American Stock Exchange Presentation Template

advertisement

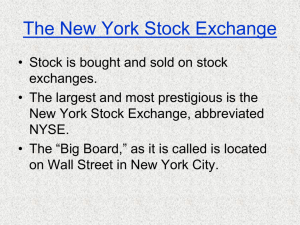

American Stock The

Exchange

Leading Exchange for Small &

Mid-Cap Companies

The Semi Annual Economic Conference

Tel Aviv, Israel

Equities Department

November 2006

Amex: The Most Diversified US Marketplace

The American Stock Exchange is the only primary exchange

offering trading across three distinct business lines:

Equities

– Capable, supportive ally to small and mid-cap companies seeking increased visibility

and institutional ownership

– Listed companies range from innovative start-ups to those in the S&P 500

– Centralized trading routed through a single specialist firm ensures a fair and orderly

market with enhanced depth and liquidity

Options

– One of the largest exchanges in the world for equity options trading

Exchange Traded Funds (ETFs)

– Created by the American Stock Exchange in 1993, ETFs are among the highest

demand investment categories in the world

– Of the approximately 320 ETFs in existence, 187 trade on the Amex,

representing over $235 billion in assets

Source: American Stock Exchange; FactSet

Data as of 7/12/06

American Stock Exchange

Visit us at www.Amex.com

2

Amex Sectors

% Based on Total Number of Listed Companies

Consum er

Discretionary

13%

Utilities

1%

Other 74%

Consum er

Staples

5%

Telecom m unication

Services

2%

Energy

11%

Materials

13%

Information

Technology

13%

Health Care

15%

Financials

13%

Inform ation

Technology

13%

Health Care

15%

28% of all Listed Companies on

the Amex represent

Information Technology and

Health Care Sector

Industrials

14%

Source: American Stock Exchange; S&P; FactSet Research Systems

Based on S&P GICS Classification System

Data as of 08 /31/06

{

}

American Stock Exchange

Visit us at www.Amex.com

3

Amex Listed Healthcare Companies

91 Healthcare companies currently listed on Amex.

15% of Amex companies are in the Healthcare sector.

IVAX Corp / TEVA Merger

– IVAX Amex has been listed since 1987, grew to 8 billion dollar market capitalization.

– Largest ever Israeli M&A, created the worlds largest generic pharmaceutical company.

Healthcare Compaines Relative Spread (%)

4.20%

American Stock Exchange

1.60%

1.60%

Amex

Nasdaq GM

Visit us at www.Amex.com

Nasdaq CM

4

Amex Listed Healthcare Companies *

As of August 31, 2006

{

Symbol

ANX

AKN

KAD

BIO

BVX

CPD

CNU

COR

DIL

ESC

FVE

HTI

HEB

HH

DMX

ISV

ILI

IMA

ILE

JAV

LCI

MCU

MDV

MDF

BUF

NHC

PRZ

PTN

DDD

SVA

YMI

{

}

}

Company Name

ADVENTRX Pharmaceuticals Inc.

Akorn Inc.

Mojave Southern Inc.

Bio-Rad Laboratories Inc.

Bovie Medical Corp.

Caraco Pharmaceutical Laboratories Inc.

Continucare Corp.

Cortex Pharmaceuticals Inc.

Dyadic International Inc.

Emeritus Corp.

Five Star Quality Care Inc.

Halozyme Therapeutics Inc.

Hemispherx Biopharma Inc.

Hooper Holmes Inc.

I-Trax Inc.

InSite Vision Inc.

Interleukin Genetics Inc.

Inverness Medical Innovations Inc.

Isolagen Inc.

Javelin Pharmaceuticals Inc.

Lannett Co. Inc.

Medicure Inc.

Medivation Inc.

Metropolitan Health Networks Inc.

Minrad International Inc.

National Healthcare Corp.

PainCare Holdings Inc.

Palatin Technologies Inc.

SCOLR Pharma Inc.

Sinovac Biotech Ltd.

YM BioSciences Inc.

{

}

Symbol

AIS

BSM

CVM

CMD

GTF

DXR

ELI

EAR

HEM

IDP

IMM

INO

IPA

LRP

MHA

MRY

MII

NVD

PME

PMD

QD

QSC

RGX

RGN

RVP

LIV

SGN

SSY

TTP

TTG

REX

{

}

Company Name

Antares Pharma Inc.

BSD Medical Corp.

CEL-SCI Corp.

Criticare Systems Inc.

Cytomedix Inc.

Daxor Corp.

Elite Pharmaceuticals Inc.

HearUSA Inc.

HemoSense Inc.

Idera Pharmaceuticals Inc.

Immtech Pharmaceuticals Inc.

Inovio Biomedical Corp.

Interpharm Holdings Inc.

Lorus Therapeutics Inc.

Manhattan Pharmaceuticals Inc.

Memry Corp.

ALD Services Inc.

NovaDel Pharma Inc.

PreMD Inc.

Psychemedics Corp.

QuadraMed Corp.

Questcor Pharmaceuticals Inc.

Radiologix Inc.

RegeneRX Biopharmaceuticals Inc.

Retractable Technologies Inc.

Samaritan Pharmaceuticals

Signalife Inc.

SunLink Health Systems Inc.

Titan Pharmaceuticals Inc.

Tutogen Medical Inc.

ViRexx Medical Corp.

{

{

}

Company Name

Accelr8 Technology Corp.

Adherex Technologies Inc.

Alteon Inc.

AMDL Inc.

AMERICAN SHARED HOSPITAL SV COM

Arrhythmia Research Technology Inc.

Aspyra Inc.

BioSante Pharmaceuticals Inc.

Callisto Pharmaceuticals Inc.

Cardiotech International Inc.

Celsion Corp.

Chad Therapeutics Inc.

Diomed Holdings Inc.

Encision Inc.

Implant Sciences Corp.

Iomed Inc.

IVAX Diagnostics Inc.

LMS Medical Systems Inc.

Matritech Inc.

MTS Medication Technologies Inc.

Nephros Inc.

Oragenics Inc.

Orion HealthCorp Inc.

PLC Systems Inc.

Pro-Pharmaceuticals Inc.

Prospect Medical Holdings Inc.

Senesco Technologies Inc.

Uroplasty Inc.

Viragen Inc.

{

}

}

Includes all Amex Listed HealthCare Companies.

Source: American Stock Exchange; FactSet Research Systems.

American Stock Exchange

Symbol

AXK

ADH

ALT

ADL

AMS

HRT

APY

BPA

KAL

CTE

CLN

CTU

DIO

ECI

IMX

IOX

IVD

LMZ

MZT

MPP

NEP

ONI

ONH

PLC

PRW

PZZ

SNT

UPI

VRA

Visit us at www.Amex.com

5

Amex Listed Technology Companies*

Symbol

Company Name

AEY

ADDvantage Technologies Group Inc.

ATA

Apogee Technology Inc.

API

Advanced Photonix Inc.

CVV

CVD Equipment Corp.

AMK

American Technical Ceramics Corp.

TRT

Trio-Tech International

TES

American Telecom Services Inc.

NLX

Analex Inc.

AFT

Axesstel Inc.

ASB

Ascendia Brands Inc.

BI

Bell Industries Inc.

AXO

AXS-One Inc.

BDR

Blonder Tongue Laboratories Inc.

CVN

Conversion Services International Inc.

TQ

Cash Technologies Inc.

GTE

GlobeTel Communications Corp.

CSN

City Network Inc.

GEX

Globix Corp.

CGN

Cognitronics Corp.

GVP

GSE Systems Inc.

JCS

Communications Systems Inc.

HX

Halifax Corp.

DOC

Digital Angel Corp.

EAG

Eagle Broadband Inc.

ILC

iLinc Communications Inc.

ASY

Elecsys Corp.

IW

ImageWare Systems Inc.

EMA

eMagin Corp.

IIG

Imergent Inc.

HCO

HyperSpace Communications Inc.

INS

Intelligent Systems Corp.

IDN

Intelli-Check Inc.

MGT

MedicSight Inc.

IIN

IntriCon Corp.

ONT

ON2 Technologies Inc.

ISO

ISCO International Inc.

PNS

Pinnacle Data Systems Inc.

ITI

Iteris Inc.

DLK

Semotus Solutions Inc.

RAE

RAE Systems Inc.

SLP

Simulations Plus Inc.

RWC

RELM Wireless Corp.

SBN

SoftBrands Inc.

SNR

Sunair Electronics Inc.

LOV

Spark Networks PLC

TKO

Telkonet Inc.

TWW

Terremark Worldwide Inc.

TLX

Trans-Lux Corp.

THK

Think Partnership Inc.

VNX

VendingData Corp.

TCX

Tucows Inc.

VII

Vicon Industries Inc.

UDW

US Dataworks Inc.

WEX

Winland Electronics Inc.

WYY

Widepoint Corp.

WTT

Wireless Telecom Group Inc.

XWG

Wireless Xcessories Group Inc.

American Stock Exchange

Visit us at www.Amex.com

6

Outperforming Major Markets & Indices

Since October 2003 the Amex Composite Index has outpaced

both the NYSE Composite Index and the Nasdaq Composite

Index, as well as the major financial indices.

{

AMEX Composite Index

NASDAQ Composite Index

Dow Jones Wilshire 5000 (Full cap)

}

NYSE Composite Index

S&P 500 Index (Reported Basis)

Russell 2000

220

200

180

160

140

120

Amex Composite (92.5%)

{

}

NYSE Composite ( 50.1%)

{

}

Nasdaq Composite ( 26.4%)

{

}

S&P 500 ( 34.1%)

{

}

Wilshire 5000 ( 38.3%)

{

}

Russell 2000 ( 48.8%)

{

}

100

80

Sep-03 Dec-03 Mar-04 Jun-04 Oct-04 Jan-05 Apr-05 Jul-05 Nov-05 Feb-06 May-06 Aug-06

Source: American Stock Exchange

Indexed price to 100 as of 9/30/03

{

American Stock Exchange

}

Visit us at www.Amex.com

7

Advantages for Israeli Companies to List on Amex

Blue Sky Exempt – When a company is listed on Amex a National Exchange, it is exempt

from registering its stock in each of the US states its securities are being offered in. This

is a great advantage, as such a process can be costly and lengthy, and can be avoided

by listing on Amex (unlike the NASDAQ Capital Market).

AEMI Platform – Will offer market participants a greatly expanded range of automated

transaction services for equities and ETFs and will combine the speed of an electronic

market with the dedicated liquidity of a specialist-auction market.

Real market intelligence - Specialist will make a point of proactively providing intelligence

on the forces affecting your stock, breaking down trading into institutional, arbitrage and

retail categories. They are in regular communication with their listings, giving those

companies greater knowledge and therefore control over their trading profiles.

Specialist – The Company chooses the AMEX specialist, that will act as a long-term

partner with the company, providing the best possible execution and price discovery. The

market maker has no obligation to the company and can step away from trading the

company’s stock at any time, which can cause trading imbalances and volatility.

Increased US Shareholder Ownership – Institutions and retail investors representing the

majority of total equity investment in the US will only buy US listed, SEC-registered

equities. The Company therefore has the opportunity to significantly increase US

investor demand for its shares beyond direct investment by US international funds in the

Home market.

American Stock Exchange

Visit us at www.Amex.com

8

Great Technology. Renewed Commitment.

AEMI (Auction & Electronic Market Integration) combines the best features of the auction

market with new capabilities only possible in an automated trading environment.

With AEMI you can expect:

–

Reg NMS Compliance

Under Reg NMS, Amex will qualify as an automated trading center and will

publish “automated” quotes by default. Incoming orders will be executed within a fraction of a second

without human intervention, maintaining our competitiveness in a fast-paced trading environment.

–

Choice of execution method

Investors can choose to have their orders executed automatically

against published bids or offers with turnaround times measured in milliseconds, or handled by floor

brokers with point of sale privileges.

–

Immediate quote updates

Quotes will be published automatically in response to order flow,

removing the need for manual updates by specialists and allowing continuous automated trading.

–

Automated price improvement

Incoming orders may receive superior execution by interacting

with orders already programmed to offer price improvement in the electronic environment.

–

Price discovery in the auction market

The specialist auction market will continue to bring added

liquidity, dampen volatility and enhance the stability of the market place

–

Enhanced surveillance capabilities

Automated trading rules and flexible access to trading activity

will allow sophisticated surveillance and assured integrity across the market.

AEMI brings together the best qualities of the electronic market and the

auction market, to deliver the highest quality marketplace.

American Stock Exchange

Visit us at www.Amex.com

9

Hybrid Market Structure: Best of Both Marketplaces

AUTOMATED

Orders trade automatically with electronic

AUCTION

Auto-ex is disabled in limited

interest in the book

circumstances

Price improvement and added liquidity

available

Routed away if the best price is not

matched or improved

Handled in the auction market if not auto-

“Auction” quote published

Orders may still enter the book or be

cancelled

Specialist gaps the quote for large

imbalances

executable

American Stock Exchange

Visit us at www.Amex.com

10

Amex Investment Banks Support

Over the last few years a number of leading investment banks have been advising their

clients from a wide variety of industries, geographies, sizes and structures that the

American Stock Exchanges is the best market to meet their needs.

Leading Global Investment Banks that have underwritten offerings on the Amex:

American Stock Exchange

BB&T Capital Markets

Broadband Capital Management LLC

CIBC World Markets

Citigroup

Credit Suisse

CRT Capital Group LLC

Deutsche Bank Securities Inc.

EarlyBirdCapital, Inc.

Ferris, Baker Watts, Inc.

I-Bank Securities

Lazard Capital Markets

Ladenburg Thalmann & Co, Inc.

Visit us at www.Amex.com

Lehman Brothers

Maxim Group, LLC

Merrill Lynch & Co.

Merriman Curhan Ford & Co.

Morgan Joseph & Co, Inc.

Oppenheimer & Co. Inc.

RBC Capital Markets

Rodman & Renshaw, LLC

ThinkEquity Partners LLC

UBS Investment Bank

Wedbush Morgan Securities

WR Hambrecht + Co

11

American Stock Exchange IR AllianceSM (AIRA)

Amex AIRA is a proprietary and complimentary investor relations program that offers:

Dedicated Issuer Services Director

“New on the Amex” updates

AIRA “communications audit”

Conferences and Shareholder Meetings

Institutional Investor Meetings

World Investor Link

Educational Conferences/Seminars

Online Investor Relations Resources

– Amex Online

– Amex.com

American Stock Exchange

Visit us at www.Amex.com

12

Amex Dual Listing Initiative

Amex Management intends to file a rule proposal with the SEC, whereas

all Amex Initial listings fees will be waived

for companies whose securities are trading on the NASDAQ or those

participating in the NASDAQ Dual Listing program.

The Amex believes its…

specialist-auction market structure,

full service investor relations support,

dedicated Issuer Services director,

Amex Online investor database,

lower fees,

blue sky exemption,

and our state-of-the-art hybrid market trading system

...will make a big difference in the success of smaller

companies.

American Stock Exchange

Visit us at www.Amex.com

13

Financial Guidelines for Listing

Guidelines

Listing Guidelines

Pretax income*

Standard 1

Standard 2

Standard 3

Standard 4

Maintenance

Standards 4

$750,000

N/A

N/A

N/A

N/A

$75 million

OR

$75 million

AND

$75 million

N/A

$50 million

Market Capitalization

N/A

Total Assets*

N/A

Total Revenue*

$3 million

$15 million

$15 million

$20 million

$1 million

Minimum price

$3

$3

$2

$3

N/A

N/A

2 years

N/A

N/A

N/A

$2,000,000

Stockholders equity 1

$4,000,000

$4,000,000

$4,000,000

N/A

applicable requirement must be

satisfied in either the last fiscal year or

2 out of 3 most recent fiscal years.

1

Issuers are required to maintain $2

million in Stockholder’s Equity if the

issuer has losses in 2 of the most

recent 3 years; $4 million if the issuer

has losses in 3 of the most recent 4

years; or $6 million of the issuer has

losses in the 5 most recent fiscal

years.

2

Market Value of

Public Float

Operating history

* The

$4,000,000

Foreign companies which do not

meet the distribution guidelines

outlined above may alternatively

qualify with 800 round-lot public

shareholders worldwide, 1,000,000

publicly held shares worldwide and a

$3,000,000 market value of public

float worldwide.

3

Public float is defined as shares that

are not held directly or indirectly by

any officer or director of the issuer or

by any other person who is the

beneficial owner of more than 10

percent of the total shares outstanding.

4

$6,000,000

Distribution Guidelines

2

Option A : 800

Public stockholders

Option B: 400

300

A company with several years of

losses which is unable to satisfy the

equity requirements, will not be

subject to delisting if it has a market

cap of $50 million or total assets and

revenue of $50 million each, and

complies with enhanced distribution

criteria including mvpf of $15 million.

Option C: 400

Option A: 500,000

Public float (shares)

3

Option B: 1,000,000

200,000

Option C: 500,000

Average daily volume

American Stock Exchange

Option C: 2,000

Visit us at www.Amex.com

N/A

14

Comparative Listing Costs for Foreign Issuers

ORIGINAL LISTING FEES [1]

SHARES

(MILLIONS)

Amex

Up to 1

1+ to 2

2+ to 3

3+ to 4

4+ to 5

5+ to 6

6+ to 7

7+ to 8

8+ to 9

9+ to 10

10+ to 11

11+ to 12

12+ to 13

13+ to 14

14+ to 15

15+ to 16

16+ to 20

20+ to 25

25+ to 50

50+ to 75

75+ to 100

100+ to 200

Maximum

$40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

40,000

NYSE

$150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

150,000

CONTINUING ANNUAL FEES [2]

Nasdaq

National

Market

Nasdaq

Capital

Market

Amex

NYSE [3]

$100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

100,000

$25,000

25,000

25,000

25,000

25,000

35,000

35,000

35,000

35,000

35,000

45,000

45,000

45,000

45,000

45,000

50,000

50,000

50,000

50,000

50,000

50,000

50,000

50,000

$16,500

16,500

16,500

16,500

16,500

19,000

19,000

19,000

19,000

19,000

21,500

21,500

21,500

21,500

21,500

21,500

21,500

21,500

24,500

32,500

34,000

34,000

34,000

$38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000

38,000+ to 46,500

46,500+ to 69,750

69,750+ to 93,000

93,000+ to 186,000

500,000 [5]

150,000+ to 157,500

157,500+ to 250,000

100,000+ to 125,000

250,000 [4]

250,000

250,000

250,000

150,000

150,000

150,000

150,000

Nasdaq

National

Market*

Nasdaq

Capital

Market

$24,500

24,500

24,500

24,500

24,500

24,500

24,500

24,500

24,500

24,500

30,500

30,500

30,500

30,500

30,500

30,500

30,500

30,500

34,500

39,150

44,500

75,000

75,000

$17,500

17,500

17,500

17,500

17,500

17,500

17,500

17,500

17,500

17,500

21,000

21,000

21,000

21,000

21,000

21,000

21,000

21,000

21,000

21,000

21,000

21,000

21,000

[1] The original listing fee for Amex and NYSE is based on the total number of shares listed, including all shares issued and outstanding, as well as shares

[1] The original listing fee for Amex and NYSE is based on the total number of shares listed, including all shares issued and outstanding, as well as shares reserved by the Board of

reserved

the BoardThe

of Directors

specific future

issuance.

TheNASDAQ

original fee

for Nasdaq

National

Market

and

Nasdaq SmallCap

based

on total shares

Directors for a specific

futureby

issuance.

original feeforfora NASDAQ

National

Market and

SmallCap

is based

on total

shares

outstanding

and appliesisto

all domestic

outstanding

applies

to all

domestic

only foreign

issuers

listing

ordinary

Fees include

one-time

listing charges

issuers and only foreign

issuersand

listing

ordinary

shares.

Feesissuers

include and

one-time

initial listing

charges

of $5,000

forshares.

Amex, $37,500

for NYSE,

$5,000initial

for NASDAQ

Nationalof $5,000 for Amex,

Market, and $5,000

for NASDAQ

SmallCap,

for theNational

first classMarket,

of securities

listed by

issuer SmallCap, applied for the first class of securities listed by an issuer.

$37,500

for NYSE,

$5,000applied

for Nasdaq

and $5,000

foran

Nasdaq

[2] Newly listed companies

billed

the annualare

fee billed

on a pro-rata

basisfee

at on

theaend

of thebasis

calendar

year

in which

are listed

[2] Newlyare

listed

companies

the annual

pro-rata

at the

end

of the they

calendar

year in which they are listed.

[3] NYSE annual fees payable are the greater of amounts shown under a minimum fee schedule or a fee applied on a per share basis.

[3] NYSE annual fees payable are the greater of amounts shown under a minimum fee schedule or a fee applied on a per share basis. Fee ranges shown

Fee ranges shown here for 25+ million shares represent the maximum amount payable for each end of the share range shown.

here for

million listings

sharesfee

represent

the maximum

amount

forincluding

each endthe

of$37,500

the share

rangecharge.

shown.

[4] The initial fee component

of 25+

the original

for common

shares is capped

atpayable

$250,000,

special

[4] The

initial feeannual

component

of the

original

feelisted

for common

shares

is capped

at $250,000,

including the $37,500 special charge.

[5] Maximum $500,000

continuing

listing fee

applies

to alllistings

securities

by an issuer,

other

than derivative

products,

[5] Maximum

$500,000 continuing

annual listing fee applies to all securities listed by an issuer, other than derivative products, fixed income products, and closed-end fund

fixed income products,

and closed-end

funds.

* Nasdaq National *Market

Annual

Fee Schedule

for ADRs

between

$ 21,225

andbetween

$ 30,000$ 21,225 and $ 30,000

Nasdaq

National

Market Annual

Fee ranges

Schedule

for ADRs

ranges

15

American Stock Exchange

Visit us at www.Amex.com

The Israeli Experience on the Amex

American Israeli Paper Mills Ltd (AIP)

– Listed since 1959

Teva Pharmaceutical Industries Ltd. / IVAX Corporation Merger

– Ivax listed since 1987, grew to 8 Billion dollars in market capitalization

– Mega Merger, creating the world's largest generic pharmaceutical company.

Gurunet Corporation

– Successful IPO

XFONE, Inc. (XFN)

American Stock Exchange

Visit us at www.Amex.com

16

Case Study: Ivax Corp.

•Ivax Pharmaceuticals merged with Teva creating the largest generic drug

company in the world. This was the largest M&A transaction in Israeli history.

•Ivax listed on the Amex in 1987 with a market capitalization of approximately

$100 million and grew to almost $8 billion at the time of the merger with Teva.

IVAX Corp

Volume (Shrs. in Thousands)

Price (USD)

60,000

40

35

50,000

30

40,000

25

30,000

20

Ivax Corp.

Amex Listing Date

to

Date of Acquisition

15

20,000

10

10,000

5

0

0

'88

American Stock Exchange

'89

'90

'91

'92

'93

'94

'95

'96 '97

'98

'99

'00

'01

Visit us at www.Amex.com

'02

'03

'04

'05

17

Case Study: Answers Corp (formerly know as GuruNet)

During June 2005, Answers Corp. (GRU) began trading its shares on the Nasdaq National

Market after moving from the American Stock Exchange. The following case study

examines the performance and trading characteristics of the stock 65 days before and after

transferring.

Results:

Answers Corp. had

experienced substantial

losses in their volume, liquidity

and price.

Affect on Trading After Transferring from the Amex to Nasdaq

(65 Trading Days Before and After)

Trade Spread

143.02%

Volume

-75.60%

-37.50%

-73.60%

Price

Liquidit

y

Source: Amex ERDB™, FactSet Research Systems, Inc.

*Percent Based on Intraday Volatility

American Stock Exchange

Visit us at www.Amex.com

18

The Amex Advantage

Auction Market Fosters Fairness & Growth

Centralized market structure, characterized by enhanced liquidity, narrower spreads and lower

volatility is conducive to creating, safeguarding and increasing shareholder value

Trading participants compete to achieve best possible prices

Increased access to capital and growth through Blue Sky Exemption and the protection of a

National Exchange listing

Broad Range of Visibility-Enhancing Services

Tailored services help companies attain a heightened profile in the capital markets

Support for building relationships with analysts and investors

Frequent opportunities to bring your story to the market’s attention

Exchange professionals, including Issuers Services Directors and Specialists work together to

enhance the attractiveness of listed company stocks

Professional Investor Relations Guidance

Guidance from seasoned IR professionals and assistance for developing or updating an

effective Investor Relations program

Educational seminars on a variety of IR topics

American Stock Exchange

Visit us at www.Amex.com

19

Contact Information:

Senior Vice President—Head of Equities

John McGonegal

Phone: 212-306-1652

European Managing Director

Robert Wotczak

Phone: 212-306-2263

robert.wotczak@amex.com

AMEX’s consultant in Europe and Israel

Amira Bardichev

Phone: +44-7956206270

amira@global-equity-ir.co.uk

Account Manager

Catherine Elbe

Phone: 212-306-8916

catherine.elbe@amex.com

American Stock Exchange

Visit us at www.Amex.com

20