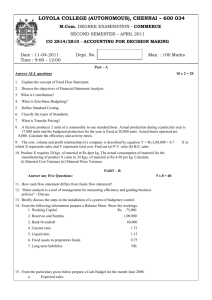

Chapter 7 – Business Accounting

advertisement

Chapter 7 – Business Accounting Syllabus Unit – Business Finance and Accounting You will learn ……………. • What is meant by “accounts” • Why businesses need to keep accounting records and use financial documents • Who uses these accounting records • What final accounts of a company contain – Profit and Loss Account – Balance Sheet • How the published accounts can be used to analyse the performance of a business Introduction • Accounts – The financial records kept by a business • Accountants – Professionally qualified people who have the responsibility for keeping accurate accounts and for producing the final accounts Why are accounts necessary? • Collection of money from customers • Ordering stock within limits • Cash flow • Profit/Loss • Tax Financial Documents involved in Buying & Selling • • • • • • • Purchase Order Delivery Notes Invoices Credit Notes Statement of Accounts Remittance Advice Slips Receipts Purchase Order Purchase Order To: Sweet Wholesalers Ltd Manor Road Newtown Abdul Sweets Ltd 15 Old Road Newtown Tel: 0381 865 4121 Fax: 0381 865 4022 Date: 18/4/10 Order No: 02/136 QUANTITY DESCRIPTION TOTAL PRICE 3 boxes @ $80 2 boxes @ $50 1 Box @ $50 Belgian Chocolates Crunch Nuts Juicy Fruits TOTAL $240 TOTAL $100 TOTAL $50 Deliver ASAP to the above address TOTAL $390 Delivery Notes • Used by supplier – Confirm goods have been received – Sign when goods delivered Invoices • Sent to supplier from customer – Request for payment for goods delivered – Should be checked Credit Notes • Issued if a mistake has been made – Wrong goods supplied – Shortage of products – Wrong price charged Statement of Account Statement of Account To: Sweet Wholesalers Ltd Manor Road Newtown Sweet Wholesalers Ltd Manor Road, Newtown Tel: 0381 862 3002 Fax: 0381 862 3220 Email: accounts @sweetwholsalers.com Account: Abdul Sweets Ltd Date Invoice No. Reference $ Value Outstanding 8/9/09 13/9/09 21/9/09 360 421 560 275X 273Z 2715A 240 100 390 Total 240 Total 100 Total 390 Total $630 Remittance Advice Slips • Usually sent with “statement of account” • Indicates which invoice is being paid • No duplication Receipts • Issued when customer pays an invoice Methods of Payment Recording Accounting Transactions Recording Accounting Transactions Who uses the final accounts in business? Trading Account (Basic) • Shows how the gross profit of a business is calculated Sales Revenue $50,000 Cost of Goods Sold $20,000 Gross Profit $30,000 Trading Account Sales Revenue Cost of Goods Sold Gross Profit 3,000 1,500 ???? 25,000 16,000 ???? 80,000 ????? 20,000 ????? 25,000 50,000 Trading Account (Typical) Newtown Trading Ltd Trading Account for year ending 31/3/10 Sales Revenue Opening Stock Purchases Total Stock Available Less Closing Stock Cost of Goods Sold Gross Profit $55,000 $10,000 $25,000 $35,000 $12,000 $23,000 $32,000 Trading Account Cost Per Unit Opening Stocks Purchases of Goods Closing Stocks Cost of Goods Sold $3 500 3,000 200 $9,900 $2 1,000 5,000 500 ????? $5 100 400 300 ???? $1 2,000 60,000 2,000 ????? Trading Account • Manufacturing Business – Direct Labour & Direct Production Costs will be deducted before arriving at the gross profit total Any more deductions need to be made? Profit and Loss Account • It shows how the “net profit” of a business and the retained profit of a company are calculated. • Net Profit – Is the profit made by a business after all costs have been deducted from sales revenue – Gross Profits – Overhead Costs Newtown Garden Nursery Profit and Loss Account For the year ending 31/3/09 Gross Profit Non-Trading Income Less Expenses: Wages and Salaries Electricity Rent Depreciation Selling and Advertising Expenses Net Profits $32,000 $ 5,000 $37,000 $12,000 $ 6,000 $ 3,000 $ 5,000 $ 5,000 $31,000 $ 6,000 Depreciation • It is the fall in value of a fixed asset over time. Profit and Loss Account for Limited Companies • Appropriation Account – After tax is distributed – either as dividends or kept in the company as retained earnings • Retained Profit – The net profit reinvested back into the business, after deducting tax and payments to owners, such as dividends Profit and Loss Account for Limited Companies 2005 Sales Turnover Cost of Sales Gross Profit Operating Expenses Operating Profit Interest Payable Net Profit (Profit before Tax) Corporation Tax Profit After Tax Dividends Retained Profit ($000) 1,250 900 350 105 245 50 195 35 160 120 40 2004 ($000) 1,300 900 400 120 280 40 240 40 200 130 70 Profit and Loss Account for Limited Companies 2005 Sales Turnover Cost of Sales Gross Profit Operating Expenses Operating Profit Interest Payable Net Profit (Profit before Tax) Corporation Tax Profit After Tax Dividends Retained Profit ($000) 1,250 900 350 105 245 50 195 35 160 120 40 2004 ($000) 1,300 900 400 120 280 40 240 40 200 130 70 Try this! • Using the pattern of a typical profit and loss account • Calculate the retained profits of ABC Ltd for the year ending 31/3/2005 from the following data Sales Revenue Tax Paid Operating Expenses Cost of Sales Interest Paid Dividends ($000) 280 40 30 100 15 25 Balance Sheet • Balance Sheet – Shows the value of a businesses' assets and liabilities at a particular time • Assets – Items that are owned by the business – S-T (Current) – L-T (Fixed) • Liabilities – Items owed by the business – S-T (Current) – L-T Balance Sheet • Fixed Assets – Items that are used by the business for more than one year • Current Assets – Items that are used by the business for less than one year – Cash, Stocks, and Debtors Balance Sheet • Long-Term Liabilities – Borrowings which do not have to be repaid within one year • Short-Term Liabilities – Borrowings which have to be repaid within one year Balance Sheet • Owners Wealth (Shareholder’s wealth) – Total Assets – Total Liabilities Age Engineering Balance Sheet as at 31/3/2005 ($000) Fixed Assets Land and Buildings Machinery Current Assets Stocks Debtors Cash Less Current Liabilities Creditors Bank Overdraft Working Capital (Net Current Assets) Net Assets Financed by: Shareholders’ Funds Share Capital Profit and Loss Reserves Long-Term Liabilities Long-Term Bank Loan Capital Employed 2005 2004 450 700 1,150 440 600 1,040 80 50 10 140 50 60 15 125 65 65 130 40 60 100 10 1,160 25 1,065 500 360 500 320 300 1,160 245 1,065 Balance Sheet Terms • Working Capital (Net Current Assets) – Current Assets – Current Liabilities – Used to pay short-term debts • Net Assets – Fixed Assets + (Current Assets – Current Liabilities) – Fixed Assets + Working Capital – Net Value of Assets – Paid for by “shareholder funds” or “long-term liabilities Balance Sheet Terms • Shareholder’s Funds – Total sum of money invested in the business • Share capital – Money invested by shareholders • Reserves – Retained Profits • Capital Employed – Shareholder’s Funds + Long-Term Liabilities – Total long-term and permanent capital of a business – Capital Employed = Net Assets Where is it found? • What was the gross profit of the business? • What dividends did we pay our shareholders? • What is the total value of our current assets? • What expenses did the business incur last year? • What was the net profit of the business? • What is the capital employed of the business? Categorize the following Published Accounts • What do published accounts tell us? – The performance of a company? – The financial strength of a company? • Without further analysis, the answer is – not a great deal! Ratio Analysis of Accounts • Liquidity – It is the ability of a business to pay back its short-term debt Ratio Analysis of Accounts • Performance Ratios – Return on Capital Employed Operating Profit X 100 Capital Employed Ratio Analysis of Accounts • Performance Ratios – Gross Profit Margin Gross Profit X 100 Sales Turnover Ratio Analysis of Accounts • Performance Ratios – Net Profit Margin Net Profit Before Tax X 100 Sales Turnover Ratio Analysis of Accounts • Liquidity Ratios – Current Ratio Current Assets Current Liabilities Ratio Analysis of Accounts • Liquidity Ratios – Acid-Test Ratio Current Assets - Stocks Current Liabilities Ratio Analysis of Accounts • Used to compare with – Other years – Other businesses • Disadvantages – Based on past results, doesn’t indicate how a business performance in the future – Results affected by inflation – Different accounting methods