Chapter 4

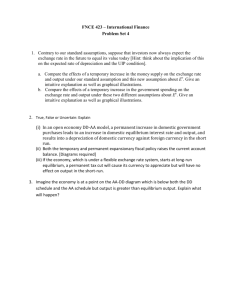

International

Financial Management

by

Jeff Madura

Florida Atlantic University

Chapter

4

Exchange Rate Determination

Why this Chapter?

Financial managers of MNCs that conduct international business must continuously monitor exchange rates because their cash flows are' highly dependent on them.

They need to understand what factors influence exchange rates so that they can anticipate how exchange rates may change in response to specific conditions.

This chapter provides a foundation for understanding how exchange rates are determined.

Chapter Objectives

To explain how exchange rate movements are measured;

To explain how the equilibrium exchange rate is determined;

To examine the factors that affect the equilibrium exchange rate;

To explain the movements in cross exchange rates; and

To explain how financial institutions attempt to capitalize on anticipated exchange rate movements.

Some important terminologies

1.

Equilibrium Exchange Rate:

The exchange rate at which the demand for a currency and supply of the same currency are equal. The equilibrium exchange rate indicates that the price of exchanging two currencies will remain stable.

2.

Cross Rate:

The currency exchange rate between two currencies, both of which are not the official currencies of the country in which the exchange rate quote is given in. This phrase is also sometimes used to refer to currency quotes which do not involve the U.S.

dollar, regardless of which country the quote is provided in.

Continued…

3.

Purchasing Power Parity - PPP:

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power.

The relative version of PPP is calculated as:

Where:

"S" represents exchange rate of currency 1 to currency 2

"P

1

" represents the cost of good "x" in currency 1

"P

2

" represents the cost of good "x" in currency 2

In other words, the exchange rate adjusts so that an identical good in two different countries has the same price when expressed in the same currency.

Continued…

4.

Exchange Rate Movements:

The fluctuations in value between currencies that can result in losses to investors and businesses that import and export goods.

5.

Fisher Effect:

An economic theory proposed by economist Irving Fisher that describes the relationship between inflation and both real and nominal interest rates. The Fisher effect states that the real interest rate equals the nominal interest rate minus the expected inflation rate. Therefore, real interest rates fall as inflation increases, unless nominal rates increase at the same rate as inflation.

Real interest rate

Nominal interest rate

Inflation rate

How can we Measure Exchange

Rate Movements ??

Email/ F.B : nusrat2008noori@yahoo.com

Measuring

Exchange Rate Movements

Exchange rate movements affect an MNC's value because they can affect the amount of cash inflows received from exporting or from a subsidiary and the amount of cash outflows needed to pay for imports.

An exchange rate measures the value of one currency in units of another currency. As economic conditions change. exchange rates can change substantially.

When a currency declines in value, it is said to depreciate . When it increases in value, it is said to appreciate . Exchange rate can be measured by comparing a foreign currency's spot rates at two specific points in time S t

– S

t-1

.

Continued …

When a foreign currency's spot rates at two specific points in time are compared. The spot rate at the more recent date is denoted as St and the spot rate at the earlier date is denoted as

S t-1

The percentage change in the value of the foreign currency is computed as follows:

St - S t-1

Percent A In foreign currency value = S t-1

A positive percentage change indicates that the foreign currency has appreciated. while a negative percentage change indicates that it has depreciated.

Continued …

On some days, most foreign currencies appreciate against the dollar, although by different degrees. On other days, most currencies depreciate against the dollar, but by different degrees.

There are also days when some currencies appreciate while others depreciate against the dollar; the media describe this scenario by stating that "the dollar was mixed in trading.

Foreign exchange rate movements tend to be larger for longer time horizons. Thus, if yearly exchange rate data were assessed, the movements would be more volatile. If daily exchange rate movements were assessed, the movements would be less volatile.

Continued …

A review of daily exchange rate movements is important to an

MNC that will need to obtain a foreign currency in a few days and wants to assess the possible degree of movement over that period.

A review of annual exchange movements would be more appropriate for an MNC that conducts foreign trade every year and wants to assess the possible degree of movements on a yearly basis.

Many MNCs review exchange rate based on short-term and long-term horizons because they expect to engage in international transactions in the near future and in the distant future.

Fluctuation of the British Pound

Over Time

Approximate

Spot Rate of £

$ 1.80

1.75

1.70

1.65

1.60

1.55

1.50

1.45

1.40

1992 1996 2000

Approximate

Annual %

D

20 %

15

10

5

0

-5

-10

-15

-20

1992 1996 2000

Approximate £ that could be

Purchased with

$10,000

£ 7000

6800

6600

6400

6200

6000

5800

5600

1992 1996 2000

Equilibrium Exchange rate

Determination

Email/ F.B : nusrat2008noori@yahoo.com

Equilibrium Exchange Rate

Although it is easy to measure the percentage change in the value of a currency, it is more difficult to explain why the value changed or to forecast how it may change in the future.

To achieve either of these objectives, the concept of an equilibrium exchange rate must be understood, as well as the factors that affect the equilibrium rate.

Before considering why an exchange rate changes, realize that an exchange rate at a given point in time represents the price of a currency, or the rate at which one currency can be exchanged for another. The exchange rate always involves two currencies.

But our focus is from the U.S. perspective.

Continued …

The exchange rate of any currency refers to the rate at which it can be exchanged for U.S. dollars, unless specified otherwise.

Like any other product sold in markets, the price of a currency is determined by the demand for that currency relative to supply.

At any point in time, a currency should exhibit the price at which the demand for that currency is equal to supply, and this represents the equilibrium exchange rate.

Off course, conditions can change over time, causing the supply or demand for a given currency to adjust, and thereby causing movement in the currency's price.

Continued …

The exchange rate represents the price of a currency, or the rate at which one currency can be exchanged for another.

Demand for a currency increases when the value of the currency decreases, leading to a downward sloping demand schedule. (See Exhibit 4.2)

Supply of a currency increases when the value of the currency increases, leading to an upward sloping supply schedule. (See

Exhibit 4.3)

Equilibrium equates the quantity of pounds demanded with the supply of pounds for sale. (See Exhibit 4.4)

In liquid spot markets, exchange rates are not highly sensitive to large currency transactions.

Exhibit 4.2 Demand

Schedule for British

Pounds

Exhibit 4.3 Supply

Schedule of British

Pounds

Exhibit 4.4 Equilibrium Exchange Rate

Determination

19

Exchange Rate Equilibrium

An exchange rate that represents the price of a currency, which is determined by the demand for that currency relative to the supply for that currency.

Value of £

S: Supply of £

$1.60

$1.55

$1.50

equilibrium exchange rate

D: Demand for £

Quantity of £

Factors that Influence Exchange

Rates

Email/ F.B : nusrat2008noori@yahoo.com

Factors Influencing Exchange rates

1.

2.

3.

4.

5.

Continued …

The equilibrium exchange rate will change over time as supply and demand schedules change.

e

f (

D

INF ,

D

INT ,

D

INC ,

D

GC ,

D

EXP ) where e

percentage

D

INF

change change in the in the spot rate differenti al between U.

S.

inflation and the foreign

D

INT

change country' in the s inflation differenti al between th e U.S.

interest rate and the foreign

D

INC

change country' in the s interest differenti al rate between th e U.S.

income level and the foreign

D

GC

change country' s income in government level controls

D

EXP

change in expectatio ns of future exchange rates

Factors that Influence

Exchange Rates

1. Relative Inflation Rates

$/£

S

1

S

0 r

1 r

0

D

1

D

0

Quantity of £

U.S. inflation

U.S. demand for

British goods, and hence £.

British desire for U.S. goods, and hence the supply of £.

Continued …

2. Relative Interest Rates

$/£

S

0

S

1 r

0 r

1

D

0

D

1

Quantity of £

U.S. interest rates

U.S. demand for

British bank deposits, and hence £.

British desire for U.S. bank deposits, and hence the supply of £.

Continued …

3. Relative Income Levels

$/£ r

1 r

0

S

0

, S

1

D

1

D

0

U.S. income level

U.S. demand for

British goods, and hence £.

No expected change for the supply of £.

Quantity of £

Continued …

4. Government Controls

Governments may influence the equilibrium exchange rate by:

imposing foreign exchange barriers,

imposing foreign trade barriers,

intervening in the foreign exchange market, and

affecting macro variables such as inflation, interest rates, and income levels.

Continued …

5. Expectations

Foreign exchange markets react to any news that may have a future effect.

Institutional investors often take currency positions based on anticipated interest rate movements in various countries.

Because of speculative transactions, foreign exchange rates can be very volatile.

If investors expect interest rates in one country to rise, they may invest in that country leading to a rise in the demand for foreign currency and an increase in the exchange rate for foreign currency.

Chapter Review

Measuring Exchange Rate Movements

Exchange Rate Equilibrium

Demand for a Currency

Supply of a Currency for Sale

Equilibrium

Factors that Influence Exchange Rates

Relative Inflation Rates

Relative Interest Rates

Relative Income Levels

Government Controls

Expectations