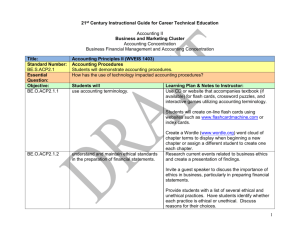

1403 Accounting II Instructional Guide

advertisement

To Be Completed 21st Century Instructional Guide for Career Technical Education Accounting II Business and Marketing Cluster Accounting Concentration Business Financial Management and Accounting Concentration Title: Accounting Principles II (WVEIS 1403) Standard Number: BE.S.ACP2.1 Essential Questions: Objective: BE.O.ACP2.1.1 BE.O.ACP2.1.2 BE.O.ACP2.1.3 BE.O.ACP2.1.4 BE.O.ACP2.1.5 BE.O.ACP2.1.6 Accounting Procedures Students will demonstrate accounting procedures. Why is necessary to have procedures in the field of accounting? Why do ethics play such an important role in the accounting field? How could technology be integrated in the accounting field? Students will Learning Plan & Notes to Instructor: use accounting terminology. Vocabulary preview, word wall, crossword puzzle, flash cards understand and maintain ethical standards Case studies, guest speakers in the preparation of financial statements. interpret characteristics of professional Case studies, guest speakers conduct. use specialized accounting software, or Use automated accounting, i.e., Excel, Quickbooks, spreadsheets, to maintain accounting Peachtree, Quicken procedures. demonstrate competence in the structure Graphic organizer and sequence of the accounting cycle utilizing manual and automated systems. analyze computer generated reports. Balance sheet, Income Statement, Schedules, Proving Cash Standard Number: BE.S.ACP2.2 Accounting Procedures for Assets, Liabilities, and Equity Students will implement accounting procedures for assets, liabilities, and equity. Essential How does the accounting equation adapt to individuals and business? Questions: Why is it important for accountants to acquire critical thinking skills? Objective Number: Objective: Learning Plan & Notes to Instructor: 1 BE.O.ACP2.2.1 BE.O.ACP2.2.2 BE.O.ACP2.2.3 BE.O.ACP2.2.4 BE.O.ACP2.2.5 BE.O.ACP2.2.6 BE.O.ACP2.2.7 BE.O.ACP2.2.8 BE.O.ACP2.2.9 BE.O.ACP2.2.10 analyze cash and accounts receivable transactions and record in appropriate journals. calculate inventories using various methods and record in appropriate journals. identify concepts and practices related to accounting for plant assets. calculate and record depreciation of plant assets. analyze plant and intangible asset transactions and record in appropriate journals. analyze current liabilities transactions and record in appropriate journals. analyze long term liabilities transactions and record in appropriate journals. analyze investments and equity transactions for various forms of business ownership and record in appropriate journals. generate financial and end-of-period statements. analyze and interpret financial statements. BE.O.ACP2.2.11 update accounts through adjusting and closing entries. BE.O.ACP2.2.12 explain and record adjusting and reversing entries for accrued revenue and expenses. BE.O.ACP2.2.13 complete account procedures for prepaid expenses and unearned revenue. BE.O.ACP2.2.14 analyze, compute and record transactions related to uncollectible accounts. Proving cash, schedule of accounts receivable and payable FIFO, LIFO, Weighted-Average Cost Method Original cost, salvage value, useful life Straight-line, sum-of-the-years digits, doubledeclining balance Intellectual property, i.e. copyrights, trademarks, patents, brand name, and goodwill Any liability requiring less than a year to satisfy. Any liability requiring more than a year to satisfy. Investments by owner(s), sale of stock, withdraw, revenue, expenses in sole proprietorships, partnerships, and corporations. Graphic organizer, flow chart, guided practice Guided practice, independent problems, case studies Guided practice REID (Revenue, Expenses, Income Summary, Drawing) Guided practice Need to account for what occurred in the fiscal year to be recorded for that year. To recognized accrual in its’ appropriate year. Guided practice REID (Revenue, Expenses, Income Summary, Drawing) Define and guided practice 2 BE.O.ACP2.2.15 BE.O.ACP2.2.16 Standard Number: BE.O.ACP2.3 Essential Questions: Objective: BE.O.ACP2.3.1 BE.O.ACP2.3.2 BE.O.ACP2.3.3 BE.O.ACP2.3.4 BE.O.ACP2.2.5 BE.O.ACP2.2.6 BE.O.ACP2.2.7 21st Century Skills Information and Communication Skills: manage the computations and recordings of Define and guided practice transactions related to notes receivable and notes payable. understand the use of a cash flow Examples, comparisons statement. Specialized Accounting Procedures Students will utilize specialized accounting procedures. How do accountants adjust procedures for various business structures? Students will determine the reasons for departmental or branch accounting systems. provide reasons for cost accounting procedures. examine accounting issues faced by different types of industries such as services, manufacturing, and distribution. differentiate between the three basic types of businesses (services, merchandising and manufacturing). explain the differences between sole proprietorships, partnerships, and corporations. understand the accounting principles for not-for-profit and government entities. demonstrate an understanding between personal and business taxation at various levels. Learning Plan & Notes to Instructor: Define, show usefulness, analyze Overhead, expense reduction Local, national, global Law of supply and demand Case study, Internet research Compare and contrast Compare and contrast: formation, liquidation, profit disbursement, taxation Define Formation, taxation IRS.gov Case study 1120 1040 Individual Schedule C Learning Skills & Technology Tools Teaching Strategies Culminating Activity 21C.O.9Student recognizes information Students use search 12.1.LS1 needed for problem solving, engines to complete an can efficiently browse, search online search for tutorials, and navigate online to access information, problem Evidence of Success Students will incorporate information in completion of 3 21C.O.912.1.TT1 21C.O.912.1.TT10 Thinking and Reasoning Skills: 21C.O.912.2.LS1 21C.O.912.2.LS2 relevant information, evaluates information based on credibility, social, economic, political and/or ethical issues, and presents findings clearly and persuasively using a range of technology tools and media. Student makes informed choices among available advanced technology systems, resources and services (e.g., global positioning software, graphing calculators, personal digital assistants, web casting, online collaboration tools) for completing curriculum assignments and projects and for managing and communicating personal/professional information. Student implements various Internet search techniques (e.g., Boolean searches, metasearches, web bots) to gather information; student evaluates the information for validity, appropriateness, content, bias, currency, and usefulness. Student engages in a critical thinking process that supports synthesis and conducts evaluation using complex criteria. Student draws conclusions from a variety of data sources solving, and research on latest accounting issues. Students use specialized accounting software. specialized accounting reports and problems. Students successfully complete automated problems. Students work in collaborative pairs, thinkpair-share for accounting problems and case studies. Students use specialized accounting software. 4 21C.O.912.2.LS3 21C.O.912.2.TT2 21C.O.912.2.TT4 Personal, and Workplace, Skills: 21C.O.912.3.LS3 21C.O.912.3.LS5 to analyze and interpret systems. Student engages in a problem solving process by formulating questions and applying complex strategies in order to independently solve problems. Student collaborates with peers, experts and others to contribute to a content-related knowledge base by using technology to compile, synthesize, produce, and disseminate information, models, and other creative works. Student uses technology tools and multiple media sources to analyze a real-world problem, design and implement a process to assess the information, and chart and evaluate progress toward the solution. Student demonstrates ownership of his/her learning by setting goals, monitoring and adjusting performance, extending learning, using what he/she has learned to adapt to new situations, and displaying perseverance and commitment to continued learning. Student exhibits positive leadership through Students prioritize, demonstrate, and share accounting tasks. Student complete guided and independent practice. Students meet deadlines with successful completion of accounting tasks. 5 interpersonal and problemsolving skills that contribute to achieving the goal. He/she helps others stay focused, distributes tasks and responsibilities effectively, and monitors group progress toward the goal without undermining the efforts of others. 21C.O.912.3.LS6 21C.O.912.3.TT1 21C.O.912.3.TT3 Student maintains a strong focus on the larger project goal and frames appropriate questions and planning processes around goal. Prior to beginning work, student reflects upon possible courses of action and their likely consequences; sets objectives related to the larger goal; and establishes benchmarks for monitoring progress. While working on the project, student adjusts time and resources to allow for completion of a quality product. Student protects software, hardware and network resources from viruses, vandalism, and unauthorized use and employs proper techniques to access, use and shut down technology equipment. Student evaluates current trends in information 6 21C.O.912.3.TT4 21C.O.912.3.TT5 technology, discusses the potential social, ethical, political, and economic impact of these technologies, and analyzes the advantages and disadvantages of widespread use and reliance on technology in the workplace and society. Student adheres to acceptable use policy and displays ethical behaviors related to acceptable use of information and communication technology (e.g., privacy, security, copyright, file-sharing, plagiarism); student predicts the possible cost and effects of unethical use of technology (e.g., consumer fraud, intrusion, spamming, virus setting, hacking) on culture and society; student identifies the methodologies that individuals and businesses can employ to protect the integrity of technology systems. Student models ethical behavior relating to security, privacy, computer etiquette, passwords and personal information and demonstrates an understanding of copyright by citing sources of copyrighted materials in papers, projects and multi-media presentations. Student advocates for legal and 7 ethical behaviors among peers, family, and community regarding the use of technology and information. 21C.O.9Student evaluates and applies 12.3.TT6 technology tools for research, information analysis, problem solving, content learning, decision making, and lifelong learning. 21C.O.9Student uses technology to 12.3.TT8 seek strategies and information to address limits in their own knowledge. Learning Skills & Technology Tools Entrepreneurship Skills: B.01-.11, .17.28 C.01-.03, .05, .09 D.21-.26, I.01-.07, .13, .21-.28 K.01-.07, .12 Understands the personal traits/behaviors associated with successful entrepreneurial performance. Understands fundamental business concepts that affect business decision making. Understands concepts, strategies, and systems needed to interact effectively with others. Understands the financial concepts and tools used in making business decisions. Understands the concepts, systems, and tools needed to access, process, maintain, evaluate, and disseminate information for business decision-making. Teaching Strategies Culminating Activity Students will process leadership, personal management, communication, and interpersonal skills as they engage in collaborative work, decision-making processes. Evidence of Success Students transfer the skills to the classroom. 8 O.0.13 Culminating Assessment: Understands the processes, strategies, and systems needed to guide the overall business organization. Culminating Assessment: As an accounting student you need to be proficient with the accounting cycle. Proficiency is evidenced by the completion of a reinforcement/mini practice simulations for a business. The reinforcement simulation can be included as part of a portfolio or project demonstrating student success within the course. End-Of-Course Test EDGE credit Links and Other Resources Related Websites: Links and Other Resources Internal Revenue Service www.irs.gov South-Western Educational Publishing www.swlearning.com Glencoe www.glencoeaccounting.glencoe.com Pathways to Success http://careertech.k12.wv.us/pathwaystosuccess/ U.S. Department of Labor in the 21st Century http://www.dol.gov/ America's Career InfoNet www.acinet.org America's Job Bank 9 www.ajb.org America's Service Locator www.servicelocator.org CareerOneStop www.careeronestop.org Employment & Training Administration www.doleta.gov The Job Accommodation Network (JAN) http://www.jan.wvu.edu Monthly Labor Review Online: Labor Force Archives http://www.bls.gov/opub/mlr/indexL.htm#Labor force Occupational Information Network www.doleta.gov/programs/onet Office of Disability Employment Policy www.dol.gov/odep Career Voyages http://www.careervoyages.gov/index.cfm Workforce West Virginia https://www.workforcewv.org/ West Virginia Earn A Degree Graduate Early (EDGE) http://www.wvtechprep.wvnet.edu/edge.htm West Virginia Career and Technical Education http://careertech.k12.wv.us/ Contacts: 10 Contacts: CTE Teachers: See CTE Directory Cluster Coordinator: Abigail R. Reynolds, areynold@access.k12.wv.us OCTI Assistant Executive Director and EOCTST Coordinator: Donna Burge-Tetrick OCTI Executive Director: Gene Coulson 11