To view this press release as a file

advertisement

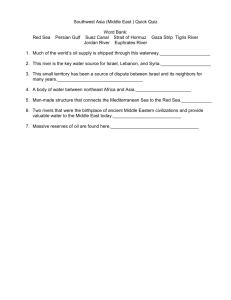

BANK OF ISRAEL Office of the Spokesperson and Economic Information March 31, 2015 Press Release The Governor of the Bank of Israel’s Remarks at the Press Conference Marking the Publication of the Bank of Israel Annual Report for 2014 Governor of the Bank of Israel Dr. Karnit Flug: The government that will be formed will need to deal with the Israeli economy’s fundamental social and economic problems and challenges—increasing labor productivity and earning capacity, reducing the cost of living and increasing competition, increasing supply in the housing market, and reducing poverty and inequality. I am convinced that the new government will study our policy recommendations and take them into account when setting policy. The chosen government must, obviously, formulate detailed policy in accordance with its priorities, and within a budgetary framework that takes into account the need to continue to reduce the public debt burden, the low civilian public expenditure, and the cost of government programs that were already approved in the past, which are not consistent with the limitation of the expenditure rule. The Bank of Israel, as always, will stand by the government’s side in order to help through the experience and professional tools available to it. The economy is in a good state, and if we are wise enough to promote long term plans to achieve the goals, we will be able to ensure that the economy maintains its comparative advantages and its stability, and will grow in a manner that benefits all population groups. I will open with a few words on monetary policy. Monetary policy is being conducted in an environment of very low interest and inflation rates, in some countries near zero and even negative. Inflation in Israel as measured over the past 12 months is negative, partly due to declines in the prices of water, electricity and fuel. We expect that the inflation rate will turn positive in the coming months, and will enter into the lower part of the target range within a year. The target that guides monetary policy is an inflation target, not a price level target. The policy does not need to correct one-off price declines that occurred due to supply side developments. Yet at the same time it is important to understand that extended price declines is not a phenomenon that over time can increase purchasing power; in the end, nominal wage adjusts itself to the nominal path of prices, and we saw a partial such adjustment this year already, when the rate of nominal wage increase slowed in light of the decline in inflation. There are good reasons that the inflation target range was set at a low positive level, by us and at most advanced economies. The low interest rates around the world are a force that acts toward shekel appreciation. Interest rate reductions or a quantitative easing program abroad, without a change in monetary policy in Israel, is in effect a relative monetary tightening, which in turn will create pressure for shekel appreciation. The appreciation forces are the result of the economy’s relatively good state, certainly compared to the situation in Europe. The importance of the effective exchange rate is its influence on activity and employment in tradable industries, both export industries as well as import substitutes, which are also dealing with weakness in global demand as well as the impact on inflation. Our estimates indicate that the economy still has a negative output gap, that is, actual GDP is lower than potential GDP, and this also contributed to the low rate of inflation during the year. The output gap reflects underutilization of production factors, such as the number of hours worked per employed person, and this is despite the low unemployment, which declined further this year, against both a cyclical background and for structural reasons. These developments were at the background of monetary policy, which worked though interest rate reductions and foreign exchange market intervention. In view of the global environment and the uncertainty related to the developments in this area, other policy tools are also on the table, and the decision if, and which, tools to operate will be examined in accordance with developments and conditions. Challenges and policy The elections are over, and the government that will be formed will need to deal with the Israeli economy’s fundamental social and economic problems, such as those that were expressed during the election campaign, while it also expresses its preferences and priorities. In my remarks I will review those fundamental problems as observed and analyzed at length in the Bank of Israel Annual Report, and I will note the direction of preferred policy, as well as policy that is not desirable, based on our professional analysis, and as it is reflected in the various chapters of the Report. Of course, the detailed policy must be formulated by the chosen government, and in my role as economic advisor to the government, I will be happy to cooperate with the Minister of Finance in order to provide the Minister with the considerable professional knowledge available to the Bank of Israel and to aid in formulating the policy. I. Issues of labor productivity, which is also the key to earning capacity Labor productivity in Israel increased at a moderate pace, and has not closed the gap with other advanced economies. This is also the basis for the moderate increase in real wages. There are several reasons for the relatively low level of productivity in many industries, and in particular those that are not exposed to competition from abroad. I will focus on a few: Low level of investment in infrastructure (including land transportation, air and sea ports, water, electricity and communications). An IMF report published recently found that investment in infrastructures has a high return in terms of growth. Over time, the low investment is seen in a deteriorated infrastructures level in most areas, by international comparison, in particular the areas of transportation, with an emphasis on public transportation and marine transport. Bureaucracy, as reflected in, for example, various parameters of the business environment, or in the Doing Business Index in which we were ranked 40th, not due to a worsening of the situation in Israel but as a result of improvement in other countries’ situations. In the global economy, what determines if companies will want to operate in an economy is the relative situation. Lack of regulatory clarity, and the contradictions between various regulatory demands focused on the same sector certainly deter potential investors. A more rapid increase in labor productivity, which is, as noted, the key to increased wages, will require: II. Increased investment in infrastructure. In this regard, investment in mass transit projects—public transportation, especially in the greater Tel Aviv area—and connecting manufacturing facilities to the gas pipeline should receive high priority. R&D investment: In this regard I will note the welcome activity of the Chief Scientist, including in low technology factories, where the Chief Scientist’s assistance in promoting innovation is at times the difference between continuing or not for those facilities. Exposure to competition from abroad as an incentive for increasing efficiency and innovation (in the past year the Bank of Israel Annual Report presented the connection between an industry’s share of exports and it efficiency level compared with competitors worldwide). Removing superfluous bureaucracy and in particular dealing with inconsistency in regulation—several government decisions were reached in this issue, and it is important to move forward with implementation. The issue of upgrading human capital—at all education levels and professional training. I expanded on this topic on previous occasions. Cost of living and increasing competition in industries where it is low The cost of living is a multidimensional concept, influenced by the prices of goods and services, both out of household income and out of total services they receive from the government. Examining the total cost of the basket of goods and services purchased by households in Israel indicates that they are slightly higher than we would have expected, given the per capita GDP in Israel. With that, there are of course areas in which the basket of products in Israel is more expensive—such as food and drink, or restaurants and hotels—and there are those in which the price level is in line with what we would have expected given the per capita GDP, such as clothing and footwear, or household furnishing and equipment. In the area of expenditure on housing services, our expenditure is relatively high (the share of households renting a home and paying more than 40 percent of their income on rent is close to 40 percent), which certainly weighs mainly on young families. Dealing with the cost of living is also multidimensional. I noted in my remarks the need to increase productivity as a base for increasing workers’ earning capacity. With regard to price levels, work should continue on increasing competition, whether from abroad through exposure to imports (such as in the food industry), or within uncompetitive industries through removing barriers to entry of new competitors (such as standards not in line with international norms), or through increasing competition between existing players. Examples of reforms that went in this direction and that led to increasing competition and declining prices are the reforms in the communications industry, and the Open Skies reform. In the Bank of Israel’s areas of responsibility, the recent change in easing the switch from one bank to another, providing the option of opening an account over the Internet, and setting fee tracks for standard banking services, are expected to increase competition on the retail side of banking services. With regard to reducing the cost of living, the Bank of Israel is hesitant about the following ideas that were recently brought up: III. Exemption from VAT on basic products is not the ideal way to help weaker population groups, as it is a very expensive way and not focused on those population groups, and is liable to negatively impact the advantage of VAT in being a broadbased tax; Placing many products under supervision is a tool that should be saved just for situations in which there is a proven market failure. Otherwise, it creates pricing distortions, prevents increasing efficiency, and requires a large bureaucratic mechanism that also comes with a cost. The issue of home prices and the need to increase supply of homes in a manner that will meet the population’s growth needs and in accordance with areas in demand The government controls most land in the country and the planning processes, and has an important role in increasing the supply of homes. The response of housing supply to an increase in demand that has occurred since 2007 was slow and hesitating. In the past two years we have seen a marked increase in number of building completions. If this is maintained, and includes in-demand areas as well, it is reasonable that we will see first stabilization and then even a decline in home prices. However for this to occur, hard work is required by all the government functions, whose collaboration is the key to increasing supply over time. The main potential for increasing housing supply in the center of the country is in increasing the density in urban areas though tools such as enhanced implementation of National Master Plan 38; “vacate and build”; and vacating IDF bases and building in the areas that are cleared. The main obstacles to accelerating construction include the need for continued simplification and shortening of the long process from initiation, though planning committees, preparation for marketing, land tender procedures, building permits, the time from when a building permit is received until the construction is started, and the actual construction time itself. The coordination with preparing the infrastructure too often continues subsequently, and not in parallel. In addition, the structure of the local authority tax system provides incentives to local authorities to prefer businesses over residential construction and this obstacle as well needs to be overcome. It is also important to emphasize that plans to increase demand one way or another, without increasing supply, will not lead to reduced prices, but to the opposite. IV. Budget policy issues The challenge for budgetary policy in the coming years derives from: Despite a decline in public debt and the fact that it is not high in international comparison, the interest burden on the debt is still high. Primary civilian expenditure is very low in international comparison, and reflects the low expenditure in all areas of public services: education—expenditure per student is very low, welfare, health—in which the share of private expenditure is especially high, as well as in the area of active labor market involvement. The investment in infrastructures is low particularly against the background of the level of infrastructure, as I noted. The government’s plans, which involve budget expenditure, deviate from the amount consistent with the expenditure rule, according to which it should increase by 2.6 percent per year. In 2016 this deviation, in our assessment, is NIS 8 billion; meeting the expenditure rule will require about an additional NIS 2 billion on the revenue side in order to meet the deficit ceiling. Against this background, it is important that budget policy strive for continued gradual reduction of the debt to GDP ratio. In order to manage the budget, it will be important to continue and use the mechanism developed at the Ministry of Finance and which is intended to monitor the cumulative cost of all government decisions, in order to ensure consistency between them and the fiscal rules (the numerator). In order to provide a response to the needs in the area of government services, infrastructure, and support for growth drivers, civilian expenditure will need to be increased. To the extent that this actually is increased, and to the extent that it will not be possible to reduce the share of defense expenditure, additional funding sources will be required for this expenditure. The additional sources can come from reducing tax exemptions that do not have economic/social justification. Increasing the deficit, in contrast, will only defer the problem to future years. V. The issue of poverty and inequality A significant challenge is turning economic growth into inclusive growth that will reach all population segments and advance them. Despite the stabilization in recent years, the inequality and poverty levels are still high by any measure. The increase in employment and in the number of wage-earners in households helps to increase income, but the share of low-wage workers remains high. The policy steps that can lead to a real decline in inequality and poverty are: VI. Continued focus on increasing the employment rate and earning capacity of Arab women and ultra-Orthodox men. Increasing earning capacity through improved affirmative action in education, ensuring education that provides the tools necessary for employment in the modern labor market for all sections of the population and improved professional and technological training. Expanding the income grant (negative income tax) program. Increased labor-law enforcement. Adjusting the supply of public housing so that it provides a solution for the weakest segments, with especially low earning capacities. Financial system issues An efficient and stable financial system is critical to channeling the public’s savings to support economic activity and in order to ensure safety and return on the public’s savings. The system in Israel has remained robust in recent years despite internal and external shocks. The public interest is in ensuring the stability, alongside ensuring and increasing its fairness and efficiency. The share of the public’s assets managed by nonbanking institutions has grown consistently, and in recent years it has been larger than the share managed by banks. It is thus important to ensure tight regulation and supervision, at similar standards, over all parts of the system. Obviously the stability of the banks and ensuring the funds of savers and depositors is of ultimate importance to the public, and goes hand in hand with proper conduct and increased competition. In contrast to the conventional wisdom, these are not conflicting goals, as the public’s confidence in the system is an important condition for its stability. We have made considerable headway in advancing competition, and we will continue to do so wherever necessary. It is important as well that the general public, on its end, acts to fully use the tools at its disposal in this area. In this connection, steps to increase transparency and information should be continued, including establishing a credit bureau, increasing financial education for smart consumerism, and advancing the infrastructure for increasing competition. Thus, for example, government support to assist in establishing new participants in the system can be considered. In contrast, easing of regulatory demands that would lead to setting up weak and unstable entities would not only fail to provide real competition to the existing system, but the failure of such an entity would endanger depositors’ funds in it, would negatively impact the public’s trust in the system whose importance we have already explained, and prevent setting up additional entities for a long time. In order to ensure the system’s stability, it is important to institutionalize the collaboration between each of the financial supervisory authorities by setting up a Financial Stability Committee. I conveyed this message last year as well. I hope that we will soon be able to complete the work on this important issue. In conclusion, the state of Israel’s economy is definitely good, as indicated by current macro data. If we will be smart enough to deal with the many challenges facing us and promote long term plans to achieve the goals we have set, we will be able to ensure that the economy maintains its comparative advantages, its stability, and its growth in a manner that benefits all population segments. Israel’s society and economy have already proven in the past that they are able to meet long term challenges and I am convinced that the new government will study our recommendations and know how to implement them in accordance with its priorities. The Bank of Israel, as always, will stand by the government’s side in order to assist with the professional tools available to it.