Treasurers: Smaller/Less Complex Locals

advertisement

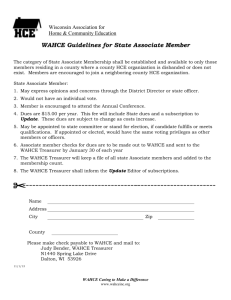

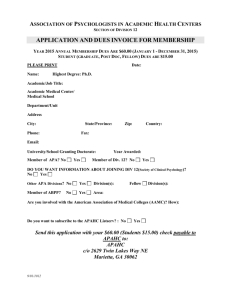

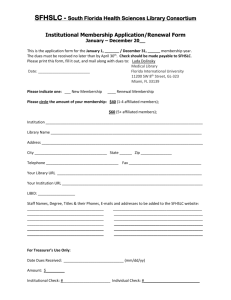

Small Local Treasurer Training Larry McBride and Steve Campbell Welcome Agenda • • • • • Financial Procedures New Treasurer info Annual Budget Annual Audit Local President’s responsibilities Financial Procedures Safeguard and manage your organization’s resources SAFEGUARD AND…. WHAT?? • Make sure your members’ funds are not: – – – – Stolen or misplaced Lost due to failure to collect them in the 1st place Wasted/used inappropriately or illegally Spent on fines, fees and penalties • And manage your funds so they are used effectively: – – – – Budget Financial reports Banking arrangements Etc. THAT’S THE TREASURER’S JOB, RIGHT? The Treasurer may do most of the work, but… …your governing body and officers have the fiduciary duty to: – – – – See that proper systems and procedures are in place Monitor for compliance Insist on transparent, ethical activity by everyone Make sure things get done in the Treasurer’s absence If you are a local leader, all of this material pertains to you, but your responsibility will vary depending on your role TOP 5 • “Top 5” safeguarding/management tools: – 1. Verify your dues income – 2. Comply with IRS rules – 3. Internal controls/Fraud prevention – 4. Budgeting – 5. IPACE funds • Other important stuff • Resources available to you BEFORE WE START… • Your “FPLR” book is an important resource • Out of necessity, this presentation is an overview. There is much more detail on all of these topics in the FPLR book • The book addresses topics that we don’t even have time to mention today “FPLR” HANDBOOK • Administration & Fiduciary Oversight • Regulatory Requirements • Technical Tasks • Appendices (Some of the previous Appendices have been moved to the IEA website) Try to be familiar with contents! 1. VERIFY YOUR DUES INCOME You need to invest whatever effort is needed in order to make sure that: – Your employer collects the correct amount of dues from all of your members/feepayers – All of this money is turned over to you per your contract’s terms – All dues paid by your employer are deposited intact – Your IEA-NEA dues are paid in full & on schedule WHY IS THIS IMPORTANT? • Your local dues are probably all that you have to fund your local programs • Your local is responsible for paying 100% of your members’ IEA-NEA dues, even if you don’t collect them • If you don’t collect enough to cover the IEANEA obligation, the difference has to be made up out of local funds Remember: It’s your members’ money; they deserve to have it used appropriately WHAT COULD POSSIBLY GO WRONG? • Local forgets to update the dues-per-member provided to the employer at the beginning of the year • District reduces the number of pay periods for withholding; local forgets to raise the duesper-pay-period accordingly • Local pays/reimburses dues for too many leaders and runs out of money WRONG (Continued) • Treasurer deducts (and pockets) cash when depositing district’s checks • Amount withheld per pay period is wrong and it’s not discovered until the end of school year • Treasurer and Membership Contact not on the same page at year-end = late payment penalties RESOURCES • FPLR manual • Website – Video – Spreadsheets • Other local treasurers/mentors • IEA office ANNUAL INFORMATION RETURN • All IEA locals must file ONE of these forms every year, based on the size of their “average annual gross receipts” • “Gross receipts”= All $$ collected, EXCEPT for IEA-NEA dues – Over $200,000= Form 990 – $50,000 to $200,000= Form 990-EZ – Under $50,000= Form 990-N (“E-Postcard”) ANNUAL INFORMATION RETURN • All but about 30 IEA locals file the E-Postcard • All except about 2 of these have authorized the IEA to file the E-Postcard for them • The other 30 file the 990 or the 990-EZ • We strongly recommend that if you file the 990 or the 990-EZ, you hire a CPA to do it for you UNRELATED BUSINESS INCOME • Income not related to union business • Rarely occurs, examples: • Rental income • Newsletter ads (not sponsorships) • Merchandise sales • Need $1,000 in UBI to incur a tax liability INCOME REPORTING REQUIREMENTS Must report payments to INDIVIDUALS to the IRS, IF: Over $600 in total for a calendar year For Services: Not for products, supplies or expense reimbursements 1099-MISC • Stipends: officers (W-2 vs. 1099) • Stipends: non-officers • Payment of dues for officers/others • Undocumented expenses: report even if under $600 1099 ISSUES • • • • Copy to recipient by 1/31 Copy to IRS by 2/28 Form is carbonized- can’t download Also need “1096” 1099-MISC 1096 IRS NOTICES • DO NOT IGNORE! • Seek help • Check TIN • Keep copies/proof of delivery IRS AUDIT • Not likely, but . . . • Random audits • Reported by disgruntled members OTHER IRS ISSUES • You CAN make a profit! • You MUST pay state sales tax • To the IRS, almost all gift cards are TAXABLE COMPENSATION – Employees: Add to W-2 income – Others: They “count” toward the $600 1099 threshold – So try to avoid using them, but if you must, make sure you keep good records (name, date, amount, purpose) TAXPAYER IDENTIFICATION NUMBER • “Social Security Number” for associations and corporations: 9 digits (xx-xxxxxxx) • Need when opening a bank account • Need when filing IRS forms • IEA has your number on file • IEA will apply for numbers when needed 3. INTERNAL CONTROLS/FRAUD PREVENTION • Most fraud consists of theft or misuse of funds • In many cases, fraud is actually easier to get away with in nonprofit organizations – Everyone knows and trusts each other – Leaders aren’t trained in detection and prevention • Don’t think “It can’t happen here;” history says otherwise • Solution: Don’t be paranoid, just have good controls in place WHY DOES FRAUD OCCUR? • Honest people: Financial pressures – Medical bills – Drugs/Gambling – Investment losses – Other financial needs • Less-than-honest people: Perception that no one will find out PROGRESSION • • • • $20/month for movie with spouse, then $50/month for nice dinner, then $500 for a new TV, then Monthly house payment or son’s college tuition THE “FRAUD TRIANGLE” YOUR JOB AS A LEADER IS… • Know the signs of possible fraud, and don’t be afraid to seek help if something makes you uncomfortable • Make sure there are good controls in place • Remember, even if today’s leaders are 100% honest, controls must be in place just in case future leaders are not! SIGNS OF POSSIBLE FRAUD: APPENDIX 4 • If you see the signs… – – – – DON’T IMMEDIATELY ASSUME THE WORST!! Probably just substandard business practices Check with your U.D. Don’t ignore the signs… this can end up reflecting on you • Completely arbitrary “Top 5 Signs of Potential Fraud” list: #5 • No “separation of duties” between President, Treasurer, Membership Contact #4 • Local is consistently behind in paying its IEANEA dues, especially at the end of the year – Leaders need to stay on top of this and not accept excuses such as “The check is in the mail” or “IEA Membership keeps making mistakes” #3 • Poor documentation of financial transactions – No documentation at all – Documentation is sloppy and poorly organized – Documentation is insufficient • Handwritten notes • Photocopies of invoices #2 • Local/Region deals in cash – Checks payable to Cash – Cash deducted from deposits – Cash given to RA delegates as an advance #1 • No oversight by the governing body – No audit – No financial reports – No dual-signature requirement – Bank statements sent directly to Treasurer – No oversight over banking arrangements AN OUNCE OF PREVENTION: INTERNAL CONTROLS • Checks/balances and separation of duties • Helps protect the organization from undetected fraud • Helps protect officers from potential embarrassment and liability • Protects the treasurer’s credibility CONTROLS • List of controls- Appendix 3 (NOT all-inclusive) • Read the example on page 16 • Completely arbitrary “Top 5 Controls” list: #5 • Don’t have credit or debit cards for your local or region – Convenience outweighed by risk – Remember the future! #4 • Have “Two Signatures Required” and two signature lines on your checks – Instruct the bank to require two signatures – Don’t allow checks to be signed before they are completely filled out #3 • Have an independent audit – Large locals- CPA – Smaller locals, and regions: Audit committee • No “insiders” • Consider nearby local Treasurer, bookkeeping teacher, etc. • Give them a list of procedures • Have them file a short report #2 • Do not deal in Cash – No checks written to Cash – No cash deducted from deposits – No cash given for travel • Possible exception: SMALL petty cash fund #1 • Have the bank mail all statements to someone besides the Treasurer – Other person reviews statement and cancelled checks, initials the statement, sends to Treasurer – Best way to prevent fraud involving checks or other withdrawals – However, it’s 90% worthless unless your bank provides check copies 4. BUDGETING Locals: No specific requirement, but there are at least five good reasons to have one: #5 • Argument prevention – Expense items are discussed and approved long before the expense is actually incurred – Gives you a reason to deny requests for off-thewall spending requests (“It’s not in the budget”) #4 • Makes members happy – Gives them input on how you spend their money – Shows you are carefully considering how their money is spent #3 • Helps you plan for future needs – Manage your annual profit/loss – Control the size of your “reserve funds” – Set long-term financial goals #2 • Avert financial disaster – Overspend dues income so that there’s nothing left to pay IEA-NEA – Plan for “non-cash” expenses such as paying leaders’ dues #1 • IEA financial assistance: Mediation, Factfinding, Arbitration • Requirements: – Local dues at least $15 – BUDGET containing at least $3/member for the above items 5. IPACE FUNDS • IPACE is funded by member contributions • Your local (not region) can receive up to $15 per contributing member as a “rebate” each year, to be used for local political purposes • Your obligations when requesting IPACE funds: – Know the rules regarding use of the funds – Keep them in a separate non-interest bearing bank account – Understand and comply with State disclosure requirements STATE POLITICAL REPORTS • DO YOU HAVE TO FILE? • One-time threshold: $5,000 spent in any 12-month period • Only certain expenses “count” • If you exceed the threshold, you must register as a PAC immediately and then file quarterly reports forever • Keep up with state due dates and requirements • • • • • • • OTHER IMPORTANT TOPICS A. IEA-NEA dues payment B. Banking C. Accounting system D. Financial reports E. Policy- RA delegates F. Treasurer transition issues G. Annual calendar A. IEA-NEA DUES PAYMENT • Be aware of schedule • Make sure you get the monthly IEA statement from your Membership Contact • Pay the amount on the statement • Pay by the due date (avoid late payment penalties!) • Have employer pay IEA direct? • See Appendix 10- How to read the statement PAYMENT SCHEDULE November 1 December 1 January 1 February 1 March 1 April 1 May 1 June 1 July 1 August 1 10% of obligation 20% of obligation 30% of obligation 40% of obligation 50% of obligation 60% of obligation 70% of obligation 80% of obligation 90% of obligation 100% of obligation B. BANKING ISSUES • How to choose a bank – Financial (interest and fees) – Service (online banking ,etc.) – Location (if you will be there a lot) – Auditability • Detailed monthly statement • Copies of all transactions- checks, deposits, etc. OPENING A BANK ACCOUNT • Banks are required by regulation to collect various information • Every bank interprets these regulations in their own way: CALL FIRST! • You will definitely need: – Drivers license for all signers – Taxpayer identification number of your local DO NOT OPEN AN ACCOUNT WITH SOMEONE’S SOCIAL SECURITY NUMBER, YOUR SCHOOL’S TIN, ETC. OTHER NEW ACCOUNT ISSUES • You are an unincorporated, not for profit labor union • If the bank wants your articles of incorporation, you don’t have them • If they want your “IRS Determination Letter,” you don’t have one • If they want proof of your tax exempt status, IEA Accounting can provide this SIGNATURES • We recommend that all bank accounts require two signatures • So you will want at least three and perhaps four or five people with the ability to sign C. ACCOUNTING SYSTEM • Every dollar that goes in or out of your bank account must be recorded • Permanent record • Future audits by IRS, etc. • Internal questions • Financial reporting • What system do you use? – “It depends” MY LOCAL HAS 200 MEMBERS, WHAT ACCOUNTING SYSTEM DO I NEED?? • One size does not fit all • Size/complexity of organization • Prior treasurer’s system • Current treasurer’s preference BASIC REQUIREMENTS Your system needs to: • Record all transactions in sufficient detail • Allow you to produce financial reports efficiently • Provide a record that others can follow WHAT ARE MY CHOICES? Some possibilities • Checkbook/check stubs • Cash receipts and disbursements journals • Excel/Access • Specialized accounting software (Quicken, etc.) D. FINANCIAL REPORTS • • • • • How much money do we have? How much income have we received? How much has been paid for expenses? How does this compare to the budget? How does this compare to prior years? FINANCIAL REPORTS • Primary audience is probably your governing board (may be shared with general membership) • Get in the habit of doing a WRITTEN report every month • Include the budget • Include explanations of large variations from budget • Line items depend on your local’s major activities and your outside reporting requirements SAMPLE REPORTS MIDTOWN EDUCATION ASSOCIATION STATEMENT OF RECEIPTS AND EXPENDITURES EIGHT MONTHS ENDED APRIL 30, 2005 ACTUAL 2004 4,870 ACTUAL 2005 5,000 BUDGET 2005 5,000 REMAINING BUDGET 0 RECEIPTS: IEA-NEA Dues Local Dues Fundraisers Interest 16,500 1,280 600 370 17,000 1,300 800 400 28,000 2,000 1,000 500 11,000 700 200 100 Total Receipts 18,750 19,500 31,500 12,000 16,500 0 600 240 335 17,000 0 500 400 400 28,000 300 800 500 600 11,000 300 300 100 200 17,675 18,300 30,200 11,900 NET INCREASE (DECREASE) TO CASH 1,075 1,200 1,300 (100) ENDING CASH BALANCE APRIL 30 5,945 6,200 6,300 (100) BEGINNING CASH BALANCE SEPTEMBER 1 PAYMENTS: IEA-NEA Dues Mediation/Fact-Finding/Arbitration Meeting Expenses Newsletter Office Supplies Total Expenses E. POLICY- RA DELEGATES Have a written policy on documentation and reimbursement (See Appendix 5) • Overall expectations • What is covered/not • Repayment of unspent funds • Consequences • Documentation requirements • Donations to FCPE (NO!) F. TREASURER TRANSITION ISSUES • Treasurer candidates should be “qualified” • “Full Disclosure” of job requirements • There should be an orderly transition of treasurers • Demonstration/Instruction • Written procedures/Calendar • Books/Records in good order • More info in FPLR handbook and on the website G. ANNUAL CALENDAR • Don’t incur fines/penalties, or let important things slip through the cracks! – – – – Outside reporting deadlines Internal reporting deadlines IEA dues payment deadlines Annual tasks such as Board review of banking arrangements – Milestones in the budget process – Etc. RESOURCES • IEA website – Publications – Videos – FAQs – Tips for new Treasurers – NEA information RESOURCES • • • • • • FPLR handbook Annual training sessions IEA Secretary-Treasurer IEA Director of Business Services Your local IEA office Other IEA locals New Treasurer Info A Quick-Start Checklist of Financial and Membership Processing Issues CONGRATULATIONS! • No matter whether this is your lifelong dream or whether you were appointed while you were out of the room… it’s your job now! • High importance= high reward OVERVIEW • This is a “101 level” summary • Detail on all topics is in the “fplr” book • You may have circumstances that are not covered here- ask questions! GETTING STARTED • FPLR manual • Membership processing guide • Info on IEA website – Financial procedures – IPACE (if applicable) • Go to the annual training at your office (or one nearby) TRANSITION • Your predecessor owes it to you and your local to have everything up to date and in order for you • Review the “transitioning the treasurer” material in the FPLR manual and on the website for suggestions and checklists • Remember your “transition experience” at the end of your term! IMPORTANT POINTS TO PONDER • Don’t stay in a silo- the other officers are expected to support you and provide oversight over your activities • Major problems occur when the treasurer has no accountability or oversight- don’t get offended about checks and balances • Don’t be shy about asking for help or support in enforcing policies, etc. MEMBERSHIP PROCESSING? • If you are also the membership contact for your local, direct training should come from the IEA membership department • If not, you still need to know the basics and also work closely with your membership contact TOP 5 PRIORITIES • • • • • 1. DUES COLLECTION & PAYMENT 2. CONTROLS 3. IRS REQUIREMENTS 4. BOOKKEEPING ISSUES 5. BUDGET 1. DUES COLLECTION • IEA Computes a “dues obligation” for your local based on your membership listing • Your local is required to remit this amount to IEA according to a predetermined schedule… DUES COLLECTION • ….Regardless of whether you collect all of the dues from your employer • So it is very important that between you and the membership contact, someone verifies that your employer is paying you all the dues that they should be! • This is an ongoing process all year long DUES COLLECTION • Deposit checks as soon as they are received • Or better yet - have them direct deposited • Some locals have IEA-NEA dues sent directly to Springfield – Talk to Membership Department first – You are still responsible for verifying accuracy DUES PAYMENT • Get a copy of the payment schedule and make sure that all payments are made on time • Pay the amount on the statement! • Watch for FCPE if applicable • Make sure there is a zero balance at the end of the year • Watch for “late statements” 2. CONTROLS • Your local is a business running on other peoples’ money (your members) • Checks and balances help prevent fraud and serious errors • Controls are good! • Forget about “trust” • Your officers need to help you enforce them CONTROLS: CHECKS • Don’t sign checks payable to yourself • Require original invoices from vendorsno copies or handwritten notes • Two signatures • Blank checks (signing/safeguarding) • Make sure your bank sends copies of your cleared checks!! CONTROLS: OTHER • See FPLR manual • Have bank mail statements to someone besides you! • Don’t deal in cash! – No checks paid to cash – No $$ withheld from deposits – Don’t give cash to members • Annual audit! AUDIT • Options – CPA – Audit Committee • Anything is better than nothing! • Don’t develop a false sense of security 3. IRS • Documentation • Annual returns CHECKS- GENERAL • IRS requirement: supporting documentation for all payments – – – – Payee Amount Description Business purpose • Keep it where you can find it!! (Staple to bank statement, etc.) • Don’t accept handwritten notes as documentation CHECKS WRITTEN TO MEMBERS • Be especially careful with documentation • Written guidelines on what will be reimbursed • Written guidelines for travel advances • IRS 1099 rules for stipends, etc. (Including dues paid on behalf of officers) • Gift cards are taxable compensation!! MONEY RECEIVED • IRS Requirement: supporting documentation for all money received – Payor – Amount – Description – Business purpose • Keep it where you can find it!! (Staple to bank statement, etc.) • Deposit checks when received IRS RETURN • ~920 locals- “e-postcard” • IEA probably files for you - check with business services to be sure • ~30 locals- form 990 or 990-EZ • Mostly filed by large mega-locals • If you are one of the 30: – Know the filing requirements – Have a CPA do it! 4. BOOKKEEPING ISSUES • • • • Bookkeeping Banking IPACE Funds Treasurer’s Report BOOKKEEPING • Checkbook/excel summary/quicken – Keep track of cash balance – Prepare financial report • Monthly bank reconciliation • Filing system – Bank statements/checks – Documentation BANKING • • • • Opening a new account: call first! Get copies of your checks!! Shop around for low fees, etc. Have the monthly statement (and check copies) sent to someone besides you • Keep the signature card up to date • Keep your board apprised about banking arrangements IPACE • Member contributions • Local rebates*- your obligations: – Know what it can be used for – Know state reporting requirements – Separate bank account/no interest * You need to know if your local has an IPACE account, and you need a general idea of how the process works when you ask for money for the first time TREASURER’S REPORT • Monthly! • Keep your board informed • Make available to members? CALENDAR OF EVENTS • Don’t incur fines/penalties, or let important things slip through the cracks! – Outside reporting deadlines – Internal reporting deadlines – IEA dues payment deadlines – Annual tasks such as board review of banking arrangements – Milestones in the budget process – Etc. 5. BUDGET • Planning – Manage your cash balance – Make sure you don’t run out of money – Spend on appropriate/useful things • Qualify for IEA financial assistance • Plenty of resources available – FPLR manual – Website RESOURCES • • • • • • • • IEA business services IEA membership processing IEA secretary-treasurer IEA website Training sessions Other local treasurers FPLR manual If in doubt, ask your U.D. Local President’s Responsibilities • • • • • • • Controls over member dues Other loss controls Theft controls Bookkeeping and financial reporting Budget Awareness of government regulations Atmosphere/Environment of honesty and transparency • Personnel considerations CONCLUSION • KNOW YOUR RESOURCES and don’t hesitate to use them! • If you’re not comfortable with how something is being done, don’t be afraid to say so • Leave the job in better shape than you found it Thank You! Any questions?