Notes

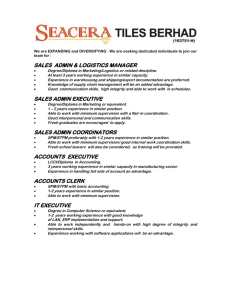

advertisement

SPTF Annual Meeting 2015: Day one notes Confronting the “SPM Skeptic”—How Far Have We Come in Ten Years? Speakers: Dina Pons, Incofin; Mukul Jaiswal, CASHPOR, India; Lubna Tiwana, Khushhalibank Pakistan. This session looked back over ten years, and reflected on some the voices of criticism and doubt we’ve heard about the SPM agenda. Dina Pons took the role of “interviewer”, putting challenging questions to Lubna and Mukul, who shared their diverse perspectives from the forprofit and not-for-profit sides of the industry. Q: In your daily work, what types of skeptics do you meet? Lubna: In the commercial microfinance world, I meet many types. First: those that challenge the microfinance model at the broadest level and think that it has zero impact on lives of poor. Second, there are those who don’t doubt the benefits of microfinance but question a particular institution’s capabilities to deliver the benefits to the clients. Thirdly, I see those that doubt the intentions of microfinance to be “social” at all – or believe that even if we have good intentions, we can’t turn them into real impact. And fourth, I see those that think that SPM is “whitewashing”— allowing MFIs to appear socially driven when they are actually profit-driven. These are generally people from equity stakeholders and management, but generally I’ve seen that much skepticism comes from those not closely associated with microfinance sector. Mukul: My experience contrasts strongly. We’ve been a not-for-profit from the start – and have never faced serious skepticism from any of our stakeholders, whether our funders, staff or board members. Our value proposition has been clear to everyone: we design products that meet clients’ needs, and we look at how our clients’ lives are changing over time. But despite being not-for-profit (we plough our surplus back into operations) and taking steps to integrate SPM into our mainstream microfinance operations – we do come across voices of doubt. Mostly these come from those who have limited knowledge about microfinance: bureaucrats, civil servants, politicians. Speaking candidly, this group also includes commercial bankers that don’t understand microfinance. They look at our interest rates and compare them with theirs, and are shocked at how high they are, so they accuse the microfinance industry of profiteering. Q: People often say that SPM is too confusing to be useful. What was your own entry point and what was your experience with that? Lubna: Those that don’t structure their SPM activities always find it confusing. When I came to Khushhalibank, I was looking for one single tool to put our “SPM house” in order, and do a selfassessment before undergoing a rating or external assessment. The SPI4 was useful for this, and it was my network (PMN) that pointed me towards it. It was also useful for external reporting and internal decision-making. The tools and systems are there – there’s really no need for confusion. Mukul: When you have a double bottom line, and are clear about your mission and objectives, there’s really no room for confusion about SPM. Our vision from the start was about reaching the poorest of the poor. We designed our own tools to measure poverty levels – the CASHPOR housing index (CHI), which looks at housing conditions/materials on a four-point scale. We’ve also used the Progress Out of Poverty Index (PPI), more latterly. We built many of our systems around these tools, including our IT systems, staff training, internal audit, and internal reporting. In addition internal audit started doing client exit surveys, and we undergo social ratings on a regular basis. Q: Some skeptics point out the cost of SPM. What do you say to this? Mukul: We’re working towards a double bottom line – so our cost structure needs to include SPM, by definition. And it’s not impossible to achieve – we were ranked in the top four MFIs globally on the MIX on key financial performance indicators such as efficiency, financial performance – and we’re generating a healthy return. So I don’t say that SPM hasn’t added costs – but we’ve looked for ways to reduce costs through automation, which is helpful. Lubna: I echo these statements. Once SPM is embedded into operational systems – the marginal additional costs goes down. Moreover, the benefits in terms of increased client loyalty and lower default are clear. At the client level, we can look at client outcomes and say it’s definitely valuable. Q: What do you say to the point that SPM is “white-washing” for commercial banks? Lubna: I agree that skeptics see SPM as an issue of branding rather than substance. But it’s their own skepticism that undermines the success of SPM. If you don’t commit to it, it won’t work. Yes we have a social mission, but we also have concrete social objectives and these are embedded into our strategy, so from our perspective it’s actually part of our institutional fabric, rather than white-wash. Q: How would you answer the skeptics that say that in a competitive market, SPM drains your profitability, which impacts your ability to compensate your staff well? Mukul: Yes, there’s a trade-off associated with SPM because it represents costs for your institution. But we’re not here to make the most profit possible, we’re here to do good things with the profit we do make. Here’s an example. I as a CEO have been given a target that our FSS should be between 105-115%, and anything outside of this, my incentives get cut. So that keeps me on track. Our operating principle is that whatever surpluses are generated, we do one of three things: we pass them on to clients through interest rate reductions or creating new training programmes. Second, we use our surpluses to strengthen our outreach to increase financial inclusion. Third, we invest in our staff. We invest in skill-building, competitive remuneration, and a good working environment. Q: I’ve heard from skeptics that say that processes and outputs are nice, but it’s the outcomes that matter. What do you say? Lubna: Through our dashboard, we track both. For example, we track numbers of client complaints – these can give you important signals that your processes might not be working correctly. Desired outcomes don’t happen by chance – process is important. Mukul: We’re tracking poverty profiles, and whether they are changing. This is all about outcomes. We collect a baseline of CHI and PPI scores for all clients, and track PPI over time. Further, we segregate by mature and new clients, on a sample basis (to keep costs down). In 2013, a social sciences research institute came in to do a study on us, and they found that 49% of our mature clients had progressed out of poverty, and I lost my bonus that year, because my target was 50%. Having outcomes data is useful for this very reason—we need to keep on track with our social objectives. Q: What about the level of skepticism? Has it changed over the last decade? Lubna: Looking back over the past 10 years, I can see awareness around SPM has increased. We have the processes, we can see the benefits. If there are those still in doubt – I think this is based on their own biases. But definitely those voices of doubt are subsiding, which is good to see. Q: Has SPM helped you weather some difficult times recently in India? Mukul: Certainly the number of skeptics has reduced over the past 10 years. Practice in India has changed a lot over the past 10 years – there’s more emphasis on transparency, responsible pricing, and ethical conduct. Because of this, there’s been a general improvement in terms of SPM practice and a reduction in skepticism. Q: If you wanted to equip a doubter with just one argument to convince them of the importance of SPM, what would it be? Lubna: I’d like to say that it’s important for everyone to construct their own social dashboard – because it’s important to have everything in one place to look at results and take good decisions. (see example social dashboard here). Being able to demonstrate the practicality of SPM is critical, as well as the benefits. Ultimately, a social dashboard which is owned unambiguously by the board is the end result of an SPM process which is fully embedded in the institution – in terms of data collection and analysis. Importantly, the dashboard also helps us to be a better business – and helps us to achieve stronger financial performance. Mukul: If you have a double bottom line, SPM should be embedded into your daily work. Don’t look at it as an additional cost – because social sustainability underpins financial sustainability.