Business Succession Presentation - JVK Life & Wealth Advisory Group

advertisement

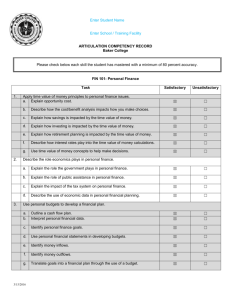

Investing in your small business success Agenda Protecting your business Banking outside the box Investing in the future Protecting your business The problems you face Day-to-day managing Long-term viability Liability protection Managing risk Your challenges Investment and retirement planning Succession planning Loss of owner/key person Attracting/retaining employees Income taxes and tax liabilities Creditor and Liability Protection Business investment income taxes Innovative banking solutions Your business – your legacy Plan a successful succession Protect your interests Anticipate future needs Valuation Tax Liabilities Capital Gains Exemption Estate Freeze Buy/Sell Funding Life Insurance Can your business survive without you? Sole Owner Sufficient funds to carry on Succession planning protects your heirs Your expectations can be met Can your business survive without you? Multiple owners Death or disability stresses the partnership Who steps in to act for the deceased? Chances for a good outcome are poor Advance planning averts catastrophe Buy/sell agreements Buy-out options Proper funding Business as usual Orderly dissolution plan Life insured investments Life insurance Death Disability Retirement Disagreement How much is it worth? Adjusted balance-sheet or asset book value Asset replacement value Comparison Pulling the trigger on tax Tax is triggered by Sale of the business A ‘deemed disposition’ Capital gains tax Change of use Transfer Emigration Death Asset exchange Assets pay debts Transfer to trust Succession strategies you can use Use your $500,000 lifetime capital gains exemption* Consider an estate freeze* Life insurance or life-insured investments *Applies to incorporated companies only Buy/Sell Funding Shareholders’ agreement Changes in ownership create financial obligations Life insurance death benefits funds: buy-out tax implications Buy/Sell Funding Corporate owned policy* Lower aggregate premiums Easier cost allocation Ensure that premiums are paid *Concerns about creditor protection, tax consequences and effects of provincial family legislation must be addressed to determine the best approach for your circumstances Buy/Sell Funding Individually owned policy* Paid for with after-tax dollars Expensive Confusing *Concerns about creditor protection, tax consequences and effects of provincial family legislation must be addressed to determine the best approach for your circumstances Collateral insurance coverage Tax deductible business expense Tailored to fit your needs What impact will the loss of a key person have on your business? Business is disrupted Sales decline Employees’ security is threatened Creditors become alarmed Deliverables in doubt Attract and retain good employees Financial compensation Business environment Life and living benefits insurance Creditor Protection Strategy Protect your personal assets Investments with insurance benefits Growth from investment Personally guaranteed debts Wages and vacation pay to employees Source deductions owed to Canada Revenue GST and PST Health and safety violations Environmental damage Strategies for protecting personal assets Incorporation Spouse’s name Business liability insurance Invest in products that offer creditor protection Hold life insurance contracts personally Professional tax and legal advice Establish a plan while the business is healthy Banking outside the box Banking outside the box Highest return on investments Unique alternatives to borrowing Innovative products Simply financing needs Manulife Bank Innovation, flexibility, outstanding rates Business Advantage Account GICs Custom investment loans Flexible, low cost financing Access Line of Credit Plus Manulife one Account Manulife Bank Investing in the future Working toward retirement Retained earnings Business investment income Individual Pension Plan Segregated Funds Life insurance GICs and GICs. What’s in a name? Guaranteed Investment Certificates Guaranteed Interest Contracts Bank Insurance company Designate beneficiary Creditor protection Probate fees and settlement delays avoided GICs. Security for your portfolio. Solid foundation for your portfolio Positive rate of return Peace of mind Broad range of investment choices Segregated Funds Investment with insurance guarantees Creditor protection Protects your beneficiaries Tax advantages Benefits for long-term investing You’ve got leverage Borrow money to earn money Interest is tax-deductible Benefit from compounding Good potential, higher risk Business investment income taxes Option: Invest surplus in GICs and CSBs CSBs and GICs taxed at top corporate rate Option: Use surplus to buy life insurance Tax-deferred growth of the surplus Tax-free death benefit Small Business Solutions Recap Loss of owner/key person Retirement Tax liabilities Succession planning Creditor protection Capital Growth Life-insured investments Life insurance Buy/Sell funding Leveraged investing Pension plan/IPP Collateral insurance Small Business Solutions Recap Loss of owner/key person Retirement Tax liabilities Succession planning Creditor protection Capital Growth Life-insured investments Life insurance Buy/Sell funding Leveraged investing Pension plan/IPP Collateral insurance Small Business Solutions Recap Loss of owner/key person Retirement Tax liabilities Succession planning Creditor protection Capital Growth Life-insured Investments Life insurance Buy/Sell funding Leveraged investing Pension plan/IPP Collateral insurance Small Business Solutions Recap Loss of owner/key person Retirement Tax liabilities Succession planning Creditor protection Capital Growth Life-insured Investments Life insurance Buy/Sell funding Leveraged investing Pension plan/IPP Collateral insurance Small Business Solutions Recap Loss of owner/key person Retirement Tax liabilities Succession planning Creditor protection Capital Growth Life-Insured Investments Life Insurance Buy/Sell funding Leveraged investing Pension plan/IPP Collateral insurance Small Business Solutions Recap Loss of owner/key person Retirement Tax liabilities Succession planning Creditor protection Capital Growth Life-Insured Investments Life Insurance Buy/Sell funding Leveraged investing Pension plan/IPP Collateral insurance Solutions for Small Business Investing Banking Insurance Manulife Investments Solutions for today Solutions for tomorrow Thank you