Risk Underlying Islamic Modes of Financing

advertisement

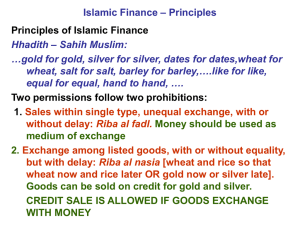

Risks Underlying Islamic Modes of Financing by Habib Ahmed Lecture Plan • Session 1: Introduction to Risks in Financial Institutions • Session 2: Risks in Islamic Financial Instruments • Session 3: Mitigating risks—financial murabahah 2 Session 1 Introduction to Risks in Financial Institutions 3 Risks—Basic Concept • Risk: “existence of uncertainty about future outcomes” “difference between expected and actual result” • Uncertainty classified as general and specific – – 4 General: ignorance of any potential outcome Specific: when objective/subjective probabilities can be assigned to potential outcomes—this is usually referred to as risk. Risks—Basic Concept • • • Risk—usually measured by the variability or volatility of outcomes—variance or standard deviation. Costs involved with higher volatility— bankruptcy Objectives of risk management are: – – – – 5 Reduce volatility Eliminate costly lower tail outcomes Maintain a certain risk profile Value maximization Classification of Risks • Business risks and financial risks – Business risk relates to uncertainty arising from the nature of firm’s business – Financial risks relates to movements in the financial market • Systematic risk and unsystematic risks – Systematic risk is associated with overall market – Unsystematic risk is linked to the specific asset or firm 6 Typical Balance Sheet of FI Assets Liabilities Banking Portfolio Deposits & Debt Trading Portfolio Equity 7 Nature of Risks Arising in FI • • • 8 Risks related to both assets and liability side Risks related to the liability side Risks on the assets side—banking portfolio (financial instruments) Risks faced by FIs (1) • Market Risks – – – – • Interest rate/benchmark risk Equity price risk Asset/Commodity price risk Currency risk Credit Risks – Loan credit risk – Trading credit (settlement) risk – Counterparty risk 9 Risks faced by FIs (2) • Liquidity risk – Funding liquidity risk – Trading liquidity risk • Operational risk – – – – 10 People risk Technology risk Process risk Legal and regulatory risks A Typical Islamic Bank (IB) • • Typical IB model—one-tier mudarabah with multiple investment tools. Liability side – – • Asset side – – 11 Savings and investment accounts –mudarabah Demand deposits—qard hasan Fixed income assets (murabahah, installment sale, istisna, salam, and ijarah) Variable income assets (mudarabah and musharakah) Unique Risks in IBs (1) • Contractual Nature of Deposits • • • • Fiduciary risk—PSIA are fiduciary contracts • • Lower rate of return or non-compliance with Shari’ah can be interpreted as breach of contract – fiduciary risk Withdrawal Risk • 12 PSIA—mudarabah contracts Demand deposits—qard hasan Need to keep risks separate Lower returns may lead to withdrawal of deposits— to avoid this, returns from shareholders transferred to depositors—transfer of risks associated with deposits to equity holders (displaced commercial risk) Unique Risks in IBs (2) • Using PSIA as capital – Difference between restricted and unrestricted PSIA • Risks in Islamic financial instruments – As modes are asset-backed or equity based, market risks are important along with credit risks – Market and credit risks intermingle and transform from one kind to another at different stages of transaction 13 Unique Risks in IBs (3) • Operational Risks – – – Person risk—lack of qualified professionals who understand/manage risks in Islamic banking Technology risk—computer softwares and IT for IBs Legal risks • • • Limitations of using RM instruments – – 14 Standardization of contracts Lack of statutes and enforcement institutions Derivatives Liquidity management instruments Risk Perceptions-Types and Instruments Average Ranking Credit Risk (CR) 3.08 Market Risk (MR) 3.24 Sale based Instruments (CR+MR) Equity based Instruments (CR+MR) 2.8 15 3.55 Withdrawal Risk – Perception of IFIs Average Ranking The rate of return on deposits has to be similar to that offered by other banks. 3.47 A low rate of return on deposits will lead to withdrawal of funds 3.47 Depositors would hold the bank responsible for a lower rate of return on deposits 3.13 16 Session 2 Risks in Islamic Financial Instruments 17 Risks in Islamic financial instruments • To understand the risks in Islamic financial instruments, we look at: – the risks at various stages of the transaction: beginning, during, and at the conclusion. – Classify CR and MR according to: • • 18 possession time (spot/future) liquidity of asset/wealth (asset/cash). Risk classification according to wealth type and time period Possession time period Wealth Type Current/spot Future Cash No risks (NR) CR Asset MR CR/MR 19 Financial Murabahah • • • • 20 The financial institution buys and then sells the good to the client at a mark-up The bank must own and posses the good The profit rate and other terms should be clearly specified in the contract The bank can ask for guarantees or collateral Risk Profile of Financial Murabahah Beginning of transaction Transaction period Conclusion of transaction Murabahah (non-binding) IFI buys good, delivery not ensured—MR Price due—CR IFI receives cash—NR Murabahah (binding) IFI buys good, Price due—CR delivery ensured –NR IFI receives cash—NR 21 Ijarah and Ijarah wa Iqtina • • • • • • 22 A leasing contract involving sale of usufructs of durable assets/goods Ownership of the asset is not transferred to the lessee The maintenance costs can be paid by the lessee if included in the contract, but costs of total damage of asset is borne by owner A hire-purchase leasing contract—ownership is transferred to lessee at the end of the contract period Fiqhi objections—two contracts in one; purchase contract cannot be binding Banks give away the asset at nominal value or as a gift at the end of the lease period Risk Profile of Ijarah and Ijarah wa Iqtina Beginning of transaction Ijarah Transaction period IFI buys asset— Rent due—CR MR Ijarah wa iqtina IFI buys asset— Rent due—CR MR 23 Conclusion of transaction Asset remains with IFI –MR Asset transferred—NR Salam • • • • • 24 A pre-production sale of goods—selling goods in advance Used to finance the agricultural sector The price has to be fixed and paid when the contract is concluded The delivery time should be fixed Parallel salam Risk Profile of Salam Beginning of transaction Transaction period Conclusion of transaction Salam Necessary cash in Good due—CR hand—NR IFI receives good—MR Parallel Salam Necessary cash in Good due—CR hand, and commits to sell good—NR IFI receives good, delivers good— NR 25 Istisna • • • • 26 A pre-production sale used when an item/asset needs to be manufactured/constructed The price of the good/asset should be known and time of payment (can be negotiated among the parties) The seller of the good/asset (bank) can either manufacture it or sub-contract it—parallel istisna The bank, however, liable for the delivery of good/asset Risk Profile of Istisna Beginning of transaction Transaction period Conclusion of transaction Istisna IFI commits to manufacture asset. Cost of production— MR Price due—CR IFI delivers asset, receives cash – NR Parallel Istisna IFI commits to manufacture asset, subcontracts. Price due—CR Seller delay in delivery/not according to specification—CPR Seller delivers asset, IFI delivers asset, receives cash –NR 27 Mudarabah • • • • 28 A form of partnership—one party supplies the capital (rab ul mal) other manages (mudarib) Profit shared among parties at an agreed upon ratio Financier cannot ask for a guarantee of capital or return Mudarabah can be restricted or unrestricted Musharakah • • • 29 A partnership contract in which all partners contribute capital and labor Like a mudarahah, but all partners manage the project Profit shared among partners at an agreed upon ratio Risk Profile of Mudarabah and Musharakah Beginning of transaction Transaction period Conclusion of transaction Mudarabah IFI invests (buys Profit non-voting share/return shares) due—CPR Principal due: Cash—NR Equity—MR Musharakah IFI invests (buys Profit voting shares) share/return due—CPR Principal due: Cash—NR Equity—MR Diminishing Musharakah IFI invests (buys Profit voting shares) share/return due—CPR Asset/equity transferred—NR 30 Risk Matrix of IF Instruments Risks MR Benchmark Murab. Ijarah Salam Istisna X ? X X MR Equity price MR Asset/Com. Price X X X X MR Currency ? ? ? ? CR Settlement X X X X X X CR Counterparty 31 Mudar. Mushar. X X ? ? X X Session 3 Mitigating risks—financial murabahah 32 Murabahah-basic features 1. Murabahah is a sale contract 2. The seller reveals the actual price of the asset/good being sold and indicates the profit in lump-sum or as a percentage 3. Delivery of the asset/good is spot, payment can be spot or deferred 4. Bai-muajjal is a sale with spot delivery and deferred payment 33 Murabahah as Financing Mode • • 34 As financial intermediaries, banks use murabahah as financing mode (Purchase order murabahah or financial murabahah) Financial murabahah is a combination of contracts Financial Murabahah Financial murabahah has the following elements: 1. Promise Agreement: The bank and the client signs and overall agreement of the promise to buy/sell 2. Agency Agreement: The bank appoints the client as an agent to purchase the good/asset 35 Financial Murabahah (contd.) 3. Purchase of the Good from the Supplier: The client buys the good and takes possession as a agent 4. Offer of Purchase: The client offers to buy the good from the bank 5. Acceptance of the Offer: The ownership of the good transferred from the bank to the client 6. Debt created: Payment due at future date(s) 36 Points to note • The commodity cannot be bought from the client If the bank purchases, the agency contract not needed • • • 37 In such cases, two separate contracts (for supplier and buyer) and the purchase has to be before sale Bills of trade resulting from transaction can be transferred at face-value only Risks in Financial Murabahah • Pre-Sale Risks – Loss/damage of the good before delivery – Refusal of the buyer to take delivery – Market (price) risk • Post Sale Risks – Latent defects in goods – Settlement (credit) risk – Market (benchmark) risk 38 Pre-Sale Risks Mitigation 1. Loss/Damage of good before delivery: – Before delivery, the good is bank’s responsibility • Risks mitigated by: – Minimize the period of holding (time between purchase and sale) – If time is long—insurance can be bought 39 Pre-Sale Risks Mitigation 2. Refusal of the Buyer to take Delivery: The bank is left with the good • Risks minimized by: – The bank purchases the good with a right to return it within a specified time – The bank sells the good and client pays the difference between cost and sale price 40 Example of Clause in the Agreements “If, for any reason whatsoever, the agent shall refuse or fail to take delivery of the Equipment or any part thereof or shall refuse or fail to conclude the Sale Agreement, the Bank shall have the right to take delivery, or cause delivery to be taken, of the Equipment and shall have the right to sell, or cause the sale of, the Equipment (but without obligation on its part to do so) in a manner determined by it at its sole discretion and shall have the right to take whatever steps it deems necessary to recover the difference between the price realized upon sale and the price paid by the Bank plus any other expenses incurred by it in relation to the Equipment.” 41 Pre-Sale Risks Mitigation 3. Market (price) risk: Risk of changes in price prior to delivery of good to client • Risks mitigated by: – Minimizing the holding time by selling immediately after buying 42 Post-Sale Risks Mitigation 1. Latent Defects in Goods: It is possible that the good supplied by the supplier is defective. • Risks minimized by transferring the liability to the vendor/supplier (through warranty) 43 Example of Clause in the Agreements “If a latent defect is discovered in the Equipment, the Vendor undertakes to assign to the Purchaser, the benefit of any guarantee, condition or warranty relating to the Equipment which may have been given to the Vendor by the Supplier and which has been examined and accepted by the Purchaser and all other warranties or guarantees as may be implied by law or recognized by custom in favour of the Vendor. In addition to the assignment to the Purchaser as herein indicated, the Vendor shall take such other action as the Purchaser shall reasonably request to enable the Purchaser to claim against the Supplier” 44 Post-Sale Risks Mitigation 2. Settlement (credit) Risk: The risk that the client will not pay his/her dues on time or default • Risk minimized by: – The bank can ask for a guarantee (sign a guarantee agreement) – Ask for a security or collateral—can sell the collateral if debtor defaults – Impose penalty for delinquency problem 45 Example of Clause in the Agreements "The client hereby undertakes that if he defaults in payment of any of his dues under this agreement, he shall pay to the charitable account/fund maintained by the bank a sum calculated on the basis of ---percent per annum for each day of default unless he establishes thorough evidence satisfactory to the bank that his non-payment at the due date was caused due to poverty or some other factors beyond his control" 46 Post-Sale Risks Mitigation 3. Market (benchmark rate) risk: The risk that the returns of the bank will be affected if the benchmark rate changes • Risks minimized by: – The contracts are usually of short-run duration 47 Conclusion • Risks in Islamic financial instruments are complex and change and evolve during the transaction • It is important to know the underlying features of the contracts and risks arising in different modes of financing • Risk management would require knowledge of Islamic contracts and also the appropriate skills to mitigate risks arising in them 48 THANK YOU! 49