Funds of funds

advertisement

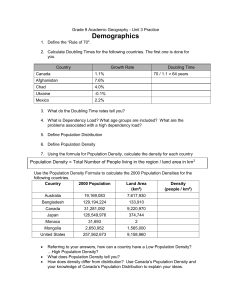

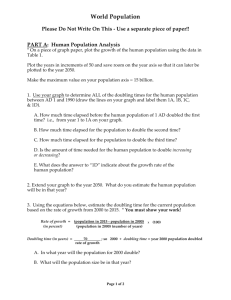

Double or nothing: Patterns of equity fund holdings and transactions Stephen J. Brown NYU Stern School of Business David R. Gallagher University of NSW Onno Steenbeek Erasmus University / ABP Investments Peter L. Swan University of NSW www.stern.nyu.edu/~sbrown Performance measurement Leeson Investment Managemen t Market Short-term (S&P 500) Government Benchmark Benchmark Average Return .0065 .0050 .0036 Std. Deviation .0106 .0359 .0015 Beta .0640 1.0 .0 Alpha .0025 .0 .0 (1.92) Arbitrage, 100% in cash at close Sharpe Style: Ratio Index.2484 .0318 .0 of trading Frequency distribution of monthly returns 35 30 25 20 15 10 5 0 % 0 % 0 % 0 % 0 % 0 % 0 % 0 % 0 % 0% 0% 0 % 0 % 0 % 0 % 0 % 0 0 .5 .0 .5 1.0 1.5 .0 .5 .0 .5 .0 .5 .0 .5 .0 .5 . 1 2 3 4 5 5 6 2 3 4 0 6 - -0 0 Percentage in cash (monthly) 120% 100% 8 0% 60% 40% 20% 0% 31-Dec-198 9 15-May-1991 26-Sep-1992 8 -Feb-1994 Examples of riskless index arbitrage … Percentage in cash (daily) 200% 100% 0% -100% -200% -300% -400% -500% -600% 31-Dec-198 9 15-May-1991 26-Sep-1992 8 -Feb-1994 Apologia of Nick Leeson “I felt no elation at this success. I was determined to win back the losses. And as the spring wore on, I traded harder and harder, risking more and more. I was well down, but increasingly sure that my doubling up and doubling up would pay off ... I redoubled my exposure. The risk was that the market could crumble down, but on this occasion it carried on upwards ... As the market soared in July [1993] my position translated from a £6 million loss back into glorious profit. I was so happy that night I didn’t think I’d ever go through that kind of tension again. I’d pulled back a large position simply by holding my nerve ... but first thing on Monday morning I found that I had to use the 88888 account again ... it became an addiction” Nick Leeson Rogue Trader pp.63-64 Sharpe ratio of doublers 0.4 0.3 0.2 0.1 0 -0.1 -0.2 All Doublers Doublers who have not yet embezzled Sharpe Ratio of Market Informationless investing Informationless investing Zero net investment overlay strategy (Weisman 2002) Uses only public information Designed to yield Sharpe ratio greater than benchmark Why should we care? Sharpe ratio obviously inappropriate here Informationless investing Zero net investment overlay strategy (Weisman 2002) Uses only public information Designed to yield Sharpe ratio greater than benchmark Why should we care? Sharpe ratio obviously inappropriate here But is metric of choice of hedge funds and derivatives traders We should care! Agency issues Fund flow, compensation based on historical performance Gruber (1996), Sirri and Tufano (1998), Del Guercio and Tkac (2002) Behavioral issues Strategy leads to certain ruin in the long term Examples of Informationless investing Doubling a.k.a. “Convergence trading” Covered call writing Unhedged short volatility Writing out of the money calls and puts Forensic Finance Implications of Informationless investing Patterns of returns Patterns of security holdings Patterns of trading Sharpe Ratio of Benchmark 100% 50% 0% -50% Benchmark -100% -150% -200% -50% 0% 50% Sharpe ratio = .631 100% Maximum Sharpe Ratio 100% 50% Benchmark 0% -50% Maximum Sharpe Ratio Strategy -100% -150% -200% -50% 0% 50% Sharpe ratio = .748 100% Short Volatility Strategy 100% 50% Benchmark 0% -50% -100% Short volatility -150% -200% -50% 0% 50% Sharpe ratio = .743 100% Doubling 100% 50% Benchmark 0% Doubling (upper 5%) -50% -100% Doubling (median) -150% Doubling (lower 5%) -200% -50% 0% 50% Sharpe ratio = .046 100% Doubling (no embezzlement) 100% 50% Benchmark 0% Doubling (upper 5%) -50% -100% Doubling (median) -150% Doubling (lower 5%) -200% -50% 0% 50% Sharpe ratio = 1.962 100% Concave trading strategies 100% 50% Benchmark 0% Doubling (median) -50% -100% Maximum Sharpe Ratio Strategy -150% -200% -50% 0% 50% 100% Hedge funds follow concave strategies R-rf = α + β (RS&P- rf) + γ (RS&Prf)2 Concave strategies: tβ > 1.96 & tγ < 1.96 Hedge funds follow concave strategies R-rf = α + β (RS&P- rf) + γ (RS&PN Concave Neutral Convex rf)2 Convertible Arbitrage Dedicated Short Bias Emerging Markets Equity Market Neutral Event Driven Fixed Income Arbitrage Fund of Funds Global Macro Long/Short Equity Hedge Managed Futures Other Source: TASS/Tremont 5.38% 0.00% 21.89% 1.18% 27.03% 2.38% 16.38% 4.60% 11.19% 2.80% 5.00% 94.62% 100.00% 77.25% 97.06% 72.64% 95.24% 82.06% 91.38% 86.62% 94.17% 91.67% 0.00% 0.00% 0.86% 1.76% 0.34% 2.38% 1.57% 4.02% 2.18% 3.03% 3.33% 130 27 233 170 296 126 574 174 1099 429 60 Portfolio Analytics Database 36 Australian institutional equity funds managers Data on Portfolio holdings Daily returns Aggregate returns Fund size 59 funds (no more than 4 per manager) 51 active 3 enhanced index funds 4 passive 1 international Some successful Australian funds Sharpe Fund Ratio 1 2 3 16 27 36 0.1017 0.1500 0.1559 0.1079 0.0977 0.1814 Alpha FF Alpha Beta Skewnes s Kurtosi Annual s turnover 0.08% 0.10% 0.90 -0.5209 4.6878 20.69 (2.21) (2.58) 0.16% 0.17% 1.11 0.0834 4.2777 0.79 (6.44) (5.88) 0.19% 0.20% 1.08 0.7382 7.6540 1.18 (4.09) (4.36) 0.09% 0.09% 0.96 -0.2558 4.1749 0.34 (2.66) (2.61) 0.12% 0.11% 1.03 -0.2667 3.4316 1.27 (2.42) (2.25) 0.29% 0.31% 0.90 -0.6248 5.1278 0.62 (3.02) (3.06) Style and return patterns Treynor Mazuy measure Modified Henriksson Merton measure Number of observations Category Beta GARP 0.96347 -0.01105 (-2.30) -0.08989 (-2.52) 2395 Growth 1.03670 -0.00708 (-1.53) -0.03762 (-1.15) 1899 Neutral 1.02830 -0.00110 (-0.29) -0.02092 (-0.71) 1313 Other 1.00670 -0.00196 (-0.53) 0.00676 (0.21) 640 Value 0.76691 -0.01215 (-1.93) -0.10350 (-2.24) 2250 Passive/ Enhanced 1.01440 0.00692 (1.51) 0.04593 (1.47) 859 Size and return patterns Largest 10 Institutional Manager Boutique firm Treynor Mazuy measure Modified Henriksson Merton measure Number of observations Category Beta No 0.9627 -0.00645 (-2.25) -0.05037 (-2.34) 6100 Yes 0.8819 -0.01306 (-2.60) -0.10095 (-2.92) 2397 No 0.9322 -0.01029 (-3.12) -0.07616 (-3.23) 5709 Yes 0.9556 -0.00452 (-1.25) -0.04184 (-1.49) 2788 Incentives and return patterns Annual Bonus Domestic owned Equity Ownership by senior staff Treynor Mazuy measure Modified Henriksson Merton measure Number of observation s Category Beta No 0.9819 0.00013 (0.03) 0.01233 (0.35) 308 Yes 0.9386 -0.00857 (-3.32) -0.06720 (-3.56) 8189 No 0.9739 -0.00990 (-2.80) -0.07282 (-2.79) 4262 Yes 0.9053 -0.00652 (-1.86) -0.05557 (-2.18) 4235 No 0.9322 -0.01029 (-3.12) -0.07616 (-3.23) 5709 Yes 0.9556 -0.00452 (-1.25) -0.04184 (-1.49) 2788 Patterns of derivative holdings Fund Investmen t Style Calls Puts Month end option positions Fund Number Strike Number Strike 1 2 3 4 5 6 11 13 0.726 -0.061 0.099 0.041 -0.650 0.222 0.811 0.054 1.017 1.050 1.017 1.023 1.062 1.076 0.002 1.076 0.395 -0.122 0.021 0.008 -1.346 0.957 0.904 0.952 0.944 0.985 15 16 17 18 -0.033 -0.039 -0.367 -0.059 1.056 1.060 1.067 1.023 Neutral 21 22 24 -0.093 0.567 0.405 Other 25 Value Passive/ Enhanced GARP Growth 0.950 0.674 Concavity decreasing 100% 29% 59% 77% Concavity increasing 71% 41% 23% 100% 100% 100% 100% 27% Total 80 246 79 898 18 11 8 11 73% 100% 65% 87% 11 8 83 344 0.107 0.108 0.951 0.913 35% 13% 1.038 0.984 0.854 -0.093 0.947 10% 100% 100% 90% 208 10 1 0.079 1.147 0.147 0.965 94% 6% 35 33 0.050 0.914 57% 43% 23 38 39 -0.013 -0.026 0.948 1.036 0.955 0.959 9% 10% 91% 90% 340 613 Total 38% 62% 3027 -0.017 -0.041 Patterns of derivative holdings Fund Investmen t Style Calls Puts Month end option positions Fund Number Strike Number Strike 1 2 3 4 5 6 11 13 0.726 -0.061 0.099 0.041 -0.650 0.222 0.811 0.054 1.017 1.050 1.017 1.023 1.062 1.076 0.002 1.076 0.395 -0.122 0.021 0.008 -1.346 0.957 0.904 0.952 0.944 0.985 15 16 17 18 -0.033 -0.039 -0.367 -0.059 1.056 1.060 1.067 1.023 Neutral 21 22 24 -0.093 0.567 0.405 Other 25 Value Passive/ Enhanced GARP Growth 0.950 0.674 Concavity decreasing 100% 29% 59% 77% Concavity increasing 71% 41% 23% 100% 100% 100% 100% 27% Total 80 246 79 898 18 11 8 11 73% 100% 65% 87% 11 8 83 344 0.107 0.108 0.951 0.913 35% 13% 1.038 0.984 0.854 -0.093 0.947 10% 100% 100% 90% 208 10 1 0.079 1.147 0.147 0.965 94% 6% 35 33 0.050 0.914 57% 43% 23 38 39 -0.013 -0.026 0.948 1.036 0.955 0.959 9% 10% 91% 90% 340 613 Total 38% 62% 3027 -0.017 -0.041 Patterns of derivative holdings Fund Investmen t Style Calls Puts Month end option positions Fund Number Strike Number Strike 1 2 3 4 5 6 11 13 0.726 -0.061 0.099 0.041 -0.650 0.222 0.811 0.054 1.017 1.050 1.017 1.023 1.062 1.076 0.002 1.076 0.395 -0.122 0.021 0.008 -1.346 0.957 0.904 0.952 0.944 0.985 15 16 17 18 -0.033 -0.039 -0.367 -0.059 1.056 1.060 1.067 1.023 Neutral 21 22 24 -0.093 0.567 0.405 Other 25 Value Passive/ Enhanced GARP Growth 0.950 0.674 Concavity decreasing 100% 29% 59% 77% Concavity increasing 71% 41% 23% 100% 100% 100% 100% 27% Total 80 246 79 898 18 11 8 11 73% 100% 65% 87% 11 8 83 344 0.107 0.108 0.951 0.913 35% 13% 1.038 0.984 0.854 -0.093 0.947 10% 100% 100% 90% 208 10 1 0.079 1.147 0.147 0.965 94% 6% 35 33 0.050 0.914 57% 43% 23 38 39 -0.013 -0.026 0.948 1.036 0.955 0.959 9% 10% 91% 90% 340 613 Total 38% 62% 3027 -0.017 -0.041 Doubling trades h0 = S0 – C0 h0 : Initial highwater mark S0 : Initial stock position C0 : Cost basis of initial position Doubling trades h0 = S0 – C0 Bad news! S1 = d S0 C1 = (1+rf ) C0 Doubling trades h0 = S0 – C0 S1 C1 Increase the = d S0 + 1 equity position = (1+rf ) C0 + 1 to cover the loss! Doubling trades h0 = S0 – C0 h1 = u S1 – (1+rf) C1 S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 Good news! 1 is set to make up for past losses and re-establish security position Doubling trades h0 = S0 – C0 h1 = u S1 – (1+rf) C1 S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 Good news! 1 is set to make up for past losses and re-establish security position 1 = h0 - u d S0 + (1+rf)2 C0 u – (1+rf) + S0 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 C2 = (1+rf ) C1 Doubling trades h0 = S0 – C0 h2 = u S2 – (1+rf) C S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Good news finally! Doubling trades h0 = S0 – C0 h2 = u S2 – (1+rf) C S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 2 is set to make up for past losses Good news and re-establish security position finally! 2 = h1 - u d S1+ (1+rf)2 C1 u – (1+rf) + S0 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 S3 = d S2 C3 = (1+rf ) C2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 S3 = d S2 C3 = (1+rf ) C2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Doubling trades h0 = S0 – C0 Bad news again! S1 = d S0 + 1 C1 = (1+rf ) C0 + 1 S2 = d S1 + 2 C2 = (1+rf ) C1 + 2 Observable implication of doubling On a loss, trader will increase position size by hi-1 - u d Si-1+ (1+rf)2 Ci-1 i = u – (1+rf) + S0 otherwise, position is liquidated on a gain, i = a + b1 (1 - i) hi-1 + b2 Vi + b3 Bi + b4 i + b5 G for all trades Observable implication of doubling On a loss, trader will increase position size by hi-1 - u d Si-1+ (1+rf)2 Ci-1 i = u – (1+rf) + S0 otherwise, position is liquidated on a gain, i = a + b1 (1 - i) hi-1 + b2 Vi + b3 Bi + b4 i + b5 G Vi = (1 - i) d Si-1 , the value of security on a los Observable implication of doubling On a loss, trader will increase position size by hi-1 - u d Si-1+ (1+rf)2 Ci-1 i = u – (1+rf) + S0 otherwise, position is liquidated on a gain, i = a + b1 (1 - i) hi-1 + b2 Vi + b3 Bi + b4 i + b5 G Bi = (1 - i) (1 + rf ) Ci-1 , the cost basis of the sec Observable implication of doubling On a loss, trader will increase position size by hi-1 - u d Si-1+ (1+rf)2 Ci-1 i = u – (1+rf) + S0 otherwise, position is liquidated on a gain, i = a + b1 (1 - i) hi-1 + b2 Vi + b3 Bi + b4 i + b5 G Gi = I (Si – Ci – hi) , the measure of gain once highwatermark is reached Observable implication of doubling On a loss, trader will increase position size by hi-1 - u d Si-1+ (1+rf)2 Ci-1 i = + S0 u – (1+rf) otherwise, position is liquidated on a gain, i = a + b1 (1 - i) hi-1 + b2 Vi + b3 Bi + b4 i + b5 G >0 >0 <0 >0 ? <0 Some successful Australian funds Sharpe Fund Ratio 1 2 3 16 27 36 0.1017 0.1500 0.1559 0.1079 0.0977 0.1814 Alpha FF Alpha Beta Skewnes s Kurtosi Annual s turnover 0.08% 0.10% 0.90 -0.5209 4.6878 20.69 (2.21) (2.58) 0.16% 0.17% 1.11 0.0834 4.2777 0.79 (6.44) (5.88) 0.19% 0.20% 1.08 0.7382 7.6540 1.18 (4.09) (4.36) 0.09% 0.09% 0.96 -0.2558 4.1749 0.34 (2.66) (2.61) 0.12% 0.11% 1.03 -0.2667 3.4316 1.27 (2.42) (2.25) 0.29% 0.31% 0.90 -0.6248 5.1278 0.62 (3.02) (3.06) Some successful Australian funds Fund Highwater mark on a loss Value of holdings on a loss Cost basis on a loss Value above highwater mark 1 0.0004 -0.0266 0.0327 -0.0119 (0.21) (-2.39) (2.19) (-0.86) 0.0346 -0.1301 0.0300 -0.8614 (2.97) (-6.45) (2.29) (-9.52) 0.0366 -0.1125 0.0216 -0.9771 (2.58) (-6.02) (1.57) (-33.69) 0.6981 -0.9135 0.0167 -0.6133 (0.69) (-2.06) (0.13) (-0.91) -0.0712 -0.3305 -0.1205 -1.3277 (-0.71) (-4.18) (-2.02) (-2.32) -0.0226 -0.0973 -0.0935 -1.0166 (-0.55) (-2.38) (-2.08) (-2.52) 2 3 16 27 36 Rsq 0.0442 0.3924 0.6098 0.1406 0.3930 0.3947 Sharpe ratio and doubling Sharpe ratio of weekly returns 0.25 0.2 0.15 0.1 0.05 0 -8 -6 -4 -2 0 t -value of value on a loss 2 4 6 Do managers lack an equity stake? Sharpe ratio of weekly returns 0.25 0.2 0.15 0.1 0.05 0 -8 -6 -4 -2 0 t -value of value on a loss 2 4 6 Is fund owned by a bank or life insurance company? Sharpe ratio of weekly returns 0.25 0.2 0.15 0.1 0.05 0 -8 -6 -4 -2 0 t -value of value on a loss 2 4 6 Is fund one of 10 largest in Australia? Sharpe ratio of weekly returns 0.25 0.2 0.15 0.1 0.05 0 -8 -6 -4 -2 0 t -value of value on a loss 2 4 6 Is fund large (not a boutique manager)? Sharpe ratio of weekly returns 0.25 0.2 0.15 0.1 0.05 0 -8 -6 -4 -2 0 t -value of value on a loss 2 4 6 Style and return patterns Treynor Mazuy measure Modified Henriksson Merton measure Number of observations Category Beta GARP 0.96347 -0.01105 (-2.30) -0.08989 (-2.52) 2395 Growth 1.03670 -0.00708 (-1.53) -0.03762 (-1.15) 1899 Neutral 1.02830 -0.00110 (-0.29) -0.02092 (-0.71) 1313 Other 1.00670 -0.00196 (-0.53) 0.00676 (0.21) 640 Value 0.76691 -0.01215 (-1.93) -0.10350 (-2.24) 2250 Passive/ Enhanced 1.01440 0.00692 (1.51) 0.04593 (1.47) 859 Style and trading patterns Category GARP Growth Neutral Other Value Passive/ Enhanced Highwater mark on a loss Value of holdings on a loss Cost basis on a loss Value above highwater mark 0.0086 -0.0584 0.0028 -0.7957 (2.45) (-7.93) (0.58) (-5.30) 0.0352 0.0291 -0.0498 -0.3429 (1.04) (0.99) (-1.66) (-0.92) 0.0005 -0.0208 0.0035 -0.2161 (0.07) (-1.89) (0.35) (-3.69) 0.0277 -0.0242 -0.0074 -0.0712 (1.84) (-1.75) (-0.60) (-0.60) -0.0006 0.0081 -0.0104 -0.1172 (-0.07) (0.88) (-1.28) (-1.85) 0.0901 -0.0769 0.0535 -0.2307 (2.06) (-1.54) (1.61) (-0.98) Rsq 0.4281 0.1339 0.0341 0.0586 0.0113 0.0089 Size and return patterns Largest 10 Institutional Manager Boutique firm Treynor Mazuy measure Modified Henriksson Merton measure Number of observations Category Beta No 0.9627 -0.00645 (-2.25) -0.05037 (-2.34) 6100 Yes 0.8819 -0.01306 (-2.60) -0.10095 (-2.92) 2397 No 0.9322 -0.01029 (-3.12) -0.07616 (-3.23) 5709 Yes 0.9556 -0.00452 (-1.25) -0.04184 (-1.49) 2788 Size and trading patterns Largest 10 Institutional Manager Category Highwater mark on a loss Value of holdings on a loss Cost Basis Value above highwater mark No 0.0384 0.0250 -0.0443 -0.4393 (1.36) (0.92) (-1.62) (-1.26) 0.0077 -0.0159 0.0011 -0.7627 (2.05) (-3.01) (0.24) (-4.82) 0.0015 -0.0040 -0.0093 -0.7502 (0.24) (-0.44) (-1.03) (-4.75) 0.0097 -0.0270 -0.0184 -0.2847 (0.66) (-1.42) (-1.07) (-4.23) Yes Boutique firm No Yes Rsq 0.0630 0.3017 0.1607 0.0751 Incentives and return patterns Annual Bonus Domestic owned Equity Ownership by senior staff Treynor Mazuy measure Modified Henriksson Merton measure Number of observation s Category Beta No 0.9819 0.00013 (0.03) 0.01233 (0.35) 308 Yes 0.9386 -0.00857 (-3.32) -0.06720 (-3.56) 8189 No 0.9739 -0.00990 (-2.80) -0.07282 (-2.79) 4262 Yes 0.9053 -0.00652 (-1.86) -0.05557 (-2.18) 4235 No 0.9322 -0.01029 (-3.12) -0.07616 (-3.23) 5709 Yes 0.9556 -0.00452 (-1.25) -0.04184 (-1.49) 2788 Incentives and return patterns Categor y Annual Bonus No Yes Domestic owned No Yes Equity No Ownership by senior Yes staff Highwate r mark on a loss Value of holdings on a loss 0.0259 -0.0233 -0.0026 0.0388 (1.52) (-1.55) (-0.20) (0.25) 0.0016 -0.0040 -0.0093 -0.7493 (0.25) (-0.45) (-1.04) (-4.74) 0.0025 0.0265 -0.0395 -0.0756 (0.48) (1.24) (-1.57) (-0.95) 0.0148 -0.0228 0.0069 -0.9023 (2.21) (-2.79) (0.99) (-12.68) 0.0015 -0.0040 -0.0093 -0.7502 (0.24) (-0.44) (-1.03) (-4.75) 0.0097 -0.0270 -0.0184 -0.2847 (0.66) (-1.42) (-1.07) (-4.23) Cost Basis Value above highwate r Rsq 0.0420 0.1601 0.1229 0.2063 0.1607 0.0751 National Australia Bank Incentives are not everything! No evidence of doubling in asset allocation Large institutional funds are organized and compensated on a specialist team basis Behavioral explanations: Prospect theory Conclusion Informationless investing can be dangerous to your financial health Funds as a whole do not seem to use these techniques However, some of most successful funds have interesting trading patterns … associated with Large, decentralized control Short term incentive compensation