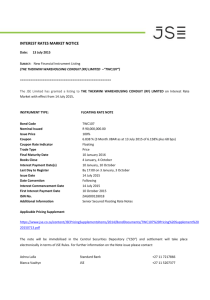

JSE Securities Exchange

advertisement

STRATE Ltd Dr Maria Vermaas Head of Legal Services 1 Introduction by JSE Securities Exchange Elbi J van Vuuren Legal Counsel Introduction Relationship between JSE and STRATE Importance of legislation to the JSE World-class settlement integrity introduced by STRATE 2 Settlement Risk amongst 20 Emerging Markets 1998 to 2003 WORST 1998 1999 2000 2001 2002 2003 India 18.76 41.48 71.42 80.66 91.77 92.71 Indonesia 74.11 56.61 67.22 77.32 96.95 99.41 South Africa (1.28) 0.14 36.41 58.48 98.13 97.62 Venezuela 60.41 53.08 46.31 53.11 65.12 64.61 Source = GSCS Benchmarks Settlement risk includes factors such as : Interest rate and overall cost of failed trades 3 Settlement Risk Ratings in 2004 for South Africa Settlement Safekeeping SA 98.56 94.86 UK 96.58 92.51 US 95.71 93.64 4 What is STRATE? Electronic settlement of equity, bonds and money market instruments (Late 2005) The CSD for financial instruments in South Africa Electronic transfer of ownership within SAFIRES Transfer of value via the Central Bank (SARB) 5 STRATE Ltd Corporate Structure ABSA Nedcor Standard Bank First Rand Citibank Ownership JSE 41% 59% STRATE Ltd CSDP A CSDP B CSDP C Participation 6 Board Members • • • Chairman: – Mervyn King Jse Securities Exchange: – Russell Loubser – Leanne Parsons – Des Davidson – Bobby Johnston Banks: – Johan Geldenhuys (ABSA) – Angela Hardwick (FirstRand) – Vernon Heunis (Nedcor) – Simon Ridley (Standard Bank) • Listed Companies: – Annamarie van der Merve • Executive Director: – Monica Singer – CEO – Erna Solomon – COO • Independent Non-executives: – Nigel Payne* – Rick Cottrell** • * Chairman of Audit & Risk Committee ** Chairman of Regulatory Committee Other: – Tom Lawless (BESA) – Stephan Malherbe – Trevor Cross – Arthur Cousins 7 Regulation Financial Services Board JSE STRATE SECA CASA Listing Requirements Rules Directives Companies Act 8 Background to STRATE • October 1996-project begins • May 1998-contract for system implementation signed with TCS and SARB goes live with SAMOS • 1999-Legislation amendments approved by Parliament • November 1999-system live with Harmony Gold Mine • July 2000-2001 - 12 more companies into STRATE • March 2001- schedule for all companies to move into STRATE approved • January 2002-all listed companies settling in STRATE • August 2003-merger with Unexcor and CD Ltd approved 9 Benefits of STRATE Contractual settlement; guaranteed by the JSE Rolling 5 day settlement= settlement certainty Optimum use of liquidity - cash and shares Electronic record vs paper Complete Shareholders’ Register Transparency of ownership- Beneficial Owner Download Simultaneous, Final, Irrevocable, Delivery versus Payment 10 Benefits of STRATE Reserve Bank connectivity and payment in Central Bank funds Electronic execution of corporate actions with no claims Automated functionality for securities lending and borrowing Electronic pledging S.W.I.F.T. messaging and ISO 15022 Discipline through increased level of regulation G30 compliance and beyond Worst settlement risk amongst emerging markets replaced with “the most sophisticated” (Global Custody Review, 2003) 11 What is dematerialisation? Dematerialisation is the process of exchanging scrip (physical certificates and certified deeds) for an electronic record of ownership. 12 Equities by Value- Dematerialisation Value of the dematerialised shares as a % of the market capital 5.22% dematerialised in STRATE held by investors in certificated form outside of STRATE 94.78% 13 Transfer of shares • Change of ownership linked to debiting and crediting (S 91A(4)(a)) • Change of ownership effective provided that transferee acts without notice (S 91A(4)(c)) 14 Rights of recourse • Actio ad exhibendum – Action for damages to owner against thief or other mala fide possessor • Criminal claim against perpetrators of fraud • Action on negligence 15 Rights of recourse (cont.) • Claims under S 91A(8) – Taking of unlawful action – Which causes removal/omission of name from register – Gives rise to liability for direct loss / damage arising out of such action 16 Loss of dividend? • Loss by depriving true owner of dividend • S 91A has not changed this position in any way • Include losses in a rights issue or unbundling or any other distribution • Registry entry and ownership more closely linked than before 17 Dispossessed Members Fidelity Fund • Creation of fund • Claims lodged and accepted • Fund paid compensation to claimant where claimant has waived further actions, including S115 18 Legislative protection to dematerialised shareholders • S 91A enables SFIDVP • No longer claim against someone who became owner in good faith • Uncertainty of certificated transfers addressed (Oakland Nominees v Gelria) • S115 must be seen in context of practically insurmountable evidentiary difficulties • DMF – limited duration • Matter only to be resolved by legislation 19 Legislative protection to dematerialised shareholders • • • • Amendment to disapply S115 partially Essential safeguard to integrity of markets Internationally accepted principle Important to know that once shares are dematerialised, they will be clean 20 Questions www.strate.co.za THANK YOU! The South African Central Securities Depository 21 Glossary of terms BDA - Broker Deal Accounting System (back-office system of brokers) CSD - Central Securities Depository CSDP - Central Securities Depository Participant FSB - Financial Services Board JET - Johannesburg Equities Trading System JSE - JSE - Securities Exchange South Africa JSE SETS - JSE Trading System (Same as London Stock Exchange) 22 Glossary of terms SAMOS - South African Multiple Options System (SARB’s system for RTGS of cash) SECOM - Swiss settlement system SARB - South African Reserve Bank (Central Bank) SFI DvP - Simultaneous, Final, Irrevocable Delivery versus Payment SAFIRES - Southern African Financial Instruments Real Time Electronic Settlement System (Strate’s system) STP Straight Through Processing - 23