PPT

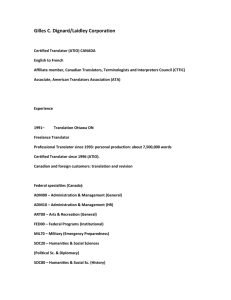

advertisement

Entrepreneurship and the Sports Business Case Studies Presented by Professor Bruce Firestone and Mr. Ted Wagstaff Telfer School of Management and Algonquin College Desmarais Building, University of Ottawa. Room DMS 4101 February 24th, 2010 from 4 to 7 pm Ottawa 67s “WANTED: RICH UNCLE BUCK TO MILLIONS TO START MY SPORTS BIZ” Jeff Hunt and his brother relocate from NFLD to Ottawa ‘Great’ JOBs– selling carpet cleaning at $3.50 per hour Jeff figures he can sell for himself Starts his own firm– he sells/his brother cleans Mom and Grandmother in tears [Jeff Hunt (left) and CFL Commissioner Mark Cohon, Photo by Tom Hanson, Canadian Press] Ottawa 67s Jeff can SELL Jeff’s insight: branding is important ‘Borrows’ Sears’ brand Takes over all Sears Carpet Cleaning coast to coast in Canada Sears lends their name/get royalty in return/money for nothing Jeff visits Chicago Ottawa 67s Hung around long enough to go golfing with Sears Roebuck VP Turned down in US market Months later: Houston we have a problem Gets opportunity to turn around Sears Carpet Cleaning in Houston Makes sure he does a good job Takes over US market Ottawa 67s A few years later– Sears decides to buy back its own name! Jeff is sitting on $40 million USD at age 40 What’s next? Buy the Ottawa 67s! Buys team from owner Howard Darwin and his partner at low point– attendance is less than 1,500 per game Everyone tells him: DON’T DO IT! Ottawa 67s Everyone tells him: * DON’T DO IT! * YOU CAN’T DO IT! * YOU’LL FAIL! * IT’S A LOSER NOW THAT THE SENS ARE IN TOWN! Ottawa 67s Makes every game an event Brings in beloved stars of old (like Yvan Cournoyer) to sign autographs and collectibles Sells out all 44 private suites by bundling them with signage, sponsorship, giveaways– things that leverage their investment Ottawa 67s Turns a cost centre into a profit centre > 500 charity requests per season Instead of giving them money, Jeff gives them discounted tickets that they can resell for a profit Never needs to turn anyone down! 67s set attendance records and is model franchise Ottawa 67s Naming rights of Civic Centre never sold Jeff creates a ‘lottery’ 30 companies who each buy minimum of $1,000 of 67s product (season tickets/signage/suites/sponsorship) entered into a draw. Urbandale wins naming rights for a year Ottawa 67s 67s set attendance records and is model franchise, copied by not only other Junior teams but by the NHL’s Ottawa Senators and others Franchise value is now vastly more than Jeff’s purchase price He is too young to retire! Ottawa 67s– Lessons Learned? Jeff had confidence in himself Brand creates trust and trust creates the opportunity to sell (more) Innovation, big and small, is important Never take ‘no’ for an answer Great execution counts– make a profit every year Buy low/sell high Turns a cost centre into profit centre– better yet, turn it into a new distribution channel Never retire Started with nothing/bootstrapped his way to wealth Now leads Lansdowne Live and the return of the CFL to Ottawa Mont Cascade and Pro Slide Rick Hunter, former Canadian Ski Team Member Retires after injury Buys a ski hill Mostly on credit and a bit of savings Loses an atrocious amount year 1 Sitting on the hill in Spring of that year– what to do? Mont Cascade and Pro Slide Family to support Debt to repay Bankruptcy facing him Looks at hill/looks at lake/looks at hill again Eureka! Mont Cascade and Pro Slide Buy two straight plastic tubes from manufacturer in Rigaud, Québec on (yet more) credit Buys a couple of pumps on (still more) credit One shack for women’s change room/another for men’s Reuse parking and food services and toilets from ski hill 30,000 people show up that summer and give Rick $13 to use his waterslides Mont Cascade and Pro Slide Saved! Asks Rigaud manufacturer: “How about a tube with a bend in it?” “No we don’t do that.” “Why not?” “We do it that way because that’s the way it’s always been done.” Rick hires first engineer to design a waterslide with a curve in it Non trivial problem of g-force calculations Mont Cascade and Pro Slide One day a Disney executive hears about this Rick gets the contract for Splash Mountain Pro Slide is born World leader in custom design, engineering and manufacturing of fiberglass water rides Mont Cascade and Pro Slide– Lesson Learned? Just because you’re a good skier doesn’t mean you know anything about running a ski hill– you need to be an expert Opportunity is where you find it/disaster focuses the mind Never give up but be prepared to change what you are doing if it isn’t working What business is Rick really in? The design business. Which can not easily be knocked off or outsourced to CHINDIA Wilderness Tours and Mount Pakenham Joe Kowalski from Philly falls in love with Algonquin Park Decides to be an outfitter– taking visitors on canoe trips First summer is a disaster– turns out no one wants a guide But he learns that there are force 4 rapids on the Ottawa River that no one had traversed in over a century Wilderness Tours and Mount Pakenham Joe and his pal Robbie Rosenberger scout out the territory Joe sees BIG OPPORTUNITY Less than 90 minutes away is a market of 800,000 outdoorsy people with lots of disposable income Next Spring, he and Robbie ask a farmer for permission to set in to the river on his property They launch Wilderness Tours with two rafts– Robbie in one and Joe in the other Wilderness Tours and Mount Pakenham 100s then 1,000s of people show up Problem– while the rapids are terrific, the ride is short Joe embraces programming: swimming the rapids/one channel for adventurous paddlers/another for families who want to bring kids/bungee jumping/kayaking/ mountain biking/rock climbing/volleyball/ horseshoes/paddle tennis/basketball/ soccer/ball hockey/lawn chess/softball Joe starts to buy land Joe starts to build a town Wilderness Tours and Mount Pakenham 4,000+ acres owned by WT Both sides of River (Québec and Ontario) No development permitted (other than WT) Problem– how to keep good staff in seasonal biz? Wilderness Tours and Mount Pakenham Buy Mount Pakenham– winter time staff reallocation Another problem– smallest vertical anywhere in the region Turn Mount Pakenham into largest ski school anywhere– safety becomes their competitive advantage Schools show up what ever the weather More programming? Add snow board park Add tubing for non-skiers/boarders Wilderness Tours and Mount Pakenham Further expansions– jet boat business in Lachine and Niagara Falls Another problem– smallest vertical anywhere in the region Turn Mount Pakenham into largest ski school anywhere– safety becomes their competitive advantage Schools show up what ever the weather More programming—snow board park/tubing for non-skiers/boarders Now selling fractional ownership for Presqu’ile Wilderness Tours and Mount Pakenham– Lessons Learned? Entrepreneurs would rather ask for forgiveness than beg for permission Start with nothing/bootstrap your way to success/make a profit/cash is King See and seize opportunities where others fail to go Outcompete your competitors Be innovative and creative Turn problems into opportunities– your biggest weakness becomes your greatest strength Ottawa Senators Terrace gets $18 per s.f. for its office space/five years later it’s $6 What to do? What does Toronto have that Ottawa doesn’t have? A zoo/Princess of Wales Theatre/ Wonderland/NHL Team Conversation w/ Cyril Leeder and Randy Sexton Bring Back the Senators Ottawa Senators Cyril asks how much will it cost? $35 million (est. based on NBA) Actual NHL ask? $50 million USD Randy says let’s go for it Cyril asks how will we pay for it? Bootstrap capital, that’s how Ottawa Senators Buy 600 acres at $12,500 per acre Put a NHL team and NHL-calibre building in the middle of it Drive up the value of the land to $112,500 per acre Keep 100 acres for Scotiabank Place and parking lot Sell extra 500 acres for a profit of $100k per acre or $50 million! NHL franchise cost = ZERO! Ottawa Senators Also get 32 Original Corporate Sponsors at $15k each And 500 Corporate Sponsors at $500 each Sell 15,000 PRNs at $25 each Raise $1,105,000 to help with bid As Al Davis once said: “Just win, baby.” Anaheim Ducks Can this work for a large firm like Disney? Sure Buy a NHL expansion franchise for $50 million Of which $25 million goes to the NHL and $25 million to Bruce McNall and LA Kings Anaheim Ducks But Bruce McNall gets $5 million per year for five years And Disney gets a leasing inducement from Ogden for Honda Centre of $20 million Plus Disney pledges their new asset for a commercial loan of $30 million Anaheim Ducks So what is the actual franchise cost? $50,000,000 - $20,000,000 - $20,000,000 - $30,000,000 = - $20,000,000 Minus $20,000,000! This is called accretive buying– where you have more cash on hand > a purchase than before Ottawa Senators and Anaheim Ducks—Lessons Learned? When something isn’t working, do something new Learn from your competitor Commitment is important: “YOU’LL NEVER, EVER GET A FRANCHISE IN … OTTAWA” You can bootstrap big projects Even Fortune 50 companies do that Sponsorship can apply to many industries and is a form of Bootstrap Capital Keep your core competencies– outsource the rest If you are profitable, you will get financing not the other way round Entrepreneurs make their own rules Jim Balsillie, the Phoenix Coyotes and the Hamilton Bid If you want to join a private club, litigating your way in probably not the best way NHL a private club with 30 voting members plus the Commissioner Similar to a political campaign to become Mayor– just fewer voters Member clubs held in trust by their owners for their fans NHL believes they should not be moved until all options exhausted Jim Balsillie, the Phoenix Coyotes and the Hamilton Bid NHL leadership—two lawyers (Gary Bettman and Bill Daly) NHL leadership– no fear of litigation Jim soundly defeated in Phoenix courtroom Expansion route probably would have worked Financial incentive for owners since they share in expansion proceeds but not relocations Jim Balsillie, the Phoenix Coyotes and the Hamilton Bid “Do you want a new one or a used one?” Relocation means disenfranchising fans in other cities (Ask Cleveland Browns fans how they feel about the Colts) New one creates opportunity for fresh brand and sets stage for love affair between fans and team NHL agrees that TO and Buffalo do not have veto Expansion remains a possibility Jim Balsillie, the Phoenix Coyotes and the Hamilton Bid But can you pay $400 million and make it work? Sure by bootstrapping it! Naming rights: $45 million Arena management, product rights, parking rights, F&B rights: $20 million Pouring rights: $15 million TV rights: $120 million Debt: $100 million Net Franchise Cost = $100 million Jim Balsillie, the Phoenix Coyotes and the Hamilton Bid– Lessons Learned? Play to your strengths not your opponent’s Be strategic Litigation is a soul-destroying, time sucking black hole Bootstrapping lowers your risks and increases your returns “You can catch more flies with honey than with vinegar,” Anon Conclusion Thank you Questions?