Absorption income statement Marginal income statement

advertisement

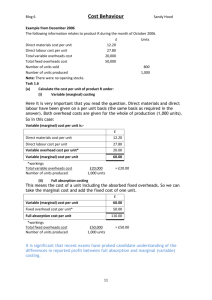

Cost analysis for planning and decision making Session 1-3 Cost classification and approach • Marginal costing ▫ variable and fixed Variable cost is charged to the product unit Fixed cost is charged against the profit period as expense. • Absorption costing ▫ Direct and indirect cost Variable and fixed cost are charged to unit output or activity. Cost behavior Fixed cost Step fixed Variable cost Total cost Calculate the cost per unit Production 5,000 unit Fixed cost $200,000 Variable cost per unit $300 Relevant range • is the range of activity for which our assumptions about constant fixed and constant unit variable hold true Determining the variable and fixed cost • • High and low method Assessing cost through scatter graph High and low method • Identify the highest and lowest production • We subtract the cost of the highest level of production with the cost of the lowest level of production. • We assume that the increase is the variable cost. • we divide the additional cost against the additional units. To give us the variable per unit. • We test it against any month production to get the fixed cost. Example • pg 13 Assessing costs using the scattered graph • We plot the data into graph and try to draw a line that passes into all the points “best fit” • We set out the fixed cost at the level were the line meets the vertical axis which the activity is zero. • Its better that the high and low because high and low test the relationship only by two points • Drawing pg 14 Scatter graph method Direct and indirect cost • Direct cost ▫ All costs that can be directly attributed to a cost object and that can be traced to it in an economical feasible way. • Indirect cost “overhead” ▫ All costs that cannot be directly traced to a cost object in an economical feasible way. Example: direct and indirect cost XYZ company produces calculators. Decide whether these cost are direct or indirect • Component parts - direct cost • Production labor - direct cost • Administration labor – indirect cost • Depreciation of equipment – indirect cost Cost and decision making • Organizations should be aware of its cost structure and cost control, to help them in decision making. • Cost can be classified according to: ▫ ▫ ▫ ▫ Nature “subjective”: ex. Material , labor, expenses Purpose “objective” : is direct and indirect Function: ex. Production , administration Behavior: ex. Fixed , variable , semi variable , stepped fixed ▫ Normal/abnormal: whether unusual event have effected cost ▫ Controllable/non-controllable: could manager influence cost ▫ Relevant/ irrelevant: this is used for decision making Cost center cost objective • Cost center: ▫ Defined as where in the company cost are gathered and then attributed to the unit “usually department” • Cost objective: ▫ Refers to any thing or activity for which a separate measurement of cost us desired The importance of accurate measurement of cost • • • • • Provide basis of assessing past performance Planning for future operations Monitoring actual performance against budget Assisting decision basis Assisting cost reduction and control The nature of production costs in terms of material, labor and overhead • Cost cards is used to record all elements of cost in a unit produced. • Production cost can be classified to the following: ▫ Material ▫ Labor Two method we can calculate wages: Time related method: ▫ time spent on job needed ▫ Hours * per hour Performance method: ▫ relevant to the units produced ▫ Minimum wage plus performance rate pay Cost can be allocated to cost center or a unit It can be direct and indirect, fixed and variable. ▫ Overhead Its relate to expenditure on labor, material or services which cannot be economically identifies with specific sellable cost of unit. (rent, insurance) The concept of contribution • Contribution means the contribution every unit sold makes first toward covering fixed cost and the towards profit. • Contribution per unit= selling price per unit – variable cost per unit Example: selling price $100 per unit variable cost $60 per unit. Break even • Break even occurs when there is neither a profit nor a loss. • Breakeven point (units) = total fixed cost/ contribution per unit • Breakeven point (dollars) = total fixed cost/ contribution to sales ratio • If we want to know the effect of change in sales to the contribution we use “contribution to sales ratio” =(contribution per unit/ sale revenue per unit)*100 Break even – sales mix • Breakeven point (units) = total fixed cost/ weighted average contribution per unit • Breakeven point (dollars) = total fixed cost weighted average contribution per unit ratio • Weighted average CM: Sum of (CM * sales mix%) • Sales mix % = sales mix of a product/ total sales mix • Target profit = total fixed cost+ target profit/ weighted average contribution per unit Break even – sales mix Product A Product B Sale price per unit 50 40 Variable cost per unit 20 15 Sales mix 3 4 Total fixed cost 15,000 • Calculate the Break even in units with proof • The company wants to earn net income of 20,000 how many units the company needs to sell. Break even graph Profit volume graph Margin of safety • Indicates by how much sales may decrease before a loss occurs : ((expected sales- breakeven sales)/expected sales) *100 • Targeted profit= (Targeted profit + fixed cost)/contribution per unit Limitation of break-even analysis • The relationships between the variables are assumed to remain constant. • Profits are calculated on marginal costing basis. • Linearity is assumed , variable cost and sales revenue change in direct proportion and in the same direction as changes in activity level. • Relevant range need to be consider • A constant sales mix or single product is assumed Limiting factor analysis “key factor” • When any recourse is scarce management should maximize the contribution per unit of that scarce resource. • Which means to ensure that the resource used most effective and efficient way. example A company produces 3 product and have limited 12,000 machine hours. How much of each component the company should manufacture: Absorption costing • It seeks to absorb all production cost whether fixed or variable, direct or indirect into a given cost object. • It assumes • Absorption rate is used to allocate the indirect cost. • The basis used for absorbing indirect cost into product units include: ▫ ▫ ▫ ▫ ▫ ▫ Direct labor hours Direct production hour/machine hour Units produced Percentage of sales value Percentage of direct cost Activity consumption (ABC) Absorption costing • Absorption cost attempts to take into account the cost of all resources needed to make a unit, while marginal cost takes into account only the variable cost • Absorption costing is used to estimate the price of a unit, while marginal cost is used to estimate the extra job / production contribution. Example Material Labor Production over head 20 kg $4 4 hours $6 4 machine hours $2 Fixed overhead $500 Unit produced 50 units Over and under absorption of overheads • Budgets are used to implements plans but they must be checked against the actual data to insure that they are reliable and valid. • At the end of the period actual cost and the level of activity has to be checked against the plan. • Plans has to be adjusted to under-recovery or over-recovery of indirect cost. Example Description Activity level in units Indirect cost Budget Actual 10,00 10,560 $76,000 $77,340 Marginal costing • Marginal costing is the cost of supplying one more unit. • Marginal costing is concerned with the behavior of costs at different level of activity and it distinguishes between variable and fixed. • We check the marginal costing if the total cost change as the level of activity change by one unit. • Marginal costing is used internally and useful for decision making, while absorption external users. • Marginal costing is used to calculate the impact of changes in volume on contribution and in profit to be calculated readily. Example • Review the below information and give judgment if we should discontinue Product line A using absorption costing income statement? Adjust it to marginal costing income statement? Description Sales revenue Direct and indirect cost Net Profit /(loss) Product A 200,000 (230,000) (30,000) Product B Product C 300,000 500,000 1,000,000 (290,000) (460,000) (980,000) 10,000 Direct and indirect cost is allocated as follows Product A Variable cost 150,000 220,00 0 Fixed cost Product B 40,000 Product C 330,00 0 Total 20,000 Total 700,0 00 280,0 00 Description Level of activity Advantage disadvantage Absorption •Reasonably stable •It calculated the total cost of a unit of output is established. •Can be directly related to revenue generated •It has a problem in allocating fixed indirect cost which is subjective and lead to different answers. •Change in volume of activity have to be dealt with by calculating over or under recovery of indirect cost Marginal Less predictable •Recognize the effect of It does not recognize changing in volume on the full impact of fixed the total cost cost •avoid arbitrary method of allocating fixed indirect cost Absorption and marginal costing Absorption income statement Marginal income statement Sales revenue Less: Production cost: Direct material Direct labor production overhead Gross profit Less: non production: selling and administrative Distribution overhead R & D expense Net profit Sales revenue less: Direct material less: Direct labor Less: variable production Contribution Less: fixed cost: production overhead selling &administrative Distribution overhead R & D expense Net profit Absorption and marginal costing • Page 44 question 4.3 / 4.5 Absorption and marginal costing • Absorption costing approach rewards production activity by including share of the fixed cost in closing inventory. • Marginal costing take in account the variable cost and the closing inventory adjustment • Inventory valuation and the balance sheet value of closing inventory will be lower in a marginal costing statement. • Absorption and marginal costing differ in profit due to: ▫ Closing inventory fixed indirect production cost • The marginal costing recognize all cost in financial period which they are incurred • Absorption costing recognize indirect cost in the period which the product is produced Allocating of indirect cost to production and service departments • Allocate indirect non production cost to specific service department. • Reallocate the total indirect cost of each service department to production department. • cost per unit is calculated. • Page 49 example 4.6 Reciprocal allocation of indirect costs and service department • Allocation of indirect costs when service departments carry out work for each other. • This type of support activity is known as reciprocal support and a reciprocal allocation method and used to allocate indirect costs. • This approach allows the allocation method to reflect the mutual nature of inter- departmental activities. • Reciprocal approach is an accurate measure but it depend on decision of management (subjective) • Page 52 Pricing decision using absorption and marginal costing approaches • Cost plus price is the price decided by adding an amount to the costs to arrive to sales price. • There is two method to calculate the price of a product : ▫ Cost plus price Total cost / (1 – Profit margin %) ▫ Mark up Total cost * ( 1 + % of markup) • Page 54 Relevant and irrelevant cost • A relevant cost is one that will occur only if the course of action in question is undertaken. • Cost that can be avoided. • Irrelevant cost can be categories to: • Sunk cost • Committed cost • Non cash cost • Relevant cost is used for decision making and all irrelevant cost has to be neglected in time of taking a decision Decision making analysis • • • • Ignore Sunk cost Ignore Committed cost Ignore Non cash cost Use remaining cash cost for decision making including any opportunity cost Calculation of relevant cost for material labor and overhead • Pg 58 Keep or buy non current asset • Loss from selling old machine is irrelevant • Investment amount of old machine is sunk cost • Total revenue and cost of keeping an asset is relevant • New asset value is consider relevant • Page 60 Opportunity cost • Opportunity cost represent the cost of opportunity forgone as a result of taking one course of action. • Page 61 Purpose of information in business • • • • • Decision making Planning Controlling Recording transaction Performance measure Organization structure • Business consist of different functional areas: ▫ ▫ ▫ ▫ ▫ Sales and marketing Purchasing Finance Accounting Human resource • Also the decision making is made in different level: ▫ Strategic ▫ Tactical ▫ operational Accounting information system and business transaction • • • • • Business transaction Sales and purchasing Non current asset (capital expenditure) Overhead expense (revenue expenditure) Payoll Accounting information system and finance function • The finance function • Raise funds