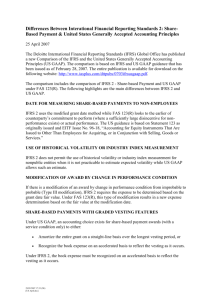

Document

advertisement

LACPA- IFRS 2 July 5, 2006 Roger Nasr Share-Based Payment. Agenda • Overview of IFRS 2 – Scope and Definition – Recognition – Measurement – Vesting Conditions – Valuation • Case studies – Grant date – Graded vesting – Market conditions IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Overview • Scope exclusions – Issuance of shares in a business combination (IAS 22) – Share based payments in the scope of IAS 32 & 39 – Share based payments other than for goods or services • Definition –Transaction in which an entity receives or acquires goods or services in exchange for: – Equity instruments OR – Based on the price of equity instruments IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Types –Equity settled –Cash settled –Choice between the two alternatives IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr New – IFRS 2 Share based payments Share based payments Goods or services Asset IFRS 2 Share-Based Payment Expense Equity instruments/ Liabilities (linked to share price) Equity Liability © 2006 Deloitte - Roger Nasr New – IFRS 2 Overview of recognition With cash alternative Equity settled Cash settled Fair value grant day only Fair value each balance sheet date (Measure at each balance sheet) No changes in fair value Changes in fair value in P&L until exercise Changes if fair value follow split IFRS 2 Share-Based Payment Equity component (measure at grant date only) Cash component © 2006 Deloitte - Roger Nasr New – IFRS 2 Equity settled payments Equity settled Employees or similar Other than employees Fair value grant date only Value goods or services at date received Expense allocated over vesting period Expense recognised as goods or services are used IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Vesting conditions • Vesting conditions means that the employee does not get the right to exercise options, unless certain conditions are met • Two types of vesting conditions – Market based – Achieve a target share price or share price relative to an index – Non-market based – Employment – Accounting key figures (e.g. EPS, revenue targets) – Personal targets – IPO of the company – Sale of the company IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Vesting Conditions • Issuance of fully vested shares • relates to past service therefore expensed immediately • Issuance of shares with a vesting period • relates to services over vesting period: expense over vesting period • Two types of vesting conditions:` 1. Non-market based vesting condition OR 2. Market based vesting condition Fair value excludes vesting conditions Fair value includes these vesting conditions True-up Adjust number of shares or vesting date for actual results No true-up Do not adjust number of shares or vesting date for actual results IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr New – IFRS 2 Valuation models Black-Scholes method IFRS 2 Share-Based Payment Binomial method © 2006 Deloitte - Roger Nasr Example 100 options each that vest if employed in 3 years 5 0 0 Fair value per option = $15 Total grant date value? $750,000 (=500x100x15) $250 each year Adjust expense for actual vested shares since there is a non-market vesting condition IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Example (continued) If 80% are expected to vest (and does vest) Year 1 $200,000 Year 2 Year 3 $200,000 $200,000 $600,000 total expense over three years (50,000 options x 80%) x $15 IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Example (continued) IF At the end of year 1: expect 85% of options to vest At the end of year 2: expect 88% of options to vest At the end of year 3: 44,300 shares (or 88.6%) actually vest Year 1 $212,500 (250 x 0.85) Year 2 Year 3 $227,500 $224,500 (500 x 0.88 212.5) (750 x 0.886 (212.5 + 227.5)) Total expense = $664,500 ($15 x 44,300) IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Example (continued) All employees resign during period 3 without receiving options (or another non-market vesting condition is not met) Year 1 Year 2 $200,000 $200,000 (250 x 0.8) (250 x 0.8) Year 3 - $400,000 - (250 x 0.8) x 2 $0 total expense reduced to zero because no options vest IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Case studies Case study 1 • Accounting for a grant of options with graded vesting conditions – What expense is recognised in year 2 and why? IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Case study 2 • Grant date – Why is the determination of grant date important? How does grant date impact the period over which any expense relating to a sharebased payment is recognised? (discussion) – What is the grant date for the share options? – Over what period should the expense in relation to the share options be recognised? – Does this have any impact on the determination of the fair value of the share options granted? IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Case study 3 • Definitions of market conditions – Determine whether the vesting conditions for the share-based payment transaction of Lamentana and Benson should be considered a market condition or a non-market condition IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr Questions IFRS 2 Share-Based Payment © 2006 Deloitte - Roger Nasr