Creating a cash flow forecast

advertisement

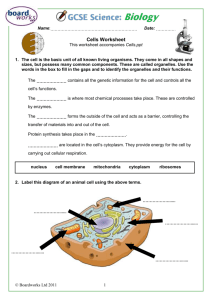

3.3 Cash Flow Forecasts – Unit 3: Investigating Financial Control 3.3 Cash Flow Forecasts Unit 3: Investigating Financial Control 1 of 13 © Boardworks Ltd 2008 Contents For more detailed instructions, see the Getting Started presentation Flash activity (these activities are not editable) Teacher’s notes included in the Notes Page 2 of 13 Key skills Printable activity Accompanying spreadsheet Sound © Boardworks Ltd 2008 Creating a cash flow forecast In this section you will learn how to prepare a cash flow forecast. Creating a cash flow forecast Case study: Andy’s new car 3 of 13 © Boardworks Ltd 2008 How to construct a basic cash flow forecast 4 of 13 © Boardworks Ltd 2008 A basic cash flow forecast January February March April May June Inflows Sales revenue Loans Grants Investors' capital Total inflows 130,000 20,000 0 0 150,000 150,000 0 0 0 150,000 160,000 0 0 0 160,000 170,000 0 0 5,000 175,000 185,000 0 0 0 185,000 195,000 0 0 0 195,000 Outflows Stock Wages Rent Utility bills Interest on loans Taxes Advertising Total outflows 30,000 100,000 4,000 1,000 2,000 1,000 11,000 149,000 30,000 110,000 4,000 1,000 2,000 1,000 12,000 160,000 25,000 110,000 4,000 1,000 2,000 1,000 12,000 155,000 30,000 110,000 4,000 1,000 2,000 1,000 15,000 163,000 30,000 110,000 4,000 1,000 2,000 1,000 12,000 160,000 30,000 115,000 4,000 1,000 2,000 1,000 14,000 167,000 20,000 1,000 21,000 21,000 -10,000 11,000 11,000 5,000 16,000 16,000 12,000 28,000 28,000 25,000 53,000 53,000 28,000 81,000 Monthly summary Opening bank balance Net cashflow Closing bank balance What do you notice about the inflows in April? 5 of 13 © Boardworks Ltd 2008 Complete a basic cash flow forecast 6 of 13 © Boardworks Ltd 2008 Case study: Andy’s new car Andy Harris wants to buy a new car to take to university in September. He knows that: A good second-hand car will cost him £2500. His Dad has agreed to give him £1500 at the end of August as a birthday present to help him buy the car. At the start of March, he had £450 in his bank account. He earns £150 a month working for his uncle. Andy is going to try and cut down on his spending. He estimates that he will spend £30 a month on clothes, magazines and music, and £25 a month socializing with his friends. 7 of 13 © Boardworks Ltd 2008 Assignment: Andy’s new car – a cash flow forecast 8 of 13 © Boardworks Ltd 2008 Case study: Andy’s new car This is what actually happened to Andy: He spent £40 shopping in May and August. He worked a few extra hours in June and earned £175. He spent £80 going to a music festival in April. He only earned £100 in March. Use the spreadsheet activity on the next slide to edit Andy’s original cash flow forecast and decide whether he can still afford his car. 9 of 13 © Boardworks Ltd 2008 Andy’s new car – revised cash flow forecast 10 of 13 © Boardworks Ltd 2008 Assignment: Andy’s yearly cash flow forecast Andy’s yearly cash flow forecast Andy decides to save over a whole year in order to go travelling. He begins saving in September and plans to travel in October of the following year. Use the information you already know about Andy’s inflows and outflows over a six month period to think about what he is likely to earn and spend over a whole year. Set up an Excel spreadsheet to create a cash flow forecast for Andy over twelve months. In groups, discuss what you think Andy could do to improve his cash flow. Present your ideas through a short talk or by designing a poster. 11 of 13 © Boardworks Ltd 2008 Beat the boss! 12 of 13 © Boardworks Ltd 2008 Glossary 13 of 13 © Boardworks Ltd 2008