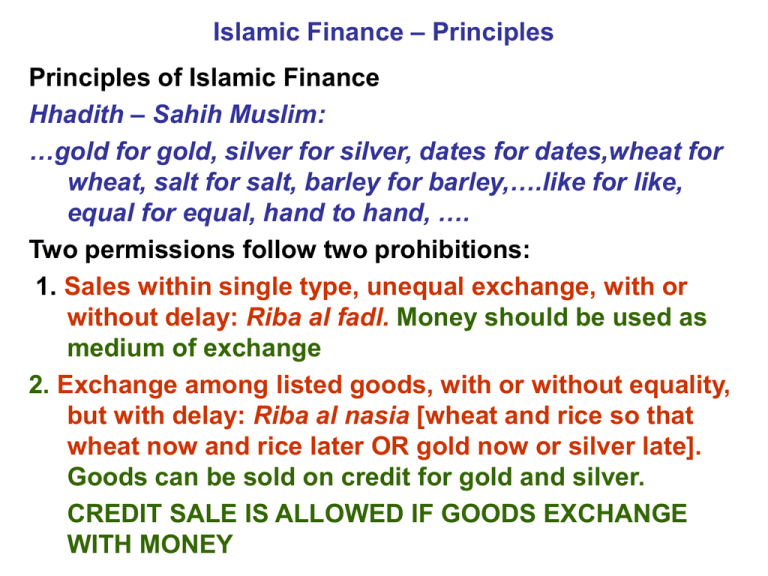

– Principles Islamic Finance Principles of Islamic Finance – Sahih Muslim:

advertisement

Islamic Finance – Principles Principles of Islamic Finance Hhadith – Sahih Muslim: …gold for gold, silver for silver, dates for dates,wheat for wheat, salt for salt, barley for barley,….like for like, equal for equal, hand to hand, …. Two permissions follow two prohibitions: 1. Sales within single type, unequal exchange, with or without delay: Riba al fadl. Money should be used as medium of exchange 2. Exchange among listed goods, with or without equality, but with delay: Riba al nasia [wheat and rice so that wheat now and rice later OR gold now or silver late]. Goods can be sold on credit for gold and silver. CREDIT SALE IS ALLOWED IF GOODS EXCHANGE WITH MONEY Theory & Practice of Murabahah Murabahah – Concept and Historical perspective • Introduced as new form of sale in second half of first Hijrah century as a sale with necessary condition of a profit margin agreed by both the seller and purchaser [Al Mutta, Imam Malik] and without the order of purchaser [cost includes direct expenses] • Modifications were made by Imam Shafi’, including an order of the purchaser, who could subsequently exercise the option not to purchase the same, and also included credit transaction • Therefore, he clearly bifurcated two sale transactions, one from supplier (or vendor) to the seller and other from seller to the purchaser Theory & Practice of Murabahah Murabahah – Concept and Historical perspective • • • • The contemporary banking also takes into account the cash and credit prices different from each other, as justified by Usmani The banks are also required to fulfill regulatory compliance relating to credit transactions, maximum exposure to risk, classification of credit transactions, international supervision, etc. In addition, the banks are also emphasized to follow the Shariah, and accounting standards issued by AAOIFI relating to Murabaha transactions. In Pakistan, the Islamic Financial Accounting Standard-1 issued by ICAP vide SECP Notification dated 24th August, 2005 is also required to be followed. Since the operation of Murabaha transaction resembles Riba based practice of lending, the preconditions prescribed by Shariah advisors are to be met in letter and spirit B’s Capital MUSHARAKAH 100% 75% P&L DISTRIBUTION OB A’s Share of Profit B’s Share of Profit 50% 50% N 25% 75% R 90% 10% OA M 25% 100% A’s Capital Islamic Modes – Agricultural Financing Bank arranges pool of funds ISLAMIC BANK Special Purpose Mudarabah Investment Units purchased Profits Accrued Retail Sales Lined up Islamic Modes – Agricultural Financing Financing of crop production Liquidity requirements (hiring of tractor & implements, sowing, purchase of water, hiring of labour for preparation of land and harvesting, marketing) Input requirements (seed, fertilizer, pesticides) Liquidity Hiring for land prep. S A L A M M U R A B Inputs in kind Liquidity Sale of fertilizers, seed, pesticides Hiring for Harvest + Marketing Exp. S A L A M Delivery Payment Delivery Islamic Modes/Instruments - Sale Contracts: Parallel Salam: Procedural Details: The disposal of commodity at the end of Bank can be through: – Parallel Salam: the original second contract the original higher than the – Bank may sell commodity, before date of delivery, to some other purchaser for the date of delivery. The period in will be shorter than contract, but price original contract. Unilateral Promise: Promise of purchase can be obtained from third party for delivery on the date of original contract. Price in this promise is set higher than parallel salam because the promisor has to pay nothing. Islamic Modes/Instruments - Sale Contracts: Risks involved in Salam Transaction: Risks Counterparty delivery risk •Client defaults after receiving price Mitigants •There could be dispute in quality, quantity, time of delivery, etc. in case of commodity •MoU should clearly specify to avoid any dispute •Defective goods could be supplied •Collateral or security can be obtained •Goods may be delivered late •Penalty clause – charity Commodity price risk •The market price at delivery time could be lower than the price expected at the time of contract •Parallel salam or promise to purchase •Liquidate security & purchase same goods from market Islamic Modes/Instruments - Sale Contracts: Risks involved in Salam Transaction: Risks Commodity marketing risk •Bank is not able to market the goods timely resulting into blocking of funds Asset holding risk •Bank bears holding cost till disposal of commodity Mitigants •Select appropriate commodities for salam, take promise with Hamish Jiddiyah or appoint client as agent •Cost can be recovered in parallel transaction Early termination chances •Clint refuse to supply the goods •Salam is a binding contract. Penalty clause can be inserted – charity Parallel Salam •Original seller might not supply •Bank may purchase the similar asset from market. But no such goods in time. The buyer in loss can be recovered from parallel salam may sue the original seller bank. Principles of Islamic Finance Principles of Islamic Finance 1. Prohibition of Riba: Prohibition in Shariah: B. Ahadith Riba al fadl: [Traditions] 1. ….exchange of radi with burny dates….. 2. Gold for gold, silver…..,……, like for like, equal for equal, and hand to hand. If the commodities differ, you may sell as you wish, provided the exchange is hand to hand. 1. When illa is different, shortfall/excess and delay both are permissible 2. When commodities of exchange are similar, excess and delay both are prohibited 3. When commodities are heterogenous but illa is the same, then excess/deficiency is allowed but delay not allowed REFERENCE SLIDES FOR PARTICIPANTS FROM BANKS Work on Murabahah Practice of Murabahah Pricing of Murabahah [Example]: • • • • • • Purchase of poultry feed stock Murabahah Facility: 180 Days Payment: Six monthly installments Rate of Profit: Six months KIBOR+2% Murabahah transaction: Rs. 500,000 Securities: Pledge of feed stock, equitable mortgage, lien on deposit, post dated cheques, etc. Practice of Murabahah Pricing of Murabahah [Example]: Particulars Amount (Rs.) Cost of goods Rs. 500,000 Rate of Profit Kibor + 2% (Floor 11.5%) Six monthly KIBOR 10% p.a. Freight & insurance 5% of cost Total cost 500000 x 5% Risk premium 2% Profit 10%+2%+2% = 14% p.a. Murabahah Price 525000+36247= 561247 Amount of Installment 561247/6 = 93541 500000 + 25000 =525000 525000 x 14% x 180/365 = 36247 Cost = 87500 Training Workshop – Islamic Microfinance Accounting of Murabahah [Example]: Advance Payment Advance Payment (Against Murabahah purchases) 500000 25000 F&I charges 525000 To Pay order (Payment made in advance for purchase of goods) Arrival of Goods Murabahah purchases A/C 500000 To Advance Payment (Against Murabahah purchases) (Goods received on account of purchases) 500000 Training Workshop – Islamic Microfinance Accounting of Murabahah [Example]: Murabahah Contract/Sale Murabahah Facility A/C 5250000 Murabahah Profit Receivable A/C 36247 To Murabahah Sale A/C 561247 (To amount of goods sold) Recovery of Murabahah Price Client’s A/C To Murabahah Facility A/C To Murabahah Profit Receivable A/C (Payment received on maturity by debiting client’s A/C on 1st installment) 93541 87500 6041 Training Workshop – Islamic Microfinance Accounting of Murabahah [Example]: Recovery of Murabahah Price Client’s A/C 93541 To Murabahah Facility A/C To Murabahah Profit Receivable A/C (Payment received on maturity – 2nd installment) Client’s A/C 87500 6041 93541 To Murabahah Facility A/C To Murabahah Profit Receivable A/C (Payment received on maturity – 3rd installment) Client’s A/C 87500 6041 93541 To Murabahah Facility A/C To Murabahah Profit Receivable A/C (Payment received on maturity – 4th installment) Client’s A/C 87500 6041 93541 To Murabahah Facility A/C To Murabahah Profit Receivable A/C (Payment received on maturity – 5th installment) Client’s A/C To Murabahah Facility A/C To Murabahah Profit Receivable A/C (Payment received on maturity – 6th installment) 87500 6041 93541 87500 6041 Accounting of Murabahah [Example]: Profit and Loss Account Statement Murabahah Sales Less COGS Purchases F&I Profit 561247 500000 25000 525000 36247 Sale Defined: Exchange of a thing of value with another thing of value with mutual consent OR the sale of a commodity in exchange of cash. Elements of a valid sale: • • • • Contract ( Aqd ) Subject matter ( Mabe’e) Price ( Thaman ) Possession or delivery ( Qabza )