How government policies can be used to achieve the

advertisement

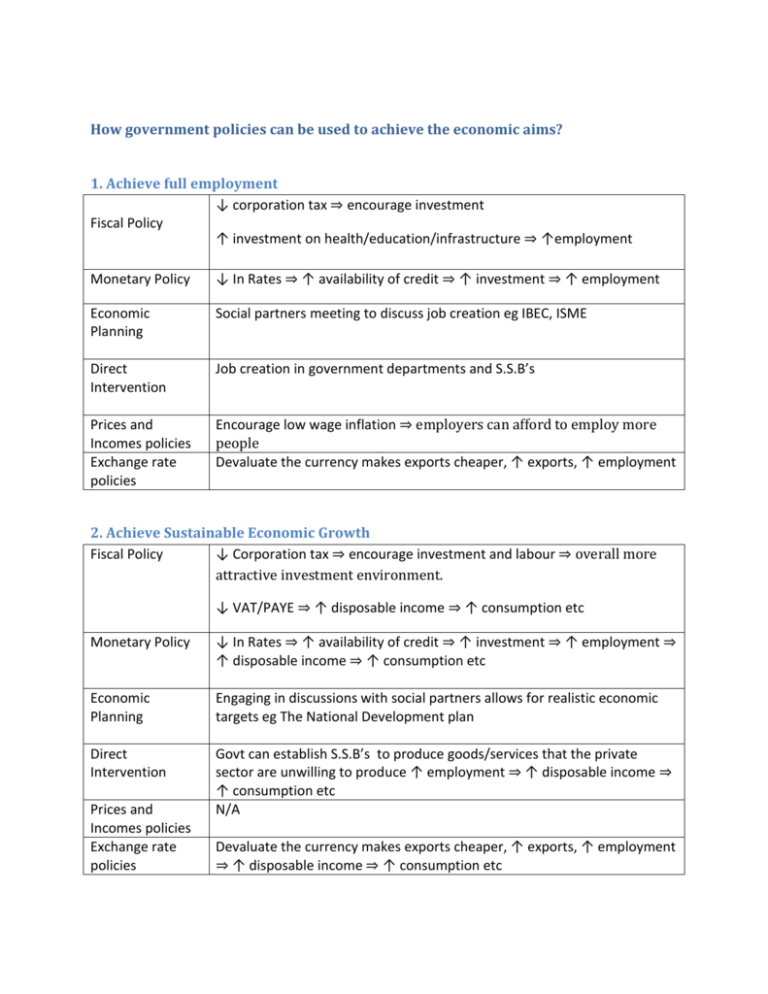

How government policies can be used to achieve the economic aims? 1. Achieve full employment ↓ corporation tax ⇒ encourage investment Fiscal Policy ↑ investment on health/education/infrastructure ⇒ ↑employment Monetary Policy ↓ In Rates ⇒ ↑ availability of credit ⇒ ↑ investment ⇒ ↑ employment Economic Planning Social partners meeting to discuss job creation eg IBEC, ISME Direct Intervention Job creation in government departments and S.S.B’s Prices and Incomes policies Exchange rate policies Encourage low wage inflation ⇒ employers can afford to employ more people Devaluate the currency makes exports cheaper, ↑ exports, ↑ employment 2. Achieve Sustainable Economic Growth Fiscal Policy ↓ Corporation tax ⇒ encourage investment and labour ⇒ overall more attractive investment environment. ↓ VAT/PAYE ⇒ ↑ disposable income ⇒ ↑ consumption etc Monetary Policy ↓ In Rates ⇒ ↑ availability of credit ⇒ ↑ investment ⇒ ↑ employment ⇒ ↑ disposable income ⇒ ↑ consumption etc Economic Planning Engaging in discussions with social partners allows for realistic economic targets eg The National Development plan Direct Intervention Govt can establish S.S.B’s to produce goods/services that the private sector are unwilling to produce ↑ employment ⇒ ↑ disposable income ⇒ ↑ consumption etc N/A Prices and Incomes policies Exchange rate policies Devaluate the currency makes exports cheaper, ↑ exports, ↑ employment ⇒ ↑ disposable income ⇒ ↑ consumption etc 3. Control of Government Finances Fiscal Policy ↓ government expenditure and ↓ borrowing ⇒ better control over national debt Monetary Policy ↑ taxes ⇒ more government revenue Lower interest rates on debt repayments Economic Planning Encourage discussion between National Treasury Management Agency and social partners as an innovative approach to government planning. Direct Intervention Prices and Incomes policies Exchange rate policies Wage freeze in the public sector 4. Promote Balanced Regional Development Fiscal Policy ↑ grants/substities to companies who are willing to locate and operate from less developed areas of the country (West of Ireland) Monetary Policy Economic Planning Direct Intervention Balanced regional development can be achieved through working closely with the social partners eg The National Spatial Strategy for Ireland 2002 2020 Relocation of government departments and S.S.B’s to less developed areas of Ireland. Provide adequate 3rd level education training and education facilities Prices and Incomes policies Exchange rate policies 5. Improve Infrastructure Fiscal Policy ↑ expenditure on infrastructure (toll roads, hospitals, schools, Parks, etc) Monetary Policy Economic The Government can combine with private companies to improve the Planning quality of infrastructure available, eg semiprivate hospitals. Direct Intervention The government can come together with private companies in an effort to provide goods and services (toll roads, waste collection, recycling centers, etc) Prices and Incomes policies Exchange rate policies 6. Control price inflation/Price stability Fiscal Policy ↓ indirect taxes ⇒ ↓ prices of goods/services ↑ direct taxes ⇒ ↓ disposable income ⇒ ↓ consumption Monetary Policy ↑ Interest rates ⇒ ↓ demand of loans ⇒ ↓ less availability of money ⇒ ↓ consumption Economic Planning Negotiating national wage agreements can control ⇒ ↓ disposable income ⇒ ↓ consumption Direct Intervention Prices and Incomes policies Price freezes Wage freeze ↓ disposable income ⇒ ↓ consumption Exchange rate policies 7. Maintain state services Fiscal Policy ↑ expenditure on health, education, social welfare, etc Provide adequate hospital, schools, housing ⇒ creates employment ↑ taxes to ↑ government revenue to fund state services. Monetary Policy Economic Planning Direct Intervention Creation of jobs in the public sector Provision of training facilities and 3rd level education. Prices and Incomes policies Exchange rate policies 8. Even distribution of wealth Fiscal Policy Spend tax so that all sectors of society benefit Provide adequate social welfare Development of training and education facilities Monetary Policy Economic Planning Direct Intervention Prices and Incomes policies Exchange rate policies Discussions with social partners – Job bridge scheme 9. Balance of payments equilibrium Fiscal Policy ↓ VAT ⇒ ↓ Price of exports ↑ grants/subsidies to encourage exports ↑ PAYE ⇒ less disposable income to spend on imports Monetary Policy ↑ Interest rates ⇒ ↓ money supply ⇒ ↓ availability of credit ⇒↓ disposable income ⇒↓spending on imports Economic Planning Consultation to encourage firms to increase exports eg IBEC Direct Intervention Import substitution Prices and Incomes policies Wage freezes ⇒↓ disposable income ⇒↓spending on imports Exchange rate policies Devaluate the currency makes exports cheaper, ↑ exports 10. Broaden the Tax Base Fiscal Policy Lower the thresholds so that lower income earners start paying tax Additional tax bracket that target high earners Introduce property tax Monetary Policy Economic Planning Direct Intervention Prices and Incomes policies Exchange rate policies 11. Stabilise the Banking Sector Fiscal Policy ↑ expenditure on recapitalizing Irish Banks ⇒ instill greater confidence in consumers Monetary Policy Economic Planning Direct Intervention ECB ↓ Interest rates ⇒ ↓Cost of credit ⇒↑ borrowing ⇒↑ investment/consumption Pass law that protects Irish consumers in the wake of a banking crisis. Prices and Incomes policies Exchange rate policies 12. Protect the environment Fiscal Policy Investment in Renewable energy ↑ grants/subsidies for environmentally friendly projects ↑ fines for pollution/carbon tax Monetary Policy Economic Planning Coming together with social partners to promote/discuss long term environment protection goals. Direct Intervention Promoting environmentally friendly environments within government departments and SSB’s Prices and Incomes policies Exchange rate policies