Omega:A Sharper Ratio

advertisement

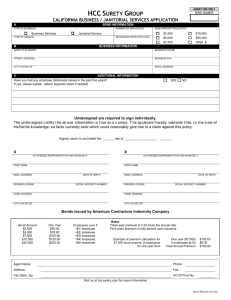

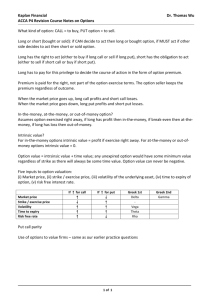

Pensions – Some Problems of Financial Analysis 10 9 Risk (4.5 , 9) Bond Risk (6.5,17.5) Equity Risk (8, 17.5) Equity Risk (4.0,9)Bond Risk (5.0, 9.0) Bond 8 7 6 5 4 3 2 1 0 0 10 20 30 40 50 60 70 80 90 100 London January 2006 ISDA / PRMIA Con Keating The Finance Development Centre 1 Valuation Methods The Finance Development Centre 2 So what’s wrong with these? • • • • • • • • • • • • • • What is and what isn’t included in the liabilities. ABO versus PBO - FRS 17 and IAS 19 PBO See SEI and Cardiff Business School Paper Dutch System – ABO, UK – PBO Source of the ABO-PBO difference is the desire to avoid a mathematical discrepancy. Benefits are defined as fractions of service, premiums are set level – so younger members do not receive good value for early years contributions. Within such schemes there is generational risk sharing. FRS17 & IAS19 are mixed attribute systems - Different basis of valuation Leads to bias and overstatement of deficits. The liability that constitutes someone else’s asset is its image about zero – symmetries reverse. The principal difference between an asset and a liability is one of control We may not without consent alter the characteristics of a liability Liability management comes down to renegotiation or defeasement The value of an asset is a function of its use. First best use, Second best use Value in use in general differs from value in exchange The Finance Development Centre 3 A way to think about Market prices • • • • • • • • • • • • • For any asset to have a value it must generate future cash-flows These future cash-flows are not known with certainty. We may present value these cash-flows by discounting them We are left with an expected present value and a range of uncertainty We shall call this fundamental uncertainty Markets serve to price this present value. We might for example today bid 60 for a stream of cash-flows which have a present value of 100 +/-10 We may be considered to be risk averse Equally we may say that we are greedy. This is the Market Risk Premium This is the fear and greed of popular market parlance. The amount by which markets discount present values varies with time. The Market Risk Premium is in fact a distribution – today 60, tomorrow 65 The Finance Development Centre 4 Market Prices Cont. • • • • • • • • • • There are two sources of uncertainty at work in the volatility of market prices. Fundamental Uncertainty Market “Risk” Premium Uncertainty This distinction is not reliant upon present values, we might equally compare future values. Fundamental Uncertainty is exogenous but the Market Risk Premium Uncertainty is endogenous. Fundamental Uncertainty may be viewed as a game against nature but the Market Risk Premium Uncertainty is a game against others. It is reasonable to assume that the higher the fundamental uncertainty, the more variable the market risk premium may be. Extending the investment tenor increases fundamental uncertainty. The market risk premium may be considered as the incentive necessary to attract speculators and dealers. However, the question then is how much of this arises from fundamental uncertainty and how much from market risk premium volatility. The Finance Development Centre 5 Financial Economics • • • • • Many attempt to justify market prices from the basis of elementary financial economics. We can today exchange £100 of equities and bonds and we can do the same tomorrow ad infinitum. This gave us Modigliani Miller and Black Scholes and the no-arbitrage replication techniques. M&M is just a re-statement of its axiomatic truth that the value of A+B is equal to the Value of A plus the Value of B Black-Scholes and no-arbitrage techniques work simply because the spanning set of securities contains the security on which the option is written. • And this contains its risk premium • • • The implied volatility of option pricing is simply a distortion of market price volatility. Market prices are risk adjusted values All of these are true but…. The Finance Development Centre 6 Finance 102 • • • • • • • • • Financial Institutions do not exist in this simple world. They are merely collections of securities Markets are complete – we can hedge any risk Accounting standards don’t matter Regulation does not modify our behaviour This is not the real world Pensions schemes exist to internalise things which cannot be done in markets Information is costly There are problems of incentives, adverse selection and moral hazard • Values are no longer unique “Value estimates that are calibrated to observable market prices may be “unbiased” with respect to market valuations. But those same valuations, in turn, may well be biased (misaligned) with respect to a counterfactual benchmark in which prices reflect the right signals for economic behaviour.” Borio and Tsatsaronis BIS The Finance Development Centre 7 Finance 101 revisited • • • • • • • • • • • Pensions liabilities are bond like They aren’t any more so than any other future cash-flow - Their sensitivities are to salaries, wage and retail price inflation and longevity The apparent sensitivity arises because we discount future cash-flows using an interest rate curve In theory the default risk free – but that does not exist But this is just a functional to compare cash-flows distributed in time In theory there are infinitely many such functionals - Including our Omega! One desirable attribute of any measure is that it is invariant – market prices are not The proliferation of regulated methods in pensions estimation results in multiple scales being used in measurement – Remember the smaller the scale, the greater the magnitude observed - Mandelbrot Partial Analysis – pensions deficits are the result of falling interest rates increasing liability values, increasing longevity, and poor equity performance. Complete Equilibrium analysis – falling interest rates make possible projects which were not previously viable and increasing longevity reduces uncertainty about future consumer demand Governments collect more taxes and Companies face less uncertainty about the future evolution of the economy The Finance Development Centre 8 Market Prices Yield curve and risk premium in Germany (January 1995) 8.80% Risk Premium and Curves 7.80% 6.80% 5.80% 4.80% 3.80% 2.80% 1.80% 0.80% -0.20% 0 5 10 15 Horizon Explanatory power: Risk Premium Volatility / Market Price Volatility If we next consider holding periods, what does our exposure to these risk sources look like? If we are holding for immediate sale, then the exposure to market risk volatility is total. If we are holding intending to consume the future cash-flows as they arrive, we are exposed only to the fundamental uncertainty The Finance Development Centre 9 Risk Exposures We begin with a comparison of equity total returns, price returns and dividend returns. The sample period is from March 1988 until March 2005 FTSE Total FTSE Price FTSE Dividend S&P Total S&P Price S&P Dividend StDev 4.33 4.32 0.21 3.90 3.89 0.10 Mean 0.93 0.61 0.32 1.00 0.81 0.19 We observe that price volatility is dominant. If we are holding these securities to consume dividends, we are not exposed to this price volatility in any economic sense. We expect prices to vary with retained earnings, interest rate shifts and changes in the risk premium. The Finance Development Centre 10 Market Risk Premium Exposure Zero coupon bonds and non-dividend paying equity Return on Equity 10%, tax rate 35% - Expected return 6.5% Volatility 17.5% Bond: Expected Return 4%, Volatility 9% Likelihood of Loss and Holding Term Years 1 0 10 20 30 40 50 60 70 80 90 100000 100 0.1 10000 Expected Value (log scale) Likelihood of Loss (log scale) 0.01 0.001 0.0001 1000 0.00001 0.000001 Likelihood of Loss Bond Equity 0.0000001 100 The Finance Development Centre 11 Shortfall and Risk Equity relative to a 4% p.a. target Expected Shortfall and Risk 8 100000 Risk Expected Shortfall 7 5 1000 4 100 3 2 Expected Shortfall - Log Scale Risk ( Product of likelihood and magnitude ES - %) 10000 6 10 1 0 0 10 20 30 40 50 60 70 80 90 1 100 Years Expected shortfall increases over time, but risk – the product of the expected shortfall and its likelihood - is complex and rapidly declining. The Finance Development Centre 12 Equities and bonds 10 9 Risk (4.5 , 9) Bond Risk (6.5,17.5) Equity Risk (8, 17.5) Equity Risk (4.0,9)Bond Risk (5.0, 9.0) Bond 8 7 6 5 4 3 2 1 0 0 10 20 30 40 50 60 70 80 90 100 A mix of different bonds and equities Which is riskier? It depends upon the horizon and the terms and conditions. The Finance Development Centre 13 Cash-Flows and Holding Period Dividend Paying Equity 7 10000 6 1000 Risk % 4 100 3 Expected Shortfall 5 Risk 2 CF adjusted Risk 10 Expected Shortfall CF adjusted Expected Shortfall 1 0 0 10 20 30 40 50 60 70 80 90 1 100 Years 75% Pay-out in Dividends – Threshold 0 By ten years the risk is negligible The Finance Development Centre 14 A base case Threshold Zero, Dividend payout total and all held in cash Dividend Paying Equity 7 1000 6 100 Risk % 4 3 Expected Shortfall 5 10 Risk 2 CF adjusted Risk Expected Shortfall CF adjusted Expected Shortfall 1 0 0 10 20 30 40 50 60 70 80 90 1 100 Years Expected shortfall and risk are constant in time The cash-flow adjusted expected shortfall rises and cash-flow adjusted risk is negligible beyond year ten. The Finance Development Centre 15 Does it work like this in the real world? • • • • • • • • • • Yes - There is a very long history of academic research finding that variations in fundamental uncertainty are unable to explain more than a small fraction of market price volatility Shiller, Mehra & Prescott and a host of others And no mention here of mean reversion and lower volatility levels. Go away and think about implied volatilities derived from option prices Go away and think about Merton based models of Credit When these are based upon equity prices, you will need to calibrate for both the likelihood and volatility of the likelihood of default. Go away and think about where the excess returns come from in those structured products. Go away and think about hedge funds and whether you really want to pay one up twenty for systematic risk premium collection Under FRS 17 and IAS 19, these effects are transmitted to the sponsor company balance sheet – debt on the sponsor and arbitrary volatility in the STRGL Under the Dutch system, where funds are treated as if they are stand-alone companies, they are required to hold surpluses to cushion against these effects – (30% of liability values) The Finance Development Centre 16 Solvency Tests A key feature of all new “Risk Based” Pensions regulation is the presence of a recurrent solvency test. It is obvious that at the point of insolvency of the sponsor we should require 100% funding of the scheme. But should this be applied elsewhere? We might for example argue that a deficit aligns the interests of company and employee. It is also often argued that a strong funding ratio is a positive signal to employees But to be credible any signal must be costly The Finance Development Centre 17 Costs of Solvency The primary decision criterion for funding from the standpoint of the finances of the company is that the (post-tax) rate of return on assets within the fund should equal or exceed the (post-tax) rate of return of assets within the business. The credit rating agencies are influential and rate companies lower in the presence of FRS 17 / IAS 19 deficits. This raises the costs of finance for the firm. The presence of a solvency test renders the investment process path dependent. An illustration of a path independent process is one where we require a certain sum of money at a point in time in the future and it does not matter how we get there. The Finance Development Centre 18 The cost of path dependency We might view path dependency as shortening the time horizon available for investment from the term of the fund to the term of the test. Viewing the world in this manner would place the cost at around 2% per annum. It is of course from the social welfare standpoint undesirable Perhaps better is to model this as a requirement to fund, to raise equity whenever deficits occur. If we have a 60/40 Equity-Bond portfolio with annual returns of 8% and 4% and volatilities of 17% and 8% and correlation of 0.40 And we begin with a 100% funded scheme, we observe a cost of around 60 basis points. The Finance Development Centre 19 The cost of path dependency Somewhat contra-intuitively if we have an all bond portfolio this cost only declines to 50-55 basis points per annum And the all bond strategy costs about 2.5% in expected return For an all equity fund the cost approaches 1% It is difficult not to conclude that these costs justify long run smoothing techniques Finally of course we should expect regulations to feed back into the behaviour of the market risk premium. The rate of change of regulation in both pensions and insurance makes this an econometrically challenging and perhaps intractable exercise In the UK such analyses are further compounded by the removal of Advanced Corporation Tax in 1997 The Finance Development Centre 20 ALM in Pensions • • • • • Stochastic duration – not the Macaulay or Modified Models for the term structure Partial durations wrt each term structure factor Multiple partial convexities. Under positive yield curves stochastic duration can vary by 10%-20% from the modified figure. • Regulation – protecting the beneficiary • One of the few things we can do to reduce dependence upon the projected evolution of the economic dependency ratio is to improve productivity growth • Productivity growth of around 1% p.a. will greatly mitigate this. The Finance Development Centre 21 Productivity and Risk based regulation • • • • • • • • • • One of the effects of risk based regulation is to encourage investment in bonds rather than equity Bonds are less volatile than equities in market price terms This is encouraging public sector investment rather than private sector investment The European Central Bank has concerns that the availability of debt finance will result in debt issuance as a tax substitute rather than for capital and infrastructure investment For the past twenty five years we have privatised everything that moves – Jon’s presentation was about one current aspect of this. The economic orthodoxy is that private sector investment is more productive than public sector investment – the analysis is one of incentives. There is no subtle risk adjustment here – the assets and markets are the same before and after privatisation The effect of risk based regulation will be to lower future productivity growth And ensure that the economic dependency ratio that causes such concern comes to pass. That is I believe an unintended consequence The Finance Development Centre 22 Further Work Problems of Recognition Newer developments in finance offer many potentially interesting new solutions It is clear also that some currently being offered are expensive and inappropriate Immunisation and Dedication approaches are among these. Insurance as an inter-temporal smoothing mechanism is obvious Hedge or Absolute Return Funds, where leverage and risk premium smoothing are at work, are perhaps another But that is the subject of the OECD/IOPS Jordan Conference. Con.Keating@financedevelopmentcentre.com The Finance Development Centre 23 A final thought…or two. John Watson, Chairman, Boots Pensions Letter to the F.T. February 19 2005 “Both trends [DC and LDI] are ill-conceived as long-run solutions,” Robert Merton, I.P.E., January 6 2006 The Finance Development Centre 24