Presentation

What Do We Know About the

Compliance Costs of the Tax System?

Arindam Das-Gupta

Outline

The cost of collecting taxes

What are compliance costs (CCs)?

Why do CCs matter?

CCs: International evidence

Recent estimates for India

Determinants of CCs

How to reduce CCs?

How to estimate CCs?

The cost of collecting taxes

Include “welfare costs, opportunity costs, psychic costs, social costs and so on” (Evans and Walpole, 1997)

Costs of taxation (Yitzhaki-Slemrod).

– Excess burden of taxes

– Excess burden of tax evasion

– Tax administration costs (substitute)

– CCs and avoidance costs.

What are CCs?

Citizen’s costs of meeting tax obligations

Excludes actual taxes paid and excess burdens.

Includes avoidance (“tax planning”) and evasion costs.

Includes costs if taxpayers, non-filers, third parties (banks, tax withholders, helping others)

Components:

What are CCs? - 2

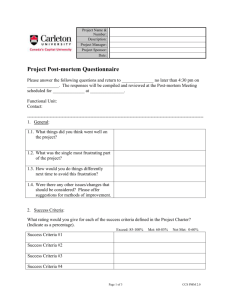

EG: Personal Income Tax Compliance Cost Components

Included in Study

Tax Compliance Costs

Category

Time spent

Taxpayers Non-filers Third Parties

Yes

Yes

Indirect estimate

Yes

Yes Direct money costs

(includes fees to tax advisors)

Bribes paid

Psychic costs

Yes

Yes

No

No

Note: Other social costs of the personal income tax

- Costs of the tax department plus part of costs of courts,

police, legislators, audit, etc.

- Excess burden of the tax and tax evasion.

Types of CCs

Mandatory versus voluntary…

...and quasi-voluntary costs

In-house versus external

Gross versus net

– Cash flow benefits

– Tax deductibility

Private versus social

– Bribes

– Tax deductibility

OVERALL versus from SPECIFIC provisions or procedures

Administration costs versus CCs

Substitutes

Other things equal, social cost considerations should dictate the choice between compliance requirements and administration responsibilities

– EG: Official versus self-assessment

Other things may not be equal…

– Documents enclosed with tax returns

– Desk versus field audits

Why look at CCs?

Three of Adam Smith’s canons of taxation relate to CCs: ‘Certainty’, ‘Convenience’, and ‘Economy’.

Policy uncertainty and complexity lead to higher CCs

Raises the effective tax rate… without any revenue benefits

Induces non-compliance and raises administration costs

CC Assessments now mandatory in some countries

International evidence: Individual income tax

Country

(percentages of tax revenue)

Year Individuals Employers Other

Private

Australia 1994-

95

Canada 1986

1984 Fed Rep of

Germany

Israel 1987

7.9

2.53

0.75

1.32

3.57 0.03

Admin Total

1.00

2.35

7.13

Netherlands 1989

New

Zealand

Norway

1992

1988

Sweden 1990-

91

1.4

8.1

2.7

0.88 0.11 0.17

1.0

1.7

0.65

9.1

4.4

1.81

United

Kingdom

U.S.A.

1986-

87

1995

2.21

9.0

1.02 0.17 1.53 4.93

International evidence: Business income taxes

Country

Australia percentages of tax revenue of relevant tax

Year Corporation tax/ Income tax

PAYE Other business taxes

1994-95 6.8

17.1 (S)

1.3

2.5 (S)

8.0

11.9 (S)

Canada

Hong Kong

Israel

Malaysia

Netherlands

1994-6

1987

1987

1994 c. 1994

New Zealand 1989-90

Norway 1987

Sweden 1993

UK 1996

USA

USA

RANGE

2000

1992

---

4.6-4.9

1.5

2.2

0.36

4.0

8.8

1.7

2.2

1.3

0.34

1.9

26.9-28.0

3.2

0.36-28.0 0.34-1.9

6.3

2.6

3.7

2.6-8.0

Estimates for India - Individual IT

Aggregate Costs of Collecting the Individual Income Tax:

Compliance and Administrative Costs

(Percentages of Individual Income Tax Collected in 2000-01)

Total Compliance Cost of Taxpayers (excluding psychic costs and litigation costs)

of which Legal Compliance Cost

Add estimated cost of representation in appeals cases

Non-filer costs (Chattopadhyay and Das-Gupta, 2002)

Cost of collecting taxes through banks

Cost of tax deduction at source

Total taxpayer and third party compliance costs

Government cost of collecting taxes – Income Tax Department

Government cost of collecting taxes – Other (ITAT, Settlement Commission, etc.)

Total direct cost of collecting personal income taxes

Total cost less bribes (transfer between individuals)

49.01

46.61

0.25

3.40

1.15

5.68

59.49

2.40

0.09

61.98

59.58

Estimates for India - Individual IT - 2

Legal compliance costs as a percentage of gross income

8

6

4

2

0

16

14

12

10

Rs 50,000 or less

Rs 50-100 thousand

Rs 100-200 thousand

Rs 200-300 thousand

Rs 300-400 thousand

Rs 4,00,000 and above

Non-Salaried Salaried

Estimates for India - Corporation IT

Summary of Findings on the Income Tax Compliance Cost of Indian Companies (2000-01)

Compliance Cost Measure

Legal compliance costs - LCC

Sample Averages

Highly variable. 4.12% of profit before tax, 30.41% of tax paid

Projection for All

Companies

4.33% to 13.18% of tax paid

Size Distribution

Opportunity cost of delayed refunds

(ODR)

Cash flow benefits from advance tax and TDS (C)

Regressive for all measures --

46% of taxes. 2.11% of tax paid

Over 50% of LCC --

Net compliance costs = LCC – C - cash flow benefits – tax deduction of compliance expenditure

"Social" compliance costs = LCC + social ODR

"Social" operating costs = "Social" compliance costs + admin costs

15% of legal compliance costs. Negative for most large firms.

--

--

Minus 0.72% to plus

0.62% of tax paid

5.61% to 14.46% of tax paid

5.92% to 14.77% of tax paid

Features of individual CCs in India

Time costs : Non-salaried: 88 hours; Salaried: 28 hours; plus

3-4 hours helping others.

– Approx. 11 hours (USA); 27 hours (NZ)

– “Conservatively” valued in cost estimates

Monetary costs : Even if time compliance costs are excluded monetary compliance costs are large compared to other studies

– Median % of tax paid: 52% (non-sal); 1.6% (salaried)

Advisor’s are used more to deal with tax uncertainty and administrative procedures rather than tax planning.

Incidence of bribe payment and bribe quantum are high, especially so for non-salary earners.

– Refunds, clearances and permissions

Harassment of assessees is widespread.

– Delayed refunds, PAN cards

Features of company CCs in India

62% benefit from compliance requirements: income statements & balance sheets are better prepared.

50% find audit requirements helpful in detecting dishonesty.

Scrutiny assessment and accounting requirements are major cost items.

70%, especially small companies use external assistance.

External costs: 39%.

Voluntary costs: 19% to 43% of gross CCs

Typical company has 12 to 14 open assessment years.

– 10 to 11 assessment years locked in disputes.

– Each extra disputed year raises legal compliance costs by 5.7%

CCs and indicators of company size

Book Value of Assets (Log Scale)

Tax Paid Index (Log Scale)

“Hot spots”

Legal requirements

– Audit requirements

– Tax deduction at source

– International tax provisions

– Loss carry forward and set off

– Valuation of perquisites to employees

– Others:export concession claims; non-resident withholding; inconsistencies with Companies

Act, depreciation provisions, free trade zone reporting; Minimum

Alternate Tax

Administrative procedures

– Refunds

– Scrutiny assessment procedures

– Accounting for TDS

– Appeals and litigation

– Completion and filing corporation tax return

– Obtaining IT clearances and approvals

How to reduce CCs? Framework

Overall CCs only show if broad tax reform is needed

CCAs of specific administration procedures or legal provisions can suggest specific reforms

MECF framework

MECF

M arg inal

NET excess m arg burden inal

revenue

CCs

M arg inal

M govt .

arg inal exp .

exp .

benefit

•

Applied in Poapongsakorn et. al. to taxpayer surveys

How to reduce CCs of the individual IT?

Tax policy process reform to reduce instability and uncertainty

Tax structure simplification

– More presumptions?

Simpler administrative procedures

– Improved taxpayer services

Institutional reform of tax administration

If this does not reduce compliance costs…abolish Individual IT?

Reducing corporation tax CCs

Net private CCs can be reduced, on average, to zero, if refunds delays and associated corruption are tackled

– Strengthen penalties for IT officials

– Institutional reform as for Individual IT

Reduce complexity and ambiguity of tax law.

Reform procedures for international transactions

Streamline clearances and permissions.

Streamline dispute resolution

Alleged bribe taking by appellate authorities to give favourable judgments?

How to estimate CCs and their impact?

Questionnaires/interviews needed

Questionnaires cannot be long

So clarity about objective crucial

– Overall CCs - interesting but not so useful?

– Impact of recent reform?

– Tax reform or administrative reform?

– Specific provisions and procedures?

CCAs for specific items most promising

How to estimate CCs and their impact? -2

Taxpayer (individual, or business) sample

– Random sample of taxpayers

– Use (short!) questionnaires for taxpayers

– PRETEST PRETEST PRETEST 2-3 versions for clarity and length…and focus groups

– 3 questionnaires:

• Canvassed/mailed with no evasion or bribe questions

• Anonymous mailing for non-compliance and bribes with a few extra questions to match samples

• Canvassed “bridge” questionnaires

Canvassed/mailed questionnaires from a sample of third parties

Tax practitioners sample on costs and activities

Data from tax administration on enforcement, detected non-compliance and disputes if needed