The Three R's

advertisement

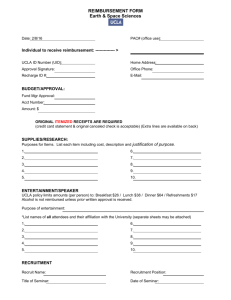

The Three R’s Recharge, Rebill and Reimbursement What does this document cover? • Understand the key characteristics of each of the three R’s • Understand the underlying accounting concepts that provide guidance on how these activities should be recorded • Understand how to apply the accounting procedures 1 What is a Recharge? • Distinguishing Characteristics – Recharge − A recharge is a charge for goods or services provided by one internal university unit to other internal university units − Rates must be approved by the Office of Financial Analysis − These revenue generating (recharge) activities have rate structures that include direct costs such as technicians to maintain testing equipment, office staff to administer billing and timekeeping, supplies consumed and the cost of equipment maintenance contracts; etc. − Units who recharge usually operate in the auxiliary fund range, and most typically in the Internal Services Fund (52000) • Example: A Chemistry Lab analyzes samples for another academic department − The Chemistry department charge the academic department’s chartfields at an expense account 613225 (Chemical Analysis Fees) − The Chemistry department records recharge revenue on their chartfields at account 410000 (General Recharge Revenue) 2 Accounting for Recharge Activity − Recharge activity must be billed through the Service Unit Billing (SUB) process − Changes to the SUB process • Additional required fields (Fall 2014) − Contact Financial Operations/Shared Services for training or questions about the SUB process − Contact the Office of Financial Analysis for questions about recharge 3 What is a Rebill? • Distinguishing Characteristics – Rebill − A rebill is a specific type of cost transfer: • Moving the original cost of a good/service from the unit that was originally charged to the unit that utilized the good/service − Rebill activity is not revenue generating because the unit receiving funding is receiving a reduction in expense − A rebill can be made between most operating funds and some nonoperating funds − Preferred method of rebilling is through service unit billings (SUB) • Example: A central unit purchases test tubes in bulk at a discounted rate. They charge other units for the test tubes at the purchase price. − The central department credits their chartfields for their sub-unit’s portion of the expense on account 618350 (Laboratory Supplies) − The central department debits the other units for their portion of the expense on account 618350 (Laboratory Supplies) 4 Accounting for Rebill Activity − All rebill activity must be recorded as a reallocation of expenses instead of revenue − Options: • Move the expense using the original expense account on both sides of the service unit billing or journal entry • A University-wide rebill program (REBIL) has been created to help identify rebill activity • Contra-expense accounts in the “Internal Rebill” range of accounts (620200 to 620999) have been expanded to help identify rebill activity − Contact Financial Operations/Shared Services regarding any questions 5 What is a Reimbursement/Rebate • Distinguishing Characteristics – Reimbursement/Rebate − Personal Reimbursement • Payment received from an individual to reimburse the university for resources used for personal benefit • The personal use of university resources should be discouraged − Institutional Reimbursement • Payment received from another organization to reimburse the university for resources used on their behalf or for their benefit − Reimbursements/Rebates are non-revenue generating activity because the university is only receiving the original cost of the good or service utilized − Reimbursements/Rebates are recorded via a Cash Receipt (CR) ticket to deposit funds back into the university’s account • Example: − Reimbursement - An employee uses their business phone to make a personal long distance call. A Cash Receipt is used to credit the department’s chartfields (reduce expenses) at account 611250 (Long Distance) − Rebate - A department purchasing a computer is sent a $50 rebate. A Cash Receipt is used to credit the department’s chartfields at account 614390 (computers under $5,000) 6 Accounting for Reimbursement/Rebate − Reimbursements/rebates must be recorded as negative expenses against the same account where the original expense was incurred − Rebates are a form of reimbursement − Contact Financial Operations/Shared Services regarding any questions 7 What resources are available? • Financial Operations: www.finance.umich.edu/finops/accounting/service_unit_billings • Office of Financial Analysis: www.finance.umich.edu/analysis 8