No. 1: Define your core values. No matter how small your business is, determining your

set of core values is key, and can potentially save you in a crisis situation.

“If a crisis takes place, at least you know what your core values and vision are, and know

it was always your intention to run the business ethically. If your first platform is wanting

to do good in the community, and something goes wrong, you will have allies and

constituents [to support you].”

No. 2: Ability to collaborate. Build relationships and share the core values you have

determined for your company. Extending your relations with business partners and

obtaining new business partners World Wide and working well with them can go a long

way and will help you, especially if you get into hot water. Co-operative principles and

Legal Entities with will be suitable in this case. Especially financial services based.

No. 3: Link your business to additional payment system. Select one of the oldest

alternative payment system which was verified by long time and survived in multiple

crisis situations.

Let’s look at two historically proved crisis management solutions and approaches.

History of Clearing and Direct Settlement from 1733 year

One of the oldest and most basic clearing methods was termed “direct settlement” and

can be traced back to 1733 with the trading of metal warrants of the East India Company.

Direct settlement dictated that each trader wanting to offset a trade or group of trades, his

“position,” had to do so with each trade’s original counterparty. This was a cumbersome

and inefficient practice.

Disputes between traders were common at that time and were resolved through expensive

court proceedings that made it difficult for some to participate in the markets. The need

for an impartial body to inexpensively arbitrate disputes gave rise to trading associations.

These associations were organized around common products and/or geographic locations.

Membership was not mandatory, but associations were nevertheless effective in bringing

some order to the chaos of these early markets.

In England, the Liverpool Association used direct settlement. Traders in Liverpool

bought and sold what were then termed “to arrive” contracts on cotton. While initially

successful, direct settlement was both inefficient and ineffective during volatile periods

such as the 1860s with the wild commodity speculation that occurred as a result of the

U.S. Civil War. To help prevent nonperformance of contracts, steps were taken by the

Liverpool Association to make the contracts more fungible, or interchangeable, through

the standardization of contract terms.

Through time, direct settlement evolved to provide more security for market participants

through the inclusion of provisions that called for margin deposits, a sort of collateral,

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

8

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

and suspension of trading privileges or expulsion from the exchange upon contract

nonperformance.

With the organization of trading associations and increased contract fungibility, direct

settlement proved to be a fairly effective system. However, as worldwide trading volume

increased toward the end of the 19th century, there was a need for a more flexible

settlement method. It was determined that the best way to do this was to allow

participants to close trading positions without having to do so with their original

counterparties.

The system that developed was termed “ring settlement.” Under this system, “rings” of

buyers and sellers were linked together to settle their accounts. This was a major step

toward the multi-party clearing system used by The Clearing Corporation today. As an

example of “ringing,” Adams sells to Brooks who sells to Campbell who sells to Adams.

Adams’ trading position is even, as the original sale to Brooks is negated through the

purchase from Campbell. By not limiting trades to original counterparties, simultaneous

contract settlement was made possible.

The benefits of ring settlement were numerous. Settlements for large volumes of

contracts could occur instantly, the costs of maintaining an open position were lowered

and, most importantly, counterparty risk was diminished.

In the history of the world’s financial markets, perhaps no single entity has had a greater

impact on the safety and soundness of the clearing process than The Clearing Corporation

(CCorp). Based on a tradition of independence, integrity, and innovation, The Clearing

Corporation has established itself as the model for the majority of the world’s

clearinghouses.

September 3, 1925 is among the most important dates in the history of the futures

industry. It was on that day, more than 85 years ago, that the Board of Trade Clearing

Corporation, now named The Clearing Corporation, was founded by the Chicago Board

of Trade (CBOT®) membership.

The Clearing Corporation is one of the oldest independent clearinghouses in the world. It

has not only survived, but flourished, through the Great Depression and periods of

recession, war, and rapid technological and economic change. Its world-class standing

has been and will continue to be built upon three fundamental concepts: Independence,

Integrity, and Innovation.

The importance of its independence as a corporate entity cannot be overestimated. This

quality has allowed The Clearing Corporation to make objective decisions during periods

of substantial stress with one goal in mind– financial integrity for the clearing and

settlement process.

Integrity goes hand-in-hand with independence. Clearing members know that The

Clearing Corporation makes decisions based on safety and soundness for the marketplace

and nothing else. [4]

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

9

BUSINESS LOAN CERTIFICATE

Last update date:

Certificate Unique Registration ESB number: 0836367876

03/01/2013

Positive experience of Swiss Bank Wir

Clearing system of Swiss Bank Wir was based on experience of Clearing Corporation

started 10 years before was additional step forward in Clearing systems development fo

fight negative phenomenas of financial crisis. From 1934 Swiss Co-operative «Wir»,

previously formed as aconomic Circle made miracle in finanacial theory and practice.

Fusion of bookkiping system, clearing, and Assets Based Landing in one Lending system

based on electronic CHW currency with intrabanking only loan transfer facility provided

during last 75++ years possibility obtain finance for small and medium businesses. More

than 60 000 businesses obtained finance during this period of time (1934-2012). In 2010

year turnover of Swiss bank Wir grow up to 6 billion CHF. But all started from small

economic Circle of 15 members only. Today its largest financial institution around the

Switzerland, which provide such type of financing for businesses located in Switzerland

only with collateral also located in this country. From 2004 the same service became

available for international customer who use the same financial technology with

panamian financial institution European Standard Bank.

Please note, there is significant difference between clearing of Clearing Corporation and

clearing system of Bank Wir (European Standard Bank).

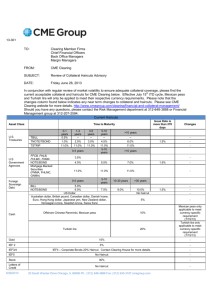

#

1

1

Assets for clearing

transactions

2

Regulation of clearing

3

Clearing model based on:

4

Clearing method

Clearing

Corporation

Bank Wir

2

3

Commodities

Markets

Contracts,

Agreecultural

Contracts,

Energy

Contracts, etc.

Non –

regulated

European

Standard

Bank

4

Commodities

Markets

Contracts,

Agreecultural

Contracts,

Energy

Contracts, etc.

Non –

regulated

independence,

integrity, and

innovation

Direct

Settlement,

ring settlement

independence,

integrity, and

innovation

Direct

Settlement,

ring settlement

Futures

Contracts,

Options

Contracts, 60

Currency Pairs

Regulated by the

Commodity

Futures Trading

Commission

(CFTC)

independence,

integrity, and

innovation

Direct

Settlement, ring

settlement,

modern open-

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

10

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

5

6

7

8

9

Trading without intent to

receive or make delivery

Time in clearing business

Electronic Clearing

Plateforms

Last update date:

outcry, complex

multi-party

settlement

YES

From 1925

ACT™, OTIS,

GAINS, ATOM,

TEAM®,

SHAMIS™

Is risk of loss for participants YES

of clearing covered ?

Source of funds for clearing Reserve Fund

risk coverage

created by

participants

03/01/2013

NO

NO

From 1934

Online, web

browser

integrated

From 2004

Online, web

browser

integrated

YES

YES

Clearing

transactions of

ring of

participants

backed by

assets of

Borrower

10 Liquidation value of

clollateral (guarantee) of

clearing in time duration

Unchangeable

Decrease (Due

to depreciation

if in use)

11 Are clearing funds

transferrable outside clearing

financial institution ?

12 Can clearing participants

obtain clearing funds as cash

?

13 Are clearing funds

applicable for pay salary and

simillar expenses in business

of clearinf participants ?

14 Possibility borrow clearing

funds as long term Loan

15 Law applicable in clearing

No

No

Clearing

transactions of

ring of

participants

backed by

assets of

Borrower plus

backed

recursively

Increase

(because assets

are substituted

with money)

No

No

No

No

No

No

No

No

Yes

Yes

USA

Switzerland

Panama

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

11

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

16 Clearing Guarantee Assets

Holder/Territory

Clearing

Bank Wir/

Corporation/USA Switzerland

United States

Corporation/

Territory of

Borrower's

Country

17 Clearing technology

considering assets

depreciation

No

No

Yes

18 Responsible for Funds

Holding for assets recovery

19 If we use Clearing financial

technology and using

clearing platforms have

these services bank notes,

which covering clearing

transactions ?

Nobody

Borrower

No

No

YES, European

Standard Bank

No

20 Are any limitations what I

can purchase by clearing

with clearing funds ?

Yes, only

prederminited

and standartized

contracts

No, any

contract with

any assets are

allowed

No, any

contract with

any assets are

allowed

This documents is certificate for one of such Loan issued for international Borrower,

and below are detailed description of this Loan in accordance impemented Swiss

Bank's finanacial technology for international customers.

1. European Standard Bank’s Loan Characteristic:

Loan currency: USD

Loan amount: 00000

Data of loan issued: 24-12-2009

Data of Loan Repayment: 24-12-2024

Interest Rate per year (%): 7

Loan type (secured/unsecured): secured

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

12

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Loan Collateral: Promissory Note

Promissory Note (secured/unsecured): secured

Promissory Note Collateral: Borrower’s owned assets plus assets acquired and paid with

this Loan

Special conditions: 1) Loan amount equal 000000 gram of 99.99999 purity Finest Gold

and Loan amount will be returned in amount which will provide possibility purchase the

same amount of gold.

2) Financial Technology contain 2 financial solutions :

- Recursive Algorithm of Collateral Creation (RACC)

&

- Dynamically Growing Assets Liquidity Value (DGALV).

2. Characteristics of Promissory Note Collateral {or determination of Dynamically

Growing Assets Liquidity Value (DGALV)}:

Date of Promissory Note issued: 24-12-2009

Date of Promissory Note redemption: 24-12-2024

A. BORROWER’S OWNED ASSETS PROPERTIES (OBTAINED BEFORE

LOAN HAS BEEN GRANTED):

Country of assets Location: Russian Federation

City (Cities) of assets Location: Moscow

Owner of assets is (private person/legal entity): Legal Entity

Citizenship for private person or country of incorporation for legal entity: Russian

Federation

ASSETS VALUATION:

Assets market value, currency: $578987.00/=

Average Term of Sale for above market value (Days): 60

Assets liquidation value, currency: $278987.00/=

Average Term of Sale for above liquidation value (Days): 14

European Standard Bank Officer’s signature _____________________________

(http://www.esbank.org),

EUROPEAN STANDARD BANK

13

(Proforma-Specimen)

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

ASSETS DEPRECIATION:

Assets structure Table 1. (Table of Class Lives and Recovery Periods, based on Publication 946

(2011), IRS, USA):

#

1

Asset

class

2

Description of assets included

3

Class

Life

(in

years)

4

Recovery

Periods

(in years)

GDS

ADS

Notes

(MACRS)

5

6

7

Where depreciation will be paid: To account number 0000 0000 0000 0000 00000 00000

of financial institution European Standard Bank

Is account with depreciation funds blocked for commercial use (y/n): YES

Frequency of depreciation will be transferred to above account (monthly/quartally/per

half year/yearly): yearly

Grace period for calculation and pay depreciation costs (years): 2

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

14

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Collateral Keeping before liquidation:

Collateral Keeper Name: Global American Syndicate

Collateral Keeper Registration number:

Collateral Keeper incorporation address (for Legal Entities): _________

Collateral Keeper postal address: _________

Assets keeping under personal responsibility of (Name, Surname): Adam Smith

Contact of assets keeping person (Email/Phone/Fax/Web): tytytu@gmail.com,

+7847657587

Preferable language of contact with assets keeping person: russian

Collateral Kipper Agree above information will be published and used by potential assets

supplier, their auditors, lawyers, attorneys, etc.

COLLATERAL INSURANCE:

Assets insured (y/n): yes

Insurance company (name, country): Trade Insur Inc., Russia

Insurance company address: _________________________________

Insurance company contact (country, city, street, Email/Phone/Fax):

Insurance company contact person: ___

Insurance policy number and date: 754676, 24-09-2010

Insured amount, currency: 54567.00/= USD

Insurance policy start date:

Insurance policy end date:

Insurance policy coverage: risk of steel, etc.

Governing Law in Case of collateral liquidation (stage of alienation): Russian Federation

COLLATERAL HOLDER (in accordance with Investment Agreement):

Collateral Holder acting in accordance with Agreement (Number and date): ______

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

15

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Promissory Note Collateral (assets) Holder is (private person/legal entity): Legal Entity

Collateral holder’s Citizenship for private person or Country of incorporation for legal

entity: United States of America

Governing Law in Case of collateral liquidation (stage of sales): USA

Collateral Holder Name: Global American Syndicate

Collateral Holder Registration number: 991072935 - 3009197

Collateral Holder postal address: Global American Syndicate, #207-1425 Marine Drive, West

Vancouver, B.C., Canada, V7T1B9

Collateral Holder Email address: gasdirect@gmail.com

Additional notes (optional): ____

B. PREVIOUSLY PURCHASED ASSETS PROPERTIES (AFTER LOAN HAS

BEEN GRANTED) WITH LOAN FUNDS UTILIZATION (NON RECURSIVE

ALGORITHM OF COLLATERAL CREATION):

Country of assets Location: Russian Federation

City (Cities) of assets Location: Moscow

Owner of assets is (private person/legal entity): Legal Entity

Citizenship for private person or country of incorporation for legal entity: Russian

Federation

ASSETS VALUATION:

Assets market value, currency: $578987.00/=

Average Term of Sale for above market value (Days): 60

Assets liquidation value, currency: $278987.00/=

Average Term of Sale for above liquidation value (Days): 14

ASSETS DEPRECIATION:

Assets structure Table 2. (Table of Class Lives and Recovery Periods, based on Publication 946

(2011), IRS, USA):

#

Asset

class

Description of assets included

Class

Life

(in

Recovery

Periods

(in years)

GDS

ADS

(MACRS)

European Standard Bank Officer’s signature _____________________________

Notes

(http://www.esbank.org),

EUROPEAN STANDARD BANK

16

(Proforma-Specimen)

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

years)

1

2

3

4

5

6

7

Where depreciation will be paid: To account number 0000 0000 0000 0000 00000 00000

of financial institution European Standard Bank

Is account with depreciation funds blocked for commercial use (y/n): YES

Frequency of depreciation will be transferred to above account (monthly/quartally/per

half year/yearly): yearly

Grace period for calculation and pay depreciation costs (years): 2

Collateral Keeping before liquidation:

Collateral Keeper Name: Global American Syndicate

Collateral Keeper Registration number:

Collateral Keeper incorporation address (for Legal Entities): _________

Collateral Keeper postal address: _________

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

17

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Assets keeping under personal responsibility of (Name, Surname): Adam Smith

Contact of assets keeping person (Email/Phone/Fax/Web): tytytu@gmail.com,

+7847657587

Preferable language of contact with assets keeping person: russian

Collateral Kipper Agree above information will be published and used by potential assets

supplier, their auditors, lawyers, attorneys, etc.

COLLATERAL INSURANCE:

Assets insured (y/n): yes

Insurance company (name, country): Trade Insur Inc., Russia

Insurance company address: _________________________________

Insurance company contact (country, city, street, Email/Phone/Fax):

Insurance company contact person: ___

Insurance policy number and date: 754676, 24-09-2010

Insured amount, currency: 54567.00/= USD

Insurance policy start date:

Insurance policy end date:

Insurance policy coverage: risk of steel, etc.

Governing Law in Case of collateral liquidation (stage of alienation): Russian Federation

COLLATERAL HOLDER (in accordance with Investment Agreement):

Collateral Holder acting in accordance with Agreement (Number and date): ______

Promissory Note Collateral (assets) Holder is (private person/legal entity): Legal Entity

Collateral holder’s Citizenship for private person or Country of incorporation for legal

entity: United States of America

Governing Law in Case of collateral liquidation (stage of sales): USA

Collateral Holder Name: Global American Syndicate

European Standard Bank Officer’s signature _____________________________

(http://www.esbank.org),

EUROPEAN STANDARD BANK

18

(Proforma-Specimen)

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

03/01/2013

Last update date:

Collateral Holder Registration number: 991072935 - 3009197

Collateral Holder postal address: Global American Syndicate, #207-1425 Marine Drive, West

Vancouver, B.C., Canada, V7T1B9

Collateral Holder Email address: gasdirect@gmail.com

Additional notes (optional): ____

C. FUTURE PURCHASE ASSETS PROPERTIES WITH LOAN FUNDS

UTILIZATION (RECURSIVE ALGORITHM OF COLLATERAL CREATION):

Country of assets future Location: Russian Federation

City (Cities) of assets future Location: Moscow

Future owner of assets is (private person/legal entity): Legal Entity

Future owner’s citizenship for private person or country of incorporation for legal entity:

Russian Federation

FUTURE PURCHASE ASSETS VALUATION:

Future purchase assets market value, currency: $578987.00/=

Future purchase assets Average Term of Sale for above market value (Days): 60

Future purchase assets liquidation value, currency: $278987.00/=

Future purchase assets average Term of Sale for above liquidation value in future (Days):

14

FUTURE ASSETS DEPRECIATION:

Future assets structure Table 3. (Table of Class Lives and Recovery Periods, based on Publication

946 (2011), IRS, USA):

#

1

Asset

class

2

Description of assets included

3

Class

Life

(in

years)

4

Recovery

Periods

(in years)

GDS

ADS

Notes

(MACRS)

5

European Standard Bank Officer’s signature _____________________________

6

7

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

19

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Where depreciation of future purchase assets will be paid: To account number 0000 0000

0000 0000 00000 00000 of financial institution European Standard Bank

Will be account with depreciation funds blocked for commercial use (y/n): YES

Frequency of depreciation will be transferred to above account (monthly/quartally/per

half year/yearly): yearly

Grace period for calculation and pay depreciation costs (years): 2

Collateral Keeping before liquidation:

Future purchase assets as Collateral Keeper Name: Global American Syndicate

Future purchase assets as Collateral Keeper Registration number:

Future purchase assets as Collateral Keeper incorporation address (for Legal Entities):

_________

Future purchase assets Collateral Keeper postal address: _________

Future purchase assets will be located under personal responsibility of (Name, Surname):

Adam Smith

Contact of future purchase assets keeping person (Email/Phone/Fax/Web):

tytytu@gmail.com, +7847657587

Preferable language of contact with future purchase assets keeping person: russian

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

20

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Future purchase assets as Collateral Kipper agree above information will be published

and used by potential assets supplier, their auditors, lawyers, attorneys, etc.

FUTURE PURCHASE ASSETS AS COLLATERAL INSURANCE:

Assets insured (y/n): yes

Insurance company (name, country): Trade Insur Inc., Russia

Insurance company address: _________________________________

Insurance company contact (country, city, street, Email/Phone/Fax):

Insurance company contact person: ___

Insurance policy number and date: 754676, 24-09-2010

Insured amount, currency: 54567.00/= USD

Insurance policy start date:

Insurance policy end date:

Insurance policy coverage: risk of steel, etc.

Governing Law in Case of future purchase assets as collateral liquidation (stage of

alienation): Russian Federation

Future purchase assets as COLLATERAL HOLDER (in accordance with Investment

Agreement):

Future purchase assets as Collateral Holder acting in accordance with Agreement

(Number and date): ______

Promissory Note Collateral (Future purchase assets component) Holder is (private

person/legal entity): Legal Entity

Future purchase assets as Collateral holder’s Citizenship for private person or Country of

incorporation for legal entity: United States of America

Governing Law in Case of collateral (Future purchase assets) liquidation (stage of sales):

USA

Collateral Holder Name: Global American Syndicate

Collateral Holder Registration number: 991072935 - 3009197

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

21

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Collateral Holder postal address: Global American Syndicate, #207-1425 Marine Drive, West

Vancouver, B.C., Canada, V7T1B9

Collateral Holder Email address: gasdirect@gmail.com

Additional notes for future purchase assets (optional): ____

SOURCES OF INFORMATION USED IN THIS DOCUMENT

1. Borrower’s existing funds [and purchased with landed funds assets] market and

liquidation price evaluation made in accordance with Expert Conclusion dated

“_____”_________ 20___ y, made by licensed financial specialist (license #____

issued by _______________________ date of issued “_____”_________

20_____ y in City __________, Country_____________).

2. Future value of purchased with landed funds assets and depreciation of existing

assets evaluation executed in accordance with demands of Publication946 (Cat.

No. 13081F), How to Depreciate Property, Department of the Treasury, Internal

Revenue Service, USA, 2011.

CONCLUSION ABOUT LEVEL OF LOAN COVERAGE (BACKED) BY ASSETS

Finally, the level of secured by Promissory Note Loan (covered with two sources of

assets [before loan owned and with loan acquired]) in accordance with described above

consist of:

- Market Value (in Currency) / Market Value (in Percent): 765678 (USD)/120(%)

- Liquidation Value Currency / Liquidation Value Percent: 765447(USD)/78(%)

That is why in accordance with above, funds for clearing transactions issued as Loan

initially to ESB account number 0000 0000 0000 0000 0000 [and further transferred to

the ESB account number 0000 0000 0000 0000 0000] have the same assets coverage

level with:

- Market Value (in Currency) / Market Value (in Percent): 765678 (USD)/120(%)

- Liquidation Value Currency / Liquidation Value Percent: 765447(USD)/78(%)

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

22

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

In case of Borrower insolvency (bankruptcy) holder of clearing funds can expect the next

actions:

-

Assets of Borrower will be sold on Market in exchange of

EUR/USD/GBP/RUB/ETC currencies

Obtained funds will be directed to Lender as loan repayment

EUR/USD/GBP/RUB/ETC currencies will substitute electronic clearing funds of

ESB clearing accounts

EUR/USD/GBP/RUB/ETC currencies will become available for withdrawal by

previous clearing funds holder (which clearing funds with ESB accounts are

derivative of Loan indicated in this document)

Any non-authorized by Lender in Investment Agreement assets related activity of

Borrower will be subject of civil and/or criminal prosecution of Borrower.

Very important : Because funds for assets depreciation recovery will be collected with

ESB accounts they (these funds) will substitute depreciated assets and from year to year

assets market value plus accumulated funds for recovery will grow and at the end of

period of recovery assets market value plus accumulated funds for recovery will be equal

assets liquidation value. By other words assets liquidation value will grow from year to

year and at the end of period of recovery liquidation value will grow up to initial assets

market value. That is why if Borrower’s owned funds before Loan obtained was small or

zero value or insignificant in most cased purchased with loan assets will cover 100% of

Loan if from time of loan was issued passed acceptable time in accordance with this

document. Information of this document provide enough facts for understanding of each

loan beneficiary his risk and reward and their relationship, to be able get designing if this

suit for beneficiary’s business goals and objectives.

Due to nature of recursive algorithm used in financial technology, this document have to

be updated after each new assets purchased.

Zhur In,

Executive officer of

Clearing Transactions Department,

European Standard Bank

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

23

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

Electronic signature:

Electronic seal:

Electronic URL for document verification:

Final Notice: This document is following modern achievements of financial science and practice, created with terminology, which

provide clarity not only for specialists in finance, but small and medium business stuff too. That is why some extended definitions

included. Document use Know-How of European Standard Bank based on two financial solutions: Recursive Algorithm of Collateral

Creation (RACC) & Dynamically Growing Assets Liquidity Value (DGALV) explained above and financial clearing technology

developed by Swiss Bank Wir (www.wir.ch) in 1934. This is only draft of document, not perfectly worded and specimen for further

development, improvement and fill out of Borrower data.

Used sources of information: 1. Updates World Economic Situation and Prospects 2012

(United Nations publication, Sales No. E.12.II.C.2), released in January 2012

(http://www.un.org/esa/policy/wess/wesp.html)

2. Paul Hannon, “The Wall Street Journal”, 2011

3. Van R. ,Lacy H. Hunt, Ph.D, Hoisington, 2012 (www.Hoisington.com)

4. WebSite of The Clearing Corporation, (USA), (www.clearingcorp.com)

5. Publication 946 (2011), IRS, USA

6. Wikipedia, the free encyclopedia, (http://en.wikipedia.org)

7. INVESTOPEDIA (www.investopedia.com)

8. Swiss Bank Wir Web Site (www.wir.ch), (www.bancawir.ch)

9. Tutto Sula Banca WIR (PDF-publication of Bank WIR in Italian language )

10. European Standard Bank Web Site (www.esbank.org)

11. Федеральный закон Российской Федерации от 7 февраля 2011 г. N 7-ФЗ "О

клиринге и клиринговой деятельности"

12.

Multiple Trade Marks used in this document belong to their respective owners.

-------- END OF CERTICATE HERE -------FAQs of Borrowers and participants of clearing transactions from CIS countries

(this part is not official addendum of Certificate)

1. Q. Law of my country demand I have make any transaction only with accounts

opened in local Bank. Can I transfer Clearing Loan to my local Bank account?

A. No, you cannot. Read document carefully and you will find reason.

2. Q. My business partner refuse accept clearing funds because he say he cannot pay

salary for stuff with them. What I can do in this case?

A. There are three solutions here:

- If you can pay for him 50% by borrowed Clearing Funds and 50% with your own

funds. It’s the best solution, which use Borrowers of Bank WIR, for example.

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

24

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

- Explain for his business partner that not all 100% of his commodities he sale with

clearing. So from others sources he can pay out salary and from clearing funds

purchase raw materials he use in business.

- Find other supplier who better understand how functioning economy in

International crisis environment of 2008-2023 or let him better to think about his

place in such economic reality.

3. Q. In my Country conducting business without brides is utopia. Can I pay bribes by

clearing for private persons?

A. We cannot evaluate moral component of your question here. But you have to

know you can always make payment for everyone is this beneficiary

recognize this method.

4. Q. In my business there are penny costs which I definitely cannot pay by

Clearing, like pencils, pens, office paper etc. How I can resolve this problem?

A. You can make bulk purchase of some assets using Clearing and re-sell them

with cash to cover such penny expenses. Nobody prohibit you to do this.

5. Q. I arrived to office of equipment supplies to purchase equipment by Clearing but

office’s stuff can not understand what is Clearing and what I talking about? What

I have to do in this case?

A. Despite Clearing exists more than 300 years it is seldom use instrument in small

trading companies or companies who have not experience of futures trading

techniques. Stuff of such companies is not right audience who able earn such

decision because clearing participant must to have account in such financial

institution as European Standard Bank and it is outside of most stuff obligations.

You must refer your offer to somebody, who have such rights and is prepared

for such trading technology. Reading of BUSINESS LOAN CERTIFICATE by

prospective seller is key to prepare him to be able to make such transactions and

get huge profit for company, especially in economic crisis environment. In any

case buyer and seller, who want to make transactions with using of clearing

possibilities – both have prepare “homework” where each of them have

understands what is clearing, why it is only way for them, how they can use

clearing funds, etc.

6. Q. I see using clearing instead of conventional bank’s accounts transactions is

more complex task and require from parties more time and efforts? May be exists

for this purposes others more easy solutions for those, for whom conventional

lending behind their capabilities ?

A. Maybe exists easier solution, but I, as scientist with 20++ years of financial

background, do not know such solutions and never read about them. My

friend also scientist, former counselor of President USA also do not know

such solution. May be YOU’LL try to find or invent them.

7. Q. What will happen if prospective seller will refuse my offer to sell with

Clearing?

A. Both parties will obtain only losses and become poorer. And nothing more

will be happen.

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

25

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

8. Q. I’m Borrower and want to know who can issue for my Loan such Certificate?

A. European Standard Bank can issue for you such Certificate in English and other

languages you need in your business practice. To obtain Certificate you have

use this specimen and include inside data from your business-plan and from

assets evaluation document made by professional specialist who have license to

do it. Based on your Business Plan, Exert Conclusion, and Agreement with your

investor ESB will issue for you such document on paper and also will be

available inside banking system. Everybody who will use your clearing money

in “clearing ring” will be able to know their market value. Read in our price list

of cost for this service.

9. Q. Can European Standard Bank provide for me list of suppliers who willing sell

with Clearing technology ?

A. We are thinking about such service to create specific market place for

Clearing participants, something like we have on Forex or Future markets.

Probably such service will exists in nearest future. But today you have make

deals on case-by-case bases with partner you will find on markets you are

working with.

10. Q. What have I to do if I want obtain for Clearing transactions Loan?

A. You have fill out application form and provide us. And we will forward to

prospective investor.

11. Q. I read that conventional international lending today does not exists at all.

Especially does not exists for emergency markets at all.

A. You are not right. Conventional International Lending exists all time. Today

you can find very much information placed into Internet by enforcement

agency, worked under nicknames of independent observers etc and place there

such false information. I don’t know there goals because I never worked there.

For example, Russian businessman Oleg Derepaska obtained billions US

dollars loans from International Lenders during last years. Please investigate

Internet and find biography and others facts of his business life and you will

find amount of International Loans he got.

12. Q. Can you tell me have any chance obtain conventional loan like Oleg Derepaska

?

A. To obtain such Loan you business must meet the next criteria: 1) You must to

be owner at least of 30% of market with you production in your country. 2)

Your business must to be based on patent of significant Know-How. 3) You

must to have collateral with high level of liquidity, which cover Loan and

Interest, sometimes twice. 4) Your company must to have stable significant

turnover, confirmed by tax officials and auditors like PRICEWOTERHOUSE

COOPERS, KPMG, etc. You must to be able at least 50% of total project

necessary investment. Nobody and never will invest in you project 100% of

capital. Some others demands are also. It was demands if you seek

international lending. If you seek joint-ventures, you have to know that each

party of joint-venture will have shares (ownership) proportionally of initial

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

26

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

capital you able invest into joint-venture business. If you have only businessplan in your hands and some insignificant assets, probably you can obtain up

to 5% shares (ownership) in joint-venture and never 30%, 40%, 50% etc.

Because it’s only your dream, which never will be true because against rules

of joint-venture creations which exists hundred years. If you will seek leasing

you also must to be capable pay et least 20%-30% of leasing upfront from

your own funds. You can obtain conventional loan theoretically if you meet

above demands. But ONLY OUT OF CRISIS TIMES. In crisis it also

impossible due to lack of money in World, in most financial institutions. Why

? Please read BUSINESS LOAN CERTIFICATE document carefully and you

will find answer.

13. Q. I think to make significant changes in my business. I want wipe my money

from the bank I use and purchase with them gold, real estate, other valuable assets

and under their collateral obtain finance in European Standard Bank for

operational needs. In this case I’ll prevent my risk to lose all in case when

collapse occurs and will keep my ability conduct my business turnover. Is it good

solution? Can it save my assets?

A. We cannot give you any advice what you have to do. Only think about next

facts. My friend, former counselor of president USA in private conversation

24 November 2012 told me:” deposits are only worth 5% of what they were

and may soon no longer exist when collapse occurs”. If you wipe money and

purchase something you will have 100% of your money market value stored

in hard assets and in case of collapse for you will be easy to recover them.

And simultaneously you will make your assets make business turnovers with

Clearing accounts of European Standard Bank. What is better for you - it’s

your business.

14. Q. I never was phisically in European Standard Bank I don't know what will

happen if this finanacial instutution will fill Bankrupcy or become insolvent.

What will happen with my assest are they safe ?

A. On the one hand you will lose nothing because assets are always WITH YOU

and European Standard Bank as any other clearing financial institution operate

only with their VALUE but never operate with phisical assets. In the World

history you can find very much banks who was insolvent or bankrupt. But you

cannot find NO ONE PURE CLEARING FINANACIAL INSTITUTION

which bacame bankrupt due to nature of clearing business. And possibility of

physical presense never guarantee for you safety of your assets, especially and

in case of collapse or risky assets management of Bank’s stuff. In case of

clearing YOU AND ONLY YOU IS YOUR ASSETS MANAGER and no

one officer of Clearing financial institution have influence here. Where you

are absolutely safe?! Think for himself, ask auditors, lawyers, consultants,

anybody who is expert in Clearing. Such is reality.

15. Q. What about taxes ? How I can pay VAT and others taxes using clearing money

?

European Standard Bank Officer’s signature _____________________________

EUROPEAN STANDARD BANK

(http://www.esbank.org),

(Proforma-Specimen)

27

BUSINESS LOAN CERTIFICATE

Certificate Unique Registration ESB number: 0836367876

Last update date:

03/01/2013

A. Nobody in the World pay taxes with clearing money. Ask taxes counsellor or

auditor or tax consultant about business practice in this case. Only I wish

inform you that tax obligations exists always and in all countries if you or

somebody sell something, or, by others words if we have change of assets

owner. Instead of sale something you can borrow money and transfer to lender

your assets as mortgage for 5, 10, or 50 years. During these 5, 10 or 50 yeras

you have not pay taxes because owner of assets is the same. It's tax planing

technique, absolutelly legal.

16. Q. My seller want not sell assets based on pure clearing technology. Some of

them ask 50% or 60% or 75% of money they have use free without any

limitations. I cannot find other party who agree for pure clearing. Exists any

solution in this case ?

A. Some clients in such case try obtain loan with others financial institutions

using assets they purchased by clearing as mortgage. In European Union countries

available loans from 3% per years sometimes. Such refinancing in countries of

Emergencies Markets are more expensive. In times of financial crisis obtaining

such finance is very problematic. Your seller MUST ADJUST his intents in

accordance with financial reality. You can involve into deal good known

consultants who will help for Seller understand reality of World in financial crisis

and adjust his dream to reality or he will obtain only loses.

European Standard Bank Officer’s signature _____________________________