p 1

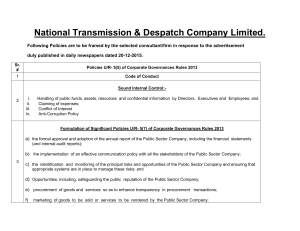

advertisement

Practical Public Sector

Combinatorial Auctions

S. Raghavan

University of Maryland

(joint work with Robert Day, University of Connecticut)

Full paper

“Fair Payments for Efficient Allocations in Public Sector

Combinatorial Auctions”, Management Science, Vol 53, No 9,

September 2007, pp1389-1406.

What is a Combinatorial Auction?

• Any auction for multiple items in which bidders may

bid on combinations of items, rather than placing bids

on items individually.

• Advantages:

– Complements: don’t have to get stuck with less

than what you want

– Substitutes: don’t have to get stuck with more than

what you want

• Disadvantages:

– Potential computational difficulty for determination

of winners, payments, and strategies

C.A. Applications

• Landing slots at airports to control

congestion

• Award of Spectrum to Telecom Co’s

• Shipping Lanes

(reverse auction)

• Industrial Procurement (reverse auction)

– CombineNet: world leader in industrial CAs

Auction Goals

• Efficiency: the items being auctioned go

to those who value them most.

• Price Discovery: an iterative process

allows competitors to learn about

supply-demand pressures to determine

market value of items

The General Winner Determination Problem:

Maximize: wd(J) =

bj(S) xj(S)

jєJ S in I

subject to:

xj(S) 1 , for each good i

jєJ

S|iєS

xj(S) 1 ,

for each bidder j

S in I

Where

xj(S) = 1 if bidder j receives set S

= 0 otherwise

bj(S) = bidder j’s bid on set S

Complexity of the General Winner

Determination Problem (WD)

• NP-hard for arbitrary bids

• Many special cases are solvable in polynomial-time

(Rothkopf, Pekec, Harstad)

• Given advances in computing power, and

optimization methodologies, most practical WD

problems can be solved to optimality in practice.

• Additionally, hybrid variations of combinatorial

auctions have been proposed where initially

separate parallel auctions are conducted (clock

phase) for the items, followed by one final round of

combinatorial auction (proxy phase).

Classic auction theory

• English auction: 1 item, price rises until only one

willing buyer remains

– Provably optimal strategy: stay in until price

reaches your true value

– Winner pays one bid increment above second

highest bidder’s value

• Sealed-bid auction:

– Each bidder submits value for item

– First-price variation: pay-what-you bid

– Second-price variation: winner pays second

highest bid

Properties of the Second-price

Sealed-bid Auction for 1 item

• Individual Rationality (IR): Bidders each

expect a non-negative payoff

• Efficiency: the highest bid wins

• Dominant Strategy Incentive Compatibility:

Misreporting value never gives an advantage

• The “Core” property: no coalition can form a

mutually beneficial renegotiation among

themselves (notion of core akin to a stable

outcome)

The Beautiful Generalization:

The Vickrey-Clarke-Groves (VCG) Mechanism

Focus in mechanism design on Incentive Compatibility

There is a unique mechanism that satisfies:

– Individual Rationality

– Efficiency

– Dominant Strategy Incentive Compatibility

for a general set of items with arbitrary preferences.

Each winning bidder j gets a discount equal to:

wd(J) – wd(J \ { j } )

VCG example (substitutes)

• b1(A) = 4, b1(B) = 3, b1(AB) = 6

• b2(A) = 3, b2(B) = 4, b2(AB) = 5

Efficient solution: bidder 1 gets A, bidder 2 gets B

Discount to bidder 1: wd(1,2) = 8, wd(2) = 5,

discount = 8 – 5 = 3, payment = 1.

Discount to bidder 2: wd(1,2) = 8, wd(1) = 6,

discount = 8 – 6 = 2, payment = 2.

Interpretation: Each bidder pays the min. amount

necessary to take her good away from the other

The problem with VCG!

The Quintessential Example

• b1(A) = 2,

b2(B) = 2,

b3(AB) = 2

VCG outcome: Bidder 1 and 2 pay zero

The seller would be better off bargaining with bidder 3

for non-zero payment (both would prefer it)

Thus, this outcome is not “in the Core”

Non-monotonicity over bids:

– More bids can mean lower revenue for the seller!

Such (non-core) payments are not acceptable in a

public sector setting.

Impossibility result in the

combinatorial auction setting

• Suppose we want a sealed-bid Combinatorial Auction

that has all the nice properties of the second-price

auction for one item:

Impossibility Result:

No mechanism can simultaneously satisfy:

–

–

–

–

Individual Rationality

Efficiency

Dominant Strategy Incentive Compatibility

the Core property

for a general set of items with arbitrary preferences

The Practical Generalization:

Core-Selecting Mechanisms

• Prevailing attitude in Mechanism Design literature:

Incentive Compatibility must be upheld (a constraint.)

• Since VCG is not practically viable we must drop DS

Incentive Compatibility as a hard constraint

– (IR and Efficiency must stay)

• The perspective of core-selecting mechanisms:

Incentive compatibility is an objective

– Maintain IR, efficiency, and the core property (with

respect to submitted bids) as constraints

– minimize the incentives to misreport

The Core

• An Allocation / Payment outcome is blocked

if there is some coalition of bidders that can

provide more revenue to the seller in an

alternative outcome that is weakly preferred

to the initial outcome by every member of the

coalition.

• An unblocked outcome is in the core.

• A Core-Selecting Mechanism computes

payments in the core with respect to

submitted bids.

5 bidder example with bids on {A,B}

• b1{A} = 28

Winners

• b2{B} = 20

• b3{AB} = 32 VCG prices:

• b4{A} = 14 p1= 14

• b5{B} = 12 p2= 12

The Core

Bidder 2

Payment

b4{A} = 14

b3{AB} = 32

b1{A} = 28

Efficient outcome

b2{B} = 20

20

The

Core

12

b5{B} = 12

14

28

32

Bidder 1

Payment

VCG prices: How much can each winner’s

bid be reduced holding others fixed?

Bidder 2

Payment

b4{A} = 14

b1{A} = 28

b3{AB} = 32

b2{B} = 20

20

The

Core

12

VCG

prices

b5{B} = 12

Problem: Bidder 3

can offer seller more

(32 > 26)!

14

28

32

Bidder 1

Payment

Bidder-optimal core prices: Jointly reduce

winning bids as much as possible

Bidder 2

Payment

b4{A} = 14

b1{A} = 28

b3{AB} = 32

b2{B} = 20

20

The

Core

12

VCG

prices

Problem: bidderoptimal core prices are

not unique!

14

b5{B} = 12

28

32

Bidder 1

Payment

Core point closest to VCG prices

Bidder 2

Payment

b4{A} = 14

b1{A} = 28

b3{AB} = 32

b2{B} = 20

20

Unique

core prices

15

12

VCG

prices

b5{B} = 12

Minimize

incentive to

distort bid!

14 17

28

32

Bidder 1

Payment

So why core (stable) pricing?

• Truthful bidding nearly optimal

– Simplifies bidding

– Improves efficiency

• Same as VCG if VCG in core (e.g., substitutes)

• Avoids VCG problems with complements

– Prices that are too low

• Revenue is monotonic in bids and bidders

• Minimizes incentive to distort bids

Representing the Core

• Formulation

pj ≥ wdC(p)

For all coalitions C in J

jєW

Exponential number of coalitions so

exponential number of constraints!

Use constraint generation to determine

minimum sum total payments over the

core.

The Separation Problem:

Finding “the most violated blocking coalition”

for a given payment vector pt

• At pt , reduce each of the winning bidder’s

bids by her current surplus:

That is let bj(S) = bj(S) – (bj(Sj) - pjt )

• Re-solve the Winner Determination Problem

• If the new Winner Determination value

> Total Payments

• Then a violated coalition has been found

• Add to core formulation and re-iterate

Adjusting payments

Minimize pj

jєW

pj ≥ wd(pτ) - pjτ for each τ ≤ t

j є W \ Cτ

j є W ∩Cτ

and for each j є W

pjVCG pj bj(Sj)

Example of the Procedure

Winning Bids

b1 = 20

Non-Winning Bids

b4 = 28

b5 = 26

b6 = 10

b2 = 20

b3 = 20

b7 = 10

b8 = 10

VCG payments

Blocking Coalition

p1 = 10, p2 = 10, p3 = 10

p4 = 28, p3 = 10

Example of the Procedure

Winning Bids

b’1 = 10

Non-Winning Bids

b4 = 28

b5 = 26

b6 = 10

b’2 = 10 b’3 = 10

b7 = 10

b8 = 10

VCG payments

Blocking Coalition

p1 = 10, p2 = 10, p3 = 10

p4 = 28, p3 = 10

Adjusting payments (1)

Minimize pj

jєW

p1 + p2 ≥ 38 – 10 = 28

for each j є W

pjVCG pj bj(Sj)

New payments

p1 = 14, p2 = 14, p3 = 10

Example of the Procedure

Winning Bids

b’1 = 14

Non-Winning Bids

b4 = 28

b5 = 26

b6 = 10

b’2 = 14 b’3 = 10

b7 = 10

b8 = 10

New payments

Blocking Coalition

p1 = 14, p2 = 14, p3 = 10

p2 = 14, p5 = 26

Adjusting payments (2)

Minimize pj

jєW

p1 + p2 ≥ 28

p1 + p3 ≥ 26

for each j є W

pjVCG pj bj(Sj)

New payments

p1 = 16, p2 = 12, p3 = 10

Winning Bids

b’1 = 16

Non-Winning Bids

b4 = 28

b5 = 26

b6 = 10

b’2 = 12 b’3 = 10

b7 = 10

b8 = 10

New payments

No Blocking Coalition exists:

p1 = 16, p2 = 12, p3 = 10

These payments are final

Conclusions

• Core mechanisms provide a practical alternative to VCG

when VCG does not work well

• Separation problem provides complexity result: finding a

core point is NP-hard iff Win. Det. is NP-hard

• Analogous to Second Price Mechanism: if bids were

replaced by payments, they would just be enough to be

winning

• When VCG does work well (is in the core) the outcomes

are the same (Ausubel and Milgrom)

• Government combinatorial auctions (FAA (USA) and

OfCom (UK)) using the quadratic rule described here are

ongoing