Project: Part One

advertisement

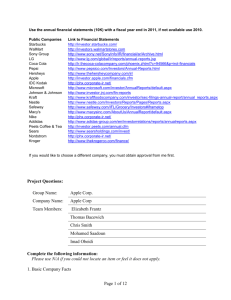

Use the annual financial statements (10K) with a fiscal year end in 2011, if not available use 2010. Public Companies Starbucks WalMart Sony Group LG Coca Cola Pepsi Hersheys Apple IDC Kodak Microsoft Johnson & Johnson Kraft Nestle Safeway Macy's Nike Addidas Peets Coffee & Tea Sears Nordstrom Kroger Link to Financial Statements http://investor.starbucks.com/ http://investors.walmartstores.com http://www.sony.net/SonyInfo/IR/financial/ar/Archive.html http://www.lg.com/global/ir/reports/annual-reports.jsp http://ir.thecoca-colacompany.com/phoenix.zhtml?c=94566&p=irol-financials http://www.pepsico.com/Investors/Annual-Reports.html http://www.thehersheycompany.com/ir/ http://investor.apple.com/financials.cfm http://phx.corporate-ir.net/ http://www.microsoft.com/investor/AnnualReports/default.aspx http://www.investor.jnj.com/fin-reports http://www.kraftfoodscompany.com/investor/sec-filings-annual-report/annual_reports.aspx http://www.nestle.com/Investors/Reports/Pages/Reports.aspx http://www.safeway.com/IFL/Grocery/Investors#iframetop http://www.macysinc.com/AboutUs/AnnualReport/default.aspx http://phx.corporate-ir.net/ http://www.adidas-group.com/en/investorrelations/reports/annualreports.aspx http://investor.peets.com/annual.cfm http://www.searsholdings.com/invest/ http://phx.corporate-ir.net/ http://www.thekrogerco.com/finance/ If you would like to choose a different company, you must obtain approval from me first. Project Questions: Group Name: Apple Corp. Company Name: Apple Corp Team Members: Elizabeth Frantz Thomas Bacewich Chris Smith Mohamed Saadoun Imad Obeidi Complete the following information: Please use N/A if you could not locate an item or feel it does not apply. 1. Basic Company Facts Page 1 of 12 a. Name of Firm: Apple Inc. b. Stock Ticker Symbol: AAPL c. Stock exchange where traded: NASDAQ d. State of Incorporation California e. Independent Auditor Ernst & Young LLP f. Company’s Fiscal Year End September 25, 2011 through September 29, 2012 g. Web site www.aaple.com 2. List up to five products or services your company sells or provides and customers to whom those products are sold. Products Mac hardware Customers Business and professional ipods iTunes iPhone iPad Page 2 of 12 3. Use the financial highlights section of your company’s annual report to note the following information. (Note: FYE may need to be adjusted) Most Recent Fiscal Year Item Next Most Recent Year Net Income $ 25,922m $ Total Assets $ 116,371m $ Total Liabilities $ 39,756m Long-term Debt $ Dividend per share Earnings per share (basic EPS) 14,013m Additional years Additional Years $ 8,235m $ 6,119m 75,183m $ 47,501m $ 36,171m $ 27,392m $ 15,861m $ 13,874m 10,100m $ 5,531m $ 3,502m $ 1,745m $ 0 $ 0 $ 0 $ 0 $ 28.05 $ 15.41 $ 9.22 $ 6.94 4. From Management’s Discussion and Analysis (MD&A), answer the following: a. Does your company’s MD&A section have the following major sections? (Note: All companies may not have these sections or use the exact terminology.) Yes Overview Yes Results of operations Yes Financial condition and liquidity Yes Market risk management Yes Critical accounting policies Yes Caution concerning forward-looking information Yes Other: Page 3 of 12 No b. What is the general tone of management’s comments in this section? Was the most recent year a positive or negative experience for the company? Is management optimistic or pessimistic about the future? Discuss. 5. Locate the Statement Management Responsibility and the Report of the Independent Accountants (or Auditor’s Report) and read them carefully to answer the following questions. a. Who is responsible for the preparation and content of the financial statements? b. Does the company have an Audit Committee? c. What is (are) the responsibility(s) of the audit committee? d. Which financial statements are covered by the audit report? Page 4 of 12 Yes No e. Who is responsible for assessing that the financial statements are fairly stated? f. To whom is the audit report addressed? g. Did your company receive an unqualified opinion? Yes No h. If your firm did not receive an unqualified opinion, what reason(s) was (were) given? 6. Review the Basic Company Facts and other parts of the Annual Report to find the following information: a. Name of CEO Tim Cook b. Name of Chairman of the Board c. When will the annual stockholder’s meeting be held? e. List other interesting information/facts, if any, disclosed in this section? Millard S. Drexler Page 5 of 12 7. Does your firm prepare consolidated financial statements? (check one) Often, the financial statement will have the word “consolidated” in its title to indicate that the corporation owns one or more subsidiaries and that the financial results of the subsidiaries have been combined with those of the parent company to produce a single set of financial statements. Yes No When the company and the subsidiaries are combined, all transactions between the company and its subsidiaries must first be eliminated. Why do you think this is necessary? 8. What format was used to prepare your firm’s income statement? (check one) Hint: If gross margin (also called gross profit) is reported on the income statement, it’s the multiple step format. Single-step x Multiple step Page 6 of 12 9. For each of the selected items on the income statement, determine its percentage relative to sales revenue for the most recent year and the next most recent year. If an item is not reported draw a line through it. Income Statement Line Most Recent Year Percent of Sales Sales or Revenue 108,249 100 Cost of Sales 64,431 59.5% 25,541 60.6% Gross Profit/Margin 43,818m 40.5% 25,684m 39.4% Operating Expenses 10,028m 9% 7,299m 11% Income before Tax 34,205 31.60% 18,540 28.42% Provision for tax 8,283 7.65% 4,527 6.94% Net Income 25,922 23.95 14,013 21.48% Other Major Items 415 0.38% 155 0.24% Next Most Recent Year % 65,225 Percent of Sales 100 % 10. Based on the common-size analysis above, which item(s) appear to be the most significant in explaining the change in net income (profitability) from the next most recent year to the most recent year (i.e., which items changed most relative to sales revenue)? Discuss below. Page 7 of 12 11. Which of the following terms describes the balance sheet as reported by your firm? (check those that apply.) Classified balance sheet (Assets are segregated into categories) X Comparative balance sheet (More than one year of data is presented) 12. Identify the amounts that your firm reported for each of the following categories and the percentage of total assets that each represents. Amount Percent Current Assets $ 44,988m 38.66 Property, Plant & Equipment $ 7,777m 6.68 Goodwill and other intangible assets $ Other long term assets $ 59,174 50.85 $ 116,371 100% Current Liabilities $ 27,970 24.03 Long-term liabilities $ 11,786 10.13 Contributed capital $ 13774 11.84 Retained Earnings $ 62,841 54 Total $ 116371 100% Total 4,432 3.81 13. If you were a creditor of a firm you would be interested in whether the firm had enough resources to pay you when you bill came due, which can be determined by two indicators: A. The amount of working capital, the cushion by which total current assets exceed total current liabilities WC = current assets – current liabilities WC= 44,988-27,970 WC=17,018 B. The current ratio, which reveals how many dollars of current assets are available to pay off each dollar of current liabilities. CR = Current Assets = 44988/27970=1.61 Current Liabilities Page 8 of 12 What amount of working capital did your company have as of the date of its two most recent balance sheets? What was the current ratio at the end of the two most recent years? Most Recent Balance Sheet Working Capital $ Current Ratio Next Most Recent Balance Sheet 17,018m $ 20,956 1.61 % 2.01 % 14. For comparison to other firms, check with three other groups to see what their working capital results were. Record the results below and on the next page. Working Capital Most Recent Balance Sheet Name of Firm Next Most Recent Balance Sheet Microsoft 74,918$ 28,774=46144 Sony $ LG 8153774$ 8871191=-717417 8094379$ 9352984=-1258605 Name of Firm Most Recent Balance Sheet Next Most Recent Balance Sheet Microsoft 2.60 % 2.13 % Sony 0.93 % 1.02 % LG 0.92 % 0.87 % 3,844,0464,126,979=-282933 55,676$ 26,147=29529 $ 4,132,8724,059,925=72947 Current Ratio 15. How does your firm compare to the other firms you listed regarding its ability to pay current liabilities as they become due? Page 9 of 12 16. Using the posted ratios in the course contents of D2L compute the following ratios for you company. Most Recent Balance Sheet Next Most Recent Balance Sheet Profit Margin 23.95 % 22.52 % Return on Asset 22 % 19 % Return on Equity 42 % 35 % 17. What does the profit margin ratio indicate about your company’s ability to convert sales into profit? Discuss. 18. What does the return on assets ratio indicate about your company’s using its assets profitably? Discuss. 19. What does the return on equity ratio indicate about how well your company has performed for its stockholders? Discuss. Page 10 of 12 Page 11 of 12 20. Final Analysis: Page 12 of 12