Looking at Exam Papers

advertisement

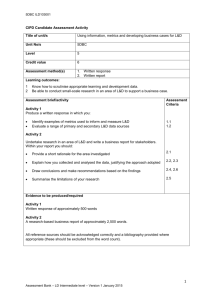

Looking at Exam Papers GCSE in Business Studies (5308) (Double Award) Development of the exam: background The Government’s agenda for vocational learning: ‘we should be offering young people a wide range of options’ ‘we need to better prepare young people for the world of work’ ‘we expect all schools to offer work-related opportunities to their pupils, often in partnership with local colleges’ The exam The exam is untiered and is targeted at students across the full ability range A* G. It contains both short and extended answer compulsory questions totalling 90 marks, answered in 1½ hours. All topics of the Unit are tested in each Series. The exam:topic weightings Marks % A Documents and B Make/receive payments C. Costs of a new product or service 19-27 21-30 1-9 1-10 D. Cash Flow Forecasts and E. Budgets 10-18 11-20 F. Break-even 10-18 11-20 G. Profit & Loss and H. Balance Sheet 10-18 11-20 1-9 1-10 10-18 11-20 Specification topic I. Importance of accounts J. Sources of finance and K. Financial planning The exam: nature of the questions (1) Theme: a ‘single business’ for the first three papers: Rainfree and Fighting Fit - both are partnerships MM Sounds - a sole trader product (umbrella) or service (gym and ‘Gift Rap’) New approach in June 2005: a ‘single location’ theme an airport – the airport owners plus 3 shops providing goods (stationery etc) and services (food, car hire) Applied: a Scenario with information introduced Q by Q Trend towards the scenario being a ‘story’ only with the Q stems introducing key information The exam: nature of the questions (2) Templates are used: eg Profit & Loss + Cash Flow note adaptation January 2005 (cash flow) this approach will continue to discourage ‘rote’/give greater Q flexibility Select from alternatives: eg documents, payment methods Will continue to avoid ‘write all you know about’ Qs Simple to complex: eg ‘Incline of difficulty’ + developed answers at end, targeted at A* This is adapted in practice to ensure a ‘realistic’ approach (eg influence of chronology) Grading questions and awarding marks Assessment objectives: AO1: Demonstrate and apply knowledge 60 – 75% (54 – 67 marks) - name, state, explain, describe AO2: Gather, select, record and analyse evidence 10 – 15% (9 – 13 marks) - explain, select, analyse AO3: Evaluate evidence and present conclusions 15 – 20% (14 – 18 marks) - explain, evaluate, give reasons why Papers are now marked ‘on-line’ with EPEN Question 1 Similar style to all past papers: alternatives based on scenario business, from which candidates select one Improving performance? (well answered/easy [only three alternatives] ) use past papers for practice ensure candidates give only 1 answer to a part (NB past questions, there may be two right answers) (General) rehearse selecting and classifying costs for a wide range of businesses – Public and private; primary, secondary, tertiary Improving performance Use past papers for practice Ensure candidates give only 1 answer to a part (when using past questions, recognise that there may be two correct alternatives but only one should be chosen) Rehearse selecting and classifying costs for a wide range of businesses – Public and private; primary, secondary, tertiary Improving performance Methods of payment Usually required to explain advantage/disadvantage from the seller’s or the buyer’s viewpoint – this is often overlooked Some candidates are content to state and not explain/ develop their answer Improving performance Methods of payment ‘State and explain’ – so some expansion of a ‘basic’ point is expected Where ‘one’ is in bold candidates must not state two advantages/disadvantages – only one will be marked Provide practical experience – e.g. of credit/debit cards Candidates must be able to distinguish between questions/situations that focus on the seller, and those that focus on the buyer: an understanding of the buyer-seller relationship is crucial to success Improving performance Budgeting Topic of Budgeting – not well understood Better answers would be based on explanations such as ‘budget = plan; actual occurs, compare against plan; take corrective action’ Improving performance Budgeting Concentrate on the planning and control aspects of budgeting ‘Variance’ is not stated in Specification but understanding the ‘concept’ of variance is valuable Practise both written and calculation answers Past paper questions on budgeting should be used Candidates should know main types – eg sales, production, cash, capital expenditure Improving performance Balance Sheets and Costs Review structure, use real examples from public/private sector, from primary/secondary/tertiary industry, practise selecting and classifying from a list Candidates must follow instructions –may be asked to use a given letter or number coding or name the cost Continue practising the identification and selection of (eg) fixed and variable costs in specific contexts Improving performance Break-even: Table completion (costs and revenues) and Chart to be constructed Explain changes to breakeven – formula given to help Improving performance Breakeven Full labelling needed on diagram Candidates must be familiar with a variety of approaches .They must also understand how a change in one item will affect both the lines on the chart and break-even position This topic may test candidates’ understanding of how ICT helps efficiency, so they may benefit from using a spreadsheet to calculate break-even Although candidates need not memorise the formula they may benefit from discussing the concept of ‘contribution’ Improving performance Business documents Main difficulty arises in differentiating between Invoice and Statement of Account Continuing use of ‘real’ documents will help Use past papers to meet variety of questions formats Improving Performance Business documents Study documents or complete Marks are lost because of: Poor knowledge of what happens to documents, or answers too brief for both marks (eg ‘File it’) Lack of precise statements eg ‘wrong quantity’ mean many lost one or both marks Good knowledge of VAT is essential Improving performance Business documents Candidates must use - complete, calculate, store – the full range Clear understanding of the different positions and roles of buyer and seller regarding documents is needed VAT calculations are needed Correction of errors and effect of errors on both buyer and seller: a question may involve finding the error, correcting it, explaining its effect Improving performance Cash Flow Forecast Similar situation/template to most CFF questions: single inflow; specific outflows; total and balance (b) Applied focus – ‘information in the CFF’ Not well answered if not well applied NB: the mark structure will ensure candidates still achieve marks if some answers to are incorrect, through application of OFR (‘own figure rule’) Improving performance Cash Flow Forecast Labelling of rows (usually 1 mark) Practise ‘netting’ balances in CFFs Candidates must be aware of effects on businesses that have negative cash flows Candidates must be able to apply their answers, interpreting the results of their CFF or interpreting CFF balance figures that will be given to them: E.g. what is the likely meaning of the high or negative/low balance to the business? Improving performance Cash Flow Forecast Practise on Excel – not just Cash Flow Forecast but also budget, P&L, break-even Anticipate specific ICT questions based on specification topics such as these Candidates should meet a range of ICTbased and ‘traditional’ situations that allow them to explore how different errors affect sales, profits, cash, balances, willingness to trade . . . Improving performance Profit and Loss Similar templates P&L date required (full date expected) Templates and related information can vary on occasion – eg Use of ‘cost’ and ‘revenue’ columns Information in a form other than a bulleted list ‘Difficult’ expense (depreciation) is preentered to assist ‘Net profit’ or ‘Net loss’ expected as descriptor (‘Net profit’ needing to be shown as negative) Improving performance Profit and Loss Understanding needed of stakeholders Basic knowledge is often shown but not applied –– few score full marks ‘Using the information above . . .’ Expect similar questions that require candidates to apply given situations/figures Improving performance Profit and Loss Candidates should practice profit/loss calculations using given templates and in other (e.g. list) formats Revenues and expenses from a wide variety of businesses should be covered: Public/private; primary/secondary/tertiary Stress the importance of the date of financial statements Practise relating answers to specific situations: limited value in giving ‘textbook’ answers about interests of different stakeholder groups Improving performance Extended last question Always an extended answer at AO2/AO3. Likely to test key financial concepts (see past papers) Decisions will be involved: ‘Explain why’ ‘Select’ ‘Recommend’ ‘Justify’ ‘Evaluate’ Improving performance Extended last question Obey the rubric, e.g. note words in bold, Explain to candidates the importance of the ‘trigger’ words (action verbs) such as ‘Justify’ Apply the Specification topics to real businesses Apply the answer to the given business Practise writing extended answers Simple phrases/answers (e.g. the ‘quick’ and ‘easy’ approach) without context or explanation receive few or no marks Preparing for future papers Helping centres maximise student performance Delivering the unit Influence/availability of resources: Textbooks – these include Barrett (Nelson Thornes) Carysforth and Neild (Heinemann) Denby and Thoma (Hodder & Stoughton) Fardon, Nuttall, Prokopiw (Osborne) Jones, Raffo and Hall (Pearson) Surridge (Collins) Delivering the unit Influence of JCQ Performance Descriptors Internet sites Eg vocationallearning.org.uk Developing vocationalism, sample assignments and scheme of work, critical success factors in delivering . . . Other resources Helping the students Variety of approaches Preferred learning styles: an active (vocational) approach is encouraged Reinforcement Tests, quizzes Past papers Edexcel Candidate Kit Summary: centres can expect future papers to . . . follow a ‘single business’ or a ‘single location’ theme be constructed using the same influences vary in the number of questions asked (normally either 9 or 10 in total) be similar in style be designed and laid out to assist on-line marking