Loans

advertisement

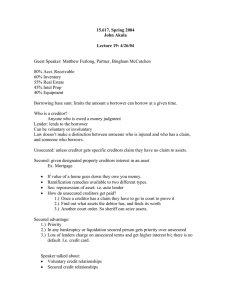

Forms of consumer borrowing Loans: From a bank, a lending institution, personal (Family, Friends) Credit Cards: Typically high interest cards used to make purchases Secured Loan A loan backed by something of value pledged to insure payment If you own your house this can be used as assurance that you will repay the loan The property pledged to back a loan is called Collateral Secured Loans A secured loan is safe for the lender because if they do not get paid back, they get the asset that has been pledged Most Secured Loans are installment loans Repaid in a certain amount of payments with a certain amount of interest i.e.: 60 months at 8% Unsecured Loans Not backed by any collateral Typically based on credit history Generally has a higher interest rate because of the risk Most Credit Cards are considered unsecured for this reason Banking Institutions as sources of loans Most common lending institutions are: Banks, Savings and Loans Associations, and Credit Unions Savings and Loans Associations typically give money for real estate, however, they often give personal loans as well Cont… Not all banks charge the same interest rates Who would typically have the lowest rate? Many banks offers lower rates to new customers to “draw” them in Other Sources of Consumer Loans Finance Co: Lend to people with poor or no credit history, higher rates Life Insurance Co: Users borrow against the value of their life insurance policy, lower rates Credit Card Cash Advances: Can be used to get cash, Very High Interest Rates Pawn Brokers: Pawn an asset for cash, High rates Rent-to-Own: Can get rent an item until you own it, Highest Interest Rates Checkpoint What is the difference between a Secured and Unsecured loan? Why would you choose one over another? What is the best source of credit? Credit Cards Must fill out an application to get one Regular Charge Accounts: Must pay off the balance from month to month Revolving Charge Accounts: Allows user to carry a balance, but charges interest Sources of Credit Cards Most Credit Cards come from: VISA MasterCard Discover American Express Credit Cards Consumers can also get a bank issued credit card They can also come from stores, gas stations, etc. Credit Card Incentives Some organizations will offer incentives to get you to use their services First year without interest Low interest rate Free Gas Frequent Flyer Miles Cash back Clothing Activity Write a list of all the places you could apply for a credit in Springfield if you were 18 Credit Card Costs Annual Fees: An annual charge a lender has (could be $15, or $100) Interest: Amount that is computed based on owed monies ( 13% APR) Grace Period: Time between billing date and paying date when no interest is accrued Credit Card Costs Limits and Penalties Credit Limit: The maximum amount you are allowed to charge to your account If you go over this amount, you will be penalized, they’ll typically charge you an overdraft fee ($15$50) Control Credit Card Costs If you can, get a loan instead of high interest credit card DO NOT just make the minimum payments When choosing a card, choose the one with the lowest interest rate Do your homework, do not just make hasty decisions Activity Alex Jones has a credit card with a 12% interest rate. His balance is 1000 dollars. How much are his monthly payments for interest alone? Jessica wants a new Mac, she does not have the money to buy one right now. What are her options? What are the + & - of each alternative? Try These & Math of Money Complete the Math of Money on page 336 together. Complete Try These and Math of Money on page 339, on your own. 1-8 & 13