Brazil “The Basics”

advertisement

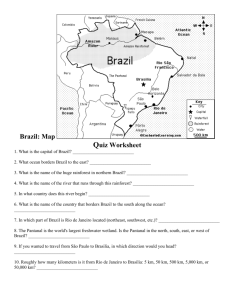

Crossing Borders New International Hot Spots for F&I Objectives • • • • • • • Brazil “Basics” Economic Overview Industry Landscape Government and the Automotive Industry The Dealers Opportunities Q&A Who Am I? • • • • • • 16 Years Retail Automotive Experience The Providence Group JM&A The McDavid Group COO/GM Began Opening Brazilian Market in 2010 Eu Estou Aprendendo Portugues – (I’m Learning Portuguese) Brazil “The Basics” • Brazilians Speak Portuguese • How many people in Brazil? – A Brazillion!! – 196,655,014 *World Bank 2011 • Brazil land mass slightly smaller than the US *geographic.org • Capital of Brazil – Brasilia – Viewed from above the main city resembles an airplane • Brazil comes from the word brazilwood Brazil’s Economy • Brazil is the 6th largest economy *International Monetary Fund • Brazil’s “Dollar” R$ – Today 1 USD = 2.02 BRL (The Money Converter .com) • GDP $2.48 Trillion** • US GDP $15.09 Trillion** • Fastest growing economy – Based on GDP increase over 5% annually **World Bank Brazil’s Economy • Brazil Regions – North • Most Area/Least Populated – Northeast • 28% of the Population – Central-West • 18.86% of the population – Southeast • São Paulo (Largest City in Brazil) - Most Populated – South • 3rd Largest Population OEM’s (Brands) • 38 Brands in Brazil • The “Big Four” – – – – FIAT Ford GM VW OEM’s • Chinese Brand Presence – – – – Chana Chery JAC Lifan • Korean Brands – Hyundai – KIA – SsangYong • Other Notable Brands – Citroën – Troller OEM’s • Standard Warranty – – – – – – Majority have 36 month “bumper to bumper” VW 12 months “b2b” 24 months powertrain Kia & Hyundai 60 months “b2b” JAC has 6 Year “b2b” No Roadside Assistance (majority) Claims paid very conservatively • Customers complain about poor claims approval Franchised and Non-Franchised • 7,092 Franchised Dealers in Brazil* – São Paulo 1,790 (Southeast Brazil) – Minas Gerais 762 (Southeast Brazil) – Paraná 593 (South Brazil) • US – 17,540 Franchised Dealers** • 45,600 Non-Franchised Dealers*** – 70 Auto Shopping Locations *Fenabrave **NADA Industry Analysis ***Fenauto Franchised and Non-Franchised • Supported by different national associations – Fenabrave (www.fenabrave.com.br) Franchised – Fenauto (www.fenauto.org.br) Non-Franchised • Dealer Associations – Associations are OEM • Big Four Associations – Fiat = ABRACAF – Ford = ABRADIF – GM = ABRAC – VW = ASSOBRAV Franchised • 46% of the Franchised dealers are small – Sell on average 40 units per month • 23% are considered large dealers – Sell more than 120 units per month • Big Four – Fiat/Ford/GM/VW • 30% Dealer Body are considered large dealers – Toyota/Nissan/Honda/Hyundai • Majority fall in Small category *J.D. Powers/Megadealer August Trends August Trends • • • • • • • • • • Fiat – 98,212 Units (45.8% over Aug. 2011) VW – 88,765 Units (37% over Aug. 2011) GM – 75,864 Units (35.6% over Aug. 2011) Ford – 31,078 Units (10.7% over Aug. 2011) Renault – 27,903 Units (58.3% over Aug. 2011) Honda – 17,086 Units (119.9% over Aug. 2011) Toyota – 10,119 Units (36.8% over Aug. 2011) Nissan – 10,045 Units (86.2% over Aug. 2011) Peugeot – 8,719 Units (11.7% over Aug. 2011) Hyundai – 8,651 Units (-14.7% over Aug. 2011) *Quatro Rodas August Trends • Record Month in August – 405,518 Units *Fenabrave • 31.7% Year over Year Increase • 15.4% Month over Month Increase • Previous Record 361,197 Units (December 2010) • Increase led by Government Incentives Government (Taxes and Fees) • Taxa and Impostos – Taxa = Fees – Impostos = Taxes • Different Types of Taxes – 6 Taxes can affect vehicle pricing – 4 Taxes are at time of sale • PIS – Social Integration Program; 1.65% (federal) • IPI – Tax on industrial products; range varies according to engine capacity (7%-25%) (federal) • COFINS – Social Security Financing; 7% (federal) • ICMS – Tax on goods and services; 12% (state) Government (Taxes and Fees) • IPI Tax – Controlled by Government – Adjusted similar to our interest rates by the fed – It has both positive and negative consequences • Used car dealers can suffer when Franchised dealers profit by a change • II Tax – Import Tax; 35% (federal) – Any Manufacturer not building in Brazil pays this • Hyundai until recently Insurance Governance • Insurance Governance – – – – – Susep (The Superintendence of Private Insurance) Under the Ministry of Finance Created by Decree-Law #73/66 Dealer must employ/outsource to a broker so sell VSC Agencies can become brokers to sell VSC and other F&I products The Dealers The Dealers The Dealers The Dealers • Average Sales Person Sells 12-18 units – 50% of the staff as is US • All stores have greeters – Sales Persons at desks working phones and internet • Great Processes – Sales – Service – Body Shop* The Dealers The Dealers The Dealers • Franchised dealers have no floor plan for used vehicles – Very Risky • Dealers focus on turning used cars every 15-17 days • In Metro areas like São Paulo dealers operate on about 1/3 the land of dealers in the US The Dealers F&I • F&I Departments – – – – – Dealers get large profit from Finance charges Dealers intermingle car insurance with F&I Many Dealers do not have F&I Departments Bank reps in the dealership F&I is more focus on the “F” and less on the “I” • Accessories – Large Profit center for dealers – In some dealers hinders F&I sales – Not focused on retention Opportunities In Brazil • • • • • Auto Auctions F&I Training F&I Consulting Insurance Administration Support & Training DMS integration – 7 DMS companies have 90% market – No integration into other systems • Web Design • Social Media Observations/Recommendations • Perform Recon of the Culture and Environment • Best way to enter Brazil is with a “Partner” • Huge Opportunity/Huge Risk – Big Profits – Big Costs – Using a known source is best of both eHow Money Tips & Warnings • • • • • • • Nearly any path to a new business in Brazil will go through Sao Paulo to start or if not Sao Paulo then Rio de Janeiro. Brazilian partners are important, or if not partners then local managers. Learning some functional Portuguese is an important gesture. You will need to have patience in all factors of the process Never speak Spanish to Brazilians Always assure customs officials that you will be taking computers or other technology out of the country when you leave. The food and drink of Brazil is wonderful and exotic, but too much will add to your waistline and a rapid pace. How to Start a Business in Brazil | eHow.com http://www.ehow.com/how_2306611_start-business-brazil.html#ixzz265nxXnEW Quick Recap • Brazil 6th Largest Economy • Brazil 4th Largest Car Market – On Pace to become the 3rd Largest by 2016* or sooner • • • • Brazil fastest growing economy Complicated Government & Laws “Guided” is the quickest and most cost effect New Opportunities for Process and Products *Global Automotive Executive Survey 2012 Q&A