Revenue Processing and Revenue Producing

Introduction of Revenue Processing

Policy

Introduction of Revenue Processing

Policy

Background:

IU processed over

750,000 payments in

2005 totaling over

$1billion.

Introduction of Revenue Processing

Policy

Background:

Over 500 organizational units and 900 individuals were involved in processing these payments

Introduction of Revenue Processing

Policy

Background:

Payments continue to increase in volume and dollar size

Introduction of Revenue Processing

Policy

Background:

Payments have become riskier

Introduction of Revenue Processing

Policy

Background:

Internal Audit of Revenue

Processing at Indiana

University

Introduction of Revenue Processing

Policy

Internal Audit Finding:

“Existing financial institutional policies do not adequately limit the risks of accepting and depositing revenues, provide guidance on the best methods for accepting and depositing different types of revenues, establish responsibility for monitoring revenues, or establish treasury as an approval authority for revenue acceptance and deposit processes.”

Introduction of Revenue Processing

Policy

Internal Audit Finding:

“Current policies do not establish collection guidelines for similar types of revenue processes. Several types of operations/revenue generating processes can be grouped (systemwide) and overall best practices suggested for each. The overall goal is to reduce or eliminate cash, check, and credit card handling in units. As mentioned above, for many (non-retail) units, an ideal first step is to implement a policy that restricts the acceptance of cash.”

Introduction of Revenue Processing

Policy

Internal Audit

Recommendation:

“Establishing guidelines for the use of available payment methods and a policy requiring Treasury’s review and approval of the collection methods…”

Introduction of Revenue Processing

Policy

Policy VI-120

Approved July 2006

Introduction of Revenue Processing

Policy

Policy Objectives:

•Exercise operational authority over the acceptance and deposit of all payments received by Indiana University including those received at the individual department level

Introduction of Revenue Processing

Policy

Policy Objectives:

•Deliver consistency in payment types across similar revenue processes

Introduction of Revenue Processing

Policy

Policy Objectives:

•Enable operational efficiency with an optimal cost structure

Introduction of Revenue Processing

Policy

Policy Objectives:

•Capitalize on the core competency of the Office of the Treasurer relative to banking services, working capital management, credit card processing, electronic payment options and developing technology

Introduction of Revenue Processing

Policy

Policy Objectives:

•Maintain the highest level of available operational controls to reduce the possibility of fraud, loss of assets and/or loss of sensitive university data

Introduction of Revenue Processing

Policy

Policy Statement:

Treasury will review current and proposed revenue processing activities (after compliance with Policy

I-450-Establishing and Generating

Revenue Producing Activity) with

Campus Administration and the department to discuss current activities, proposed changes and implementation timetables, if applicable.

Introduction of Revenue Processing

Policy

Policy Statement:

Treasury, in consultation with Campus

Administration, will recommend and approve the payment method(s) based on business need. Similar revenue generating activities should have similar revenue processes whenever possible. Business needs for exceptions will be approved by

Treasury, in consultation with Campus

Administration.

Introduction of Revenue Processing

Policy

Revenue Processing

Options:

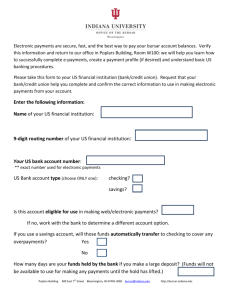

Electronic Transmittal

•Point of Purchase (POP)

•Accounts Receivable Conversion (ARC)

•Remote Check Capture

•WEB Payments (ACH and Credit card)

•IUPay

•BEX

•Credit/debit cards

Introduction of Revenue Processing

Policy

Revenue Processing

Options:

Lockboxes

•FMS AR

•Departmental lockboxes

Centralized credit/debit card system

Drop Box

Introduction of Revenue Processing

Policy

Key Principles:

•Electronic processing is preferred

•Use of cash is discouraged

•Separation of Duties

•No copies of checks

•No storing complete account data

Introduction of Revenue Processing

Policy

•Policy VI-120 will be phased in over several years

•Training sessions will be held in connection with implementation

Treasury Resources

Web Page: http://www.indiana.edu/~iutreas

Newsletters are published quarterly – archives available on web

Payment Card Services

(812)855-0586 pmtcards@indiana.edu

Cheryl L. Shifflett, AAP, CTP

(812)855-6465 cshiffl@indiana.edu

Kim L. Stuart, CTP

(812)856-5838 klstuart@indiana.edu

Money Movement Services

(812)855-9268 moneymov@indiana.edu

Ruth A. Harpool, AAP, CTP

(812)855-3910 rharpool@indiana.edu

W. David Newsom

(812)855-9457 wnewsom@indiana.edu