Section 3: Institutional risks materialise

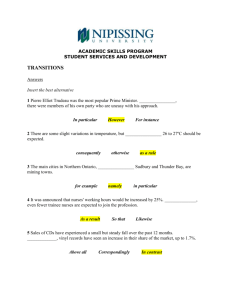

advertisement

Section 3: Institutional risks materialise Chart 3.1 Major UK banks’ and LCFIs’ credit default swap premia(a)(b) Sources: Markit Group Limited, Thomson Datastream, published accounts and Bank calculations. (a) Data to close of business on 20 October 2008. (b) Asset-weighted average five-year premia. (c) April 2008 Report. Chart 3.2 UK GDP growth forecast dispersion and major UK banks’ credit default swap premia Sources: Consensus Economics Inc., Markit Group Limited, Thomson Datastream and Bank calculations. (a) Based on the standard deviation of forecasts of current and year-ahead GDP growth collected by Consensus Economics Inc. A value of one indicates average dispersion of forecasts between January 1998 and October 2008. (b) Monthly average of asset-weighted five-year CDS premia except for last estimate, which is the average to close of business on 20 October 2008. Table 3.A Major central bank operational announcements since April 2008(a) May Bank of England Federal Reserve Announced that expanded three-month long-term repos would be maintained in June and July. Expanded size of Term Auction Facility (TAF). European Central Bank Co-ordinated central bank announcements(b) Expansion of agreements between Federal Reserve and European Central Bank. Extended collateral of Term Securities Lending Facility (TSLF). July Introduced 84-day TAF. Primary Dealer Credit Facility (PDCF) and TSLF extended to January 2009. September Announced that expanded three-month long-term repos would be maintained in September and October. Announced long-term repo operations to be held weekly. Announced that it would conduct operations under the 84-day TAF to provide US dollars to European Central Bank counterparties. Authorised the auction of options for primary dealers to borrow Treasury securities from the TSLF. Announced that supplementary three-month longer-term refinancing operations (LTROs) would be renewed in August and September. Expanded collateral of PDCF. Announced six-month LTROs would be renewed in October, and three-month LTROs would be renewed in November and December. Expanded size and collateral of TSLF. Announced provision of loans to banks to finance purchase of high quality asset-backed commercial paper from money market mutual funds. Conducted Special Term Refinancing Operation. Extended drawdown period for Special Liquidity Scheme (SLS). October Extended collateral for one-week US dollar repos and for three-month long-term repos. Extended collateral of all extended-collateral sterling long-term repo operations, US dollar repo operations, and the SLS to include bank-guaranteed debt under HM Government’s bank debt guarantee scheme. Expansion of agreements between Federal Reserve and European Central Bank. Establishment of swap agreements between Federal Reserve and Bank of England, subsequently expanded. Bank of England and European Central Bank, in conjunction with Federal Reserve, announced operation to lend US dollars for one week over quarter end, subsequently extended to scheduled weekly operations. Announced payment of interest on required and excess reserve balances. Increased size of six-month supplementary LTROs. Increased size of TAFs. Announced reduction in corridor of standing facilities from 200 basis points to 100 basis points around the interest rate on the main refinancing operation. Announced creation of the Commercial Paper Funding Facility. Introduced swap agreements with Swiss National Bank. of funding. Announced schedules for TAFs and Forward TAFs for auctions of US dollar liquidity during the fourth quarter. European Central Bank and Bank of England announced tenders of US dollar funding at 7-day, 28-day, 84-day maturities at fixed interest rates for full allotment. Swap agreements increased to accommodate required level Announced Operational Standing Facilities and a Discount Window Facility, which together replace existing Standing Facilities. Sources: Bank of England, European Central Bank and Federal Reserve. (a) Data to close of business on 20 October 2008. (b) Co-ordinated actions also involved on one or more occasions some or all of the Bank of Canada, Bank of Japan, Danmarks Nationalbank, Norges Bank, Reserve Bank of Australia, Sveriges Riksba Chart 3.3 Three-month interbank rates relative to expected policy rates(a)(b) Sources: Bloomberg and Bank calculations. (a) (b) (c) (d) (e) Spread of three-month Libor to three-month overnight indexed swap rates. Data to close of business on 20 October 2008. April 2008 Report. Fannie Mae and Freddie Mac taken into conservatorship. Lehman Brothers Holdings files for Chapter 11 bankruptcy protection. Chart 3.4 Equity prices of distressed institutions(a) Sources: Bloomberg and Bank calculations. (a) (b) (c) (d) (e) Data to close of business on 20 October 2008. Fannie Mae and Freddie Mac taken into conservatorship. Lehman Brothers Holdings files for Chapter 11 bankruptcy protection. Benelux, Icelandic and UK governments nationalise or take stakes in banks. UK authorities announce comprehensive package of measures. Chart 3.5 Capital positions of Fannie Mae and Freddie Mac Sources: Bloomberg and published accounts. Chart 3.6 US securities’ houses exposures to structured credit as a proportion of total assets at end-2008 Q3(a) Sources: Published accounts and Bank calculations. (a) Includes exposures to leveraged loans and asset-backed securities where details disclosed by firms. Chart 3.7 Major UK banks’ and LCFIs’ market capitalisation Sources: Bloomberg and Bank calculations. Chart 3.8 90-day US Treasury bill yield(a) Source: Global Financial Data. (a) Data to close of business on 20 October 2008. Chart A Outstanding notional amounts of derivatives Source: BIS. Chart B Gross market value and net credit exposures in OTC derivatives Source: BIS. Chart 3.9 US money market mutual funds’ total assets under management(a) Sources: Bloomberg and Investment Company Institute. (a) Comprises US dollar assets of retail and institutional funds. (b) Lehman Brothers Holdings files for Chapter 11 bankruptcy protection. (c) US Treasury announces temporary guarantee programme for US money market mutual funds. Chart 3.10 Maturity profile of US commercial paper issuance(a) Source: Board of Governors of the Federal Reserve System. (a) Data to close of business on 20 October 2008.