4-Steps To Achieving Your Financial Goals

advertisement

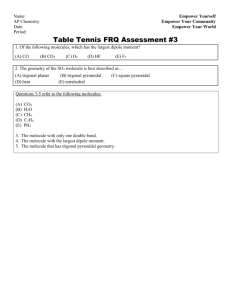

Community Empower Presented to: The National Guard Overview As a current or retired member of the National Guard, you and your family may face unique financial challenges – especially if you are looking to become a homeowner, facing deployment or returning to civilian life. Dealing with these important events requires a plan of attack. That’s why Community Empower has developed a 4-step strategy that offers current and retired National Guard members and their families exclusive financial benefits. 4-Steps To Achieving Your Financial Goals 1. Prepare your family budget to meet your current and future financial goals. 2. Protect your family’s finances before, during and after deployment. 3. Repatriate yourself financially upon the return to civilian life. 4. Plan for life after the Guard and create generational wealth as a legacy to your loved ones. 4-Steps To Achieving Your Financial Goals Step 1: Prepare for future financial goals. Analyze and improve your finances. Specially trained counselors from Community Empower will analyze your finances, and give you specific improvement advice. Get pre-approved to purchase or lease-to-own a home. Community Empower can pre-qualify you for a variety of homeownership programs with special benefits for Guard members and their families. 4-Steps To Achieving Your Financial Goals Step 2: Protect your family’s finances while you are deployed. Maximize financial protections under the SCRA. Community Empower will help you take advantage of the financial protection and special privileges afforded to you under the Servicemembers Civil Relief Act (SCRA). Tap into your home equity for extra cash or debt reduction. Your family may need a little extra cash or credit – especially while you are away. One solution is to use the equity in your home for a loan or line of credit 4-Steps To Achieving Your Financial Goals Step 3: Repatriate yourself financially upon the return to civilian life. Increase your income by raising your credit score and lowering debt. By reducing your debt and improving your financial situation, you can essentially “increase” your income. Community Empower can show you a variety of ways to accomplish this, from debt management to bill consolidation. Go to college or start a business. Getting some extra education, or starting your own business is a great way to advance your career and improve your income earning potential. Community Empower can help you qualify for an education or consolidation loan. 4-Steps To Achieving Your Financial Goals Step 4: Plan for life after the Guard and create generational wealth as a legacy to your loved ones. Build generational wealth by purchasing or refinancing a home. Owning a home is the most common way Americans acquire wealth. National Guard members are eligible for special discounts for home purchases and refinances. Finance home improvements or buy a new car. You’ve earned the right to enjoy life to its fullest. A home equity loan or line of credit can help you make these dreams come true. Avoiding The Secret Sacrifice What is the “Secret Sacrifice?” • Millions of ordinary Americans will pay more or be denied credit, insurance, rent or utilities because of the growing use of the consumer “Credit Score”. • In virtually every household budget a Secret Sacrifice is being made by consumers as creditors use low credit scores to justify increased fees on the highest level of consumer debt in history. In The Example Above, Lori Is Paying $202 More Per Month Than Tim She Is Sacrificing $2,424 Of Her Annual Income Due To Her Low Score! Chart is for illustration purposes only. Community Empower Offers Many Benefits: Community Empower’s ScoreManager Provides: • Easily invoke SCRA protection • Stop making the Secret Sacrifice and take home more of your pay • • Discover your credit score and take action to improve your score Correct errors being reported on your credit report • Learn which spending behaviors affect your credit-worthiness so you can achieve your financial goals • Forecast potential credit score improvements over the next 12 months • Automatically pre-qualify to buy a home • Find out if you can Lease-to-Own a new home while ScoreManager prepares you to become the owner Access Your Benefits Online www.communityempower.com/guard Click Here To Get Started Access Your Benefits Online Community Empower provides a comprehensive analysis. View An Analysis For Both Applicants Credit Score Ranking Budget Analysis Positive & Negative Factors Affecting Score Debt-ToIncome Ratio Access Your Benefits Online CE shows you how to improve your credit. Correct Mistakes On The Credit Report Action Plan Gives Specific Improvement Advice And Projects Score Increase Enroll In ScoreManager To Get Monthly Action Plans Click Here To Invoke SCRA Forecast Potential Credit Improve ments CE Offers Many Resolution Programs For More Difficult Issues Access Your Benefits Online CE pre-qualifies you for loans and homes. The System Alerts The Consumer When They Have Become Qualified For A Loan or Lease! With Just One Click The Customer Is Referred To A Loan Officer Consumers Can Also Check-Out Special Offers On Homes. How Do I Get Started? Enroll Online or Call. Taking advantage of these exclusive benefits is easy. Enroll at the web site below to get expert advice and help to get you started. www.communityempower.com/guard or call 800-816-2586