CAMPUT 2015 Energy Regulation Course WK TAYLOR

advertisement

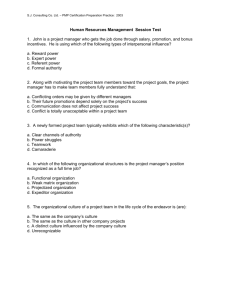

Cost of Service Regulation Wayne Taylor W. K. TAYLOR CONSULTING LTD. June 22, 2015 Cost of Service Regulation Revenue Requirement Applications (Phase I) Revenue Requirement Forecast Revenue at Existing Rates Required Average Rate Increase Rate Design Applications (Phase II) Rate Classes Cost of Service Study Rate Rebalancing and Rate Design Terms and Conditions of Service CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Typical Revenue Requirement Components Capital-Related Costs Depreciation Interest Return on Equity Income Tax Operating Costs Labour Materials and Supplies Fuel and Purchased Power Property Taxes CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Capital Expenditures and Additions Year 1 Construction Work in Progress Opening Balance Capital Expenditures AFUDC Capital Additions Closing Balance Mid-Year Balance Year 2 0.0 500.0 16.5 0.0 516.5 258.3 516.5 1,000.0 67.1 0.0 1,583.6 1,050.0 Gross Plant Opening Balance Capital Additions Retirements Closing Balance Mid-Year Balance 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Accumulated Depreciation Opening Balance Depreciation Retirements Closing Balance Mid-Year Balance 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CAMPUT 2015 Energy Regulation Course Year 3 1,583.6 500.0 50.6 (2,134.2) 0.0 791.8 Year 4 Year 5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 2,134.2 0.0 2,134.2 1,067.1 2,134.2 0.0 0.0 2,134.2 2,134.2 2,134.2 0.0 0.0 2,134.2 2,134.2 0.0 26.7 0.0 26.7 13.3 26.7 53.4 0.0 80.0 53.4 80.0 53.4 0.0 133.4 106.7 W.K. TAYLOR CONSULTING LTD. Rate Base Year 1 Mid-Year Rate Base Gross Plant Accumulated Depreciation CWIP in Rate Base Future Income Tax Account Construction Contributions Allowance for Working Capital Total CAMPUT 2015 Energy Regulation Course 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Year 2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Year 3 1,067.1 (13.3) 0.0 (7.3) 0.0 0.0 1,046.4 Year 4 2,134.2 (53.4) 0.0 (28.5) 0.0 0.0 2,052.3 Year 5 2,134.2 (106.7) 0.0 (54.5) 0.0 0.0 1,973.0 W.K. TAYLOR CONSULTING LTD. Rate Base 2,500 2,000 Rate Base 1,500 1,000 500 0 1 3 5 7 9 11 13 15 17 19 21 23 Year 25 27 29 31 33 35 37 39 41 Mid-Year Balance CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Revenue Requirements Year 1 Revenue Requirements Depreciation Cost of Debt Cost of Equity Income Taxes Operating Costs Total CAMPUT 2015 Energy Regulation Course 0.0 0.0 0.0 0.0 0.0 0.0 Year 2 0.0 0.0 0.0 0.0 0.0 0.0 Year 3 26.7 31.4 37.7 12.6 0.0 108.3 Year 4 53.4 61.6 73.9 24.6 26.7 240.1 Year 5 53.4 59.2 71.0 23.7 27.6 234.8 W.K. TAYLOR CONSULTING LTD. Cost of Capital Capital Structure Debt Equity Weighted Average Income Tax 60% 40% Rate Cost per $1,000 of Rate Base 5.0% 9.0% 6.6% 30.0 36.0 25.0% 12.0 Total 78.0 Weighted Average Incl Tax 7.8% CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Cost of Capital Capital Structure Debt Equity Weighted Average 60% 40% Income Tax Cost per $1,000 of Rate Base Cost per $1,046.4 of Rate Base 5.0% 9.0% 6.6% 30.0 36.0 31.4 37.7 25.0% 12.0 12.6 Rate Total 78.0 Weighted Average Incl Tax 7.8% CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Capital-Related Revenue Requirements 300 250 Revenue Requirements 200 150 100 50 0 1 3 5 7 9 11 13 Depreciation CAMPUT 2015 Energy Regulation Course 15 17 19 Cost of Debt 21 23 Year 25 Cost of Equity 27 29 31 33 35 37 39 41 Income Taxes W.K. TAYLOR CONSULTING LTD. Total Revenue Requirements 300 250 Revenue Requirements 200 150 100 50 0 1 3 5 7 9 11 Depreciation 13 15 Cost of Debt CAMPUT 2015 Energy Regulation Course 17 19 21 23 Year Cost of Equity 25 27 Income Taxes 29 31 33 35 37 39 41 Operating Costs W.K. TAYLOR CONSULTING LTD. Capital Cost Allowance CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Future Income Tax Account Revenue Requirement Income Tax Return Financial Statements Revenue 108.3 108.3 108.3 Less: Operating Costs Interest Depreciation Capital Cost Allowance (31.4) (26.7) - (31.4) (85.4) (31.4) (26.7) - Net Income Before Taxes 50.2 (8.5) 50.2 (12.6) - 2.1 - 2.1 (14.7) 37.7 (6.3) 37.7 Income Tax Transfer to FIT Account Net Income After Taxes CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Future versus Flow-Through Income Taxes CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Future Income Tax Account CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Total Revenue Requirements – Flow-Through CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Comparison of Future and Flow-Through CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Depreciation Systems Method of Allocation Straight Line Accelerated (e.g. Declining Balance) Decelerated (e.g. Sinking Fund) Group Procedure Average Life Procedure Equal Life Procedure Adjustment Technique Whole Life Remaining Life CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Revenue Requirements – Different Lives CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Impact of Including CWIP in Rate Base Year 1 Construction Work in Progress Opening Balance Capital Expenditures AFUDC Capital Additions Closing Balance Mid-Year Balance Year 2 0.0 500.0 0.0 0.0 500.0 250.0 500.0 1,000.0 0.0 0.0 1,500.0 1,000.0 Gross Plant Opening Balance Capital Additions Retirements Closing Balance Mid-Year Balance 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Accumulated Depreciation Opening Balance Depreciation Retirements Closing Balance Mid-Year Balance 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 CAMPUT 2015 Energy Regulation Course Year 3 1,500.0 500.0 0.0 (2,000.0) 0.0 750.0 Year 4 Year 5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 2,000.0 0.0 2,000.0 1,000.0 2,000.0 0.0 0.0 2,000.0 2,000.0 2,000.0 0.0 0.0 2,000.0 2,000.0 0.0 25.0 0.0 25.0 12.5 25.0 50.0 0.0 75.0 50.0 75.0 50.0 0.0 125.0 100.0 W.K. TAYLOR CONSULTING LTD. Impact of Including CWIP in Rate Base Year 1 Mid-Year Rate Base Gross Plant Accumulated Depreciation CWIP in Rate Base Future Income Tax Account Construction Contributions Allowance for Working Capital Total Revenue Requirements Depreciation Cost of Debt Cost of Equity Income Taxes Operating Costs Total CAMPUT 2015 Energy Regulation Course Year 2 0.0 0.0 250.0 0.0 0.0 0.0 250.0 0.0 0.0 1,000.0 0.0 0.0 0.0 1,000.0 0.0 7.5 9.0 3.0 0.0 19.5 0.0 30.0 36.0 12.0 0.0 78.0 Year 3 Year 4 Year 5 1,000.0 (12.5) 750.0 (6.9) 0.0 0.0 1,730.6 2,000.0 (50.0) 0.0 (26.7) 0.0 0.0 1,923.3 2,000.0 (100.0) 0.0 (51.1) 0.0 0.0 1,848.9 25.0 51.9 62.3 20.8 0.0 160.0 50.0 57.7 69.2 23.1 25.0 225.0 50.0 55.5 66.6 22.2 25.8 220.0 W.K. TAYLOR CONSULTING LTD. Impact of Including CWIP in Rate Base CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Impact of Including CWIP in Rate Base CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Impact of Including CWIP in Rate Base CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Required Average Rate Increase Revenue Requirement Capital-Related Costs Depreciation Interest Return on Equity Income Tax Operating Costs Labour Materials & Supplies Fuel & Purchased Power Property Taxes Total 600 130 700 200 3,300 Forecast Revenue at Current Rates Revenue Shortfall Required Rate Increase 3,000 300 10.0% CAMPUT 2015 Energy Regulation Course 500 450 540 180 W.K. TAYLOR CONSULTING LTD. Actual Net Income Revenue Capital-Related Costs Depreciation Interest Operating Costs Labour Materials & Supplies Fuel & Purchased Power Property Taxes Net Income Before Taxes Income Tax Net Income After Taxes CAMPUT 2015 Energy Regulation Course 3,300 (500) (450) (600) (130) (700) (200) 720 (180) 540 W.K. TAYLOR CONSULTING LTD. Typical Phase I Studies Load and Revenue Forecast Study Depreciation Study Lead-Lag Study Cost of Capital Studies Compensation Surveys Corporate Cost Allocation Study Capital Overhead Study CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. BC Hydro Revenue Requirements F2011 Actual F2012 Update F2013 Update F2014 Update Cost of Energy Operating Costs Taxes Amortization Finance Charges Return on Equity Non-Tariff Revenue Inter-Segment Revenue Deferral Accounts Deferral Account Additions Interest on Deferral Accounts Deferral Account Recoveries Total Other Regulatory Accounts Regulatory Account Additions Interest on Regulatory Accounts Regulatory Account Recoveries Total 1,309.1 909.7 177.4 501.4 495.4 588.9 (102.4) (89.2) 1,203.2 1,366.7 183.9 616.4 570.7 594.5 (82.9) (38.6) 1,348.3 1,386.1 193.1 634.3 613.8 566.4 (79.5) (39.5) 1,469.5 1,305.7 202.7 625.0 667.2 599.1 (81.2) (40.0) (295.5) (30.0) 112.9 (212.6) (65.9) (39.4) 89.2 (16.1) (103.2) (39.4) 94.3 (48.3) (46.3) (40.3) 99.4 12.8 (171.1) (8.0) (56.5) (235.6) (669.5) (15.0) 92.9 (591.6) (696.2) (28.3) 145.0 (579.5) (600.0) (41.2) 90.2 (551.0) Subsidiary Net Income Less Other Utilities Revenue Less Deferral Rider Total Rate Revenue Requirement (71.9) (16.3) (112.9) 3,141.1 (134.5) (14.6) (89.2) 3,568.1 (115.3) (14.8) (94.3) 3,770.9 (118.9) (15.5) (99.4) 3,976.1 Rate Revenue at Current Rates 3,141.1 3,323.0 3,360.1 3,409.7 Revenue Shortfall Rate Increases (May 1 for F2012) CAMPUT 2015 Energy Regulation Course 245.0 8.00% 410.8 3.91% 566.4 3.91% W.K. TAYLOR CONSULTING LTD. BC Hydro CWIP F2011 Actual F2012 Update F2013 Update F2014 Update Capital Expenditures 1,620.0 1,699.2 2,271.4 2,289.1 Capital Additions 1,411.8 1,384.2 1,368.4 1,437.1 Unfinished Construction Beginning of Year Adjustment to Opening Balance Change in Unfinished End of Year Mid-Year Balance 1,390.6 7.3 208.2 1,606.1 1,498.3 1,606.1 0.0 315.0 1,921.1 1,763.6 1,921.1 0.0 903.0 2,824.1 2,372.6 2,824.1 0.0 852.0 3,676.1 3,250.1 CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD. Summary Carefully test the capital forecast. Capital is expensive; once in rate base, a capital project impacts the revenue requirement for the life of the facility. The choice of income tax method and CWIP treatment will shift costs between generations of customers, but impacts life-time revenue requirements and can impact the cost of raising capital. Also carefully test the revenue forecast. Watch the regulatory account and CWIP balances. Study the financial schedules. CAMPUT 2015 Energy Regulation Course W.K. TAYLOR CONSULTING LTD.