Memo - Ellie Kramer

advertisement

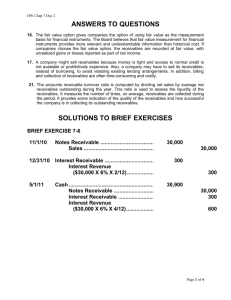

To: Mr. Lammer From: Ellie Kramer Date: November 28, 2012 RE: Transfer of Receivables Thank you for your inquiry on the various options to transfer a portion of your receivables to an outside party. There are a few different options for you including secured borrowings and different methods of outright selling of you receivables. I will go into detail about each method to hopefully make you comfortable with each method. Many companies choose to use secured borrowing. When using secured borrowing you pledge your accounts receivable as collateral for a loan. This loan would be recognized as a financing arrangement- a liability account. There are also types of secured borrowing that require certain assets to be assigned as collateral for a loan. For example if you buy a car the bank keeps the title to the car until it is fully paid off; that way if you default on the payments for a certain period of time the bank can then sell the car to pay off the rest of the loan. Typically, the amount a bank or a financial institution lends to your company is less than the amount of the receivable your company assigns, due to the risk of possible uncollectible accounts. You are not required to associate certain accounts receivable with the loan but rather your accounts receivables as a whole. Dealing with secured borrowing does not require any special accounting principles but rather a disclosure note on the financial statements. Also, other than the stated interest on the loan, the lenders often require an upfront finance charges to provide some sort of insurance to the bank. Therefore, the amount of cash that your company receives would be less than the amount of the loan in fact. Once you collect the cash from the receivables, you would use that to settle the financing arrangement and pay for the interest of the loan. As a result, accounts receivable and financing arrangement would go down accordingly. On another note, the consequence for secured borrowing is that in case the debt is not paid off by your company, the collection of assigned receivable would go directly toward the payment of the debt. If your company assigns an asset as collateral for the loan, the asset would be sold to pay for the debt. Another alternative is factoring where a company sells its accounts receivables to a financial institution. Major credit card companies are examples of factoring. Companies such as Discover or VISA handle collection and billing and charge a fee for this service and this is a form of factoring. Factoring will create more capital to help your cash flow because you are getting the cash immediately in exchange for accounts receivable rather than waiting a couple of months for the customer to pay you. In exchange for the cash from the factors, your company would have to give up the future cash receipts of receivables. The requirement for factoring is that receivables quality and length of time before payment must be reasonable and clearly stated. In reality, it is natural that not every account receivable will be collected, as well as every receivable will be collected in full. Consequently, there is a significant factor your company must consider when receivables are transferred: risk of uncollectibility. If the buyer assumes this risk, accounts receivable are sold without recourse. In other words, the buyer of these receivables cannot ask for more money from the seller if receivables are not paid by customers. On the other hand, if the seller holds the risk of un-collectability, accounts receivable are sold with recourse and buyer will be paid whether receivables are collectible or not. Either way, companies that are involved in sales of receivables must establish two new accounts for their transactions: receivable from factor and loss on sale of receivables. Receivable from factor is the difference between the fair value of last part of receivables (e.g. 10%) to be collected and the factoring fee. Loss on sale of receivable will be calculated lastly in order to balance the journal entries. Also, if receivables are sold with recourse, the seller has to estimate a liability called recourse obligation as the approximate amount that the seller will have to pay the financial institution as reimbursement for uncollectible receivables. If the financial institution collects all of receivables, the seller would eradicate recourse liability and reduce the loss. Understanding that the concept is lengthy and possibly confusing, we would try to clarify the idea with an example. Suppose Lammer Inc. has sold a net amount of receivables of $10,000 (without recourse) to Ellie Bank. Ellie Bank will immediately pay Lammer Inc. 80% of the factored amount, which is $8,000. The factoring fee is 5% of the factored amount, which is $500. Management estimates that last 15% of receivable to be collected worth $1,000. Notice that the fair value ($1,000) of the last 15% of receivables is less than 15% of receivables’ book value ($1,500). This is understandable since last receivables are more likely to be cut down due to allowances and sale returns. Back to our example, we would recognize $500 ($1,000-$500) as receivables from factor. The rest ($1,500) of the journal entry is loss on sale of receivables. As a whole, the journal entry would look like this: Cash $8,000 Loss on sale of receivables Receivable from factor Accounts receivable $1,500 $500 $10,000 Now, suppose the factor’s fee is withheld from the cash advanced to the company at beginning of the arrangement. Then, the amount of cash would go down by $500, which is the factor fee; in addition, receivable from factor would go up by the same amount. If the receivables are sold with recourse, and the recourse obligation is estimated to be $1,000, that would simply increase loss on sale of receivables by $1,000 and keep everything else the same. The journal entry now would look like: Cash $8,000 Loss on sale of receivables Receivable from factor $2,500 $500 Recourse liability $1,000 Accounts receivable $10,000 Another method for sales of receivables is securitization. In this case, your company would establish a trust or a subsidiary named “special purpose entity” (SPE) in order to securitize accounts receivable. After the SPE buys a pool of receivables, it would use them as collateral before selling related securities (etc. debt) such as bonds or commercial paper. It also allows your company to receive a cash payment for sold receivable. On behalf of SPE, your company continues to provide services and collect receivables. An advantage of securitization is that your company can reach a hefty pool of investors and attain promising financing terms. Consequence for securitization may be that when SPE is consolidated, any transactions between your company and the SPE are eradicated. The company would look like they have kept its receivables and participated in secured borrowing with financial institutions that loaned money to the SPE. I hope this answered some of your questions regarding your concern about transfer of receivables. If you have any further questions we would be more than willing to help. Best regards, Ellie Kramer