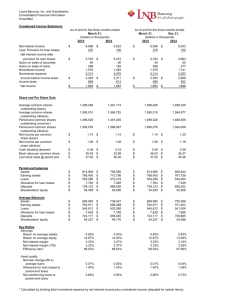

Interest Income

advertisement

Fin 464 Chapter 5: The Financial Statements of Banks 5-2 Bank Financial Statements Report of Condition – Balance Sheet Report of Income – Income Statement 5-3 Report of Condition The Balance Sheet of a Bank Showing its Assets, Liabilities and Net Worth (equity capital) at a given point in time May be viewed as a list of financial inputs (sources of funds) and outputs (uses of funds) 5-4 The Balance Sheet of Bank Financial Outputs (use of bank funds) Cash Assets [C] Financial Inputs (sources of bank funds or liabilities) Deposits from the Public [D] Cash in vault/ reserve requirement with Central Retail or corporate deposit, interbank deposit bank & deposits with other depository institutions Investment in Securities [S] Nondeposit Borrowings [NDB] Money market instrument such as T-bills, commercial paper Discount loans (loans from Fed), loans from holding companies or other banks Loans & Leases [L] Equity Capital [EC] Miscellaneous Assets [MA] Fixed assets such as branch network, computers, premises 5-5 Balance Sheet Identity Assets = Liabilities + Equity Capital C + S + L + MA = D + NDB + EC C = Cash Assets D = Deposits S = Security Holdings NDB = Nondeposit Borrowings L = Loans EC = Equity Capital MA = Miscellaneous Assets 5-6 Bank Assets: Cash Cash Account is the cash held in bank’s vault and deposits due from depository institutions Meet the need of liquidity for deposit withdrawals, demands on loans and other unexpected need. Includes: Vault Cash Deposits with Other Banks (Correspondent Deposits) Cash Items in Process of Collection (uncollected Checks) Reserve Account with the Federal Reserve Sometimes Called Primary Reserves Balance kept low as earn little or no interest income 5-7 Bank Assets: Investment Securities Two types of Investment Securities: i. The liquid portion (secondary reserves) ii. The Income-Generating Portion Liquid Portion (investment securities available for sale) is often called Secondary Reserves It is the back up source & Includes Short Term Government Securities Privately Issued Money Market Securities − − Interest Bearing Time Deposits with other banking firms (bank deposit that has a specified date of maturity e.g.CD or saving accounts) Commercial Paper The Income-generating portion (held-to-maturity securities) are bonds, notes and other securities held for expected rate of return ● 5-8 Bank Assets: Trading Account Assets Securities purchased to provide short-term profits from shortterm price movements When the Bank acts as a securities dealer, securities acquired for resale are included in this account Reported at fair value or market value Trading assets may include U.S. Treasury securities, mortgage-backed securities, foreign exchange rate contracts and interest rate contracts. 5-9 Bank Assets: Federal Funds Sold and Reverse Repurchase Agreements A Type of Loan Account Generally Temporary/Overnight Loans Provided to depository institutions, securities dealer or industrial corporations Federal Funds – the funds come from the deposits held at the Federal Reserve Reverse Repurchase Agreements – Bank takes temporary title to securities owned by borrower. It is the sale of securities together with an agreement for the seller to buy back the securities at a later date. 5-10 Bank Assets: Loans & Leases It is the major asset Types of loan are broken down into similar feature such as based on maturity, collateral, pricing terms, etc. The common one is based on the purpose for borrowing money. 1. Commercial and Industrial Loans 2. Consumer Loans (Loans to Individuals) 3. Mortgage lending & Real Estate Loans 4. Financial Institution Loans 5. Foreign (international) Loans 6. Agriculture Production Loans 7. Security Loans aiding the investors & dealer 8. Leases (purchase equipment & give to rent to their business client) 5-11 Loan & Leases: Loan Losses Gross Loans = Sum of all outstanding loans Net Loans = Gross Loan - Loan Loss Allowance (both current & projected loan losses) - Unearned Income Unearned Discount Income: interest income on loans received from customers, but not yet earned. Allowance for Possible Loan Losses (ALL): reserve for future loan losses from the income based on recent loan-loss experience. It is a Contra Asset Account represent accumulated reserve from which bad loans can be charged off. When a loan is uncollectible, accountant write it off the book by reducing ALL & decrease asset account (gross loans). Bad loans normally do not effect current income. 5-12 Allowance for Loan Losses (ALL) The allowance for possible loan losses is built up over time by annual deductions from current income and known as Provision for Loan Losses (PLL). It is a noncash expense item that appears in the Income Statement PLL is debited whereas, Allowance for Loan Loss (ALL) is credited in the Balance Sheet. Beginning Balance for ALL + Provision for Loan Loss (PLL, Income Statement) = Adjusted Allowance for Loan Losses Actual Charge-Offs of worthless loans = Net Allowance for Loan Losses + Recoveries from Previous Charge-Offs = Ending Allowance for Loan Losses 5-13 Specific & General Reserves ALL account divided into two parts: 1. Specific Reserves Set aside to Cover a Particular Loan which bear above-average risk Designate a Portion of ALL or Add More reserves to ALL 2. General Reserves Remaining ALL Determined by Management But Influenced by Taxes and Government Regulation 5-14 Non Performing Loans & Miscellaneous Assets Nonperforming (noncurrent) loans is a category of loan which doesn’t accrue interest income or have to be restructured to accommodate borrower’s changed circumstances. Loan is placed in this category when scheduled repayment is past due for more than 90days. Miscellaneous Assets: i. Bank Premises and Fixed Assets ii. Other Real Estate Owned (OREO): real estate investment to compensate nonperforming loans iii. Goodwill and Other Intangibles 5-15 Bank Liabilities A. Deposits: 1. Noninterest-bearing demand deposits: permits unlimited check writing but can not pay interest rate. 2. Savings Deposits: lower rate of interest with minimum size requirement of deposits & permit the customer to withdraw at will. 3. Money Market Deposit Accounts: MMDAs pay competitive interest rate with limited checking privileges, normally 7 days prior notice is required before withdrawal of cash 4. NOW Accounts (Negotiable order of withdrawal) - bear interest & check writing facilities 5. Time Deposits - fixed maturity term & stipulated (set) interest rate B. Nondeposits Borrowings - No reserve requirement or insurance fee required, that reduces the cost of fund and makes it flexible but interest rate is highly volatile - During the time of financial problems, lender may refuse to extend credit - Sources are : Money & Capital Market, Federal Funds Purchased, Commercial Paper, Euro Market, Long-term borrowings. 5-16 Equity Capital It represent the owner’s share of the business Financial Institution are the most highly leveraged of all businesses Capital Accounts normally represents less than 10% of the total asset Preferred Stock Common Stock Common Stock Outstanding Capital Surplus Retained Earnings (Undivided Profits) Treasury Stock & Contingency Reserve 5-17 Off-balance-Sheet Items Banks have converted many of their customers in recent years into fee-generating transactions that are not recorded on their balance sheet. Standby Credit Agreements (bank pledges to guarantee repayment of a customer’s loan received from a third party) Interest Rate Swaps (bank promises to exchange interest payment on debt securities with another party) Financial Futures & option Interest-rate Contracts (bank agrees to deliver or to take delivery of securities from another party at a guaranteed price) Loan Commitments (bank pledges to lend up to a certain amount of funds until the commitment matures) Foreign exchange Rate Contracts (bank agrees to deliver or accept delivery of foreign currencies) 5-18 Major Components of Income Statement Shows how much it has cost to acquire funds and to generate revenues from the uses of funds in Report of Conditions Noninterest Income (Fee Income): Fees earned on fiduciary activities (trust service) Service charges on customer deposits Trading account gains & fees Additional non-interest income (Invest banking, security brokerage, insurance service) Interest Income: Interest & Fees on Loans Interest on Investment Securities Interest Expenses: Deposit Interest Costs Interest on Short-term debt Interest on Long-term debt Noninterest Expenses: Wages, Salaries & other personnel expenses Costs of maintaining properties , rental fees on office space (premises & equipment expenses) Provision for Loan-Loss (PLL) Expenses Extra-ordinary Income Sale of non-current asset 5-19 Income Statement (cotn..) Net Interest Income = Interest Income – Interest Expenses Net Noninterest Income = Noninterest Income – Noninterest Expenses Pretax Net Operating Income = Net Interest Income + Net Noninterest Income- Provision for loan losses Income before extraordinary items = Pretax Net Operating Income + Securities gains (losses) -Tax 5-20 Fees Earned from Fiduciary Activities Fees for managing protecting a customer’s property Fees for record keeping for corporate security transactions and dispensing interest and dividend payments Fees for managing corporate and individual pension and retirement plans 5-21 Service Charges on Deposit Accounts Checking account maintenance fees Checking account overdraft fees Fees for writing excessive checks Savings account overdraft fees Fess for stopping payment of checks 5-22 Trading Account Gains and Fees Net gains and losses from trading cash instruments and off balance sheet derivative contracts that have been recognized during the accounting period 5-23 Additional Noninterest Income Investment Banking, Advisory, Brokerage and Underwriting Venture Capital Revenue Net Servicing Fees Net Securitization Income Insurance Commission Fees and Income Net Gains (Losses) on Sales of Loans Net Gains (Losses) on sales of Real Estate Net Gains (Losses) on the Sales of Other Assets 5-24 Income Statement Net Interest Income - Provision for Loan Loss Net Income After PLL +/- Net Noninterest Income Net Income Before Taxes +/- Security Gains(losses) - Taxes Income before extraordinary items -Extraordinary gains (losses) Net Income - Dividends Undivided Profits 5-25 Features & Consequences of Bank Financial Statements Key Features Heavy dependence on borrowed funds supplied by others increased the use of financial leverage. Consequences for Bank Managers The bank’s earnings will be at risk if bank cannot repay those borrowings in due time. It must hold a significant proportion of high-quality & marketable assets to meet its most pressing debt obligation. Most revenues stem from interest on loans & securities. The largest expense item is the interest cost. Bank management must choose loans & investments carefully to avoid a high proportion of earnings assets that fail to pay out as planned. Must be competent to protect against losses due to interest-rate movements. Greatest proportion of asset is devoted to financial assets relatively to fixed assets and tend to make limited use of operating leverage. Financial firms' earning s are less sensitive to fluctuations in sales volume (operating revenues) than those of many other businesses.