SEWP: Plan Funding

advertisement

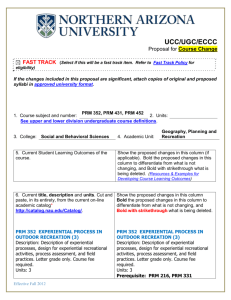

PRM Financial Group Reality-Based Planning™ PRM Financial Group 2 Northfield Plaza, Suite 255 Northfield, IL 60093 847-386-7692 Fax 847-386-7154 e-mail: peter@prmfinancial.com PRM FINANCIAL GROUP COMPANY OVERVIEW • Located in Northfield, IL • Network of Actuaries, TPAs, advanced planning experts, marketing, sales, & underwriting assistance • Reality-based planning™ • Dealing with real rather than ideal situations • Provide meaningful employer focused benefits, meet budgetary restraints, and achieve management strategic goals • Optimized for today, enduring through tomorrow PRM FINANCIAL GROUP COMPANY OVERVIEW • Serve the benefits, retirement, and tax planning needs of individuals, small businesses and professional companies PRM FINANCIAL GROUP COMPANY OVERVIEW • Serve the benefits, retirement, and tax planning needs of individuals, small businesses and professional companies • Partner with CPAs, financial and legal consultants, sales professionals, and other advisors to provide individuals and small business clients with a wide range of planning solutions PRM FINANCIAL GROUP COMPANY OVERVIEW • Serve the benefits, retirement, and tax planning needs of individuals, small businesses and professional companies • Partner with CPAs, financial and legal consultants, sales professionals, and other advisors to provide individuals and small business clients with a wide range of planning solutions • Design customized plans that reach the client’s goals while respecting budgetary constraints PRM FINANCIAL GROUP COMPANY SERVICES • Health Insurance • Telemedicine • Individual and Small Business Insurance Planning PRM FINANCIAL GROUP COMPANY SERVICES • • • • Health Insurance Telemedicine Individual and Small Business Insurance Planning Multiplan • Highly specialized planning concept PRM FINANCIAL GROUP COMPANY SERVICES • • • • Health Insurance Telemedicine Individual and Small Business Insurance Planning Multiplan • Highly specialized planning concept • Retirement Plan Comparisons • Analysis of available and appropriate plan options for educated client decisions PRM FINANCIAL GROUP COMPANY SERVICES • • • • Health Insurance Telemedicine Individual and Small Business Insurance Planning Multiplan • Highly specialized planning concept • Retirement Plan Comparisons • Analysis of available and appropriate plan options for educated client decisions • Single Employer Welfare Plan (SEWP) • An employer sponsored welfare benefit plan • Designed to fund post retirement medical expenses on a pre-tax basis PRM FINANCIAL GROUP COMPANY SERVICES • Education • Qualified Retirement Plans • 419A(c)(2) Single Employer Welfare Plans • Other relevant, unique, owner-focused concepts PRM FINANCIAL GROUP COMPANY SERVICES • Education • Qualified Retirement Plans • 419A(c)(2) Single Employer Welfare Plans • Other relevant, unique, owner-focused concepts • Marketing Support • • • • Marketing Pieces E-mail content and/or campaign management Contact lists and calling programs Others as needed PRM FINANCIAL GROUP COMPANY SERVICES • Focus for Today… • Single Employer Welfare Plan (SEWP) •An employer sponsored welfare benefit plan •Designed to fund post retirement medical expenses on a pre-tax basis PRM FINANCIAL GROUP THE GOAL • Help you close more business • We are in the game with you…not on the sideline PRM FINANCIAL GROUP THE GOAL • Help you close more business • We are in the game with you…not on the sideline • Be a trusted resource and partner for you • Qualified Retirement Plans • 419A(C)(2) Single Employer Welfare Plans • Other relevant, unique, and owner-focused concepts PRM FINANCIAL GROUP THE GOAL • Help you close more business • We are in the game with you…not on the sideline • Be a trusted resource and partner for you • Qualified Retirement Plans • 419A(C)(2) Single Employer Welfare Plans • Other relevant, unique, and owner-focused concepts • Do the dirty work • • • • Gather information and options Filter through the data Make the proposals digestible and saleable! Provide and manage the necessary documents PRM FINANCIAL GROUP SINGLE EMPLOYER WELFARE PLAN (SEWP) • Create • Protect • Preserve A stand alone program or companion to retirement planning PRM FINANCIAL GROUP SEWP: THE NEED • People are living longer than ever before • There is a 62% chance that at least one spouse can expect to survive to age 90 PRM FINANCIAL GROUP SEWP: THE NEED • People are living longer than ever before • There is a 62% chance that at least one spouse can expect to survive to age 90 • Health care costs continue to rise faster than rate of inflation • It has outpaced inflation for 20 years! PRM FINANCIAL GROUP SEWP: THE NEED • People are living longer than ever before • There is a 62% chance that at least one spouse can expect to survive to age 90 • Health care costs continue to rise faster than rate of inflation • It has outpaced inflation for 20 years! • It is widely believed that Medicare is in deep trouble • Deficit nearly twice as large as the Social Security deficit PRM FINANCIAL GROUP SEWP: THE NEED •In 2010, approximately 24% of a retiree’s after-tax income was needed to pay for health care costs PRM FINANCIAL GROUP SEWP: THE NEED •In 2010, approximately 24% of a retiree’s after-tax income was needed to pay for health care costs • Approx. 29% in 2020 PRM FINANCIAL GROUP SEWP: THE NEED •In 2010, approximately 24% of a retiree’s after-tax income was needed to pay for health care costs • Approx. 29% in 2020 • Approx. 35% in 2030 PRM FINANCIAL GROUP SEWP: THE REASON • Longer lives PRM FINANCIAL GROUP SEWP: THE REASON • Longer lives • Advances in medical technology • Leading to better, but more expensive treatments PRM FINANCIAL GROUP SEWP: THE REASON • Longer lives • Advances in medical technology • Leading to better, but more expensive treatments • High administration costs • Fragmented health care delivery and financing system PRM FINANCIAL GROUP SEWP: THE REASON • Longer lives • Advances in medical technology • Leading to better, but more expensive treatments • High administration costs • Fragmented health care delivery and financing system • Existence of many highly paid medical specialists • They are doing amazing things, but it is expensive PRM FINANCIAL GROUP SEWP: THE REASON • Longer lives • Advances in medical technology • Leading to better, but more expensive treatments • High administration costs • Fragmented health care delivery and financing system • Existence of many highly paid medical specialists • They are doing amazing things, but it is expensive • Prescription Drugs • The number of drugs (expensive) that represent miracle cures • The number of people who are required to take drug treatments PRM FINANCIAL GROUP SEWP: A SOLUTION • Post Retirement Medical Planning is a solution • This is the only plan that Penn Mutual allowed after conducting“Third Party Planner” audit PRM FINANCIAL GROUP SEWP: A SOLUTION • Post Retirement Medical Planning is a solution • This is the only plan that Penn Mutual allowed after conducting“Third Party Planner” audit • Its up to us to help our clients secure their financial futures! • Most people are unaware of this planning concept PRM FINANCIAL GROUP SEWP: A SOLUTION • Post Retirement Medical Planning is a solution • This is the only plan that Penn Mutual allowed after conducting“Third Party Planner” audit • Its up to us to help our clients secure their financial futures! • Most people are unaware of this planning concept • Plan today for the costs of tomorrow • They are inevitable PRM FINANCIAL GROUP SEWP: OVERVIEW • A Welfare benefit plan designed to fund post retirement medical expenses on a pre-tax basis • Supplements Medicare • Allows clients to use their dedicated retirement funds for their retirement rather than for medical expenses PRM FINANCIAL GROUP SEWP: OVERVIEW • A Welfare benefit plan designed to fund post retirement medical expenses on a pre-tax basis • Supplements Medicare • Allows clients to use their dedicated retirement funds for their retirement rather than for medical expenses • Annual funding contributions accumulate the cash value necessary, at a specific retirement time, to pay for medical expenses for the lifetime of the participant and eligible dependents PRM FINANCIAL GROUP SEWP: OVERVIEW Contributions to the plan = tax deductible Cash Value Growth = tax free Withdrawals During Retirement = *tax free * When taken for allowable medical expenses PRM FINANCIAL GROUP SEWP: OVERVIEW • Contributions are based on actuarial calculations PRM FINANCIAL GROUP SEWP: OVERVIEW • Contributions are based on actuarial calculations • Spouses and dependants can be included in plan funding PRM FINANCIAL GROUP SEWP: OVERVIEW • Contributions are based on actuarial calculations • Spouses and dependants can be included in plan funding • In the event that the participant does not live to retirement or completion of the plan, a death benefit is paid to the beneficiary PRM FINANCIAL GROUP SEWP: OVERVIEW • Internal Revenue Code Section 419A(c)(2) authorizes current funding of post-retirement life and medical benefits PRM FINANCIAL GROUP SEWP: OVERVIEW • Internal Revenue Code Section 419A(c)(2) authorizes current funding of post-retirement life and medical benefits • Provided that the benefit reserves • Are actuarially determined PRM FINANCIAL GROUP SEWP: OVERVIEW • Internal Revenue Code Section 419A(c)(2) authorizes current funding of post-retirement life and medical benefits • Provided that the benefit reserves • Are actuarially determined • Are levelly funded over the working lives of participating employees PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • Premium payments for Medicare Part B PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • Premium payments for Medicare Part B • Supplemental insurance PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • Premium payments for Medicare Part B • Supplemental insurance • Medical expenses not covered by Medicare PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • • • • Premium payments for Medicare Part B Supplemental insurance Medical expenses not covered by Medicare Prescription drugs PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • • • • • Premium payments for Medicare Part B Supplemental insurance Medical expenses not covered by Medicare Prescription drugs Rehabilitative and/or Long-Term care PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • • • • • • Premium payments for Medicare Part B Supplemental insurance Medical expenses not covered by Medicare Prescription drugs Rehabilitative and/or Long-Term care Hospice care PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • • • • • • • Premium payments for Medicare Part B Supplemental insurance Medical expenses not covered by Medicare Prescription drugs Rehabilitative and/or Long-Term care Hospice care Transportation and lodging expenses incurred in the process of obtaining medical treatment PRM FINANCIAL GROUP SEWP: OVERVIEW • Medical benefits* may include, but are not limited to: • • • • • • • Premium payments for Medicare Part B Supplemental insurance Medical expenses not covered by Medicare Prescription drugs Rehabilitative and/or Long-Term care Hospice care Transportation and lodging expenses incurred in the process of obtaining medical treatment • Durable equipment & supplies necessary to regain or maintain physical well-being *See IRC Section 213 for full list PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Focusing on funding for post-retirement benefits addresses two vital issues PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Focusing on funding for post-retirement benefits addresses two vital issues • Creates means of dealing with real future expenses whose costs might otherwise be disastrous PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Focusing on funding for post-retirement benefits addresses two vital issues • Creates means of dealing with real future expenses whose costs might otherwise be disastrous • Creates demand for substantial employer contributions that are deductible under the Code PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Permanent insurance works because • One contract can provide the features that serve both pre and post- retirement benefit needs PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Permanent insurance works because • One contract can provide the features that serve both pre and post- retirement benefit needs The cost of the contract is divided into two elements PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Permanent insurance works because • One contract can provide the features that serve both pre and post- retirement benefit needs The cost of the contract is divided into two elements • The Pre-retirement Death Benefit PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Permanent insurance works because • One contract can provide the features that serve both pre and post- retirement benefit needs The cost of the contract is divided into two elements • The Pre-retirement Death Benefit • Everything Else PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Permanent insurance works because • One contract can provide the features that serve both pre and post- retirement benefit needs The cost of the contract is divided into two elements • The Pre-retirement Death Benefit • Everything Else • All of which is attributed to post-retirement benefit funding and to calculate post-retirement funding contributions PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Insurance Companies provide the amount of annual contribution necessary to reach the target amount of cash value at the specified time PRM FINANCIAL GROUP SEWP: PLAN FUNDING • Insurance Companies provide the amount of annual contribution necessary to reach the target amount of cash value at the specified time • Based on level funding over the working lives of the participants PRM FINANCIAL GROUP SEWP: PLAN DESIGN • Customized plan design is based on company profile, desired company spending goal, and overall plan objectives PRM FINANCIAL GROUP SEWP: PLAN DESIGN • Customized plan design is based on company profile, desired company spending goal, and overall plan objectives • ERISA compliant plan design options focused on satisfying the business owner’s objectives and the corporations needs PRM FINANCIAL GROUP SEWP: CLIENT PROFILE • Successful Small Businesses PRM FINANCIAL GROUP SEWP: CLIENT PROFILE • Successful Small Businesses • Must be a business entity PRM FINANCIAL GROUP SEWP: CLIENT PROFILE • Successful Small Businesses • Must be a business entity • Cannot be a Sole Proprietor PRM FINANCIAL GROUP SEWP: CLIENT PROFILE • Successful Small Businesses • Must be a business entity • Cannot be a Sole Proprietor • The fewer employees, the better PRM FINANCIAL GROUP SEWP: CLIENT PROFILE • Successful Small Businesses • Must be a business entity • Cannot be a Sole Proprietor • The fewer employees, the better • Disparity in age between the business owner and other employees is a plus PRM FINANCIAL GROUP SEWP: CLIENT PROFILE • Successful Small Businesses • Must be a business entity • Cannot be a Sole Proprietor • The fewer employees, the better • Disparity in age between the business owner and other employees is a plus • Able to make annual contributions for at least 5 years PRM FINANCIAL GROUP SEWP: SUMMARY • Contributions to fund SEWP approx. 95% Deductible PRM FINANCIAL GROUP SEWP: SUMMARY • Contributions to fund SEWP approx. 95% Deductible • Funds disbursed to pay post-retirement medical benefits generally non-taxable PRM FINANCIAL GROUP SEWP: SUMMARY • Contributions to fund SEWP approx. 95% Deductible • Funds disbursed to pay post-retirement medical benefits generally non-taxable • Participants are taxed only on current economic benefit value of pre-retirement death benefit (Table 2001) PRM FINANCIAL GROUP SEWP: SUMMARY • Contributions to fund SEWP approx. 95% Deductible • Funds disbursed to pay post-retirement medical benefits generally non-taxable • Participants are taxed only on current economic benefit value of pre-retirement death benefit (Table 2001) • Single Employer Welfare Plan is designed to accommodate a variety of company profiles PRM FINANCIAL GROUP OUR GOAL • We want to be your resource for Pension, Benefits, and Tax Planning Solutions PRM FINANCIAL GROUP OUR GOAL • We want to be your resource for Pension, Benefits, and Tax Planning Solutions • We will design attractive plans that provide meaningful benefits, meet budgetary restraints and achieve management strategic goals PRM FINANCIAL GROUP OUR GOAL • We want to be your resource for Pension, Benefits, and Tax Planning Solutions • We will design attractive plans that provide meaningful benefits, meet budgetary restraints and achieve management strategic goals • Reality-based planning™, plan designs that are optimized for today and endure through tomorrow PRM FINANCIAL GROUP CONTACT US Office: 847-386-7692 My e-mail address: peter@prmfinancial.com PRM FINANCIAL GROUP THANK YOU Reality-based planning™ Optimized for today Enduring through tomorrow