Bazargan

advertisement

Digital Cash

Mehdi Bazargan

Fall 2004

Introduction

•

•

•

•

•

•

•

Definition

Motivations

Overview

Properties

Blind Signatures

Brands Scheme

Analysis

Definition

• Since hard currency or paper cash carries total

anonymity in transactions, the term digital cash is coined

to refer to anonymous electronic token based payment

systems.

• Digital Cash is meant to work as paper cash.

• There are different implementation of Digital Cash.

• Digital Cash is a technical product of anonymous digital

commerce in strategic level.

• It is a highly political subject.

Well…

• Anonymous? How can I prove I made my payments?

• Private? What keeps the bank from stealing from me?

• If a government doesn't know who pays whom, how can

it collect an income tax?

• If the ownership of financial assets is indeterminate,

what happens to taxes on financial assets?

Motivations

• Comparing to paper

cash, paper cash is: slow,

vulnerable, costly, and

difficult to transfer.

• Compared to credit

cards, digital cash

provides more anonymity

and security.

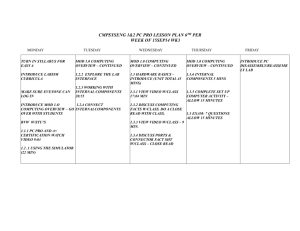

Overview

2

1

3

4

5

1. Alice deposits cash into the bank

2. Alice receives some coins

3. Alice sends over the coins to Bob

4. Bob receives the coins

5. Bob cashes the coins and send Alice the product

Overview

• There are several approaches in implementing digital

cash: “Simple Anonymous Cash” by Fiat-Caum-Naor,

“Traceable Anonymous Cash” by Ferguson, the Brands

scheme, and “Auditable, Anonymous Electronic Cash” by

Sander-Ta-Shama.

• The introduced methods have advantages and

disadvantages. The Brands scheme provides reasonable

security and anonymity; however, it is more complicated.

Overview

• In Brands Scheme, we will mostly get benefit from a set

of algorithms and mathematical toolkits:

• Prime Factorization:

In short, it is hard to calculate prime factors of N=p.q

where p and q are large primes.

• Discrete Log Problem:

In short, if you have x= ga mod p, it is hard to find a

where x and g are known.

Overview

• Representation Issue in Groups with Prime Order

Given a prime group G and a generator tuple of G (g1,

g2,..gn), and constant h, it is hard to find a

representation of h as Πki=1 (giai) where ai belongs to Z.

However, it would be easy if you know the generator

tuple and integers ai.

• Schnorr’s Digital Signature

A method of signing messages and verifying validity of

signatures.

Properties

Some important features of the system include these:

• The on-line system is a self-contained subset of the off-line system,

and if the off-line features are not used, the remaining software-only

system still could be efficiently implemented.

• Payments are private-- i.e. untraceable and unlinkable.

• The customer is protected from fraudulent bank claims that the

customer is double-spending (i.e. protected from framing attempts by

the bank),

• There is non-repudiation-- customers cannot deny having made a

valid payment.

Restrictive Blind Signature

• Let M denote a message. This message may be

anything, including a piece of digital cash to be signed. To

sign this message, the bank will raise it to the power x

mod p, yielding

[1] z = signed(M) = M^x.

• If we raise the message M to a random power w, we will

call the result b a pseudo- signature. That is,

[2] b = pseudo-signed(M) = M^w.

Restrictive Blind Signature

•The public key of the signer is a generator g raised to the

power x. So let's call the generator g raised to a random

power w a pseudo-public key. Label this a. Thus we

have:

[3] public key h = g^x,

[4] pseudo-public

key a = g^w.

Restrictive Blind Signature

• The steps in the restrictive blind signature protocol are

as follows (all calculations in this protocol are done mod

p, unless otherwise stated):

•Step 1: The customer, Alice, sends a message M to the

bank. It is intended that the bank sign M with its secret

key x: z = M^x

•The proof is to guarantee to the customer that the bank

has signed M with a valid signature; namely with its

secret key x.

Restrictive Blind Signature

• Step 2: The bank, generates a random number w and

sends to the receiver, Alice, the following elements:

the signed message z = M^x

the pseudo-public key a = g^w

the pseudo-signed message b = M^w

• We shall see that b & a will be used in part to provide

zero-knowledge proof for Alice that the bank’s signature is

valid.

Restrictive Blind Signature

• Step 3: The receiver generates a challenge c. To do

this, the customer first generates four random numbers:

s, t and u, v. Using s and t, the customer computes

modifications of M and z, namely the blinded message M'

and the signed blinded message z':

[5] M' = M^s * g^t (blinded message)

[6] z' = z^s*h^t

= (M^x)^s*(g^x)^t

= [M^s*g^t]^x

= M'^x (signed blinded message)

Restrictive Blind Signature

• Using u and v, the receiver (customer) computes

modifications of a, and b, namely, a', and b':

[7] a' = a^u*g^v = (g^w)^u*g^v = g^w',

[8] b' = [a^(u*t)]*[b^(u*s)]*M'^v

= [(g^w)^(u*t)]*[(M^w)^(u*s)]*M'^v

= [(g^t)^(u*w)]*[(M^s)^(u*w)]*M'^v

= [M'^(u*w)]*M'^v

= M'^w'.

where

[9] w' = u*w + v mod q.

Restrictive Blind Signature

• The customer then computes the hash value

[10] c' = H(M', z', a', b'),

and sends to the bank the challenge c:

[11] c = c'/u mod q .

•Step 4: The signer (bank) responds with

[12] r = w + c*x mod q.

•Notice this is a point on a line with slope x (the secret

key) and intercept w.

Restrictive Blind Signature

• Step 5: The receiver, Alice, uses the challenge c and

the response r to check that

[13] a*h^c = g^r

and

[14] b*z^c = M^r .

• If so, the receiver accepts the signature.

Brand’s Scheme

• Uses the concepts in

signature blinding as

discussed. Brand’s

implementation of Digital

Cash considers:

• Opening an Account

• Withdrawal

• Deposit

• Payment

Opening an Account

• The user has public/private key pairs. These are not

used in the protocols that follow so will not be denoted by

individual symbols. But we require that the user be able to

send digitally signed messages to the bank.

• To open an account, the user U generates a random

number u1 from Z(q)*, and computes an identifier or

public key

[15] hu = g1^u1 mod p .

Opening an Account

•The user checks that hu*g2 is not equal to 1 mod p, and

if so sends hu to the bank, keeping u1 secret. The bank

stores hu along with any other information it requires on

U. The bank computes and returns to the user U a

signature with its secret key x as follows:

[16] z = (hu*g2)^x mod p .

Withdrawal

• Before the user U is allowed to withdraw a coin, U must

first prove ownership of his account.

•Step 1: The bank generates a random number w from

Z(q)*, and sends the pseudo-public key a and the

pseudo-signed message b to the user U:

[17] a= g^w mod p

[18] b = (hu*g2)^w mod p

Withdrawal

•Step 2: The user U

generates three random

numbers s, x1 , and x2 from

Z(q)*. These are used to

calculate:

[19] A = (hu*g2)^s mod p

[20] B = g1^x1*g2^x2 mod p

[21] z' = z^s mod p

Withdrawal

• U also generates two random numbers u, v from Z(q)*.

These are used to calculate

[22] a' = a^u*g^v mod p

[23] b' = b^(s*u)*A^v mod p

• The user U then computes the challenge c' as:

[24] c' = H(A, B, z', a', b')

then sends the blinded challenge c back to the bank:

[25] c = c'/u mod q .

Withdrawal

• The coin is the set of numbers {A, B, (z',a',b',r')}.

• (z',a',b',r') is Schnorr’s signature on A, B.

• Denominations… take different g for each different

denomination.

Withdrawal

• Step 3: The bank sends the response r :

[26] r = w + c*x mod q

and debits U's account in the amount equal to the value

of one coin.

•Step 4: U accepts the debit only if

[27] g^r = a*h^c mod p

[28] (hu*g2)^r = b*z^c mod p .

•The user U also calculates r':

[29] r' = v + r*u mod q .

Payment

• When the user U is ready to spend the coin, the

following protocol is enacted between the user and the

shop S:

•Step 1: The user sends {A, B, (z',a',b',r')} to S.

•Step 2: The shop returns the challenge d:

[30] d = Ho(A, B, SHOP-ID, DATE-TIME) .

•Step 3: The user U calculates the responses r1, r2:

[31] r1 = d*(u1*s) + x1 mod q

[32] r2 = d*s + x2 mod q

Payment

• Step 4: The shop S

accepts the coin only if:

[33] g^r' = a'*h^c' mod p

[34] A^r' = b'*z'^c' mod p

[35] A^d*B = g1^r1*g2^r2

mod p

Deposit

• When the shop S is ready to deposit the coin at the

bank, the shop sends the payment transcript consisting of

the coin {A, B, (z',a',b',r')}, along with (r1, r2) and the

DATE-TIME of the transaction. The bank already knows

the SHOP-ID, which is used in the communication.

• Step 1: The bank verifies equations [33] to [35] to see

that this is a valid coin.

Deposit

• Step 2: If the coin is valid, the bank checks its database

to see if the coin was spent previously.

• CASE A: If the coin is not in the database, then it was

not previously spent. Hence the bank credits the account

of S, and records the coin in the form

{A, B, DATE-TIME, r1, r2}.

Deposit

• CASE B: If the coin is already in the database, then a

fraud has occurred. If S previously deposited the coin,

and the DATE-TIME are the same, then S is trying to

deposit the same coin or transcript twice. The deposit is

rejected for that reason. The bank knows the identity of

the shop S responsible.

Deposit

• CASE C. Otherwise, the coin has been double-spent,

and the bank takes steps to unmask the double-spender.

The bank has two sets of information on the coin:

{A, B, DATE-TIME, r1, r2}.

{A, B, DATE-TIME', r'1, r'2}.

•Hence, the bank can calculate

•(r1 - r'1) / (r2 - r'2) = [d*(u1*s) - d'*(u1*s)] / [d*s - d's]

= u1 mod q.

•Thus it can check its database for the user identity!

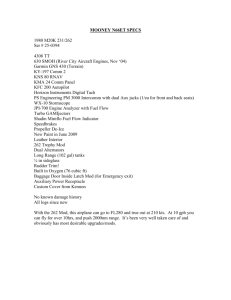

Analysis

• Advantages:

Security of this system rests

on the difficulty in finding

discrete logarithmic factors.

Other systems rely on prime

factorization used in RSA.

So the ability in factoring for

large primes would not break

this system as it would be

the case in other systems.

Analysis

• Advantages:

The major advantage of this

mechanism is that the user

does not need to keep track

many copies of identity and

many different bills as is the

case in other systems.

Analysis

• Disadvantages:

This scheme is difficult to understand and is more

complex compared to other mechanisms used such as

Chaum’s system. Moreover, since we use discrete

logarithmic signatures, we have to deal with larger

signatures compared to other methods.

References

• Jahanian Farsi, Mandana. Digital Cash. Retrieved: November. 2004

www.simovits.com/archive/dcash.pdf

• Cormen, Leiserson, Rivest, and Stein. Introduction to Algorithms.

Massachussetts: McGraw Hill, 2001.

• Sander, Ta-Shama. Auditable, Anonymous Electronic Cash. Retrieved:

November. <2004 www.cs.tau.ac.il/~amnon/Papers/ST.crypto99.pdf>

• Bleumer, Gerrit. Electronic Cash. 25 April. 2004.

http://www.win.tue.nl/~henkvt/GBl.ElectronicCash.pdf

• Orlin Grabbe,J . Stefan Brands' System of Digital Cash . 1997.

http://www.aci.net/kalliste/stefbrdc.htm

Questions, Comments…

?