COPE Slide Presentation

advertisement

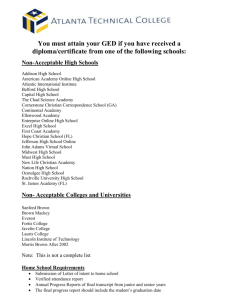

“COPE” – Property Underwriting and Effective Loss Control Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance The advent of the modern property policy can be traced back to just after the Great Fire of London in 1666 Property underwriters from the very beginning have used the same information to evaluate a risk: Construction (C) Occupancy (O) Protection (P) Exposure (E) Collectively known as “COPE” data within the insurance world. Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance The “Construction” element of COPE is broken into three sub-parts: Construction materials Square footage Age Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance ISO defines six construction classifications based on the combustibility and damageability of the “major structural features” “Major structural features” are defined as: Exterior, load-bearing walls (primary element) Roof (secondary element) Floors (secondary element) Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Exterior, load-bearing wall types (“Primary”): Masonry Fire resistive/modified fire resistive Non-masonry / non-fire resistive Combustible (i.e. wood) Roof and floor types (“Secondary”): Concrete Fire resistive/modified fire resistive Non-combustible/slow burning Wood or materials not included above Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Primary and secondary elements combine to delineate the construction class. The lower the number, the more susceptible to fire damage the structure is considered to be: “1” – Frame “2” – Joisted-Masonry “3” – Non-Combustible “4” – Masonry Non-Combustible “5” – Modified Fire Resistive “6” – Fire Resistive Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance 1. If the exterior load-bearing wall is frame (wood), the entire building is rated as frame, regardless of the roof material 2. If the exterior load-bearing wall is anything OTHER THAN masonry, modified fire resistive or fire resistive, the structure’s construction class is based on the roof and floor construction material Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance 3. If the load-bearing walls are masonry, fire resistive or modified fire resistive, the construction class becomes a function of the floor and roof materials. 4. “Major structural features” are often an assembly of several parts. When this is the case, the entire assemblage is classed using its most combustible or susceptible member Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Wall Material Floor/Roof Material Construction Class Code Wood / Combustible1 Non-Combustible / Metal Masonry2 Modified Fire Resistive Fire Resistive Wood / Combustible1 Wood / Combustible1 Wood / Combustible1 Wood / Combustible1 Wood / Combustible1 Frame Frame Joisted Masonry Joisted Masonry Joisted Masonry 1 1 2 2 2 Wall Material Floor/Roof Material Construction Class Code 1 3 Wood / Combustible Non-Combustible / Metal Masonry Modified Fire Resistive Fire Resistive Non-Combustible / Slow Burning Non-Combustible / Slow Burning3 Non-Combustible / Slow Burning3 Non-Combustible / Slow Burning3 Non-Combustible / Slow Burning3 Frame Non-Combustible Masonry Non-Combustible Masonry Non-Combustible Masonry Non-Combustible 1 3 4 4 4 Wall Material Floor/Roof Material Construction Class Code Concrete, Modified Fire Resistive or Fire Resistive Concrete, Modified Fire Resistive or Fire Resistive Concrete, Modified Fire Resistive or Fire Resistive Concrete or Fire Resistive Concrete, Modified Fire Resistive or Fire Resistive Modified Fire Resistive Concrete or Fire Resistive Frame Non-Combustible Modified Fire Resistive Fire Resistive Modified Fire Resistive Modified Fire Resistive Fire Resistive 1 3 5 6 5 5 6 1 Wood / Combustible Non-Combustible / Metal Masonry4 Masonry4,5 Modified Fire Resistive Fire Resistive6 Fire Resistive6 1 Includes a “Combustible Assembly” One layer of non-load-bearing bricks covering metal studs is not considered a masonry wall; it is a non-combustible wall with a brick facade. 3 This includes Built-Up Tar and Gravel Roof 4If the masonry does not meet the requirements of footnote “5” but is at least 4 inches thick, then the structure is classed as modified fire resistive. 5To qualify, the wall must be either: 1) solid masonry at least 4” thick; 2) hollow masonry at least 12” thick; or 3) hollow masonry between 8” and 12” think with a listed fire resistance rating of at least 2 hours. 6”Fire Resistive” is defined as a non-combustible material or assemblies with a fire resistance rating of at least 2 hours. Can be accomplished based on the material or by the application of a sprayed on cementitious mixture covering all exposed metal. If between 1 and 2 hours fire resistance rating, the member is considered “modified fire resistive.” 2 Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance What affect does a combination of diverse construction materials have on a building’s construction classification? Unless the superior construction materials constitute 66 2/3% or more of that ratable “major structural feature,” the entire feature is assigned the lower class Two examples follow Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Exterior and Interior features may affect combustibility and damageability. These are known as “Minor” or “Secondary” construction features A large amount of combustible interior walls (including assemblies) Combustible flooring (think bowling alleys) Combustible exterior attachments Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance The main aspect of structure size from the underwriting aspect is in the comparison of the building’s “maximum possible loss” (MPL) versus its “probable maximum loss” (PML) Requires the insurer to review the possibility of a total or constructive total loss Necessitates a review of the “Protection” (“P”) features in place Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Underwriters will concern themselves with the building’s major systems (roofing, plumbing, HVAC and wiring) when underwriting an older structure Have the systems been maintained and updated as necessary? When were the last updates? What was the extent of those updates? Who did the updates? Agents should concern themselves with the age issue due to changes in construction-related ordinances and laws. May create the need for additional coverage Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance “Occupancy” information is broken into two parts: 1. What the insured does 2. How the insured manages the “hazards” associated with what they do (known as the “Hazards of Occupancy”) “Hazard” is defined as: Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Two primary occupancy classifications: Each class of insured presents its own basic relative risk of property loss. The greater the basic risk of loss, the more closely the underwriter analyzes the operations/occupancy. Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Similarly classed insureds do not necessarily manage their operations similarly. Since each insured manages its exposures and hazards differently, each presents its own “hazards of occupancy.” Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Body Shop “A” Body Shop “B” Body Shop “C” All three share the same construction classification, protection class, square footage, general methods of doing business and experience. The only difference is how flammable/ combustible liquids are stored. Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Housekeeping The amount of combustible materials within the building The condition of major systems (heating and wiring) Dust-collection systems for woodworking and like operations Use of spark-reduction/arresting equipment where necessary The amount and storage of any other potentially hazardous materials Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Property underwriters view property protection measures in regards to their ability to lessen the amount of property damage Primary property protection provided by: Sprinkler systems Fire extinguishers Alarm systems Fire doors and fire walls Public fire protection Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Merely having a sprinkler system is not sufficient Main question: Is the system adequate and proper for the occupancy? (Fire load, water supply, etc.) Other necessary underwriting information: The type of system; The condition of the system; If the location and number of sprinkler heads is adequate; The size and location of any non-sprinkered area; and Whether there is adequate sprinkler protection in the situation where there is high-rack storage Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance What the underwriter needs to know about extinguishers: Are there an appropriate number for the building Are they properly located and at eye level Are they in the path of natural exit Are they the correct size Are the fire extinguishers the correct type: o o o o o Class A – Paper, wood, etc. (anything that produces “A”sh) Class B – Flammable or combustible liquids (anything that “B”oils) Class C – Electrical fires (anything that has a “C”harge) Class D – Combustible metals such as shaved magnesium Class K – Cooking oils and fats (“K”itchen) Are the extinguishers inspected and, if necessary, charged annually Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Underwriter Concerns: The type of system in use If at an off-site location, is the monitoring company listed by Underwriters Laboratory (UL) Where does the alarm sound? Is the system installed properly? Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Directly affect the “Probable Maximum Loss” (PML) Fire WALLS must meet certain minimum standards: Continuous masonry wall At least 6” to 8” thick (based on the masonry material used) Must come into direct contact with fire resistive, masonry or non-combustible roof or walls Must pierce “slow burning,” or combustible (including assemblies) roof or walls HVAC ducts must be protected by at least ONE 1½ hour damper Any openings must be protected by proper “fire doors” What is a “Proper Fire Door” Self-closing Listed for 3 hour protection (Class “A” by UL) or have a sprinkler curtain Cannot be blocked open Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Fire departments are graded on a scale of 1 to 10 based on response time, personnel, training, equipment and water supply (including alternative water sources); the lower the number, the better the rating. Country Wide 30.000% 25.000% 20.000% 15.000% Country Wide 10.000% 5.000% 0.000% 1 2 3 4 5 6 7 8 9 10 What about “Split Classes” (i.e. 6/9) Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Is the insured property exposed to any external hazards? External exposures relevant to property underwriters include: The insured structure’s proximity to a high-hazard operation The local wildfire risk The possibility for damaging winds and/or water The structure’s flood zone location (located in or near a special flood hazard area (SFHA)) The structures earthquake exposure The jurisdictions building code requirements Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance Allows better planning when gathering the property information Knowing what to provide and why to provide specific information makes the underwriting process smoother and, hopefully, quicker Agents can better assist clients when they are planning upgrades to current structures or constructing new buildings Insurance Journal’s Academy of Insurance Training Series “COPE” – Property Underwriting and Effective Loss Control © 2011 Insurance Journal Academy of Insurance