MTFS 16-17 to 20-21 - Harrogate Borough Council

advertisement

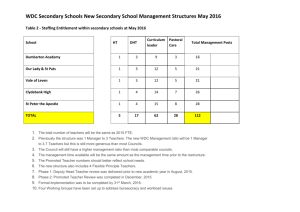

Medium Term Financial Strategy 2016/17 – 2020/21 Introduction 1. The Medium Term Financial Strategy (MTFS), for the years covering 2016/17 to 2020/21, sets out how we plan to manage our finances over the next five years and how we can more closely align resources to the priorities set out in the Council’s other key strategic documents, the Corporate Plan and Organisational Development Strategy. This strategy builds on the refresh agreed by Council in October 2014. 2. In an era of austerity, councils have to be more self-reliant, demonstrate longer term approaches to planning and be more outward looking. Harrogate is in a strong position and this strategy will seek to ensure that this continues to be the case in the coming years. 3. The MTFS encompasses: - An introductory overview of the Council’s current financial position, both from an individual standpoint and in the wider context of other English district councils. - The aim of continuing to be a thriving district against the backdrop of reducing Government support. - Integrating Medium Term Financial Planning more fully into the Corporate Planning process. - Setting out a longer term approach to managing our assets. - The key considerations in the Council’s financial planning over the next five years. - Outline changes to our financial processes designed to increase transparency and improve efficiency. Introductory Overview 4. During a period of once in a generation funding reductions, as the government continues to rein in the national deficit, and as other councils across the country face uncertain futures, Harrogate has been able to freeze council tax for its residents for six consecutive years without cutting frontline services. This is a testament to the council’s strong record of financial management before and during the current “age of austerity”. 5. Since the 2010 Comprehensive Spending Review (CSR), total local government funding in England has been reduced by approximately 37%. At the same time, there have been significant changes in the way Local Government services are funded including the introduction of localised business rates and the abolition of council tax benefit. 6. Harrogate has not been immune to the funding reductions and since 2010, its general grant allocation has reduced by £5.4m (54%). The table below shows that during the same period, our net spend has reduced by £6.9m. 2010/11 2011/12 2012/13 Net Budget £000's 24,872 22,037 21,221 Page 2 2013/14 2014/15 2015/16 Total Reduction 20,982 19,718 17,991 -6,881 7. However, against the backdrop of funding reductions, Harrogate has maintained its position nationally as a well-resourced council. As the 13th most populous of England’s 201 shire districts, in 2015/16 Harrogate has: - The 4th highest net spend (services funded by council tax, revenue support grant (RSG) from government and localised business rates). - The 12th highest taxbase (the number of band D equivalent properties council tax is levied on), reflective of the district’s high property values. All of the districts above Harrogate are situated in southern England. - However, a net spend per head considerably lower at 25th out of 201 councils, reflective of the high population of the district. 8. Most importantly, under the localised business rates funding regime, 84% of Harrogate’s net spend is now locally generated (73% council tax, 11% business rates), with the residual 16% coming via RSG. 9. Each Council has a unique split of funding which is based on past decisions related to council tax, the size of its taxbase and previous funding allocations. 10. The government’s approach to funding allocations so far has been broadly based on blanket percentage reductions. The table below shows a basic example of the effects of this approach on two councils with different splits in their funding. Council A, like Harrogate, has a high proportion of its funding generated locally, whereas Council B is more reliant on government support. When a 30% reduction in RSG funding is applied, as has been the case in recent years, Council B’s overall net spend is reduced significantly more than Council A’s. It should be noted that due to local circumstances, Harrogate is particularly susceptible to reductions in fees, charges and local income due to economic changes. Council Tax Business Rates RSG Net Spend Council A £m % 14.000 70% 3.000 15% 3.000 15% 20.000 Council B £m % 6.000 30% 7.000 35% 7.000 35% 20.000 30% Reduction in RSG As a % of Net Spend -0.900 -5% -2.100 -11% 11. Given the pattern of funding reductions is likely to continue during the new parliament as the government aims to bring the national budget into surplus, the continued effects of the example outlined above will become more pronounced, as councils with lower proportions of locally generated income experience significant reductions in their net spend. This will most likely lead to a situation where some districts thrive and others decline. Page 3 12. A thriving district council will demonstrate: - self-reliance on income sources, - investment in facilities and infrastructure, - innovative and effective service provision, - a long term approach to planning. 13. The thriving district’s fortunes will be underpinned by steady increases in their council taxbase and business rates yields, increases from other income sources such as planning and car parks, as well as falling local welfare costs. 14. A declining district council will demonstrate: - no capacity to plan or invest in the future, - a greater emphasis in cutting services, - over reliance on government funding. 15. The declining district’s fortunes will be underpinned by static income from council tax, falling business rates yields, pressures on income budgets and rising welfare costs. 16. As well as the high levels of locally generated income funding our net spend, Harrogate clearly already displays a number of other key characteristics of a thriving district, including the Harrogate International Centre (HIC) and business tourism impact on the council, the Innovate programme and office accommodation strategy. 17. However, we can and will do more to cement this status. This strategy will outline steps to further integrate the MTFS with the Corporate Plan so that our spend better reflects our priorities, as well as developing longer term approaches to managing our finances and assets that ensures we are best placed to meet future challenges. Integrating Corporate and Financial Planning 18. One of the biggest challenges for any organisation is ensuring that its expenditure is aligned to its priorities. More often than not, historic spend will determine how much is invested in different activities which can lead to disparity between budgets and corporate priorities. 19. Harrogate’s latest Corporate Plan, covering the years 2014 to 2017 was approved by Cabinet in May 2014. This sets out our long term vision for the Harrogate district, our aim as an organisation, our corporate priorities and the long term outcomes that we want to achieve. Each year we publish our delivery plan, which details what we will do, what are targets are and how we will measure these. It comprises the following four priorities: i) A Strong Local Economy ii) A Sustainable Environment iii) Supporting our Communities iv) Excellent Public Services Page 4 20. One of the key aims of the MTFS will be to deliver budgets over the period that shifts our existing spend towards the priorities outlined above. This has to be a phased approach to ensure services can plan appropriately for change. We will achieve this via a number of means, including: - Reprioritisation of spend: taking account of past performance, ensuring that service budgets are properly aligned. - Transformation: the Innovate transformation programme has realised £1.9m in ongoing savings to date. Work will begin during 2015/16 which will see the introduction of a new programme that will build upon the work of Innovate. This will include the development of an Entrepreneurialism Culture that will seek to maximise income generation and ensure financial self-sufficiency by the end of the current Parliament. - Organisational Development: This strategy provides a very clear plan for how the council as a whole and at all levels needs to develop and change to meet future challenges. Our strategy works by promoting a whole system change and culture shift which enables us to really improve our effectiveness. - Workforce: We want a committed and motivated workforce which is skilled and flexible, which can adapt to the changing needs of both our customers and the council, and which feels valued and empowered. We want the right people, with the right skills at the right time, in the right place delivering excellent services. - Reducing corporate overheads: past internal reviews and External Audit reports have both concluded that our central service costs are high. The first phase of Corporate Affairs reviews will conclude during 2015/16 which will deliver over £0.5m in on-going staffing savings. - Office Accommodation: the move to new office accommodation on one site will help us deliver our priorities more effectively at the same time as creating scope for a leaner and more efficient organisation. - Maximisation of our assets: maximising the value extracted from our asset base by ensuring it is fully utilised and fit for purpose. Developing a Longer Term Approach to Managing Our Assets 21. How an organisation manages its assets can have a significant bearing on its long term success. The organisation that can create capacity to invest in its asset base will have a far greater chance of meeting its objectives than the organisation who will not or cannot do so, and who as a result will have a higher likelihood of facing the challenges of gradual decline. 22. With its current strong and varied asset base, Harrogate is no different and it is therefore imperative that we develop such an approach to ensure we can continue to meet our priorities. 23. This approach will have a number of aspects, including: - rationalising the current asset base so we only retain assets that help us deliver our priorities, Page 5 - maintaining the assets we do retain so that we can maximise the return from them and provide the best possible services to our residents, - identifying opportunities for acquiring new assets that help us further achieve our corporate objectives, - demonstrating flexibility in the way we fund such activity so that we get the most from our financial resources. Planned Maintenance of Our Asset Base 24. The 2015/16 MTFS agreed the introduction of a Planned Asset Maintenance budget, that would ensure a timely and prioritised approach to maintaining our assets, and that would be built up to a total of £800k over a three year period to 2017/18. The final 2015/16 budget included £356k in on-going funding for this leaving a balance to find of £444k in the following two years. 25. Since the introduction of the budget, comprehensive asset reviews have been undertaken, which have refined the assumptions over the pace of the budgetary growth required. A total of £800k is still required over the long term, but over the next four years rather than the initially assumed two. With the agreement of Strategic Property, this plan therefore allocates £111k per annum to that budget upto 2019/20. Capital Funding Review 26. Whilst the previous section of the report focuses on strengthening our approach to revenue maintenance, we will also identify capital investment opportunities in the coming years. 27. The council has a significant and varied asset base and work is on-going by the Strategic Property board to identify assets that are no longer economically advantageous to retain or that no longer contribute towards corporate priorities. 28. Rationalisation of the asset base may result in capital receipts that we will be able to reinvest in improving our existing assets, thereby creating facilities that are fit for purpose and which the revenue maintenance budget cannot achieve alone, or that we can invest in new assets that contribute to the council being a more efficient and effective organisation, the prime example being the new office accommodation project. 29. To date, the council has taken the approach of no external borrowing on general fund capital activity and in many cases has built up or borrowed internally against cash balances in order to pay for new assets. In times when there is abundant cash available, this can be a fair approach. However, there are a number of drawbacks when the funding circumstances are less favourable, including: i) Delays or missed service delivery opportunities that the new asset would bring during the period the cash balances are built up, ii) Given the differing time frames over which the repayment of borrowing and building up of balances occurs, there will undoubtedly be the issue that money that is being set aside could be better spent on providing frontline services. 30. Clearly too much borrowing by individuals or businesses can lead to a spiral of decline. However, CIPFA’s Prudential Code provides the framework and controls for councils to Page 6 reduce the likelihood of such issues occurring. If it helps the organisation meet the dual aims of meeting its priorities more quickly and effectively, at the same time as ensuring more funding is available for service provision, borrowing should be seen as a preferable option. 31. The recent Reserves Review identified that over £9m (60%) of our earmarked reserves are set aside for capital or investment purposes and that over £1.5m of the annual revenue budget is used for replenishing these reserves. As part of the outcomes of that report, we are committed to reviewing our approach to capital funding which we aim to complete within the next twelve months. The review will seek to: - assess our capital requirements over the next 25 years, - determine if the current approach represents the best use of resources, - re-assess options such as borrowing and leasing so that the Council is able to maximise benefit from its assets over the long term. Key Considerations in our Medium Term Financial Planning 32. This section outlines the detailed key considerations and assumptions we will make in our financial planning over the next five years. Council Tax 33. Harrogate has frozen its basic band D council tax for residents at £219.56 for six consecutive years. Funding well over 70% of our net spend, it is one of our most important income streams. 34. Following the 2010 general election, the coalition government committed itself to keeping bills down and from 2011/12 provided funding to councils who froze their tax. The terms of the grant on offer have varied in value and duration. Funding was initially the equivalent of a 2.5% increase and time limited. However, this has most recently fallen to 1% but with the commitment that it will be built into on-going funding settlements. 35. As the grant offers have been based on each council’s ability to raise tax, the biggest winners in the current system are those with the largest taxbases. A council with a large taxbase will more than likely be in an affluent area which will be reflected in relatively high property values, Harrogate being a prime example. Councils that haven’t done so well under the system tend to be in more deprived urban areas which have lower property values and as a result have lower taxbases. 36. As a result of past freezes locally, the Council currently receives £758k in funding from the government, equivalent to 4% of the net budget and summarised in the table below. It should be noted that the grant for freezing in 2012/13 was for the equivalent of a 2.5% increase but was provided for one year only. It is also important to highlight the council has foregone £1,106k in recurring income as a result of accepting past freeze offers. 2011/12 Freeze Grant (2.5%) 2014/15 Grant Value £000 340 Page 7 2013/14 Freeze Grant (1.0%) 2014/15 Freeze Grant (1.0%) 2015/16 Freeze Grant (1.0%) Total 139 139 140 758 37. At the same time as offering funding for council tax freezes, the coalition government replaced the old capping rules and introduced local referenda to veto excessive tax increases. Under this approach, alongside the annual funding settlement announcement, the Secretary of State for Communities & Local Government announces the tax rate increase that they deem excessive and if a council sets a rate that breaches this, the council would have to take the vote to the local electorate to approve it. 38. When the referendum rules were introduced, the excessive rate was 3.5%. However, like the freeze grant, this has reduced in time as the government has sought to impose its promise of frozen bills. 39. Following the May 2015 General Election, and the Chancellor’s 8 July Summer Budget, we anticipate that there will be a Comprehensive Spending Review (CSR) during the autumn to set out government spending plans for the new parliament. This will most likely be the earliest point in time where there will be clarity over the continuation of freeze grants. Whatever happens with freeze grants, there will be an expectation that Council Tax levels are kept low to contribute to overall lower public spending. 40. Any assumptions made about long term property growth in the district will be dependent on the development of the Local Plan. Until that is in place, we can expect the current scale of planning applications to continue and are therefore confident that the taxbase growth will result in £50k additional Council Tax income per annum and the Medium Term Plan later in the strategy reflects this. 41. For planning purposes, this strategy assumes annual council tax increases of 1.95%, just under the current referendum limit, which would generate an additional £250k per annum in new income. As the budget process develops, we will seek to identify options that may result in lower tax increases or even a freeze. 2016/17 2017/18 2018/19 2019/20 2020/21 Assumed Council Tax Increase 1.95% 1.95% 1.95% 1.95% 1.95% Additional Income £000's 250 250 250 250 250 Business Rates 42. Prior to 2013/14, all income collected by councils from business rates was paid into a national pool and then redistributed on the basis of relative need as part of the Formula Grant system. Under that scheme, a council’s main involvement was ensuring adequate collection. Page 8 43. One of the last government’s key themes was growing the economy and it is on that basis that they introduced the localised business rate retention scheme from 1 April 2013. The scheme allows local government to retain a share of any growth in business rates, with the aim that the sector will work hard to generate local economic development. In Harrogate’s case, the council can keep 50% of its 40% share of any growth, paying the rest over as a levy, in place to limit disproportionate gains. 44. In order to stimulate growth over wider geographic areas, councils are allowed to pool together. The main benefit of this is that rather than paying levies to the government, the money is retained by the pool for local uses. Harrogate is part of the Leeds City Region (LCR) Pool, along with Leeds, York, Wakefield, Calderdale, Kirklees and Bradford. 45. In the first two years of the system, a projected £4.5m has been saved in retained levies, including a £0.9m contribution from Harrogate. This money is being used for economic development initiatives across the region. 46. Priority 1 in the Council Plan is a Strong Local Economy, and aside from the positive social outcomes of a buoyant district, there are now direct financial rewards under the rates retention system. It is therefore important that emphasis is placed on continued economic development in the district to achieve these dual aims. 47. The introduction of the system has not been without complication. Each business has the right to appeal the valuation of its premises and the grounds for many of these are such that the liability extends back before the new system was introduced. Each council has been required to raise a provision which these potential costs can be charged against, which has served to reduce income in the first year in particular. The risk for all councils is whether the provision raised is enough to cover refunds as they materialise. 48. Several areas of the country, most prominently the North East, have been vociferous in their criticism of the retention scheme saying that coupled with the reduction of general grant, their average spending power is a fraction of that in the South East. There remains the possibility that the government may take the view that realigning business rates baselines will address these concerns. Should this happen, it will most likely negatively impact on Harrogate given our buoyant economy and positive figures from the first two years of the scheme. 49. The Government is also committed to reviewing the system from the perspective of businesses and a report on this is expected in time for the March 2016 Budget. 50. An overall reset of the current system is not planned until 2020. It is difficult to predict with any certainty the effects of this exercise and future versions of the financial strategy will develop assumptions on our approach to managing the reset. However, the Government Funding section later in the strategy makes a prudent assumption on the potential effects to the 2020/21 budget. 51. Given Harrogate’s early performance in the scheme, this strategy makes the assumption of £150k per annum year on year growth. This is a challenging target but reasonable as the council continues to deliver on its Strong Local Economy priority. Page 9 2016/17 2017/18 2018/19 2019/20 2020/21 Additional Income £000's -150 -150 -150 -150 -150 Government Funding 52. The council receives two main grants from the Government, RSG and the New Homes Bonus (NHB). Both are funded from the residual amounts of business rates collected nationally that are not returned to councils in the form of top up or safety net payments. Revenue Support Grant 53. The current RSG system was introduced at the same time as localised business rates. Like the business rates baseline, the majority of the initial allocation was determined on a relative needs basis. Since its introduction a number of other grants have been added including council tax freeze funding. 54. As highlighted earlier, the government is applying blanket reductions to RSG to reduce overall local government spending. The table below shows the allocations and reductions applied to Harrogate since 2013/14. 2013/14 2014/15 2015/16 Base Year on Year Allocation Reduction £000's £000's % 4,914 3,916 -998 -20% 2,905 -1,011 -26% 55. As outlined earlier, we are in a period of sharp uncertainty around our central government funding until the CSR is delivered in the autumn. In interpreting past projections and the Government’s election manifesto, the likelihood is that any reductions to our RSG will be frontloaded early in the Parliament in order to contribute to removing the national budget deficit. 56. We are conceivably in a position where our RSG will disappear in its current form by 2019/20. That said there are mechanisms by which the government can rebase the system, including via a business rates reset referred to earlier. The assumptions for the strategy, shown in the table overleaf, therefore centre on deep cuts in 2016/17 and 2017/18, lower reductions in 2018/19 and 2019/20 to reduce our allocation to nil and a £600k pressure in 2020/21 that reverses out prior gains from business rates. Page 10 2016/17 2017/18 2018/19 2019/20 2020/21 Grant Reduction £000's -1,100 -1,000 -500 -500 -600 New Homes Bonus 57. Introduced in 2011/12, NHB is an incentivised grant which is allocated based on a council’s ability to grow its domestic property taxbase and in effect, but not exclusively, rewarding the amount of new homes built. Alongside this, there are also premiums added for reducing long term empty properties and increasing the amount of affordable homes. The scheme was to be built up incrementally over six years. 2015/16 will be the fifth year of operation and the council will receive a total of £1,494k. The table below shows a breakdown of the amounts received in respect of each year to date. New Homes Bonus Allocations £000's 2011/12 2012/13 2013/14 2014/15 2015/16 Total 273 353 172 302 394 1,494 58. To date, like many others, Harrogate have used the grant to support on-going spend and there are two schools of thought surrounding this. On the one hand, the grant is funded from the overall national local government pot so if NHB didn’t exist, we would receive the money in some other form, with the value dependent on the allocation mechanism. On the other hand, it is not generally best practice to fund on-going expenditure from what could be seen as non-recurring money and other councils have used the money in imaginative ways such as creating funds to help generate economic growth. 59. Recent reviews, by the DCLG and the Institute of Fiscal Studies, have raised concern over the long term future of the NHB, with disagreement over whether the scheme actually provides an incentive for long term housebuilding. 60. In the absence of any certainty, this strategy assumes the scheme will continue and we will receive an increased allocation of £250k in 2016/17, before modest incremental increases on allocations from the first six years of the scheme are built upon in future years. Workforce and Pay 61. Local Government has been through a prolonged period of pay restraint experiencing a freeze for the four years between 2009/10 and 2013/14. The most recent pay deal, Page 11 covering the period 1 January 2015 to 31 March 2016 was 2.2% for all staff except chief officers (excluding the Chief Executive) who received 2%. 62. The initial pay claim made by the trades unions for 2016/17 is for a flat rate £1 per hour increase on all salary points. There is an expectation in this strategy that this will be rejected by local government employers and the more modest assumption of 1% awards per annum for each of the next five years (generating annual cost pressures of c.£250k) is included in the plan. 63. The national single tier pension system will be introduced in April 2016, and this will include the abolition of the current contracting out arrangements whereby organisations operating final salary schemes opt out of the second state pension and as a result pay lower contributions. Given the nature of the Local Government Pension Scheme, this will have a significant financial impact on the sector. Current estimates show that Harrogate will face a cost pressure of £420k in 2016/17 as a result of paying the higher contributions. 64. Superannuation payments due to the North Yorkshire Pension Fund for the past service element of pension costs have been set for the years to 2016/17, based on the latest triennial valuation of the fund, which will result in an additional cost increase of £160k in 2016/17. Indicative information has been received from the pension fund’s actuaries that shows a further increase of £110k in 2017/18 is likely and we assume costs of £100k per annum thereafter. These payments are required to remove the deficit related to this aspect of the fund over a 15 year period. This links to our Organisational Development Strategy and the issue of the ageing workforce and associated increased costs of redundancy and early retirement. Waste Recyclates 65. The Council will renew its dry waste recyclate contract in January 2016. The current contract with Yorwaste provides income fixed at £45 per tonne of co-mingled dry waste, which gives the council an overall income line in respect of material rebate of £495k. Since the current contract was signed in 2012, the market in which Yorwaste sell on the recyclates has fallen dramatically to the point that in March this year, the market rate for haulage and treatment by recycling of the co-mingled fraction was approx. £55 per tonne cost to the Council. 66. In negotiating the terms of the new contract, there is an expectation that market risk is not borne solely by the waste disposal company, as it is at present, and therefore we face the certain risk of a significant cost pressure to meet in the 2016/17 budget. Based on the figures quoted above, which have not moved significantly since March, we would expect to see a £600k swing in the recyclate material rebate income line. The income line from recycling credits will remain the same as this is a fixed rate (£47.15 per tonne) paid by NYCC to the Council. 67. For the purposes of planning, this strategy assumes the £600k pressure materialises in full in 2016/17. However, this will be kept under constant review as the contract is finalised during the autumn and winter. Reserves and Past Performance 68. As well as considering external funding factors, a financial strategy must take account of existing internal resources, such as reserves, as well as looking at past performance. Page 12 Reserves Review 69. The last edition of this strategy provided an overview of the council’s reserves position that showed balances, as at 31 March 2014, of c. £21.8m covering three categories: the working balance, earmarked reserves and business unit reserves. 70. Following on from this analysis, a fundamental review of the council’s reserves was carried out and reported to Members during June 2015. Building on the £1.6m release from the working balance as part of the February 2015 budget report, a further £530k reduction in earmarked and business unit reserves has ensured a £2.1m fund has been created to contribute towards the capital cost of the new office accommodation project. 71. Earlier sections of this strategy highlight the c.£9m of the balances that are in place to support capital investment, and also sets out our commitment to review the long term asset needs of the council to ensure this is the best use of our resources. 72. We have also introduced a new challenge process over the usage of business unit and earmarked reserves which will be incorporated into a revised annual service planning process, further demonstrating the integration of corporate and financial planning. There is an expectation that this will yield further releases into the annual budget process that can contribute to one-off investment in services. 73. The review also reset the recommended minimum working balance to £2.5m, which will be re-assessed annually by the Head of Finance as part of their statutory responsibilities on reporting on the robustness of the budget and adequacy of council reserves. 2014/15 and Past Performance to Approved Budget 74. The 2014/15 outturn position was reported to Members during June 2015. The report showed an underspend of £2,006k from Revised Estimate (RE) to outturn. Together with the £1,422k underspend reported at RE, there was an overall consolidated underspend for 2014/15 of £3,428k. 75. Mirroring the final outturn performance of 2013/14, our income generating services have again performed well above budget. Across the Council, consolidated variances against budget for fees and charges income are over £2m including: - HIC Lettings Income: -£694k - Planning Fee Income: -£527k - Revenues Recovery Income: -£428k - Waste Related Income: -£263k - Car Parking: -£114k 76. These income lines are all areas that suffered during the recession. The fact they have now improved markedly is an indicator of improved economic circumstances, but also reflect an overly conservative approach to estimation. A key strand of meeting the projected budget deficits in the early years of the Medium Term plan must be to realign our income budgets to more realistic levels. 77. The current budget monitoring process includes the mid-year Revised Estimate against which year-end performance is reported. At this stage, significant variances may result in Page 13 virements to other services and/or contributions to the working balance and other reserves. 78. It is however important to assess how the year-end outturn position relates to the Original Estimate (OE) budget approved in the previous February, as well as the RE. Figure 1 below shows this (Final underspend – solid line, RE underspend – dotted line) and demonstrates that, despite the current national picture, the council has consistently spent well under its approved budget, with the magnitude of the final position growing year on year. 4,000 3,500 3,000 £k 2,500 2,000 1,500 1,000 500 0 2010/11 2011/12 2012/13 2013/14 Fig 1: Revised Estimate and Final Underspends 2010/11 to 2014/15 2014/15 79. The graph also demonstrates a growing disjoint between what we are actually spending and what is being reported formally, the RE being the last point Members receive financial information before year-end. This promotes an unrealistic and risk averse financial culture in the organisation aided by a process that uses data from October. It also dilutes accountability by resetting all budgets at the mid-year point. 80. Whilst the graph clearly shows the ability of the organisation to live well within its means, there always remains the risk of an overspend, particularly if there is for example another fast and unexpected economic downturn. Continuing with the current approach significantly increases the risk of not capturing or formally reporting such issues so that mitigating actions can be taken. 81. This is why we shall be abolishing the RE process in 2015/16 and instead produce, on a service by service basis, three timely quarterly reports to Cabinet plus a final outturn report, all monitored against the same budget. This will be underpinned by new monthly exception reporting to Management Board. This will provide us with a monitoring system that increases accountability and increases the reliability of information reported formally. Previous Levels of Savings 82. In considering how we tackle future financial pressures, it is useful to assess the level of savings made in previous budgets. The table overleaf shows that since 2010/11, a total of £6,548k in savings have been delivered. The majority of these have been efficiency savings and with no reduction in frontline services. Page 14 2015/16 2014/15 2013/14 2012/13 2011/12 2010/11 Total Total Savings £000's -841 -955 -1,250 -1,434 -1,347 -721 -6,548 83. Figures in 2013/14 and 2014/15 were underpinned by significant savings related to the move to alternate weekly collections of waste, the result being that on average the council has typically made approximately £700-900k in efficiency savings per annum. 84. In recent years, variable targets have been allocated to ensure frontline services are protected relatively, whilst we have reduced costs of the back office at a higher rate. 85. Whilst broad year on year reductions to services cannot be the sole solution to balancing the budget, particularly in times of austerity, the council should always strive to ensure its services are cost effective and an element of efficiency savings should underpin each budget process or otherwise wastefulness creeps into the organisation. Summary 86. The high level reserves position, year-end performance and savings delivered since 2010/11 provide a good evidence base for the council’s strong financial health. It also demonstrates that the council has been resilient during the period of the economic crisis. 87. Whilst the reasons for year-end underspends vary, there is a clear pattern developing that suggests some income budgets are conservative rather than realistic. We also must not lose sight of the fact we can continually seek to cut out wastefulness in the organisation. In summary, there remains capacity to meet the challenges that will be posed by the five year plan outlined in the following section. The Medium Term Plan 88. One of the key aims of the Medium Term Plan is to determine how we need to shape our finances over the next five years. As well as the key considerations outlined above, we also have to be mindful of service specific issues. 89. In constructing this plan, we have made the following further assumptions: - Utility costs – an allowance for general price inflation as well as additional costs associated with the introduction of the Government’s electricity market reform policy from 2015/16. - Other cost pressures – allowances for general inflation, vehicle fuel price increases, and potentially volatile income streams. Page 15 - Interest receipts – assuming a gradual increase in interest rates resulting in improved returns on our investments. - Grants reduced and removed – as well as decreases in general grant allocations, individual specific grants are also likely to decrease, notably in relation to benefits administration. - Office Accommodation – Council will make a final decision on 15 July 2015 on future office accommodation. This plan assumes a net nil impact on the bottom line pressure, with any debt charges to be met by the efficiency savings identified in the reports package. 90. The table below brings together our key considerations and further assumptions outlined above. Medium Term Plan 2016/17 2017/18 2018/19 2019/20 2020/21 £000 £000 £000 £000 £000 Changes in Expenditure Pay Award National Insurance – End of Contracting Out Past Pension Costs Utility Costs Planned Asset Maintenance Waste Recyclates Other Cost Pressures 250 420 160 110 111 600 250 250 0 110 110 111 0 250 250 0 100 110 111 0 350 250 0 100 110 111 0 400 250 0 100 110 0 0 450 Changes in Income Interest Receipts -50 -150 -125 -125 -125 Changes in Funding Retained Business Rates Revenue Support Grant Council Tax Increase Increases to the Council Taxbase Additional New Homes Bonus Other Grant Variations -150 1,100 -250 -50 -250 70 -150 1,000 -250 -50 -30 60 -150 500 -250 -50 -30 50 -150 500 -250 -50 -30 40 -150 600 -250 -50 -30 30 Initial Budget Deficit 2,321 1,261 866 906 935 91. The table shows significant pressures of £3.6m covering the first two years of the strategy, which is an unprecedented level when as we have seen, we have typically had to find in the region of £700-900k savings per annum in the past. To summarise the passages of the key considerations, the reasons for the significant pressures are: - RSG reductions - anticipated to be front loaded in the early years of the new Parliament. This is our best current estimate and the Chancellor's summer budget on 8 July and CSR thereafter will likely signal whether refinements to our assumptions, including potentially a worsening position, are required. - National Insurance - contracting out arrangements cease with the introduction of the single state pension on 1 April 2016 increasing costs to employers. Page 16 - Waste Recyclates - the market for selling on dry recyclates has fallen dramatically. The new recyclates contract will be renewed in January 2016 and the £600k pressure is the current forecasted swing compared to the current budget. Budget Transition Fund 92. The initial budget deficits for 2016/17 and 2017/18 will be extremely challenging to achieve without cutting services and cannot be delivered by efficiency savings alone. Whilst we have already made it clear that we will do all we can to ensure existing income budgets are realistic, again that will not cover the gap. 93. Potential significant savings items such as the introduction of Green Garden Waste charges, reviews of leisure provision and developing the entrepreneurialism agenda will take time and will not yield significant gains until 2017/18 at the earliest. 94. It is for this reason that Cabinet agreed the set aside of £1m from the 2014/15 year end underspend to create a Budget Transition Fund. The fund will allow us to smooth the effects of the first two years of the Medium Term Plan into more manageable, but still challenging, savings targets until such a time when we expect the deficits to be smaller and when the large projects outlined above will be fully operational. It will also help reduce, but not remove the risk, of cutting services and a full appreciation of the discretionary services that we provide on an ongoing basis is still required during this planning period. 95. Based on the current plan, the table below shows how we intend to allocate the fund and the corresponding effects on the projected deficits. Members have to be mindful that we need to demonstrate flexibility with the fund as assumptions are refined during the budget process. 2016/17 2017/18 2018/19 2019/20 2020/21 £000 £000 £000 £000 £000 Initial Deficit 2,321 1,261 866 906 935 Use of Budget Transition -700 -300 0 0 0 Removal of Prior Year Effect 0 700 300 0 0 Revised Deficit 1,621 1,661 1,166 906 935 Savings Approach 96. The last edition of this strategy raised the possibility of planning our budgets on a rolling two year basis and since that time Mazars, our external auditors, have increased our risk rating for financial sustainability in their Annual Report. This is because to date we have only been able to demonstrate savings plans for one of the next three years. 97. Given we have set out the need to take a longer term approach to managing our finances, we will therefore bring forward proposals in the autumn covering 2016/17 and 2017/18, introducing a rolling two year budget process from that point onwards. This is the right approach in demonstrating the attributes of a thriving council as it gives us the opportunity to better plan our services and increase the certainty of our financial position over a longer time period. 98. In terms of meeting the challenges of identifying £3.3m of expenditure reductions over two years, the equivalent of 2.5% of controllable combined expenditure and income per annum, we will: Page 17 - Allocate initial resource allocations, reflective of the service’s contribution to corporate priorities, which reduce service budgets to meet each annual deficit. - Understand that some services may be able to reduce their budgets in one year more than another and reflect this with flexed allocations. - Acknowledge that the pay award, utilities and inflation are met corporately as demonstrated in the Medium Term Plan. - Ensure that each service demonstrates clearly how it has moved from the previous year to the new allocation, including any other areas of budgetary growth are met by compensating reductions in expenditure or increases in income within the service’s overall resource allocation. - Give services more flexibility in meeting their resource allocation by allowing changes to Fees and Charges to contribute for the first time. - In line with established Financial Procedures, recommend a 2.5% increase on Fees and Charges. However, we must be pragmatic about this; where it is economically advantageous to increase beyond this level, the opportunity must be exploited; where it can be demonstrated such an increase will harm service usage levels, lower increases or a freeze must be appropriately explained. 99. This approach requires full commitment from Officers and Members alike so that comprehensive plans can be presented formally for approval in January and February 2016. Risk Statement 100. Medium term financial planning, set against a backdrop of severe reductions in Government funding, is a risk laden exercise. Many factors may impact on the figures presented here and themes have been highlighted where appropriate. Most significant would appear to be the potential revisions in Local Government finance policy that may occur during the summer and autumn as the government finalises the next CSR. It remains to be seen to what extent this would affect Harrogate; however, we have to be mindful that, relatively speaking, we benefit from the current system focused on property and business bases. Should there be a change in emphasis, particularly around rebalancing RSG and Business Rates funding, there may be further reductions above those presented in the plan that would place further pressure on the council to deliver balanced budgets, without harming frontline services. 101. Beyond this, further policy announcements from the Government following the General Election, particularly around welfare reform and housing, may have effects on our finances in the coming years. 102. Despite these risks, we will continue to plan effectively and the process changes outlined in Appendix 1 will strengthen our culture of strong financial management so that the council can continue to meets its priorities and provide the best possible services to the district. Page 18 Appendix 1 Summary of Financial Process Changes The purpose of this appendix is to provide Members with summary information, referred to throughout the strategy, on some of the numerous changes we are making to our financial processes as part of the Finance review. 1. We will take a longer term approach to managing our finances by: - assessing our long term capital investment needs so as to ensure best use of the reserve and base budget resources currently available to us. - plan budgets on a rolling two year resource allocation basis which will allow us to better plan our services and increase the certainty of our financial position over a longer time period. 2. We will improve transparency and reduce complexity by: - simplifying the budget setting process, which will demonstrate the following key strands: removal of the current Service Level Agreement process so that services have more time to focus on delivering their own controllable budget resource allocation. presenting service budget reports to Cabinet and Overview & Scrutiny Members that are understandable, focus on the controllable budget of each service and link easily to the presentation of the overall corporate budget report. in achieving the above, significantly reducing the current over-emphasis on recharges so allocations are shifted into the background as indeed any accounting exercise should be. 3. We will increase accountability by: - abolishing the RE process, with Heads of Service held accountable to the approved budget throughout the entire year. - moving to monthly reporting at Management Board to cement full corporate ownership of the council’s financial position. - increasing the amount of timely financial monitoring reports presented to Members in year, with three quarterly reports and a revamped outturn report. 4. We will further integrate corporate and financial planning and performance by: - introducing a further performance clinic in the autumn that challenges each Heads of Service budget and service plans, including reserve balances. - working towards linking finance and performance monitoring reports so as to facilitate stronger decision making.